I’m a strong believer in fundamental tax reform. We need a system like the flat tax to improve economic performance.

No tax system is good for growth, of course, but the negative impact of taxation can be reduced by lowering marginal tax rate(s), eliminating double taxation of saving and investment, and getting rid of loopholes that encourage people to make decisions for tax reasons even if they don’t make economic sense.

While the general public is quite sympathetic to tax reform and would like to de-fang the IRS, there are three main pockets of resistance.

- The class-warfare crowd is opposed to the flat tax for ideological reasons. They want high tax rates and punitive double taxation – even if the government winds up collecting less money.

- The lobbyists and special interest groups also are opposed to tax reform, along with the politicians that they cultivate. The tax code is a major source of political corruption, after all, and there would be a lot fewer opportunities to game the system and swap loopholes for political support if the 72,000 page tax code was tossed in a dumpster.

- Beneficiaries of certain tax preferences such as the mortgage interest deduction, the charitable deduction, and the state and local tax deduction are worried about tax reform, either because they are taxpayers who utilize the preferences or because they represent interest groups that benefit because the government has tilted the playing field.

This post is designed to allay the fears of this third group, specifically the folks who worry that tax reform might be bad news for charities.

The Wall Street Journal today published a pro-con debate on the charitable deduction. As you might expect, my role is to argue in favor of a simple and fair system that would eliminate all tax preferences.

Here’s some of what I wrote on the charitable deduction, beginning with the key point that economic growth is key because the biggest determinants of charitable giving are disposable income and net wealth.

Here’s some of what I wrote on the charitable deduction, beginning with the key point that economic growth is key because the biggest determinants of charitable giving are disposable income and net wealth.

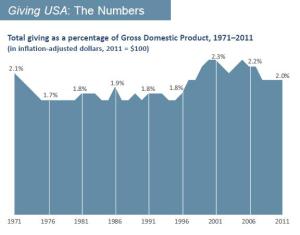

…the best way to help charities is to boost economic growth, which leaves people with more money to donate. And I think the best way to do that is to replace our current system with a simple and fair flat tax. …I don’t think there’s a compelling argument for the charitable deduction. …Over the decades, there have been major changes in tax rates and thus major changes in the tax treatment of charitable contributions. At some points, there has been a big tax advantage to giving, at others much less. Yet charitable giving tends to hover around 2% of U.S. gross domestic product, no matter what the incentive.

The final sentence in the above excerpt is key. The value of a tax deduction is determined by the tax rate. So in 1980, when the top tax rate was 70 percent, it only cost 30 cents to give $1 to charity. By 1988, though, the top tax rate was down to 28 percent, which means that the cost of giving $1 had jumped to 72 cents.

Yet charitable giving rose during the 1980s. Why? Because Reagan implemented reforms – such as lower tax rates – that produced a healthier economy.

Yet charitable giving rose during the 1980s. Why? Because Reagan implemented reforms – such as lower tax rates – that produced a healthier economy.

Some may wonder whether the example I just cited is appropriate since it focuses on the tax rate (and therefore the value of the tax deduction) for upper-income taxpayers.

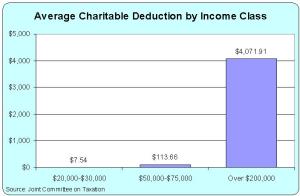

But there’s a good reason for that choice. The charitable deduction overwhelmingly goes to the rich.

Upper-income households are the biggest beneficiaries of the deduction, with those making more than $100,000 per year taking 81% of the deduction even though they account for just 13.5% of all U.S. tax returns. The data are even more skewed for households with more than $200,000 of income. They account for fewer than 3% of all tax returns, yet they take 55% of all charitable deductions.

I’m not against rich people, or against them lowering their tax liabilities. But I do want a tax system that generates more prosperity because that’s good news for the entire economy – including the nonprofit sector.

