I’ve been writing about proposed carbon taxes since 2012.

My message is simple and straightforward. It’s possible to design a carbon tax that is theoretically appealing. Simply use all the revenue to get  rid of some other tax that causes greater economic harm, such as the corporate income tax.

rid of some other tax that causes greater economic harm, such as the corporate income tax.

Which is basically the same argument that leads some folks to like the value-added tax.

But my argument against the carbon tax (like my argument against the VAT) is that we shouldn’t give politicians a new source of revenue without some sort of up-front, non-reversible repeal of an existing tax.

And since that’s not possible, the only good carbon tax is a dead carbon tax. However, it’s not very easy to kill this tax.

Columbia University’s Center on Global Energy Policy, working with several other organizations, just released four studies to boost the carbon tax.

Study #1.

Study #2.

Study #3.

Study #4.

And below you’ll see the most relevant table, which comes from study #4. It shows – in theory – what politicians might do with the additional money.

To add my two cents, I augmented the chart by numbering the options (in red) and then providing a short critique (in green).

In large part, I’m pointing out that “theory” may not resemble reality. For instance, how likely is it that politicians would impose this huge tax hike and allow all the funds to be used for deficit reduction (Option #3) instead of using a big chunk of the cash to buy votes?

Unfortunately, it’s not just academics and think tank people who are interested in this new tax.

The Wall Street Journal reports that a Republican congressman is pushing this levy.

A Florida Republican is set to propose a carbon-tax bill in Congress… The plan from Rep. Carlos Curbelo, who represents a Miami-area district…, would replace the federal gasoline tax with a tax on businesses including refineries, power plants and steel mills based on how much oil, coal and other fossil fuels they buy. The carbon tax would likely add three to 11 cents to the average pump price for a gallon of gasoline… he also views it as an infrastructure bill—it is crafted to raise additional revenue for bridges, roads and other projects—and as something he can sell as tax reform because it eliminates the gasoline tax. …Mr. Curbelo’s proposal would price carbon at $24 a metric ton and increase that every year by 2% plus the rate of inflation. It replaces the gasoline tax, which Mr. Cubelo frames as a version of tax overhaul. If enacted, his plan would raise an additional $57 billion to $106 billion a year.

The carbon tax would likely add three to 11 cents to the average pump price for a gallon of gasoline… he also views it as an infrastructure bill—it is crafted to raise additional revenue for bridges, roads and other projects—and as something he can sell as tax reform because it eliminates the gasoline tax. …Mr. Curbelo’s proposal would price carbon at $24 a metric ton and increase that every year by 2% plus the rate of inflation. It replaces the gasoline tax, which Mr. Cubelo frames as a version of tax overhaul. If enacted, his plan would raise an additional $57 billion to $106 billion a year.

Since Congressman Curbelo largely wants the new tax to fund bigger government, he’s proposing a version of Option #5.

Alex Brill of the American Enterprise Institute wants a different type of carbon tax.

One worthy candidate for the next tax reform effort is a cut in the most distortionary taxes in exchange for a tax on carbon emissions, combined with permanent carbon deregulation of the energy sector.  …here are the three key components of a deregulatory carbon tax reform… Roll back burdensome carbon-related regulations. …The motivation is not disregard for the environment or climate, but distrust in the regulatory state as an efficient instrument. …A transparent carbon tax would…raise the price of certain consumer goods, including electricity and gasoline. That is a reality… It is, in fact, the policy’s intent. …a carbon tax would generate revenue that could be used to offset the cost of eliminating other taxes that impose greater harm on the economy. …Turning carbon tax revenues into universal welfare payments, as some have suggested, would not promote long-run economic growth.

…here are the three key components of a deregulatory carbon tax reform… Roll back burdensome carbon-related regulations. …The motivation is not disregard for the environment or climate, but distrust in the regulatory state as an efficient instrument. …A transparent carbon tax would…raise the price of certain consumer goods, including electricity and gasoline. That is a reality… It is, in fact, the policy’s intent. …a carbon tax would generate revenue that could be used to offset the cost of eliminating other taxes that impose greater harm on the economy. …Turning carbon tax revenues into universal welfare payments, as some have suggested, would not promote long-run economic growth.

