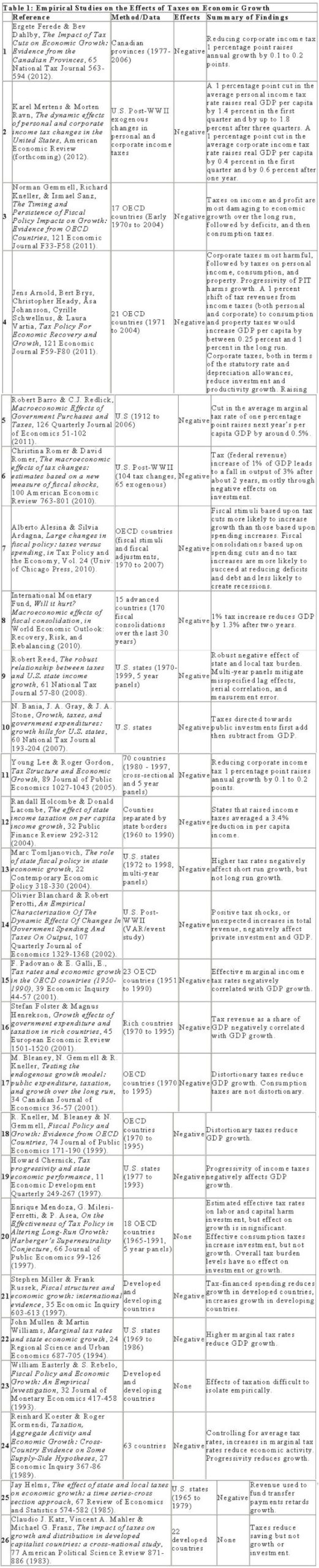

Back in 2013, the Tax Foundation published a report that reviewed 26 academic studies on taxes and growth.

That scholarly research produced a very clear message: The overwhelming consensus was that higher tax rates were bad news for prosperity.

That scholarly research produced a very clear message: The overwhelming consensus was that higher tax rates were bad news for prosperity.

Especially soak-the-rich tax increases that reduced incentives for productive activities such as work, saving, investment, and entrepreneurship.

That compilation of studies was very useful because then-President Obama was a relentless advocate of class-warfare tax policy.

And he partially succeeded with an agreement on how to deal with the so-called “fiscal cliff.”

Well, as Yogi Berra might say, it’s “deju vu all over again.” Joe Biden is in the White House and he’s proposing a wide range of tax increases.

It’s unclear whether Biden will gain approval for his proposals, but I’ve already produced a four-part series on why they are very misguided.

- In Part I, I showed that the tax code already is biased against upper-income taxpayers.

- In Part II, I explained how the tax hike would have Laffer-Curve implications, meaning politicians would not get a windfall of tax revenue.

- In Part II, I pointed out that the plan would saddle America with the developed world’s highest corporate tax burden.

- In Part IV, I shared data on the negative economic impact of higher taxes on productive behavior.

The bottom line is that the United States should not copy France by penalizing entrepreneurs, innovators, investors, and business owners.

Particularly since the rest of us are usually collateral damage when politicians try to punish successful taxpayers.

