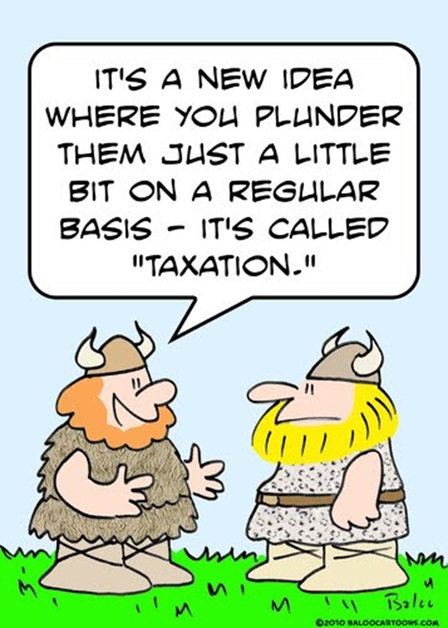

I recently explained the evolution of taxation – and the unfortunate consequences of income taxation – to a seminar in the country of Georgia.

One of my main points was that income taxes are a relatively new source of revenue.

The first income tax was adopted in the United Kingdom in the mid-1800s and other nations followed over the next 50-plus years (the United States joined that unfortunate club in 1913).

The first income tax was adopted in the United Kingdom in the mid-1800s and other nations followed over the next 50-plus years (the United States joined that unfortunate club in 1913).

And, as noted in the video, income tax enabled a massive expansion in the burden of government spending.

In a column for the Foundation for Economic Education, Martin Litwak explains how the U.S. and U.K. made the mistaken choice to impose income taxes.

…income tax is a rather recent “invention,”… Income Tax was first introduced by William Pitt in the United Kingdom in 1798, and it started to be charged in 1799. The aim was not to finance original expenses of the State but the Napoleonic Wars. …It was kept in force until the Battle of Waterloo. When the tax was annulled again, every document that referred to it was burnt, due to the sense of shame

associated with having established and charged this tax. …Prime Minister Robert Peel reestablished it in 1841, not to finance a war but to cover the Government’s deficit. …the United States became independent from the United Kingdom in 1776…the country imposed the first income tax…to finance…the Civil War. …In 1872, the income tax was annulled, basically due to the pressure of taxpayers, who deemed it expropriatory… In 1894, the income tax was incorporated again, but the next year, …the Supreme Court declared it unconstitutional. …In 1909, the creation of this tax was proposed again… The 16th Amendment was introduced precisely to achieve this goal.

A sad column.

But it gets worse because politicians also then imposed payroll taxes.

Then they imposed value-added taxes.

Then they imposed value-added taxes.

Both of which helped to finance further expansions in the burden of government spending.

The bottom line is that it’s never a good idea to give politicians a new source of revenue.

Especially new taxes that are capable of generating a lot of revenue (or a medium amount or small amount of revenue).

P.S. Interestingly, many early advocates of income taxes in the U.K. and U.S. were not trying to finance a big welfare state, but rather wanted a new revenue source so they could lower or eliminate protectionist taxes on imports.

The moral of the story is to be careful of unintended consequences.

P.P.S. If you enjoyed watching a video about the history of the income tax, here’s a (much longer) history of economic policy in the 20th century.

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] been complaining for decades about excessive and wasteful government spending. I’ve also been grousing for just as long about counterproductive, class-warfare tax […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] instance, look at how the simple and modest income tax that was adopted in 1913 has morphed into a complicated and punitive nightmare (which helps to […]

[…] Payroll taxes are not as damaging as income taxes, but that’s hardly an endorsement. Such levies still discourage work and […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] you can see, the president wants to make the US slightly worse than average for personal income taxes, significantly worse than average for the corporate income tax, and absurdly worse than average for […]

[…] you can see, the president wants to make the US slightly worse than average for personal income taxes, significantly worse than average for the corporate income tax, and absurdly worse than average […]

[…] you can see, the president wants to make the US slightly worse than average for personal income taxes, significantly worse than average for the corporate income tax, and absurdly worse than average for […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] I actually think its biggest problem is the risk that politicians would not actually get rid of the income tax. Or, maybe they would get rid of the income tax, but then reinstate that awful levy after a few […]

[…] could solve almost all of the problems in the current system. That’s technically true, but tinkering with the tax code over the past 110 years is what’s produced the current […]

[…] could solve almost all of the problems in the current system. That’s technically true, but tinkering with the tax code over the past 110 years is what’s produced the current […]

[…] could solve almost all of the problems in the current system. That’s technically true, but tinkering with the tax code over the past 110 years is what’s produced the current […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] since that dark day in 1913 when the income tax was enacted, presidents and members of Congress have been making the system more and more […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] For instance, the (tragic) 16th Amendment gives the federal government the authority to impose an income tax and voters repeatedly have elected politicians who have opted to exercise that […]

[…] good example. The U.S. economy did well during that century, but it was because of policies such as no income tax and no welfare […]

[…] good example. The U.S. economy did well during that century, but it was because of policies such as no income tax and no welfare […]

[…] you can see, rapid growth began well before 1900. Before income taxes. Before the welfare state. And long before anything resembling […]

[…] you can see, rapid growth began well before 1900. Before income taxes. Before the welfare state. And long before anything resembling […]

[…] In an ideal world, there would be no corporate income tax (or any income tax). […]

[…] In an ideal world, there would be no corporate income tax (or any income tax). […]

[…] need to collect taxes, but we did just fine for more than 100 years with no income […]

[…] need to collect taxes, but we did just fine for more than 100 years with no income […]

[…] need to collect taxes, but we did just fine for more than 100 years with no income […]

[…] In an ideal world, there would be no corporate income tax (or any income tax). […]

[…] In an ideal world, there would be no corporate income tax (or any income tax). […]

[…] In an ideal world, there would be no corporate income tax (or any income tax). […]

[…] Heck, I should have called for repeal of the 16th Amendment, so we also could enjoy the experience of living in a nation without an income tax. […]

[…] Heck, I should have called for repeal of the 16th Amendment, so we also could enjoy the experience of living in a nation without an income tax. […]

[…] are two ways those laws could be improved. First, officials could abolish its income tax because a zero income tax is better than a flat […]