The good news is that Alex wants Option #4 and is opposed to Option #2.

But that still doesn’t make it a good idea since Congress would never get rid of the corporate income tax.

Writing for the Washington Examiner, Michael Marlow also wants advocates of smaller government to support a carbon tax.

…conservatives should embrace the political opportunity it presents to reduce the harmful distortions imposed by other taxes and shrink the regulatory morass of federal agencies such as the Environmental Protection Agency. …conservatives can achieve these goals with a well-crafted revenue-neutral carbon tax. …Because it would trade “good” policy (a carbon tax) for “bad” policy (regulations and taxes with high excess burdens), it would make government more efficient. And packaging together the benefits from deregulation and tax reform would compensate the public for any adverse economic impact… Ensuring that a carbon tax would not simply finance more government spending requires a strict commitment by conservatives that any legislation establishing a tax on carbon emissions must also include, first, an equal tax cut, preferably targeting existing taxes that impose the highest excess burdens on the economy, and second, a significant rollback of carbon regulations. On these points, conservatives should not negotiate.

with a well-crafted revenue-neutral carbon tax. …Because it would trade “good” policy (a carbon tax) for “bad” policy (regulations and taxes with high excess burdens), it would make government more efficient. And packaging together the benefits from deregulation and tax reform would compensate the public for any adverse economic impact… Ensuring that a carbon tax would not simply finance more government spending requires a strict commitment by conservatives that any legislation establishing a tax on carbon emissions must also include, first, an equal tax cut, preferably targeting existing taxes that impose the highest excess burdens on the economy, and second, a significant rollback of carbon regulations. On these points, conservatives should not negotiate.

Like Alex Brill, Michael Marlow is proposing to do the wrong thing in the best way.

But Option #4 would only be acceptable if the corporate tax is being totally abolished. And that’s not what he’s proposing.

Which is why many sensible voices are explaining that there’s no acceptable argument for a carbon tax.

The Wall Street Journal, for instance, opined on this issue last year.

…never changing is the call from some Republicans to neutralize the issue by handing more economic power to the federal government through a tax on carbon. …George Shultz and James Baker …have joined a group of GOP worthies for a carbon tax… They propose a gradually increasing tax that would be redistributed to Americans as a “dividend.” This tax on fossil fuels would replace the Obama Administration’s Clean Power Plan and a crush of other punitive regulations. …A carbon tax would be better than bankrupting industries by regulation and more efficient than a “cap-and-trade” emissions credit scheme. Such a tax might be worth considering if traded for radically lower taxes on capital or income.

…have joined a group of GOP worthies for a carbon tax… They propose a gradually increasing tax that would be redistributed to Americans as a “dividend.” This tax on fossil fuels would replace the Obama Administration’s Clean Power Plan and a crush of other punitive regulations. …A carbon tax would be better than bankrupting industries by regulation and more efficient than a “cap-and-trade” emissions credit scheme. Such a tax might be worth considering if traded for radically lower taxes on capital or income.

The WSJ shares my concern that Option #4 eventually would turn into Option #2 or Option #5.

…in the real world the Shultz-Baker tax is likely to be one more levy on the private economy. Even if a grand tax swap were politically possible, a future Congress might jack up rates or find ways to reinstate regulations. Another problem is the “dividend.” …the purpose of taxes is to fund government services, not shuffle money from one payer to another. No doubt politicians would take a cut to funnel into renewable energy or some other vote-buying program. The rebates would also become a new de facto entitlement… all methods of calculating a price for carbon are susceptible to political manipulation. The Obama Administration spent years fudging “social cost of carbon” estimates to justify its regulatory agenda. The tax rate would also be influenced by international climate models that have overestimated the increase in global temperature for nearly two decades.

A column in National Review is similarly skeptical.

