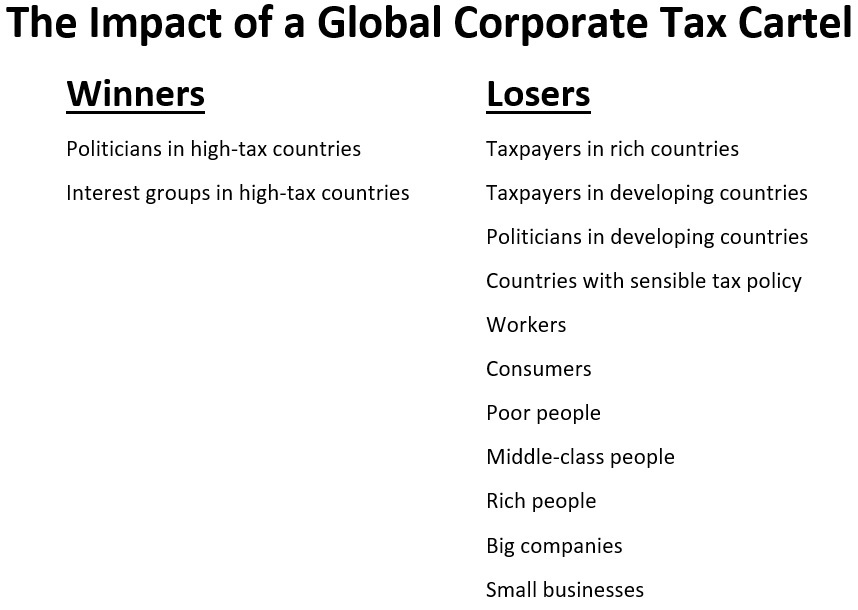

When President Biden first proposed a global minimum tax on companies, I immediately warned that creating a corporate tax cartel would be very bad news for workers, consumers, and shareholders.

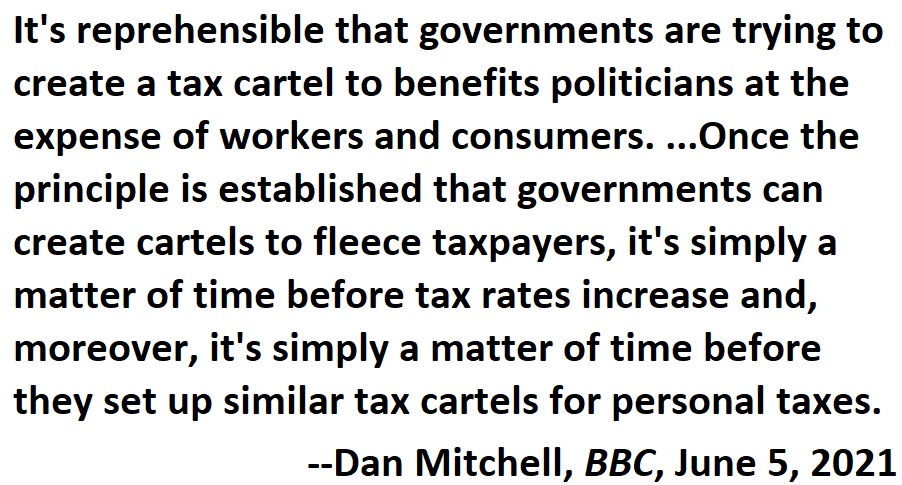

I also warned a BBC audience that proponents would use the agreement as a stepping stone for other statist initiatives to increase the power of politicians.

I also warned a BBC audience that proponents would use the agreement as a stepping stone for other statist initiatives to increase the power of politicians.

Simply stated, I’ve been ringing the alarm bells that a tax cartel will lead to ever-higher corporate tax rates. And it will serve as a model for other forms of harmonization.

Well, now that Ireland has capitulated and governments formally adopted the scheme, this is my “I told you so” column.

In a column for the Washington Post, Larry Summers, a former top adviser for Bill Clinton and Barack Obama, celebrates the creation of a global tax cartel.

His column has a laughably inaccurate title, but he starts with some accurate observations about the importance of the agreement.

This agreement is arguably the most significant international economic pact of the 21st century so far. It is built around a profoundly important principle:

Countries should cooperate to raise corporate taxation, not compete to reduce it. …It also demonstrates the power of ideas to shape economic policy, as tax scholars have for years been pondering the conundrums of taxing global companies.

