Even though I fret about a growing burden of government and have little faith in the ability (or desire) of politicians to make wise decisions, I somehow convince myself that good things will happen.

Here’s some of what I wrote two years ago, when asked whether I thought America could be saved from a Greek-style fiscal collapse.

I think there’s a genuine opportunity to save the country. …we can at least hold the line and prevent government from becoming bigger than it is today. Sort of a watered-down version of Mitchell’s Golden Rule. The key is the right kind of entitlement reform.

But in that same article, I also issued this warning.

I may decide to give up if something really horrible happens, such as adoption of a value-added tax. Giving politicians a big new source of revenue, after all, would cripple any incentive for fiscal restraint.

To be blunt, imposing a big national sales tax – in addition to the income tax – would be a horrible defeat for advocates of limited government. A VAT would lead to more spending and more debt.

And that’s when folks might consider looking for escape options because America’s future will be very grim.

Here’s a video I narrated on why the value-added tax is awful public policy.

Thankfully, I’m not the only one raising the alarm.

In a recent editorial, the Wall Street Journal wisely opined on the huge downside risk of a value-added tax.

It’s the hottest trend among tax collectors, raising a gusher of revenue for spendthrift governments worldwide. …a new report from accounting firm Ernst & Young says that VAT “systems are spreading” around the world and “rates are rising.”

By the way, the comment about “rates are rising” is an understatement, as illustrated by the table prepared by the Heritage Foundation.

Politicians love VATs both because they generate huge amounts of revenue and because the tax is hidden in the price of products and thus can be increased surreptitiously.

The WSJ explains.

The VAT is a sort of turbo-charged national sales tax on goods and services… Politicians love it because it is the most efficient revenue-raiser known to man, and its rates can be raised gradually to finance new entitlements or fill budget holes. The VAT is typically introduced with a low rate but then moves up over time until it swallows huge chunks of national economies. …Because VATs are embedded in the price of products, they can often rise unnoticed by the consumer, which is why liberals love them as a vehicle for periodic stealth tax hikes.

And in this case, “periodic” is just another way of saying “whenever politician want more money.”

And if recent history is any indication, “whenever” is “all the time.”

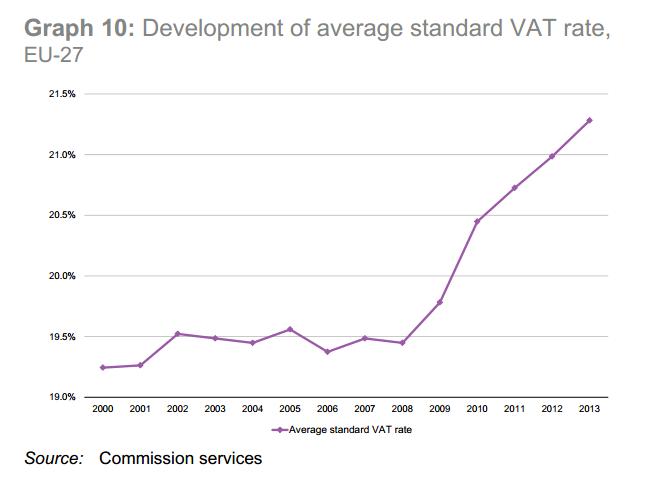

E&Y says standard VAT rates now average a knee-buckling 21.6% in the European Union, up from 19.4% in 2008. Average standard rates in the industrial countries of the Organization for Economic Cooperation and Development have climbed to 19.2% from 17.8% in 2009. Japan is another example of the VAT upward ratchet. The Liberal Democratic Party tried to introduce the tax for years and finally succeeded with a 3% rate in 1989. Eight years later the shoguns raised it to 5%. Last year it climbed to 8%, whacking consumption and sending the economy back to negative growth.

The Japanese experience is especially educational since the VAT is a relatively new tax in that nation.

And here’s a chart showing what’s happened in the past few years to the average VAT rate in the European Union.

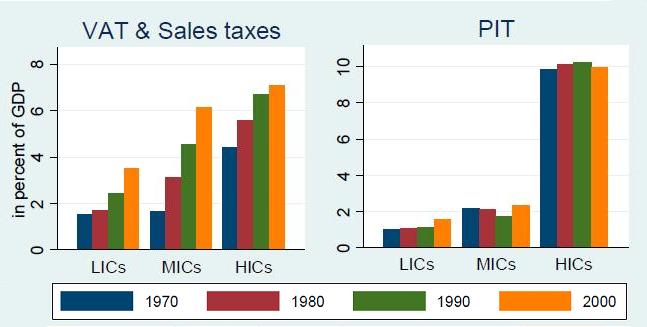

Now let’s look at another chart that is far more worrisome.

It shows that the burden of government spending in Europe, before VATs were adopted, wasn’t that much different than the fiscal burden of the public sector in the United States.

