As part of my “Question of the Week” series, I said that Australia probably would be the best option if the United States suffered some sort of Greek-style fiscal meltdown that led to a societal collapse.*

One reason I’m so bullish on Australia is that the nation has a privatized Social Security system called “Superannuation,” with workers setting aside 9 percent of their income in personal retirement accounts (rising to 12 percent by 2020).

Established almost 30 years ago, and made virtually universal about 20 years ago, this system is far superior to the actuarially bankrupt Social Security system in the United States.

Established almost 30 years ago, and made virtually universal about 20 years ago, this system is far superior to the actuarially bankrupt Social Security system in the United States.

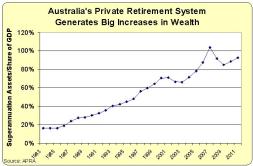

Probably the most sobering comparison is to look at a chart of how much private wealth has been created in Superannuation accounts and then look at a chart of the debt that we face for Social Security.

To be blunt, the Aussies are kicking our butts. Their system gets stronger every day and our system generates more red ink every day.

Their system gets stronger every day and our system generates more red ink every day.

And their system is earning praise from unexpected places. The Center for Retirement Research at Boston College, led by a former Clinton Administration official, is not a right-wing bastion. So it’s noteworthy when it publishes a study praising Superannuation.

Australia’s retirement income system is regarded by some as among the best in the world. It has achieved high individual saving rates and broad coverage at reasonably low cost to the government.

Since I wrote my dissertation on Australia’s system, I can say with confidence that the author is not exaggerating. It’s a very good role model, for reasons I’ve previously discussed.

Here’s more from the Boston College study.

The program requires employers to contribute 9 percent of earnings, rising to 12 percent by 2020, to a tax-advantaged retirement plan for each employee age 18 to 70 who earns more than a specified minimum amount. …Over 90 percent of employed Australians have savings in a Superannuation account, and the total assets in these accounts now exceed Australia’s Gross Domestic Product. …Australia has been extremely effective in achieving key goals of any retirement income system. …Its Superannuation Guarantee program has generated high and rising levels of saving by essentially the entire active workforce.

The study does include some criticisms, some of which are warranted. The system can be gamed by those who want to take advantage of the safety net retirement system maintained by the government.

Australia’s means-tested Age Pension creates incentives to reduce one’s “means” in order to collect a higher means-tested benefit. This can be done by spending down one’s savings and/or investing these savings in assets excluded from the Age Pension means test. What makes this situation especially problematic is that workers can currently access their Superannuation savings at age 55, ten years before becoming eligible for Age Pension benefits at 65. This ability creates an incentive to retire early, live on these savings until eligible for an Age Pension, and collect a higher benefit, sometimes referred to as “double dipping.”

Though I admit dealing with this issue may require a bit of paternalism. Should individuals be forced to turn their retirement accounts into an income stream (called annuitization) once they reach retirement age?

I’m torn on this issue. Paternalists sometimes do have good ideas, but shouldn’t people have the freedom to make their own decisions, even if they make mistakes? But does the answer to that question change when mistakes mean that those people will be taking money from taxpayers?

Fortunately, I don’t need to be wishy-washy on the other criticism in the study.

Australia’s system does have shortcomings. It is heavily dependent on defined contribution plans and is vulnerable to weaknesses in such programs.

I strongly disagree. A “defined contribution” account is something to applaud, not a shortcoming.

The author presumably is worried that a “DC” account leaves a worker vulnerable to the ups and downs of the market, whereas a “defined benefit” account promises a specific payment and removes that uncertainty. Sounds great, but the problem with “DB” accounts is that they almost inevitably seem to promise more than they can deliver. And that seems to be the case whether they’re supposedly based on real savings (like company retirement plans or pension funds for state and local bureaucrats) or based on pay-as-you-go taxation (like Social Security).

*Since I’m somewhat optimistic that America can be saved, I’m not recommending you head Down Under just yet.

P.S. I’m also a huge fan of Chile’s system of private accounts. At the risk of oversimplifying, Chile’s system is sort of like universal IRAs and Australia’s system is sort of like universal 401(k)s.

P.P.S. There’s much to admire about Australia, but its government is plenty capable of boneheaded policy. Heck, the government even provides workers’ compensation payments to people who get injured while having sex after work hours, simply because they were on a business-related trip. Talk about double dipping!

P.P.P.S. Here’s my video explaining why we should implement personal retirement accounts in the United States.

P.P.P.S. The death tax has been abolished in Australia, so there’s more to admire than just personal retirement accounts.