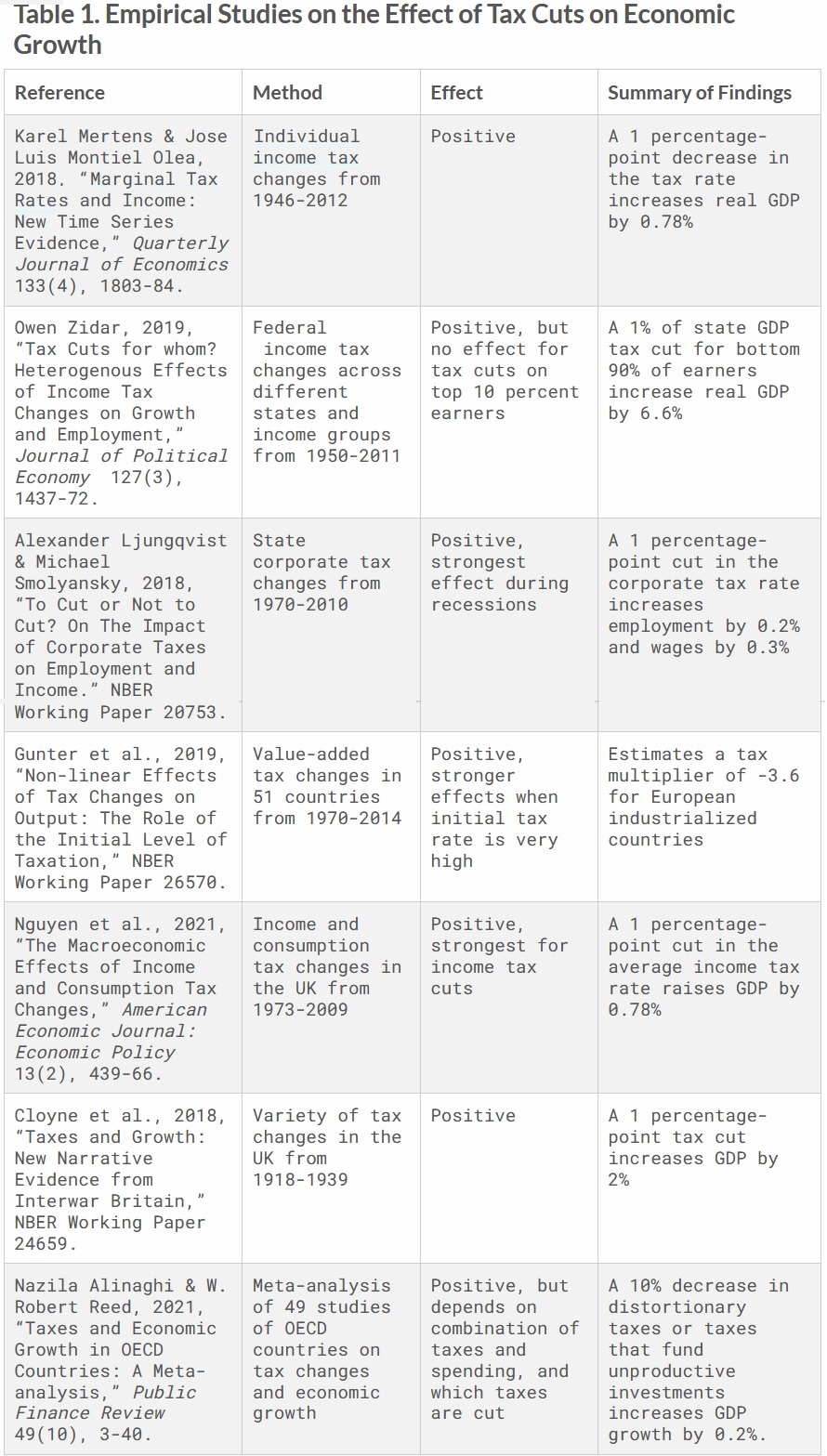

So it’s serendipity that the Tax Foundation has just updated it’s list of research with a new report looking at seven new high-level academic studies.

Here’s some of what the report says about class-warfare tax policy.

With the Biden administration proposing a variety of new taxes, it is worth revisiting the literature on how taxes impact economic growth. …we review this new evidence, again confirming our original findings:

Taxes, particularly on corporate and individual income, harm economic growth. …We investigate papers in top economics journals and National Bureau of Economic Research (NBER) working papers over the past few years, considering both U.S. and international evidence. This research covers a wide variety of taxes, including income, consumption, and corporate taxation.

And here’s the table summarizing the impact of lower tax rates on economic performance, so it’s easy to infer what will happen if tax rates are increased instead.

Some of these findings may not seem very significant, such as changes in key economic indicators of 0.2%, 0.78%, or 0.3%.

But remember that even small changes in economic growth can lead to big changes in national prosperity.

P.S. In an ideal world, Washington would be working to boost living standards by adopting a flat tax. In the real world, the best-case scenario is simply avoiding policies that will make America less competitive.

[…] understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] Class-warfare tax policy is bad news. […]

[…] Class-warfare tax policy is bad news. […]

[…] Second, it’s even more absurd to assert that Social Security is good for young people. Those are the people who are getting a terrible deal from the program. And even if young people aren’t directly hit by the author’s proposed tax increases, they will indirectly suffer as the economy gets weaker. […]

[…] model is based on how higher tax rates discourage productive behavior. And there’s lots of academic evidence to support that […]

[…] fails to account for how tax increases would negatively impact national well-being. And it also fails to account for how a rising burden of government spending […]

[…] may seem obvious, especially for people familiar with the academic research on this topic, but CBO used to have some very silly views on tax […]

[…] may seem obvious, especially for people familiar with the academic research on this topic, but CBO used to have some very silly views on tax […]

[…] these economists also would […]

[…] economy suffers because of the tax increases, and that means less taxable income. So the projected tax increases […]

[…] The economic argument that lower taxes lead to better economic performance and more growth. […]

[…] you might expect, the two academics propose a bunch of class-warfare taxes (which won’t raise as much money as they think), along with a big energy tax on American […]

[…] understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] the actual revenue collected would be lower because all of these tax hikes would significantly undermine incentives to engage in productive behavior by entrepreneurs, investors, small business owners, and […]

[…] it is important to realize that the taxes needed to fund redistribution also are harmful (the magnitude of the problem can be viewed here and […]

