A wealth tax is an extraordinarily destructive way for governments to generate revenue.

It violates the principles of sensible tax policy and it does a lot of damage since people have less incentive to save and invest. It’s unadulterated double taxation. Or, in some cases, triple or quadruple taxation.

And it’s unfair.

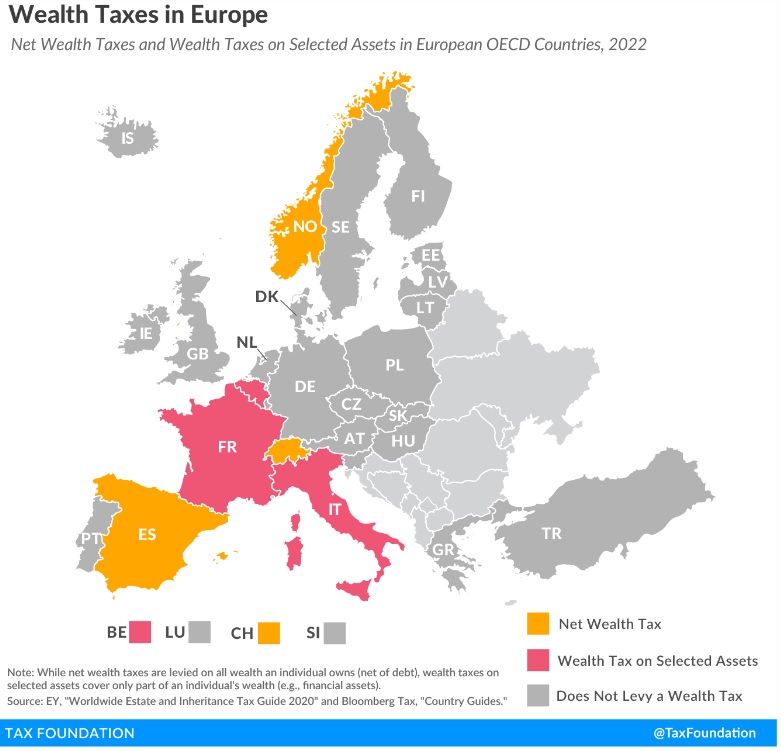

These factors explain why many nations in Europe have abolished their wealth taxes. This map from the Tax Foundation shows the holdouts that still pursue this senseless version of class warfare.

You’ll notice that Spain is one of the few countries that still has this punitive levy. And if you want to learn more about the Spanish version of this levy, you can click here and here for thorough summaries.

But one thing that everyone should understand is that politicians are always capable of making a bad situation worse.

And as you can see from this story by Grace Dean for Business Insider, that’s precisely what the Spanish government is doing by imposing a second wealth tax on the country.

Spain has introduced a second wealth tax amid soaring inflation, adding an extra 3.5% tax on top of wealth over $10 million. …To avoid people being double-taxed, the tax will only apply to the part of people’s assets not already taxed by their autonomous community,

the government said. People will be taxed at a rate of 1.7% on assets between 3 and 5 million euros, 2.1% on assets between 5 and 10 million euros, and 3.5% on assets of more than 10 million euros (around $9.76 million). The government said that it was a temporary state tax for 2023 and 2024… The government is also raising taxes on companies with at least 200 million euros in annual income and expects to bring in an additional 200 million euros by increasing taxes on capital gains above 200,000 euros.

The title of today’s column asks “what fiscal policy is worse than a wealth tax”?

The obvious answer is two wealth taxes.

Though I’m not sure why people are referring to this levy as a second wealth tax when it could be considered an expansion of the existing wealth tax.

Though I’m not sure why people are referring to this levy as a second wealth tax when it could be considered an expansion of the existing wealth tax.

But semantics don’t matter. What is important is that this levy will backfire.

I explained back in 2019 that a wealth tax is basically a back-door way of increasing the tax burden on income that is saved and invested.

This is a very bad idea in theory, for reasons explained here and here, but most people do not realize how bad it is in practice.

It can result in effective tax rates of more than 100 percent.

That’s already happened to some French taxpayers.

And it almost surely will happen to some Spanish taxpayers, particularly since financial markets are not exactly enjoying a good year.

Hardly a recipe for improved competitiveness and faster growth.

But also hardly a surprise given the harsh ideological perspective of the leftist parties governing Spain.

P.S. I predict Andorra will be the big winner.

[…] On the other end of the spectrum, Spain is compounding the damage of wealth taxation by imposing a second wealth […]

Reblogged this on Utopia, you are standing in it!.

[…] What Fiscal Policy Is Worse than a Wealth Tax? — International Liberty […]

[…] What Fiscal Policy Is Worse than a Wealth Tax? […]

[…] Source link Author Dan Mitchell […]

A wealth tax, properly designed, can be part of the three legged tax stool of income, consumption, and net wealth. Taxing all three tax bases can keep rates for each at their lowest to produce the same revenue. It is foolish to talk about double and triple taxation when the rate can be half for each. We can pay half when we earn it (income, payroll) and half when we spend it (sales, VAT, and or business taxes passed to the consumer). We would be better off paying one third the levy on income, one third when it is consumed or invested, and one third for net wealth (real estate, savings, other assets).

All three measures are vital to families and adjustments are necessary at different stages in life. In retirement we need more wealth to offset the lack of earned income and modest spending that can be expected. During family formation more income and spending may be necessary while substantial wealth accumulations can wait until retirement.

While the governments at all levels might want to spread the tax load equally among the three bases, their are fair ways of self adjusting for the needs at each stage of life. Wealth is somewhat self adjusting in that student loans, mortgage, and other loans should be deductions in computing net wealth. Real estate taxes and similar fees should be credits against income (not simply deductions). Consumption taxes of all types should be paid by the business so the consumer is not directly affected.

Progressive taxation may be appropriate for high incomes and high net wealth families well above upper middle class standards.

Of course the elephant is the room is, and always has been, tax expenditures and government transfer programs based on assumed need. Data on the family mix of net wealth and income is far more fair than income alone in determining financial need. Perhaps the government will use it.

[…] – BloombergWhat will happen with inflation, interest rates and housing? – MarketWatchWhat Fiscal Policy Is Worse than a Wealth Tax? – Daniel J. MitchellBritish Pound Climbs as U.K. Scraps Tax Cut for Highest Earners – […]

A wealth tax is a government telling you, your money is not really yours.