…a small but persistent group of Republicans are trying to persuade conservatives to abandon…principles and embrace a national energy tax. …the Climate Leadership Council, a group led by James Baker and George Shultz …recently met with the Trump administration to encourage the adoption of a $40-per-ton carbon tax. …There is nothing free-market about their massive new tax hike… A carbon tax would punish users of natural gas, oil, and coal, which make up 80 percent of the energy we consume. This means that all American families would face higher electricity bills and gasoline prices. In fact, it’s estimated that the Council’s carbon tax would hike gasoline prices by 36 cents per gallon. …these hikes would have a disproportionate impact on poor and middle-class families, who spend a higher percentage of their income on energy.

…recently met with the Trump administration to encourage the adoption of a $40-per-ton carbon tax. …There is nothing free-market about their massive new tax hike… A carbon tax would punish users of natural gas, oil, and coal, which make up 80 percent of the energy we consume. This means that all American families would face higher electricity bills and gasoline prices. In fact, it’s estimated that the Council’s carbon tax would hike gasoline prices by 36 cents per gallon. …these hikes would have a disproportionate impact on poor and middle-class families, who spend a higher percentage of their income on energy.

The column discusses a specific plan that envisions a new entitlement (Option #2), warning that it eventually would trigger other types of new spending (Option #5).

Shultz and Halstead want to offset the tax by redistributing to the American people the $300 billion in anticipated revenue from the carbon tax. This is not practical in the real world. The idea that Washington politicians would perpetually refund a massive new revenue stream is incredibly naïve… The more likely scenario is that the government would eventually begin to spend the new revenue… Carbon taxes make energy more expensive. They also destroy jobs, particularly in the manufacturing sector.

Benjamin Zycher of AEI also has a skeptical assessment.

The view is widespread among economists that a (Pigouvian) tax on emissions would be more efficient than the regulatory approach because regulations impose a rough, one-size-fits-all framework for reducing emissions,  while a tax allows each emitter to find the least expensive method of achieving its emissions goal. …The central problem with the consensus view is straightforward: The emissions goal is not fixed. Instead, it must be chosen. …Once government derives revenues from a system of carbon taxes, with ensuing political competition for those revenues, it is not difficult to predict that under a broad range of conditions the emissions reduction goal will be inefficiently stringent. That is, the tax rate will be too high.

while a tax allows each emitter to find the least expensive method of achieving its emissions goal. …The central problem with the consensus view is straightforward: The emissions goal is not fixed. Instead, it must be chosen. …Once government derives revenues from a system of carbon taxes, with ensuing political competition for those revenues, it is not difficult to predict that under a broad range of conditions the emissions reduction goal will be inefficiently stringent. That is, the tax rate will be too high.

And what about the notion that at least the revenues can be used to reduce other taxes?

Fanciful thinking, Zycher explains.

Why should we predict that the interests benefiting from the reduction in the corporation income tax would prove to be the marginal members of whatever congressional coalition imposes the carbon tax? That certainly is possible, but other outcomes seem far more likely. Some industries and geographic regions will bear disproportionate burdens attendant upon the carbon tax, and their votes will be necessary to enact it, particularly in the US Senate. …The list of potential supplicants is long indeed, each comprising some combination of constituencies to protect and campaign contributions and votes to offer.

For all intents and purposes, he’s explaining that “public choice” will turn a bad idea into a really bad reality.

Paul Blair of Americans for Tax Reform summarizes another new proposal for a carbon tax, which is largely a version of Option #2.

Just last month, seven-figure swamp lobbyists Trent Lott and John Breaux rolled out their support for a “simple and elegant” tax on carbon dioxide emissions. Realizing the insufficient appetite for a new “tax,” the former senators disingenuously relabeled it as a “fee.”  Their $40 per ton carbon tax would immediately result in a 36 cent per gallon increase in the gas tax. Proponents of the tax admit that the price of home heating would increase by 22 percent and coal would increase by an average of 264 percent. The revenue generated from this tax would constitute the largest tax increase in U.S. history. To offset some of these astronomical increases in energy costs, the plan would create a new national federally managed welfare program, paying the average family of four $2,000 a year…a program of that scale would greatly exceed the size of Obamacare, giving Uncle Sam the responsibility of managing another $1.7 trillion over a decade.

