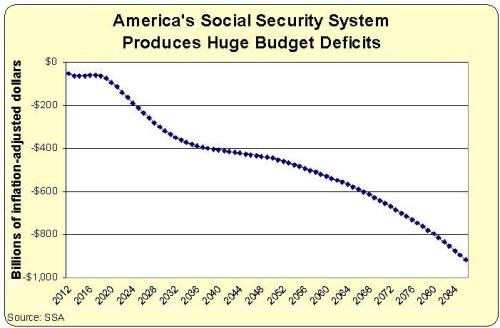

There are two serious problems with America’s Social Security system. Almost everyone knows about the first problem, which is that the system is bankrupt, with huge unfunded liabilities of about $30 trillion.

The other crisis is that the system gives workers a lousy level of retirement income compared to the amount of taxes they pay during their working years. Younger workers are particularly disadvantaged, as are African-Americans because of lower life expectancy.

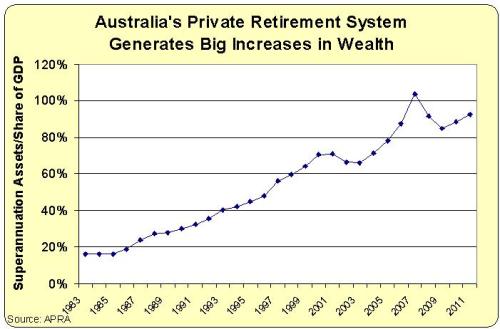

These are critical issues, but perhaps looking at a couple of charts is the best way to illustrate why the Social Security system is inadequate.

Let’s start by looking at some numbers from Australia, where workers set aside 9 percent of their income in personal retirement accounts.

This system, which was made universal by the Labor Party beginning in the 1980s, has turned every Australian worker into a capitalist and generated private wealth of nearly 100 percent of GDP. Here’s a chart, based on data from the Australian Prudential Regulation Authority.

Now let’s look at one of the key numbers generated by America’s tax-and-transfer entitlement system. Here’s a chart showing the projected annual cash-flow deficits for the Social Security system, based on the just-released Trustees’ Report.

By the way, the chart shows inflation-adjusted 2012 dollars. The numbers would look far worse if I used the nominal numbers.

The two charts aren’t analogous, of course, but that’s because there’s nothing to compare. The Social Security system has no savings. Indeed, it discourages people from setting aside income.

And Australia’s superannuation system doesn’t have anything akin to America’s unfunded liabilities. The closest thing to an analogy would be the safety net provision guaranteeing a basic pension to people with limited savings (presumably because of a spotty employment record).

So now ask yourself whether Australia should copy America or America should copy Australia? Seems like a no-brainer.

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] an ideal world, Americans would have personal retirement accounts, just like workers in Australia, Sweden, Chile, Hong Kong, Israel, Switzerland, and a few dozen other […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] is probably the world’s leading example for mandatory savings, while Australia, Denmark, Chile, Switzerland, Hong Kong, Netherlands, Faroe Islands, and Sweden are a few […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] is probably the world’s leading example for mandatory savings, while Australia, Denmark, Chile, Switzerland, Hong Kong, Netherlands, Faroe Islands, and Sweden are a few […]

[…] is probably the world’s leading example for mandatory savings, while Australia, Denmark, Chile, Switzerland, Hong Kong, Netherlands, Faroe Islands, and Sweden are a few […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] (10th place) to engage in another wave of reform. Australia has some good polices, such as a private Social Security system, but it would become much more competitive if it lowered its punitive top income tax rate (nearly […]

[…] If you want to learn more about the best option, Australia, Denmark, Chile, Switzerland, Hong Kong, Netherlands, Faroe Islands, and Sweden are a few of the […]

[…] Australia […]

[…] a Greek-style economic decline. That’s still true, especially since the Aussies have a mostly private Social Security system. Switzerland is always a good option, along with the Cayman Islands, […]

[…] better way of addressing Social Security’s long-run problem. I’ve written favorably about the Australian system, the Chilean system, the Hong Kong system, the Swiss system, the Dutch system, the Swedish […]

[…] way of addressing Social Security’s long-run problem. I’ve written favorably about the Australian system, the Chilean system, the Hong Kong system, the Swiss system, the Dutch system, the Swedish […]

[…] It’s not pure libertarianism, but Australia’s system of private retirement accounts is vastly superior to America’s bankrupt tax-and-transfer Social Security […]

[…] I’m irked, though, that the article doesn’t mention that Hawke (in power from 1983-91) began Australia’s system of personal retirement accounts. […]

[…] far better approach is personal retirement accounts. I’ve written favorably about the Australian system, the Chilean system, the Hong Kong system, the Swiss system, the Dutch system, the Swedish […]