[…] such a system would not be easy, especially since we have been kicking the can down the road. But Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, and Sweden […]

[…] not Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, […]

[…] The better option is a shift to retirement systems based on private savings, like the ones in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, […]

[…] not Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, […]

[…] can shift to retirement systems based on private savings, like Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, […]

[…] is not the top nation in the Mercer/CFA report. It trails Australia, Denmark, Iceland, Israel, Netherlands, and Norway – all of which have systems that are fully or […]

[…] not Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe […]

[…] not Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe […]

[…] not Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, […]

[…] Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, […]

[…] is not the top nation in the Mercer/CFA report. It trails Australia, Denmark, Iceland, Israel, Netherlands, and Norway – all of which have systems that are fully or […]

[…] is not the top nation in the Mercer/CFA report. It trails Australia, Denmark, Iceland, Israel, Netherlands, and Norway – all of which have systems that are fully or […]

[…] Chile and Australia have created personal retirement accounts. You can also learn about reforms in Switzerland, Hong […]

[…] Chile and Australia have created personal retirement accounts. You can also learn about reforms in Switzerland, Hong […]

[…] Many nations around the world have adopted this approach, most notably Chile and Australia. […]

[…] Many nations around the world have adopted this approach, most notably Chile and Australia. […]

[…] from mandated private retirement accounts, such as those in places such as Australia and Chile (Pillar […]

[…] is a significantly higher level of mandated private savings when compared to countries such as Australia and […]

[…] Except our debt started higher and grew by more, so we face a more difficult future (especially since Australia is much less threatened by demographics thanks to a system of private retirement savings). […]

[…] It’s noteworthy that the system of personal accounts, known as superannuation, manages to attract praise from unlikely quarters. […]

[…] a chart from the OECD report. It shows that many developed nations already have fully or partly privatized […]

[…] a chart from the OECD report. It shows that many developed nations already have fully or partly privatized […]

[…] accounts. Funded systems based on real savings work very well in jurisdictions such as Australia, Chile, Switzerland, Hong Kong, and the Netherlands, but achieving this reform […]

[…] retirement accounts. Funded systems based on real savings work very well in jurisdictions such as Australia, Chile, Switzerland, Hong Kong, and the Netherlands, but achieving this reform in the United […]

[…] from the Faroe Islands. Are they big fans of their private Social Security system? My writings on Australian pension reform may also explain the high level of visits from Down […]

[…] My dissertation topic at GMU was Australia’s private retirement system, which was a clever decision on my part. Nobody in the United States at the time know anything […]

[…] retirement accounts. Funded systems based on real savings work very well in jurisdictions such as Australia, Chile, Switzerland, Hong Kong, and the Netherlands, but achieving this reform in the United States […]

[…] Except our debt started higher and grew by more, so we face a more difficult future (especially since Australia is much less threatened by demographics thanks to a system of private retirement savings). […]

[…] Except our debt started higher and grew by more, so we face a more difficult future (especially since Australia is much less threatened by demographics thanks to a system of private retirement savings). […]

[…] what it’s worth, I would put Australia in the “defined contribution” grouping. Yes, there is still a government age pension […]

[…] private Social Security system, and I’m always telling policy makers we should copy their approach. The Aussies also abolished death taxes, which was a very admirable […]

[…] of which underscores why I think we should have a system similar to what they have in Australia or Chile (or even the Faroe […]

[…] at least compared to other developed nations (see table 25 of this OECD data), and it has a very attractive private Social Security system that puts Australia in relatively good shape when looking at the long-run fiscal health of […]

[…] at least compared to other developed nations (see table 25 of this OECD data), and it has a very attractive private Social Security system that puts Australia in relatively good shape when looking at the long-run fiscal health of […]

[…] at least compared to other developed nations (see table 25 of this OECD data), and it has a very attractive private Social Security system that puts Australia in relatively good shape when looking at the long-run fiscal health of […]

[…] sensible “pre-funded” system in The Netherlands, and there are many other nations (ranging from Australia to Chile to the Faroe Islands) that have implemented this type of […]

[…] “pre-funded” system in The Netherlands, and there are many other nations (ranging from Australia to Chile to the Faroe Islands) that have implemented this type of […]

[…] of which underscores why I think we should have a system similar to what they have in Australia or Chile (or even the Faroe […]

[…] if live in a semi-sensible jurisdiction such as Australia or Chile, the impact is modest because personal retirement accounts preclude Social Security-type […]

[…] if live in a semi-sensible jurisdiction such as Australia or Chile, the impact is modest because personal retirement accounts preclude Social Security-type […]

[…] Many nations have adopted genuine reform based on private retirement savings, including Australia, Sweden, the Faroe Islands, Chile, and The […]

[…] Many nations have adopted genuine reform based on private retirement savings, including Australia, Sweden, the Faroe Islands, Chile, and The […]

[…] lots of hard data, including the fact that “funded” accounts already exist in nations such as Australia, Chile, Sweden, and the […]

[…] lots of hard data, including the fact that “funded” accounts already exist in nations such as Australia, Chile, Sweden, and the […]