I also think the agreement is important, albeit in a very bad way.

And it does show the power of ideas, albeit very bad ideas (though politicians instinctively want more money and power and merely rely on left-leaning academics and policy wonks for after-the-fact rationalizations of statism).

As you might expect, Summers veers from reality to fantasy when discussing the implications of the new tax cartel.

Countries have come together to make sure that the global economy can create widely shared prosperity, rather than lower tax burdens for those at the top. By providing a more durable and robust revenue base, the new minimum tax will help pay for the sorts of public investments that are fundamental to economic success in all countries.

For all intents and purposes, he’s embracing the absurd notion that more growth will materialize if politicians impose higher tax rates and use the money to expand the burden of government.

Proponents of this view conveniently never offer any evidence.

Proponents of this view conveniently never offer any evidence.

Why? Because there isn’t any.

The scholarly research shows the opposite is true. Free markets and small government are the recipe for growth and prosperity.

I’ll now shift back to a part of the column that is unfortunately accurate.

It is also a template for much more that needs to be done to tackle the adverse side effects of our modern, global capitalism.

What’s accurate about that sentence isn’t the jibe about “adverse side effects” of capitalism (unless, of course, he thinks mass prosperity is a bad thing).

But he’s right about the statists using the global tax cartel as “a template” for further schemes to empower politicians and their cronies.

But he’s right about the statists using the global tax cartel as “a template” for further schemes to empower politicians and their cronies.

Summers mentions issues such as public health (I guess he wants to reward the World Health Organization’s corruption and incompetence).

Since I’m a public-finance economist, I’m more worried about cartels that will be created for personal income tax, capital gains tax, dividend tax, wealth tax, etc.

P.S. The corporate tax cartel will lead to higher tax rates, but OECD and IMF data (and U.S. data) show that this doesn’t necessarily mean higher revenue.

[…] Biden began his push for a global corporate tax cartel back in 2021, I explained why the idea was very bad news for the world’s workers, consumers, and […]

[…] from uncompetitive nations have been pushing to harmonize corporate taxes, including a global minimum rate of 15 […]

[…] from uncompetitive nations have been pushing to harmonize corporate taxes, including a global minimum rate of 15 […]

[…] The article also notes that the OECD’s global minimum tax scheme will hurt […]

[…] The article also notes that the OECD’s global minimum tax scheme will hurt […]

[…] The article also notes that the OECD’s global minimum tax scheme will hurt […]

[…] no idea about the legality or constitutionality of the tax cartel, but the authors once again dodge the real issue, which is whether it is a good idea to to divert more money from the productive sector of the […]

[…] But let’s not forget that taxes on companies are actually paid by workers, consumers, and shareholders. […]

[…] The main takeaway is that the proposed “minimum global tax” is an agreement by politicians for the benefit of politicians. […]

[…] https://danieljmitchell.wordpress.com/2022/01/03/the-need-for-global-tax-competition/ https://danieljmitchell.wordpress.com/2021/11/01/the-global-tax-cartel-is-a-victory-for-politicians-… […]

[…] the “Best and Worst News of 2021,” I included Joe Biden’s global tax cartel as one of the awful things that happened in the past 12 […]

[…] Tax Cartels – One of last year’s big defeats was the creation of a global tax cartel by governments.Barring some sort of miracle that prevents […]

[…] Tax Cartels – One of last year’s big defeats was the creation of a global tax cartel by governments. Barring some sort of miracle that prevents […]

[…] will require all nations to have a corporate tax rate of at least 15 percent. This is a victory for politicians over workers, consumers, and shareholders. And it creates a very dangerous […]

[…] cartel that will require all nations to have a corporate tax rate of at least 15 percent. This is a victory for politicians over workers, consumers, and shareholders. And it creates a very dangerous […]

At this point, the US (South Dakota) and Sweden are the freest countries in the world. Covid rules are anti-business in that they impose extra burdens.

This is crazy…..you want World governments representing failing economies, to vote taxes to be paid by you, to fund their failing centralized command economies run by their politico/bureaucrats? It is a bad American habit, started long ago with the U.S. bailing out World countries from their mistakes after starting two World Wars, destroying their economies, causing their people to starve for lack of food, and requiring/justifying American largesse to reconstruct what they caused to be destroyed.

Tis a bit like drinking your way to sobriety.

All I’ve seen from the Biden administration is one bad idea after another. Doesn’t the law of averages assure us of at least one good idea?