[…] far better approach is personal retirement accounts. I’ve written favorably about the Australian system, the Chilean system, the Hong Kong system, the Swiss system, the Dutch system, the Swedish […]

[…] Australia […]

[…] there a private savings system? – Nations such as Switzerland, Australia, Chile, and the Netherlands have significant private retirement […]

[…] Australia […]

[…] Australia […]

[…] you want real-world role models of retirement systems based on private saving, take a look at the Australian system, the Chilean system, the Hong Kong system, the Swiss system, the Dutch system, the Swedish […]

[…] to reform the system by allowing personal retirement accounts. She was even kind enough to quote me cheerleading for the Australian […]

[…] reform the system by allowing personal retirement accounts. She was even kind enough to quote me cheerleading for the Australian […]

[…] to reform the system by allowing personal retirement accounts. She was even kind enough to quote me cheerleading for the Australian […]

[…] which was a clever decision on my part. Nobody in the United States at the time know anything about the Aussie approach, which meant it was a) comparatively easy to make a contribution to the literature, and b) the […]

Australia has had pension schemes for public service workers and major private companies for many years. In 1980, the government a) made it compulsory for all workers, b) enforced a minimum contribution by all workers of 9%. Funds are invested and the worker eventually gets back the value of his investments at retirement. The retirement scheme is entirely separate from social security e.g unemployment, sickness, housing, family allowances etc. These are unfunded and paid out of central funds.

[…] Australia […]

[…] actually written about many of these systems, especially the ones in Australia and […]

[…] (no unstable welfare states on the border, which is why I didn’t select Switzerland), its private social security system (unfunded liabilities are small compared to the $44 trillion shortfall in America’s […]

[…] to “funded” retirement systems based on real savings. I’m a big fan of the Australian approach. Chile also has a great system, and Switzerland and the Netherlands are good role models as well. […]

[…] noting that the Swiss system is based on “defined contribution” like the Chilean and Australian private retirement systems. This means retirement income generally is a function of how much is […]

[…] how personal accounts are good news, both for workers and the overall economy. Heck, just compare these two charts on the United States and […]

[…] the implicit message should be explicit. Other nations should copy jurisdictions such as Chile, Australia, and Hong Kong by shifting to personal retirement […]

[…] Or, to be more accurate, the right approach is to start with the default assumption that people are responsible for saving and investing to support themselves in retirement. There are lots of nations that now have systems of personal retirement accounts, and this puts them in much stronger position than nations that rely solely on tax-and-transfer entitlement schemes. Hong Kong is a good example, as are Chile and Australia. […]

[…] that’s in part a sad indictment on the global paucity of market-oriented nations. There are some very good policies Down Under, but the fiscal burden of government is far too large. The current government is taking […]

[…] generally a fan of Australia. I wrote my dissertation on the country’s private Social Security system, and I’m always telling policy makers we should copy their approach. The Aussies also […]

[…] Paul Keating – Another non-libertarian, this former Australian Prime Minister gets a nod because of the big role he played in creating his nation’s private social security system. […]

[…] (10th place) to engage in another wave of reform. Australia has some good polices, such as a private Social Security system, but it would become much more competitive if it lowered its punitive top income tax rate (nearly […]

[…] to copy what works. We should partially privatize our Social Security system (actually, we should be like Australia and have full privatization, but we should at least get the ball rolling). And we should have […]

[…] policy, the welfare state, supply-side economics, the tax code, Europe’s fiscal crisis, Social Security reform, demographics, overpaid bureaucrats, healthcare economics, inequality, fiscal policy, and the Ryan […]

[…] Here’s additional language from the report, which cites the private retirement systems in Australia and […]

[…] Here’s additional language from the report, which cites the private retirement systems in Australia and […]

You are leaving out an important part of the Australian story here. Employers are required to contribute 9% to retirement also. See the link and the quote below:

http://www.financialsamurai.com/australian-education-taxes-healthcare-retirement/

“One big benefit I think we do have here in Australia is compulsory employer contributions to employee retirement funds (we call it superannuation). This runs at 9% of your wage as a minimum, but some employers pay more. It is pretty nice having a mandatory systems that helps to ensure you have some funds available when you retire, but as you would expect, it doesn’t add up to much unless you contribute a lot more for retirement yourself. We also have some pretty stringent laws that govern the way this money can be invested and when you can access it, but most people invest in a diversified portfolio through a superannuation fund provider and get access to it at the age of 65.”