But once the VAT gave politicians a new source of revenue, spending exploded.

By the way, you won’t be surprised to learn that politicians increased spending even more than they increased taxes.

So not only did VATs lead to more spending, they also led to more debt. I guess that’s a win-win from the perspective of statists.

Let’s now return to the WSJ editorial. Proponents sometimes claim that VATs are neutral and efficient. That may be somewhat true in theory (just as an income tax, in theory, might be clean and simple), but in the real world, VATs simply make it possible for politicians to auction off a new source of loopholes.

…while VAT systems are often presented as models of simplicity that theoretically treat all goods and services alike, politicians can’t resist picking winners and losers, creating higher or lower rates for industries at their whim. “The politicians always start running with exemptions,” says E&Y’s Gijsbert Bulk.

Here’s the bottom line.

Americans, be warned. …don’t think it can’t happen here. Liberals campaign on soaking the rich, but they know there’s only so many rich to soak. To finance the growing entitlement state, they need a new broad-based tax that hits the middle class, where the big money is. That means either a VAT or a new energy tax, like the BTU tax Bill and Hillary Clinton proposed in 1993 or the cap-and-tax scheme that President Obama wanted.

The WSJ is correct. We need to be vigilant in the fight against the VAT.

But what makes this battle difficult is that some putative allies are on the wrong side.

Tom Dolan, Greg Mankiw, and Paul Ryan have all expressed pro-VAT sympathies. The same is true of Kevin Williamson, Josh Barro, and Andrew Stuttaford.

And I’ve written that Mitch Daniels, Herman Cain, and Mitt Romney were not overly attractive presidential candidates because they expressed openness to the VAT.

P.S. Some of you may be asking why leftists are so anxious for a VAT since they traditionally prefer class-warfare based tax hikes that extract revenue from the rich.

But here’s one of the dirty secrets of Washington. They may not admit it in public, but sensible leftists understand that there are Laffer-Curve constraints on extracting more revenue from upper-income taxpayers.

They’re familiar with the evidence from the 1980s about the sometimes-inverse link between tax rates and tax revenue and they are aware that “rich” people have substantial control over the timing, level, and composition of their income.

So if you want to collect more money, you have to go over lower-income and middle-income taxpayer.

Which is exactly what the IMF inadvertently revealed in a study showing that VATs are the “effective” way of financing bigger government.

P.P.S. I should have written that leftists generally don’t admit that they want higher taxes on the general population. Because every so often, some of them confess that their goal is to rape and pillage the middle class.

P.P.P.S. You can enjoy some good VAT cartoons by clicking here, here, and here.

[…] The bottom line is that the VAT is a money machine for bigger government. […]

[…] wasn’t until the mid-1960s that the welfare state exploded in size (aided and abetted by the imposition of value-added […]

[…] Public finance experts sometime differ in how to describe a value-added tax. […]

[…] If you dig through the details, the good news is that the United States has a very high score for “consumption taxes,” which largely is because we haven’t copied the mistake of other nations and imposed a value-added tax. […]

[…] to say, those VAT increases are having the same impact in Europe as they are in Japan – bigger government, more debt, and anemic economic […]

[…] written dozens of columns explaining why it would be a terrible idea for the United States to enact a value-added […]

[…] Notice that the United States (highlighted in red) gets very bad scores for property taxation and international tax rules. But that bad news is somewhat offset by getting a very good score on consumption taxation (let’s hope politicians never achieve their dream of imposing a value-added tax!). […]

[…] stated, I don’t want that to happen in […]

[…] So the case for trade taxes is very similar to the market-friendly case for a value-added tax. Yes, there is a theoretical argument to replace all income taxes with a VAT, but it’s not realistic. […]

[…] Houses agree. “Any tax” includes a national sales tax and a national value added tax (VAT). Statists love the VAT because it raises a “gusher of revenue for spendthrift governments”. This is what will replace the income, gift, and estate […]

[…] agree. “Any tax” includes a national sales tax and a national value added tax (VAT). Statists love the VAT because it raises a “gusher of revenue for spendthrift governments”. This is what will replace the income, gift, and estate […]

[…] It’s worth pointing out that the value-added tax has generated much of the additional tax revenue (and therefore enabled much of the added burden of government spending) in […]

[…] also why I want the value-added tax (VAT) to become a third-rail issue. Simply stated, it would be a catastrophic mistake to give Washington an additional source of tax […]

[…] The bottom line is that the VAT is the Ebola Virus of big government. […]

[…] I start foaming at the mouth when politicians talking about value-added taxes. But Senator Cruz obviously isn’t proposing […]

[…] This is the same reason why I’m so strongly opposed to the value-added tax even though it theoretically doesn’t do as much damage – per dollar collected – […]

[…] VAT helped finance the giant expansion of the welfare state in […]

[…] VAT helped finance the giant expansion of the welfare state in […]

[…] VAT helped finance the giant expansion of the welfare state in […]

[…] warned just last week about the dangers of letting politicians impose a value-added […]

Tax revenues are up, Meanwhile the value of the Euro has fallen to half of what it was compared to the dollar.

