I’m very leery of corporate tax reform, largely because I don’t think there are enough genuine loopholes on the business side of the tax code to finance a meaningful reduction in the corporate tax rate.

That leads me to worry that politicians might try to “pay for” lower rates by forcing companies to overstate their income.

Based on a new study about so-called corporate tax expenditures from the Government Accountability Office, my concerns are quite warranted.

The vast majority of the $181 billion in annual “tax expenditures” listed by the GAO are not loopholes. Instead, they are provisions designed to mitigate mistakes in the tax code that force firms to exaggerate their income.

Here are the key findings.

In 2011, the Department of the Treasury estimated 80 tax expenditures resulted in the government forgoing corporate tax revenue totaling more than $181 billion. …approximately the same size as the amount of corporate income tax revenue the federal government collected that year. …According to Treasury’s 2011 estimates, 80 tax expenditures had corporate revenue losses. Of those, two expenditures accounted for 65 percent of all estimated corporate revenues losses in 2011 while another five tax expenditures—each with at least $5 billion or more in estimated revenue loss for 2011—accounted for an additional 21 percent of corporate revenue loss estimates.

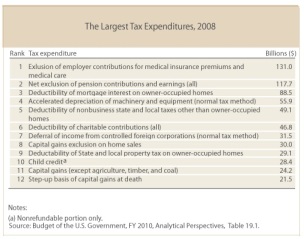

Sounds innocuous, but take a look at this table from the report, which identifies the “seven largest corporate tax expenditures.”

To be blunt, there’s a huge problem in the GAO analysis. Neither depreciation nor deferral are loopholes.

I wrote a detailed post explaining depreciation earlier this month, citing three different experts on the issue. But if you want a short-and-sweet description, here’s how I described depreciation in my post on corporate jets.

If a company purchases a jet for $20 million, they should be able to deduct – or expense – that $20 million when calculating that year’s taxable income… A sensible tax system defines profit as total revenue minus total costs – including purchases of private jets. But today’s screwy tax code forces them to wait five years before fully deducting the cost of the jet (a process known as depreciation). Given that money today has more value than money in the future, this is a penalty that creates a tax bias against investment (the tax code also requires depreciation for purchases of machines, structures, and other forms of investment).

In other words, businesses should be allowed to immediately “expense” investment expenditures. What the GAO refers to as “accelerated depreciation” is simply the partial mitigation of a penalty, not a loophole.

The same is true about “deferral.” Here’s what I wrote about that issue in February 2010.

Under current law, the “foreign-source” income of multinationals is subject to tax by the IRS even though it already is subject to all applicable tax where it is earned (just as the IRS taxes foreign companies on income they earn in America). But at least companies have the ability to sometimes delay when this double taxation occurs, thanks to a policy known as deferral.

I added to those remarks later in the year.

From a tax policy perspective, the right approach is “territorial” taxation, which is the common-sense notion of only taxing activity inside national borders. It’s no coincidence that all pro-growth tax reform plans, such as the flat tax and national sales tax, use this approach. Unfortunately, America is one of the world’s few nations to utilize the opposite approach of “worldwide” taxation, which means that U.S. companies face the competitive disadvantage of having two nations tax the same income. Fortunately, the damaging impact of worldwide taxation is mitigated by a policy known as deferral, which allows multinationals to postpone the second layer of tax.

Simply stated, the U.S. government should not be trying to tax income earned in other countries. “Deferral” is the mitigation of a penalty, not a loophole.

So why would the GAO make these mistakes? Well, to be fair to the bureaucrats, they simply relied on the analysis of the Treasury Department.

But why does Treasury (and the Joint Committee on Taxation) make these mistakes? The answer is that they use the “Haig-Simons” tax base as a benchmark, and that approach assumes bad policies such as the double taxation of income that is saved and invested. If you want to get deep in the weeds of tax policy, I shared late last year some good analysis on Haig-Simons produced by my colleague Chris Edwards.

By the way, properly defining loopholes also is an issue for reform on the individual portions of the tax code. I’ve previously pointed out the flawed analysis of the Tax Policy Center, which put together a list of the 12 largest “tax expenditure” and included six items that don’t belong.

By the way, properly defining loopholes also is an issue for reform on the individual portions of the tax code. I’ve previously pointed out the flawed analysis of the Tax Policy Center, which put together a list of the 12 largest “tax expenditure” and included six items that don’t belong.

To conclude, the right tax base is what’s called “consumed income.” But that’s simply another way of saying that the system should only tax income one time, and it’s how income is defined for both the flat tax and national sales tax.

One final comment about GAO. It’s understandable that they used the Treasury Department’s methodology, but they also should have produced a list of tax expenditures based on a consumed-income tax base. That’s basic competence and fairness.