[…] understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] if they succeed in enacting those tax increases, we can be very confident of terrible economic consequences. It will be the reverse of Reagan’s very successful […]

[…] Which brings us to the final lesson, which is that class-warfare tax policy was a bad idea in the 1960s and it is still a very bad idea today. […]

[…] main purpose of those columns was to explain why it would be economically harmful to impose punitive tax rates on productive behaviors such as work, saving, investment, and […]

[…] freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] have combined the worst of two worlds, giving us a tax code that simultaneously is filled with class-warfare provisions that punish success while also containing thousands of special tax breaks that benefit the well-heeled friends of […]

[…] 10 years and include every possible tax hike, it’s obvious that a class-warfare agenda (which also would have negative economic effects) would not be enough to finance all the spending that is currently in the […]

[…] 10 years and include every possible tax hike, it’s obvious that a class-warfare agenda (which also would have negative economic effects) would not be enough to finance all the spending that is currently in the […]

[…] 10 years and include every possible tax hike, it’s obvious that a class-warfare agenda (which also would have negative economic effects) would not be enough to finance all the spending that is currently in the […]

[…] freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] The economic consequences of class-warfare taxation are never positive. […]

[…] The economic consequences of class-warfare taxation are never positive. […]

[…] MITCHELL If you’re wondering which economists are right, there’s a lot of evidence that taxpayers are sensitive to changes in tax rates, Especially upper-income taxpayers, in part […]

[…] you’re wondering which economists are right, there’s a lot of evidence that taxpayers are sensitive to changes in tax rates, Especially upper-income taxpayers, in part […]

[…] It’s unfortunate that Biden wants a higher corporate tax burden in the United States. It’s even more disturbing […]

[…] Tax cuts are good for growth, but their effectiveness and durability will be in question if there is not a concomitant effort to […]

[…] Tax cuts are good for growth, but their effectiveness and durability will be in question if there is not a concomitant effort to […]

[…] money. And if they don’t have money, they want to move to places where lower tax burdens create more economic […]

[…] It’s unfortunate that Biden wants a higher corporate tax burden in the United States. It’s even more disturbing […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] It’s unfortunate that Biden wants a higher corporate tax burden in the United States. It’s even more disturbing […]

[…] It’s unfortunate that Biden wants a higher corporate tax burden in the United States. It’s even more disturbing […]

[…] It’s unfortunate that Biden wants a higher corporate tax burden in the United States. It’s even more […]

[…] obvious takeaway is that the United States should not throw away its competitive advantage. Yet another reason to reject Joe Biden’s class-warfare fiscal […]

[…] obvious takeaway is that the United States should not throw away its competitive advantage. Yet another reason to reject Joe Biden’s class-warfare fiscal […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] The Tax Foundation has crunched the numbers from Biden’s tax agenda and has published some very sobering numbers about this latest version of the President’s class-warfare proposals. […]

[…] The Tax Foundation has crunched the numbers from Biden’s tax agenda and has published some very sobering numbers about this latest version of the President’s class-warfare proposals. […]

[…] But if you read this, this, this, and this, you already knew that. […]

[…] But if you read this, this, this, and this, you already knew that. […]

[…] like that the video pointed out how tax-the-rich schemeswouldn’t work, though it would have been nice if they added some information on how genuine […]

[…] that anyone should be surprised by these results. The academic literature clearly shows that it’s not smart to impose high tax rates on productive behavior such as work, saving, […]

[…] believe that there’s no downside if you combine anti-growth spending increases with anti-growth tax increases – so long as there’s no increase in red […]

[…] we know that tax increases generally backfire, both because they undermine economic growth and because they give politicians leeway to spend even more […]

[…] few issues) because Biden has embraced a reckless Bernie Sanders-type agenda of budget profligacy, class-warfare taxes, regulatory excess, and crass protectionism that is too extreme for sane people on the […]

[…] few issues) because Biden has embraced a reckless Bernie Sanders-type agenda of budget profligacy, class-warfare taxes, regulatory excess, and crass protectionism that is too extreme for sane people on the […]

[…] few issues) because Biden has embraced a reckless Bernie Sanders-type agenda of budget profligacy, class-warfare taxes, regulatory excess, and crass protectionism that is too extreme for sane people on the […]

[…] like that the video pointed out how tax-the-rich schemeswouldn’t work, though it would have been nice if they added some information on how genuine […]

[…] like that the video pointed out how tax-the-rich schemes wouldn’t work, though it would have been nice if they added some information on how genuine […]

[…] is especially noxious because it naturally leads to all sorts of misguided policies. Not just class-warfare taxation, but also protectionism and the welfare […]

[…] is especially noxious because it naturally leads to all sorts of misguided policies. Not just class-warfare taxation, but also protectionism and the welfare […]