I’m not against rich people, or against them lowering their tax liabilities. But I do want a tax system that generates more prosperity because that’s good news for the entire economy – including the nonprofit sector.

Speaking of which, I think tax-deductible groups will become better and more efficient without the deduction.

Charities, meanwhile, get fatter and lazier because of that dynamic. Think of all the exposés in recent years about charities that devote an overwhelming share of their budgets to administrative costs and marketing expenses. No system will create perfect nonprofit groups, but cutting back or cutting out the deduction would break the cycle of inefficiency that now exists.

![]() My debating partner is Diana Aviv, the head of Independent Sector, which is basically a trade associate in DC for charities. Here are the most relevant excerpts from her piece.

My debating partner is Diana Aviv, the head of Independent Sector, which is basically a trade associate in DC for charities. Here are the most relevant excerpts from her piece.

…more than 80% of those who itemized their tax returns in 2009 claimed the charitable deduction and were responsible for more than 76% of all individual contributions to charitable organizations.

That’s all fine and well. What she’s basically saying is that almost all rich people itemize and those rich people get the lion’s share of the benefit from the deduction.

But that’s not the key issue. What matters is whether the deduction makes a big difference for the amount that people contribute. Diana addresses that point.

According to a 2010 Indiana University survey, more than two-thirds of high-net-worth donors said they would decrease their giving if they did not receive a deduction for donations.

I don’t put complete faith in public opinion data, but let’s assume that this poll is a completely accurate snapshot of how rich people think they would react. But let’s balance that off with the real-world evidence from the 1980s, which shows that rich people gave more money in the 1980s after Reagan cut tax rates and dramatically lowered the value of the tax deduction.

I’m not saying the lower tax rates caused the increase in giving, but I am saying that the lower tax rates and other reforms helped boost the economy. And I’m saying that rich people gave more to charity because they had more income and more wealth.

I also can’t resist a comment about this excerpt.

Finally, there’s another important consideration. The charitable deduction is unique in that it’s a government incentive to sacrifice on behalf of the commonweal. Unlike incentives to save for retirement or buy a home, it encourages behavior for which a taxpayer gets no direct, personal, tangible benefit.

Huh?!? Diana’s entire article is based on the notion that people need to be bribed in order to contribute, yet she simultaneously says that taxpayers get “no direct, personal, tangible benefit.”

Let me close by tying this debate to the fiscal cliff negotiations. There is some discussion of capping itemized deductions as a way of extracting more money from the rich. That creates a bit of a quandary. Here’s something else I wrote for my part of the debate.

I don’t want to give more revenue to Washington. That’s like putting blood in the water with hungry sharks around. But if politicians are going to extract more money from the private sector anyway, reducing or eliminating the deduction is much less damaging to growth than imposing higher marginal tax rates.

That being said, that type of change – while not as bad for the economy – probably would have a negative impact on charitable giving.

My argument is that real tax reform can benefit the nonprofit sector because the loss of the deduction is more than offset by the pro-growth impact of lower tax rates, less double taxation, etc.

But if all politicians are doing is limiting the deduction as part of a money grab, then nonprofits get some pain and no gain.

Incidentally, this is why the nonprofit community should join the rest of us in fighting against an ever-climbing burden of government spending. If we don’t rein in Leviathan, it’s just a matter of time before politicians get rid of the deduction as part of a relentless search for more revenue.

I think it would be better for nonprofits – and for the rest of us – if we limit the size and scope of government and enact a tax system that produces the kind of prosperity that is beneficial for all sectors of the economy.