[…] Here’s a comparison of real savings in Australia’s system of private accounts compared to the growing debts of America’s pay-as-you-go government-run […]

[…] on savings and wealth accumulation (these dramatic charts show Social Security debt in America compared to ever-growing nest eggs in Australia’s private pension […]

[…] France, Greece, corporate inversions, supply-side economics, income inequality, the Ryan budget, Social Security reform, comparative economic systems, and healthcare […]

[…] personal retirement accounts. This “funded” approach is working very well in nations such as Australia, Chile, and the Netherlands. Since there would be less payroll tax revenue going to government, […]

[…] retirement accounts. This “funded” approach is working very well in nations such as Australia, Chile, and the Netherlands. Since there would be less payroll tax revenue going to government, […]

[…] While I’m a very strong advocate of personal retirement accounts (my Ph.D. dissertation was about Australia’s very good system), I’ll be the first to admit that it’s even more important to modernize Medicare and […]

[…] I’m a very strong advocate of personal retirement accounts (my Ph.D. dissertation was about Australia’s very good system), I’ll be the first to admit that it’s even more important to modernize Medicare and […]

We didn’t leave the SS money in the hands of bureaucrats and politicians to invest it. We just let them steal it.

[…] personal accounts promote national savings, whereas government-run systems lead to debt (check out these two charts for an […]

[…] personal accounts promote national savings, whereas government-run systems lead to debt (check out these two charts for an […]

[…] personal accounts promote national savings, whereas government-run systems lead to debt (check out these two charts for an […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] special attention. Click here if you want to learn about Chile’s successful system and click here if you want to see how Australia’s “superannuation” system has been a big […]

[…] why I’m a big fan of the very successful reforms in places such as Chile and Australia, where personal accounts are producing big benefits for workers. These systems also boost national […]

[…] the most sobering comparison is to look at a chart of how much private wealth has been created in Superannuation accounts and […]

[…] think the video is a good summary explanation, but I also invite you to look at these two charts, one showing the impressive private wealth being accumulated in Australia thanks to personal […]

[…] on this blog, but I’m very interested in Social Security reform. I wrote my dissertation on Australia’s very successful system of personal retirement accounts, for instance, and I narrated this video on Social Security reform in the United […]

[…] world and the winner will be the blindfolded person who puts his pin closest to a nation such as Australia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] world and the winner will be the blindfolded person who puts their pin closest to a nation such as Australia or Switzerland that has a relatively low risk of long-run fiscal […]

[…] the Canadian Liberal Party or Australian Labor Party, it does not appear that the Socialist Party in France is willing to recognize reality and do the […]

[…] in public opinion polls. And with the very good results we’re seeing from nations such as Australia and Chile, I’m cautiously optimistic that reform can happen in […]

[…] referring to Switzerland, with its strong human rights policy on financial privacy, or Australia, with its personal retirement accounts? Nope, the reporter wrote about “fiscally conservative […]

[…] the most sobering comparison is to look at a chart of how much private wealth has been created in Superannuation accounts and […]

[…] the most sobering comparison is to look at a chart of how much private wealth has been created in Superannuation accounts and […]

[…] the most sobering comparison is to look at a chart of how much private wealth has been created in Superannuation accounts and […]

[…] on this blog, but I’m very interested in Social Security reform. I wrote my dissertation on Australia’s very successful system of personal retirement accounts, for instance, and I narrated this video on Social Security reform in the United […]

[…] copying other nations, either when they get one policy right (such as Estonia’s flat tax or Australia’s system of personal retirement accounts), or when they get a bunch of policies right and routinely rank at the top for economic freedom and […]

[…] it sure would be nice to have personal retirement accounts, just like Australia, Chile, and other nations that have modernized their […]

[…] it sure would be nice to have personal retirement accounts, just like Australia, Chile, and other nations that have modernized their […]

[…] copying other nations, either when they get one policy right (such as Estonia’s flat tax or Australia’s system of personal retirement accounts), or when they get a bunch of policies right and routinely rank at the top for economic freedom and […]

[…] referring to Switzerland, with its strong human rights policy on financial privacy, or Australia, with its personal retirement accounts? Nope, the reporter wrote about “fiscally conservative […]

Ideally (this country has difficulty with this simplicity) each family should provide its own insurance policies (medical included), and it should put aside its own funding for retirement (starting when a person begins working). It the government does not have to collect taxes to protect everybody, then government bankruptcy won’t happen, and it can look to national security freely. Such idyllic systems should have been respected back when the idea of government oversight into retirement first reared its ugly head. When in history have politicians been known to think rationally? D.L. Wood

[…] copying other nations, either when they get one policy right (such as Estonia’s flat tax or Australia’s system of personal retirement accounts), or when they get a bunch of policies right and routinely rank at the top for economic freedom and […]

[…] on this blog, but I’m very interested in Social Security reform. I wrote my dissertation on Australia’s very successful system of personal retirement accounts, for instance, and I narrated this video on Social Security reform in the United […]

[…] on this blog, but I’m very interested in Social Security reform. I wrote my dissertation on Australia’s very successful system of personal retirement accounts, for instance, and I narrated this video on Social Security reform in the United […]

[…] Australia vs. the United States: Two Charts that Tell You Everything You Need to Know about Social S… […]

My preference is to be able to choose between funds based upon their expense ratios, fully disclosed and the funds past performance. Then if the high fee guy with his guarantee can show me that his expense is more than offset by the performance, I can make an informed decision.