[…] Washington (primarily the Treasury Department and the Joint Committee on Taxation, but also CBO, GAO, ) uses the Haig-Simons tax […]

[…] definition when measuring tax loopholes, they are not alone. The Joint Committee on Taxation, the Government Accountability Office, and the Congressional Budget Office make the same mistake. Heck, you even see Republicans […]

[…] keep their own money. That’s reminiscent of the offensive “tax expenditure” term used by some of the people in […]

[…] properly defined. Sadly, that simple task is too challenging for the Joint Committee on Taxation, the Government Accountability Office, and the Congressional Budget Office (or even the Republican […]

[…] restraint. We both favor getting rid of loopholes (though I fear she may favor the Haig-Simons definition of loopholes rather than the consumption-base definition). And we both seem to agree that lower […]

[…] like spending restraint. We both favor getting rid of loopholes (though I fear she may favor the Haig-Simons definition of loopholes rather than the consumption-base definition). And we both seem to agree that lower tax […]

[…] is saved and invested. You see this approach from the Joint Committee on Taxation. You see it from the Government Accountability Office. You see it from the Congressional Budget Office. Heck, you even see Republicans mistakenly use […]

[…] that is saved and invested. You see this approach from the Joint Committee on Taxation. You see it from the Government Accountability Office. You see it from the Congressional Budget Office. Heck, you even sometimes see Republicans […]

[…] is saved and invested. You see this approach from the Joint Committee on Taxation. You see it from the Government Accountability Office. You see it from the Congressional Budget Office. Heck, you even sometimes see Republicans […]

[…] that is saved and invested. You see this approach from the Joint Committee on Taxation. You see it from the Government Accountability Office. You see it from the Congressional Budget Office. Heck, you even sometimes see Republicans […]

[…] not joking. You see this approach from the Joint Committee on Taxation. You see it from the Government Accountability Office. You see it from the Congressional Budget Office. Heck, you even see Republicans mistakenly use […]

[…] the Congressional Budget Office, the Joint Committee on Taxation, and the Government Accountability Office will all agree, saying that you’re benefiting from a “tax […]

[…] the way, the Government Accountability Office is worse than CBO. When GAO did a report on corporate tax expenditures, that bureaucracy didn’t even acknowledge that there was an alternate way of looking at the […]

Interesting tree.

Tree in the forest of trying to convince, or trick, people into working for the collective, rather than for themselves and their families – so that politicians become the main managers of wealth and gain the associated, fame, power, wealth.

But this approach to maintaining top worldwide prosperity is doomed to fail, as would be clear to anyone who looks at the forest of America’s voter-lemming convergence to a European mentality.

People may not understand all the intricacies of tax codes, loopholes, credits, subsidies etc. But they do experience the effects of such distorting policies. They will thus soon come to the empirical conclusion that work does not pay – or pays somewhat less. That the differential standard of living between exceptional effort and dedication is just not worth the effort. Not many will necessary take drastic action. But even marginal withdrawal from motivation will compound into dramatic effects on the worldwide stage.

While most people, including collectivists, do understand this correlation between incentives and production, they think the effect will be small, outweighed by the benefit of more “fairness”. What they perilously, and delusionaly ignore, is that there is a tipping point. International competitiveness depends on very narrow margins. A nation that is a mere twenty percent less productive (production per person per lifetime) does not simply have twenty percent less prosperity (and more fairness, per leftists). As in business, that nation gets obliterated in international competition and fades away into a vicious cycle, unable to bootstrap itself out of its lower competitiveness.

So to all these accounting deceits and gimmicks, aimed at tricking people to work for the collective, rather than for themselves and their families, I say: “You can trick some people some time, you can trick some people all the time, and you can even trick most people a few times. But you cannot systemically trick all people all the time”. People will empirically realize that, for whatever reason, work does not pay. The effort reward curve will have become flatter and their enthusiasm will fade below that of other nations. Once that happens, its game over. Of course, politicians would be just as happy to get away with tricking enough people for the few short years they are in office. Voter-lemmings will be bamboozled by the politician siren song to their peril.

Americans are used to an environment where American business outcompete everyone else worldwide – and perilously take this serendipitous reality for granted. But the tipping point has either been reached, or is about to be reached, as voter-lemmings throughout the western world react to the competition of three billion emerging world souls moving towards more economic freedom, by hunkering down into statism. The forces are enormous, and convergence will be swift.

So prepare your bags, so that you are ready to move to whichever democracy –..well I hope its is a democracy, though I’m starting to fear a different outcome — the voters let you keep the reward of your efforts – perhaps through some serendipitous coincidence of history that spares those voters the classic lemming cycle to decline. The world is now moving ever faster. Declines that once used to take centuries will now conclude in a couple of decades. The western world voter-lemming is setting himself/herself up for interesting times ahead… While the world as a whole is moving more and more towards marvelous increase in total prosperity, the change of fortunes facing western world voter-lemmings, materializing in such a short period of time, will be historically unprecedented. Humanity is more advanced than ever and keeps accelerating. Things that never happened before will happen…

Dan so sorry but I see you have given in to the concept/semantics change. By using the term “tax expenditures” you/they assume that everything I earn belongs to the government up front. Kind Regards Bill Eisele

Sent from my iPhone