Their $40 per ton carbon tax would immediately result in a 36 cent per gallon increase in the gas tax. Proponents of the tax admit that the price of home heating would increase by 22 percent and coal would increase by an average of 264 percent. The revenue generated from this tax would constitute the largest tax increase in U.S. history. To offset some of these astronomical increases in energy costs, the plan would create a new national federally managed welfare program, paying the average family of four $2,000 a year…a program of that scale would greatly exceed the size of Obamacare, giving Uncle Sam the responsibility of managing another $1.7 trillion over a decade.

His conclusion is not subtle.

It’s a plan designed to harm American manufacturers, raise prices for every single American consumer, and prop up uncompetitive expensive sources of energy like solar and wind. It places trust in the federal government to manage yet another massive welfare program, while giving the Left a significant opportunity to extract more and more money from taxpayers. Killing a carbon tax dead in its tracks isn’t only good policy, it’s a basic IQ test for modern day conservatives.

Since Republicans have failed many IQ tests in recent years (see here, here, and here), this doesn’t leave me overflowing with optimism.

Last but not least, Ryan Ellis opines on Cong. Curbelo’s carbon tax.

Rep. Carlos Curbelo, R-Fla., will introduce a costly carbon tax bill on manufacturers… Curbelo’s own press release indicate that his carbon tax is structured to be a net tax increase.  While it will eliminate the $0.184 per gallon federal tax on gasoline, the carbon tax will raise taxes higher (on net?) to the tune of $57 billion to $106 billion per year. Over a decade that’s a trillion dollar tax increase… Structurally, the Curbelo carbon tax is typical tax-and-spend liberalism. With the extra resources from the net tax increase, the plan proposes throwing money at so-called “infrastructure projects,” which comes right out of the 2009 Obama stimulus playbook.

While it will eliminate the $0.184 per gallon federal tax on gasoline, the carbon tax will raise taxes higher (on net?) to the tune of $57 billion to $106 billion per year. Over a decade that’s a trillion dollar tax increase… Structurally, the Curbelo carbon tax is typical tax-and-spend liberalism. With the extra resources from the net tax increase, the plan proposes throwing money at so-called “infrastructure projects,” which comes right out of the 2009 Obama stimulus playbook.

As you can see, Ryan is not a fan of what Curbelo is proposing, which is a version of Option #5.

And Ryan also doesn’t want to enrich and empower the swamp.

While the bill by statute includes coal, petroleum, and natural gas, the EPA administrator is also given free rein to expand this carbon taxable list of industries at will. Imagine what an Obama administration would have done with that kind of power. …the Curbelo carbon tax also creates a United Nations NGO-style “National Climate Commission.” If that doesn’t sound scary enough, it also empowers this commission with an unlimited authorization to procure the services of “experts and consultants.” This section of the bill might as well be called the “DC swamp deep state full employment act.” How many of these taxpayer-funded “consultants” would an Obama-like administration use to enforce left-wing policies on the rest of us?

This is a long column, so let me conclude by noting that my opposition to a new tax has nothing to do with partisan politics. I’ve criticized Republicans for backing a carbon tax and I’ve also skewered Democrats for supporting that levy.

Heck, I’ve even gone after self-styled libertarians who advocate for this new tax.  Especially when they pull a bait and switch, claiming initially that the revenue from a carbon tax could be used to lower other taxes, but then later admitting that they’re willing to acquiesce to a huge net tax increase.

Especially when they pull a bait and switch, claiming initially that the revenue from a carbon tax could be used to lower other taxes, but then later admitting that they’re willing to acquiesce to a huge net tax increase.