[…] believe that there’s no downside if you combine anti-growth spending increases with anti-growth tax increases – so long as there’s no increase in red […]

[…] I’m not a fan of Joe Biden’s economic policy, particularly his tax-and-spend agenda. […]

[…] being said, there’s a lot of evidence that higher tax burdens hinder growth, that ever-rising debt burdens can lead to crisis, and that less government […]

[…] being said, there’s a lot of evidence that higher tax burdens hinder growth, that ever-rising debt burdens can lead to crisis, and that less government spending produces […]

[…] I’m not a fan of Joe Biden’s economic policy, particularly his tax-and-spend agenda. […]

[…] not a fan of Joe Biden’s economic policy, particularly his tax-and-spend […]

[…] believe that there’s no downside if you combine anti-growth spending increases with anti-growth tax increases – so long as there’s no increase in red […]

[…] and led to more revenues from the rich. Biden now wants to run that experiment in reverse, so don’t expect positive […]

[…] here’s a look at what happens when politicians create never-ending handouts financed by ever-higher taxes on an ever-smaller group of rich […]

[…] freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] Higher taxes and a bigger welfare state […]

[…] and led to more revenues from the rich. Biden now wants to run that experiment in reverse, so don’t expect positive […]

[…] the sensible approach to business taxation, but the Biden Administration is motivated instead by class warfare and grabbing […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] believe that there’s no downside if you combine anti-growth spending increases with anti-growth tax increases – so long as there’s no increase in red […]

[…] that there’s no downside if you combine anti-growth spending increases with anti-growth tax increases – so long as there’s no increase in red […]

[…] this chart illustrates, class-warfare taxation is the worst way of financing a bigger burden of […]

[…] this chart illustrates, class-warfare taxation is the worst way of financing a bigger burden of […]

[…] Biden Administration’s approach to tax policy is awful, as documented here, here, here, and […]

[…] here’s a look at what happens when politicians create never-ending handouts financed by ever-higher taxes on an ever-smaller group of rich […]

[…] here’s a look at what happens when politicians create never-ending handouts financed by ever-higher taxes on an ever-smaller group of rich […]

[…] Biden Administration’s approach to tax policy is awful, as documented here, here, here, and […]

[…] and led to more revenues from the rich. Biden now wants to run that experiment in reverse, so don’t expect positive […]

[…] and led to more revenues from the rich. Biden now wants to run that experiment in reverse, so don’t expect positive […]

[…] column cited new scholarly research about the negative economic impact of Biden’s plans to increase capital gains […]

[…] column cited new scholarly research about the negative economic impact of Biden’s plans to increase capital gains […]

[…] not referring to President Biden’s destructive tax plan (which you can read about here, here, here, and here). Instead, today’s column will focus on the […]

[…] not referring to President Biden’s destructive tax plan (which you can read about here, here, here, and here). Instead, today’s column will focus on […]

[…] motivates the tax-and-spend crowd? Why do they want high tax rates and a big welfare […]

[…] recognition of the negative consequences of higher […]

[…] Sadly, it’s quite likely that more Americans will be giving up their citizenship if Biden is able to push through his class-warfare tax agenda. […]

[…] understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare […]

[…] Don’t forget all the debilitating taxes that will accompany all the new […]

[…] Don’t forget all the debilitating taxes that will accompany all the new […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] Biden’s Class-Warfare Agenda Is Bad News According to Academic Research on Taxes and Growth […]

[…] And since the underlying economic principles apply in all nations, we also should conclude that higher taxes would be a big mistake for the United States. […]

[…] And since the underlying economic principles apply in all nations, we also should conclude that higher taxes would be a big mistake for the United States. […]

[…] and that’s a big reason why we can confidently state that Biden’s class-warfare agenda is bad for ordinary […]

[…] and that’s a big reason why we can confidently state that Biden’s class-warfare agenda is bad for ordinary […]

[…] freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] of lavish freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and […]

[…] tax agenda – especially the proposed increase in the corporate rate – would be very bad for […]

[…] bottom line is that Biden wants higher taxes and more redistribution, but that’s been a big failure in the part of […]

[…] bottom line is that Biden wants higher taxes and more redistribution, but that’s been a big failure in the part of the world that has […]

[…] Class-warfare tax policy. […]

[…] « Biden’s Class-Warfare Agenda Is Bad News According to Academic Research on Taxes and Grow… […]

[…] Biden’s Class-Warfare Agenda Is Bad News According to Academic Research on Taxes and Growth […]

At first I thought the people behind Joe Biden were just misguided. I don’t think that Joe even knows where he’s at most of the time. I now believe that the people who have propped up Joe are determined to destroy this country. Sad. The evidence that I’ve seen is overwhelming. Nothing good will come from this administration. They must be removed.