There is nothing wrong with VAT as a tax system but Dan has it completely right… the problem is government. It is up to us to make it as difficult as possible to raise taxes, if it is left to politicians they will expand government and its taxes until someone is literally pointing a gun at their heads.

VAT is just too easy to be left in the hands of our irresponsible politicians. The levels of taxation in Europe will inevitably lead to social and political unrest. No matter how much revenue governments get, they will spend more. History has shown this to be true.

Both the VAT and a National Sales Tax (FairTax) have two significant problems:

1. Because taxes are already part of gross salaries, removing the tax on income is the same as giving everyone a raise and then taxing the increased cost. For example, assume that a company with no overhead or profit has one employee paid $100,000. Currently he pays $25,000 in taxes. Under a FairTax of 23%, he would receive his $100,000, but his company would have to increase the price of his services from $100,000 to $130,000 to pay the 23% tax.

2. Because taxes on services are notoriously difficult to collect, there is $30,000 for the buyer and seller to split by dealing under the table. Of course, not all transactions would be under the table, but enough would to damage revenue collection.

The most efficient revenue collection method would be a hybrid flat tax/FairTax. Under that plan salaries would be taxed. Companies would be taxed on a percentage of gross sales, however, they could deduct domestic gross salaries, domestic components, domestic transportation (of product), and domestic capital goods from gross sales; since all these items were previously taxed.

Since most services are primarily labor based you avoid problem #2.

While this is all factual and true with respect to European VAT systems, the same is hardly true of North American VAT systems. Canada, hardly the spendthrift spoiled child of Mitchell’s nightmare, has actually lowered the federal VAT rate from 7% in 1991 at the introduction to 5% today. Most learned readers here would surely agree that the USA is much more like our closest neighbors to the north than distant relatives across the Atlantic ocean.

Dan,

Provided we adopt a VAT to replace the income tax, I don’t see any problem. A 10% VAT can appear on every sales receipt in the same way that State sales taxes are shown today. There is nothing “hidden” about a VAT. And the good news is that illegal evasion tends to go down due to the self policing nature of a VAT. Why not think about a 10% VAT on all new goods and all services. It would replace the revenue from the current individual income tax and might gain Congressional support?

In most welfare state jurisdictions, the rich have been Laffered. So the main source of political power remaining is to eat the very voter-lemmings who put politicians into office.

Those are the natural dynamics of the myopic voter-lemming. Hence few, and few jurisdictions will escape this fate.

Stay mobile.

So as a large proportion of the developed world has already Laffered its rich, attempts to tax them more have immediate consequences on revenue.

More importantly, most jurisdictions also Rahned their dynamism long time ago into sub-par growth rates. Hence they are mired in low growth which cannot even match half the world average. They are thus IN DECLINE.

Again, stay mobile.

The same voter-lemming that goes on strike because he did not get his three percent raise, will acquiesce to a VAT.

Did I say stay mobile?

Reblogged this on Brian By Experience.

[…] The Case against the Value-Added Tax | International Liberty. […]

The main problem is not which tax, but the total tax embedded in prices.

For example, if a product would sell for $75 without any taxes, it must sell for $100 with a 25% tax burden. This tax increases the price by 33%. However, that same product with a 50% tax burden must sell for $150, or a 100% increase in price. Therefore any increases in the tax burden result in a compounded price increase in the product.

Since product price increases are assumed to be inflation, government’s role in triggering the price increase is obvuscated.

The Wall Street Journal has it wrong. Increasing a VAT is definitely noticed by the consumer, since prices necessarily rise. However, the consumer may not know why prices are rising, since prices could rise for a variety of reasons.

A tax on earned income, sales, and a VAT are all consumption taxes, in that the total tax collected ultimately hits the consumer through the prices paid.

The most efficient form of taxation would be to pick one of the three [assuming a flat tax on earned income]. Government does not want to do that because than the burden of imposed tax is more obvious.

While a flat tax is just as transparent as the other two to the consumer, the wage earner also feels the sting; even though it is the consumer that ultimately pays his gross salary with its imbedded taxes through his purchases.

Dan:

Your article has it backwards. A VAT does not lead to increased spending and debt. The desire to increase spending leads to increased taxes and debt.

[…] But here’s one of the dirty secrets of Washington. They may not admit it in public, but sensible leftists understand that WAIT, THERE’S MORE… […]

[…] By Dan Mitchell […]