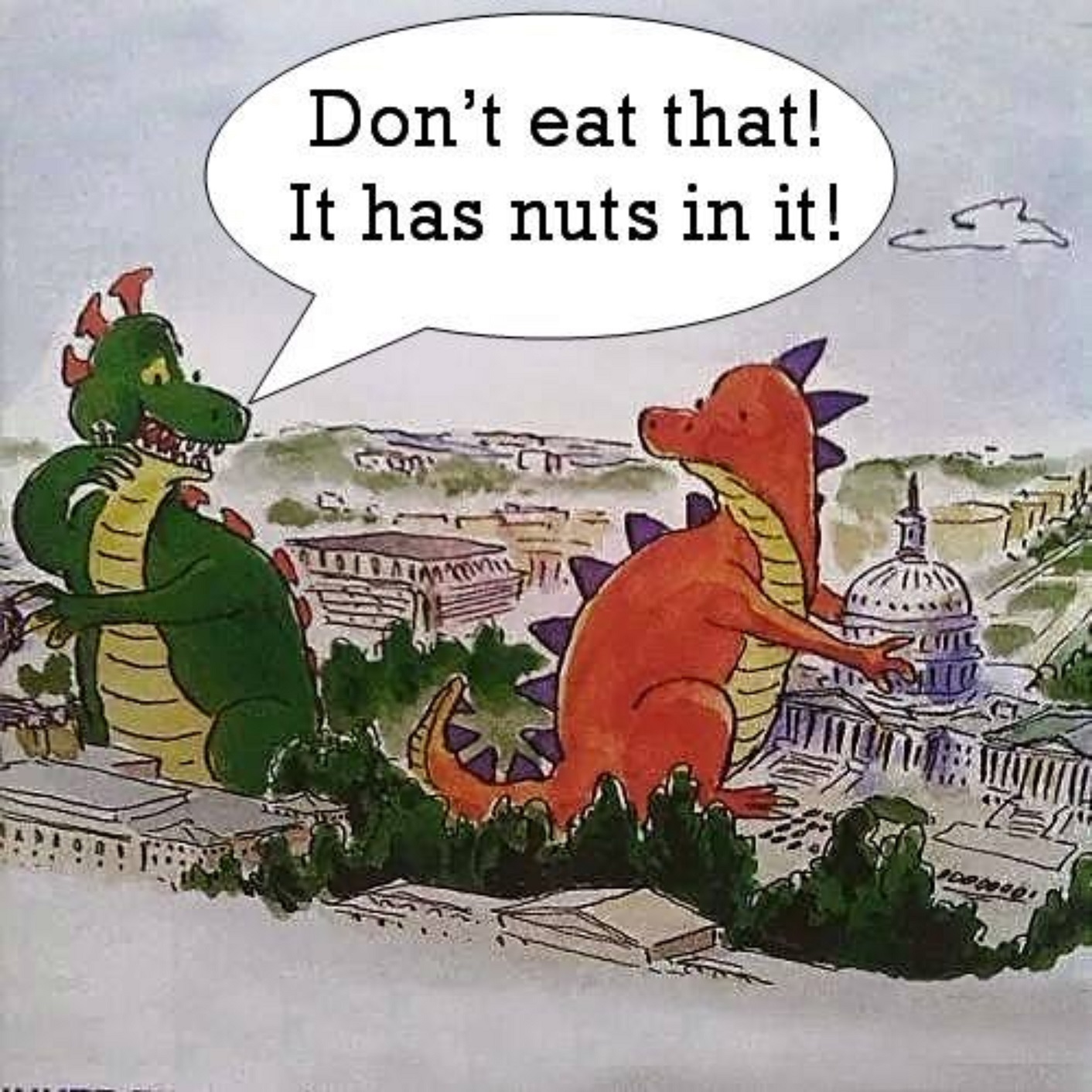

Which confirms all my fears that a carbon tax would wind up being a gusher of money that would trigger an orgy of new spending in Washington.

P.S. I hope nobody will be surprised to learn that both the International Monetary Fund and the Organization for Economic Cooperation and Development support higher energy taxes for the United States.

Read Full Post »

Richard Blumenthal

Richard Blumenthal