[…] instance, even though I don’t like itemized deductions for things like charitable contributions and home mortgage interest, I am glad when taxpayers are able to use those tax preferences to […]

[…] Nor is it like a traditional tax preference, where you can lower your tax bill if you do something politicians like – such as having a mortgage or contributing to charity. […]

[…] for the government to know about our donations. And since there’s plenty of evidence that nonprofits would prosper without a special preference in the tax code, this would be a win-win […]

[…] I’m a skeptic of Duquette’s research for the simple reason that real-world data shows that charitable contributions rose after Reagan slashed tax […]

[…] In the long run, that can happen with a simple and fair flat tax that does away with the deduction for charitable contributions and thus removes any need for monitoring and […]

[…] In the long run, that can happen with a simple and fair flat tax that does away with the deduction for charitable contributions and thus removes any need for monitoring and […]

[…] what it’s worth, I don’t like the state and local tax deduction and the charitable deduction, and I also don’t like preferences for […]

[…] include itemized deductions for mortgages and charitable contributions, as well as the fringe benefits exclusion and the exemption for municipal bond interest. And there […]

[…] include itemized deductions for mortgages and charitable contributions, as well as the fringe benefits exclusion and the exemption for municipal bond interest. And there […]

[…] getting rid of preferences such as the healthcare exclusion, the municipal bond exemption, the charitable contributions deduction, and the state and local tax […]

[…] the deduction for charitable contributions isn’t an optimistic sign for those of us who support fundamental tax […]

[…] allowance in a flat tax, which is akin to lines 4 and 9, but there are no deductions, so line 5 and line 6 could disappear. Likewise, there would be no redistribution laundered through the tax code, so line […]

[…] favors in the tax code for ethanol also deserve scorn and disdain, and I’m also not a fan of the charitable deduction or the ways in which housing gets preferential […]

[…] no distorting preferences for charity or housing. And no double taxation of any form, along with expensing instead of depreciation. Very […]

[…] no distorting preferences for charity or housing. And no double taxation of any form, along with expensing instead of depreciation. Very […]

[…] no distorting preferences for charity or housing. And no double taxation of any form, along with expensing instead of depreciation. Very […]

[…] already shown how the vast majority of charitable deductions are taken by those making more than $200,000 per […]

[…] to loopholes, the disappointing news is that the charitable deduction is untouched and the home mortgage interest deduction is merely trimmed. But the positive news is […]

[…] to loopholes, the disappointing news is that the charitable deduction is untouched and the home mortgage interest deduction is merely trimmed. But the positive news is […]

[…] much lower tax rates. Including the healthcare exclusion, the mortgage interest deduction, the charitable giving deduction, and (especially) the deduction for state and local […]

[…] Charity? Nope. […]

[…] Charity? Nope. […]

[…] Charity? Nope. […]

[…] Charity? Nope. […]

[…] income tax, such as the state and local tax deduction, the mortgage interest deduction, the charitable contributions deduction, the muni-bond exemption, and the fringe benefits […]

[…] another argument for the flat tax. If there’s no charitable deduction, there’s no opening for a politically biased IRS bureaucracy to investigate and harass […]

[…] and shelters, including one that benefit me such as the home mortgage interest deduction, the charitable contributions deduction, and the state and local tax […]

[…] I’ve specifically come out against tax preferences for ethanol, housing, municipal bonds, charity, and state and local […]

[…] previously explained why it’s okay to get rid of itemized deductions for mortgage interest, charitable contributions, and state and local tax […]

[…] previously explained why it’s okay to get rid of itemized deductions for mortgage interest, charitable contributions, and state and local tax […]

[…] though I knew some people would call me Scrooge, I wrote a few days ago about why we should get rid of the tax deduction for charitable contributions in exchange for lower tax […]

[…] though I knew some people would call me Scrooge, I wrote a few days ago about why we should get rid of the tax deduction for charitable contributions in exchange for lower tax […]

[…] though I knew some people would call me Scrooge, I wrote a few days ago about why we should get rid of the tax deduction for charitable contributions in exchange for lower tax […]

SteveSturm, your idea that a charitable donation can be viewed as money that was never received by the donor is a flawed one. How an individual chooses to spend his money (on food, gambling, fast woman, paying state taxes or making a charitable donation) can not change the economic reality, that he has earned this money and has then decided on how it will be spent. In the tax law, he has an unrestricted claim to such money, and that means that he has recognized income of such amount, regardless of how he chooses to spend the money..

