There are many reasons to reject Joe Biden’s proposal for higher corporate tax rates, and I listed many of them when I narrated this nine-minute video.

This two-minute video from the Tax Foundation has a similar message.

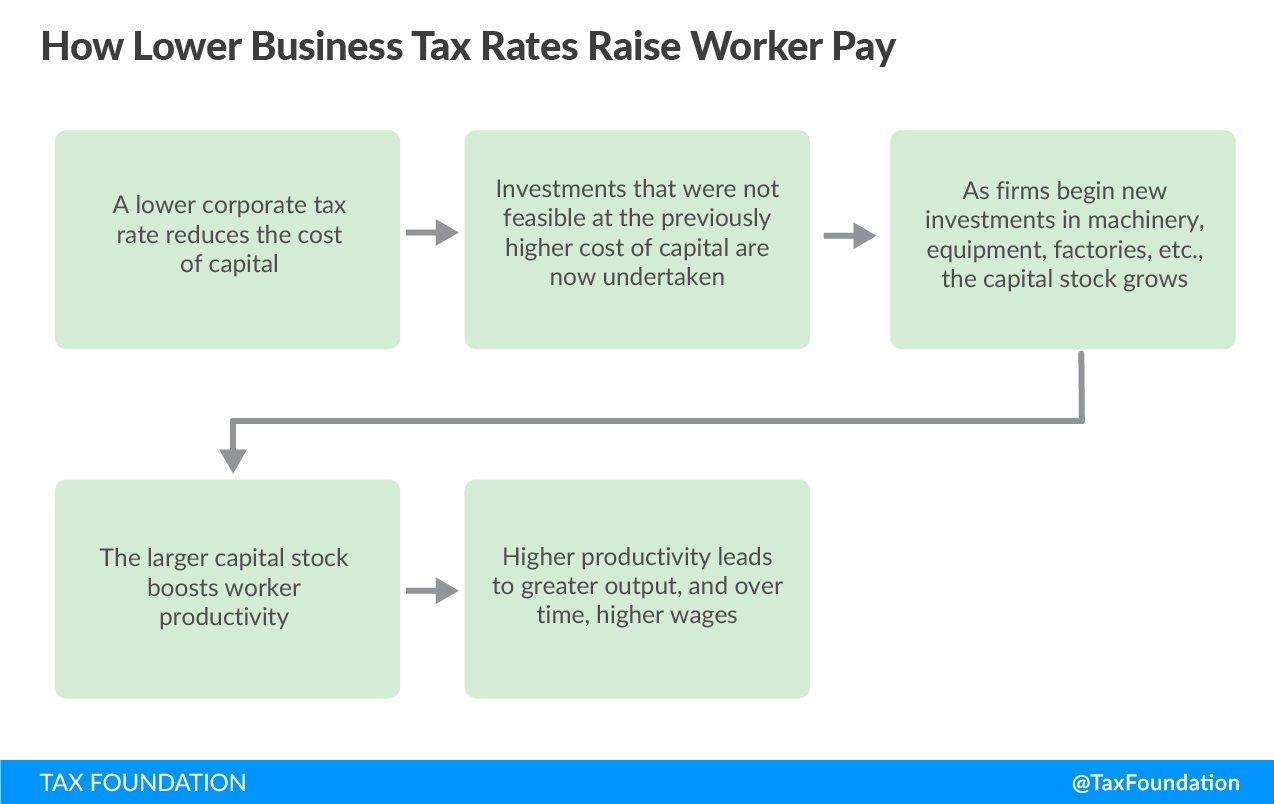

The main message is that workers, consumers, and shareholders are the ones who actually pay when suffer when politicians impose higher taxes on business.

And the damage grows over time because higher corporate tax rates reduce investment, which inevitably leads to lower wages.

By the way, while a low tax rate is very important, there are many other policy choices that determine the overall damage of business taxation.

Is there double taxation of dividends?

Is there double taxation of dividends?- Is there worldwide taxation?

- Is there deprecation or expensing?

- Is there equal treatment of debt and equity?

This is just a partial list. There are other policies – such as alternative minimum taxation, book income, loopholes, and extenders – that also can increase the damage of the corporate taxation.

The bottom line is that we know the sensible approach to business taxation, but the Biden Administration is motivated instead by class warfare and grabbing revenue.

P.S. For more information on corporate taxation and wages, click here, here, here, here, and here.

P.P.S. For more information on corporate tax rates and corporate tax revenue, click here, here, here, and here.

[…] she would be wrong. Wildly wrong. As shown by this map from the Tax Foundation, France already has the fourth-highest […]

[…] the arguments don’t change simply because we cross the Atlantic […]

[…] Here is the argument why corporate tax rates should be as low as possible. […]

[…] Here is the argument why corporate tax rates should be as low as possible. […]

[…] Here is the argument why corporate tax rates should be as low as possible. […]

[…] Here is the argument why corporate tax rates should be as low as possible. […]

[…] to already voluminous research in the area (including studies from Australia, Canada, Germany, and the United Kingdom), I wrote yesterday […]

[…] Here is the argument why corporate tax rates should be as low as possible. […]

[…] are some issues – such as class-warfare tax rates and the minimum wage – where intelligent people on the left will privately admit […]

[…] are some issues – such as class-warfare tax rates and the minimum wage – where intelligent people on the left will privately admit being wrong […]

The video does not convince me, as it is essentially asserting the proposition, rather than demonstrating why it s so. Although, as an Australian, I am not fully aware of US laws, but high corporate taxes with the resultant double taxation of dividends, may make the incorporation of smaller businesses unviable. How then would the government raise the trillions from unincorporated partnerships, family businesses and sole traders?