As far as those so called ‘guaranteed returns”, there is a cost for that both in terms of fees and performance, and if the guaranteed return is below the market performance and it comes at a big expense ratio it will not suit my needs. Maybe it would suit yours, and as long as you are making an informed decision and the options available, then far be it to question your decision.

However, currently, guaranteed returns have been pretty low, and if you had been in the market the last 3 years, you would have WAY out performed that guarantee. And maybe that was still a good decision for you, but it comes at a cost, so you just need to recognize that, in my opinion.

The problem in the past for Australia, was that you did not have that option in their Supra. Maybe that has changed now, but last time I looked no one had the low expense ratios like a Vanguard who charges as little as 20 basis points for index funds. (even less for their admiralty accounts) If you are paying more than than, in my opinion, you better be really beating the market to justify the cost.

Of course, in social security, you have a ‘guaranteed return’ in the way of a lifetime of payments after eligibility, but no choice to improve on the performance, and I take your point about leaving it to the bureaucrat is less than desirable. If I only had the choice between the bureaucrat and your guarranteed return, I too would probably chose what you have, but if I also had a choice of low cost VG index funds, then I would probably be more inclined to go that route, depending on age and closeness to retirement.

@JustMe – But, is that really a problem? I live in Brazoria County, Texas – one of the three counties in the US (along with Galveston and Matagorda) that was able to opt out of Social Security in the early 1980’s so I’ve seen a lot of private plans up close – though unfortunately not able to participate in ours (it’s restricted to just county employees).

I can’t speak on how Australia does it, but the way it works here is that different wealth management firms bid every few years for control of the fund. They use it to make investments since they can make a larger return for a larger stake – just like other hedge funds.They have to guarantee a certain return on the money and pay out of pocket if they lose money, but if they make a return higher than the guaranteed return – they get a percentage of that return as their fee/profit. So they only make money if the account makes money higher than the guaranteed return – and they only get a fraction of that.The rest goes to the account.

So they aren’t “draining off any wealth” – every account grows by a guaranteed return every year. The wealth management firms only make “big fees” if they make even bigger returns on the account.

That’s a good thing. The profit incentive makes them very concerned about making the proper investments in high growth markets and since they have to make up any losses, they limit their high risk moves. Politicians and bureaucrats have a much worse investment record.

So, it boils down to this – would you prefer leaving the management of your fund to a lesser able, uncompensated bureaucrat who makes the same amount regardless of whether or not the fund makes or loses money or would you prefer leaving the money in the hands of highly skilled investment managers who guarantee your investment and who don’t make a dime unless they make you money above and beyond your guaranteed return?

For me, that’s a no brainer.

[…] 1. Look at this post comparing the red ink from America’s bankrupt Social Security system with the huge l…. […]

[…] Australia is perhaps my favorite country. In part this is because there have been some good economic reforms, such as personal retirement accounts. […]

[…] Australia is perhaps my favorite country. In part this is because there have been some good economic reforms, such as personal retirement accounts. […]

Reblogged this on Talon's Point.

[…] Australia vs. the United States: Two Charts that Tell You Everything You Need to Know about Social S… […]

One of these days the liberal democrats will stop bragging about being the party that started Social Security!!!

Totally agree with “Just Me” !

Just me has a good point, but politicians cannot watch money move from point A to point B without taking off a hunk as it goes by. Apologies to Tom Wolfe.

The only thing wrong with the Australian Superannuation program, as I see it, is the Big fees that are charged by the companies administering the plans. It drains off the accumulated wealth over time. If Auzzies could have a plan administered by no load or low load fees, like Vanguard, at 20 basis points, it would be much better.

Excellent 🙂

[…] private social security accounts and it appears to work well for them. Thanks to Dan Mitchell for this excellent […]

Reblogged this on Public Secrets and commented:

The arguments for privatized retirement accounts are so compelling, from Australia and elsewhere, that only fools can oppose them. And by “fools” I mean Democrats and other Statists who demand control of other people’s money.

[…] of good charts, Dan Mitchell at International Liberty has a couple of charts comparing the personal wealth created by Australia’s social security system (a privatized […]

The word cliché exists for a reason. The path to hell is paved with good intentions. They wanted to take care of the elderly, they thought they had a good scheme, but then politicians said, “Oh look a giant pool of money we can play with”.

It’s all over, but for the crying and dying.

Reblogged this on RIGHTthoughts and commented:

There are other ways to solve our problems. A good blog that demonstrates this point.

Reblogged this on Gds44's Blog.