[…] “funded” accounts already exist in nations such as Australia, Chile, and the Netherlands, but some critics say that there’s too much risk in that kind of […]

[…] “funded” accounts already exist in nations such as Australia, Chile, and the Netherlands, but some critics say that there’s too much risk in that kind of […]

[…] Australia also is one of my favorite nations, in part because of its privatized Social Security system. […]

[…] Second, I made the argument for entitlement reform, specifically the “pre-funding” version of Social Security reform that’s been adopted in nations as diverse as Australia and Chile. […]

[…] I’m a big fan of Australia. Their private Social Security system is a huge success, and I’ve even suggested that it might be the best place to go if America suffers a […]

[…] that narrow and cramped approach, however. Some academics at Boston College, for instance, produced some research showing some big benefits from Australia’s private Social Security […]

[…] Unexpected Praise for Australia’s Private Social Security System […]

[…] in their accounts, creating a system that’s even larger than the private retirement models in Australia and […]

[…] “pre-funding” version of Social Security reform that’s been adopted in nations as diverse as Australia and […]

[…] version of Social Security reform that’s been adopted in nations as diverse as Australia and […]

[…] Australia also is one of my favorite nations, in part because of its privatized Social Security system. […]

[…] Australia also is one of my favorite nations, in part because of its privatized Social Security system. […]

[…] Daniel Mitchell: […]

[…] Unexpected Praise for Australia’s Private Social Security System […]

Reblogged this on Gds44's Blog.

Reblogged this on Public Secrets and commented:

Articles like this one are sometimes so frustrating; there are far better national pension systems than the one we have. In addition to Australia, discussed in Mitchell’s article, Chile has a very good, very effective set up. But the statists in this country fight tooth and nail against any sensible reform, as if allowing people to keep their own money, build wealth, and live independently is some sort of horrific crime.

I can agree strongly that in a fair and just world this is correct. As the system runs to its ultimate conclusion I am of the opinion that fairness and justice no longer apply. The same global financial system causing problems elsewhere in the world is present in Australia and will ultimately undermine what should be sound investments by Australians.

Between the Australian and Chilean models, I have to give the nod to Chile. Mandates from government on how to pay workers, which would include retirement funds and healthcare, should be avoided, with the exception that all current DB arrangements should become DC. We’re now facing the consequences of too many IBG/YBG [I’ll be gone and you’ll be gone] agreements creating unrealistic pension benefits.

A second problem with the Australian “profit sharing” arrangement is that those working for unprofitable or marginally profitable companies might end up with no pensions at all. On the other hand, profitable companies would benefit by having employees that have a stake in the company’s success, but that could also be done under the Chilean model.

The increase from 9% to 12% of earnings by 2020 will necessarily put a damper on wage increases. Government must be very careful not to mandate too much retirement saving. It does no good for individuals to retire with a million dollar portfolio, if they had to eat dog food or forego entrepreneurial opportunities to get there.

Regarding the means-tested Age Pension, whenever you have means-testing, the system will be gamed.

The real problem with our current Social Security system is that expectation of future benefits has displaced the personal savings that supports long term growth. Social Security was set up in the 1930’s when Keynesian “logic” indicated that money should be spent on consumption now, rather than saved.

80 years later, a large portion of our population [particularly those in lower quintiles] has no savings. Outstanding commitments complicate our ability to transition to either the Australian or the Chilean models. Migration will take a generation [~30 years].

For more on this see:

re: “and then look at a chart of the debt that we face for Social Security.”

The problem is that chart is likely not very reliable, the Social Security estimates appear to have not gotten much critique since they suffer from many obvious flaws (which need to be urgently spread around so perhaps they consider correcting them in their next annual report in the next few weeks). For instance the supposed “high cost” forecast is high cost in nominal $, but when you adjust it for inflation it turns into the *low cost* scenario in real $. The forecasts pretend to look at a high cost scenario, but seem to be too overoptimistic regarding their accuracy, which is bad since we need to plan conservatively since the future is hard to predict. They act as if they can forecast the GDP out to 2090 more accurately than other entities have shown to forecast it for 2-5 years.. and in fact more accurately than GDP is measured (based on the GPD vs. GDI statistical discrepancy as a minimum). This page details it, noting:

http://www.politicsdebunked.com/article-list/ssaestimates

“The 1950 annual SSA report projected US population in 2000 to be worst case 199 million, best case 173 million. In reality it turned out to be 282 million, 42% above their highest projection. Imagine if their real costs turn out to be 42% higher than their current projections.

We need to plan for the possibility their numbers may be off. The Medicare forecasts rely on some of the same questionable Social Security numbers.

I’ve been in the workforce for many decades and always thought there must be a better way than social security. I’m retired and now I find out how smart the Aussies have been. Who in gov’t. gained from Social InSecurity? Glad I had enough sense to provide for myself. B^}=