You also assert that being able to deduct doesn’t give the taxpayer a discount on his taxes; that it allows him to contribute more than he otherwise would have been able, and you say these two are not the same thing. Yes, these are not the same things, but you infer that if it serves one of these two purposes, then it cannot also be the other. Yet, it should be obvious to you that a charitable donation could result in both of these effects: a discount on his taxes and providing him with an ability to make more charitable donations.

A different, and in my mind, better way of justifying the charitable deduction is to deem the donation as not having been received by the taxpayer. They are effectively saying ‘I want $XX of my income to go to someone else’ and they should thus be taxed only on the money they actually receive. Charitable donations can thus be differentiated from other uses of income, such as paying state taxes, education, child care or mortgage interest in that these are all items that can only logically be spent out of money you’ve received.

I also find it interesting that you dislike the (liberal) approach of treating deductions as a ‘cost to the government’, yet you sort of take that view towards charitable contributions. Being able to deduct charitable deductions doesn’t give the taxpayer a discount on his taxes, it allows him to contribute more than he otherwise would be able to donate. Not the same thing.

I’d suggest looking at the issue more like vouchers for school choice. Some propose school choice might be handled better via a tax credit than a voucher.

A 100% tax credit for charity (with perhaps a rising cap to ensure the government isn’t entirely defunded right away 🙂 ) would serve the same purpose as a tax credit for education, to force the government to compete for your money. There are variants on the notion of introducing competition into the process of helping people on this page, along with comments on reducing the tax credit after competition leads the private sector to take over from government provision of social programs:

http://www.politicsdebunked.com/government-fails-the-poor

Last year based on US Census data $195 billion would have been needed last year to simply give everyone enough money to bring their income above the poverty level.

$1030 billion at least was spent on federal anti-poverty programs (including state funding put into those programs).

Many suggest Milton Friedman’s idea of a negative income tax would encourage government dependency too easily, vs. charitable programs that might be designed to get people on their feet in a sustainable fashion.

The idea is to let people keep more of their own money, rather than “bribery” with the tax code. I acknowledge that is a general problem with the tax code, but in certain cases I think the potential benefits may outweigh the concerns.

The flat tax will never gain political momentum. The flat tax would decimate demand for political services and thus would seriously reduce the number of zero-sum, real cost, political jobs.

Support for a flat tax would have to reach a 70% supermajority amongst the voting public before politicians cave in to reducing demand for the very services they offer: central planning and redistribution that is as complex as possible. Politicians from both right and especially left will fight it tooth and nail. It is, after all their jobs and the life path they have chosen that are at stake for them.

An obvious point which would be superfluous, were it not for the fact that the pitchfork rhetoric is becoming the new norm:

Portraying the charitable deduction almost as “a perk for the rich” is quite perverse.

When a despicable rich greedy person donates $1000 to a charity, he is out $1000. Whether his $1000 all go to the charity, or whether he has to donate $600 to the charity and $400 to the state is monetarily the same. Of course, the evil rich may be less inclined to donate in the second case, since only $600 from his donation will reach his favorite charity, the remaining $400 having to go towards the mandatory compassion, political allocation of wealth, and incentives to mediocrity that voters have demanded.

Even better would be the Fair Tax, or national sales tax. Foreign tourists (we have many) would contribute to our tax burden each time they make a purchase.

Watching children at play is instructive. Inevitably (this holds true from k-8th) they will play for two minutes, and then spend the next 43 minutes arguing the rules of the game. I see a complete parallel with the tax code. The bad actors are all trying to game the play with their rules.

That everyone would be much better off with simple, clear rules is not an option they will consider. They in this case being both the children and the politicians.

Well Said! Couldn’t agree more.