I’m in Sydney, Australia, but not because I’m confirming that this country will be my escape option if (when?) the United States suffers a Greek-style fiscal collapse.

Instead, I’m Down Under for the annual Friedman Conference.

This gives me an excuse to write about Australia, especially since national elections just took place this past weekend. Interestingly, the incumbent, right-of-center government retained power in an upset, winning 77 or 78 seats (out of a possible 151).

Here’s the breakdown.

The folks at Slate lean to the left, so their article is understandably riddled with anguish.

Australia’s dysfunctional, unpopular, conservative government…held onto power for a third term in Saturday’s national election. This happened despite the fact that most analysts expected it to lose a large number of seats; despite being (seemingly) out of step with the nation’s emerging consensus on climate change.. A Labor Party win had been anticipated for three years, with the opposition winning every single poll of the last term. …Expected swings against the coalition in several regions of the country didn’t materialize, while there was a crucial 4 percent swing against Labor in the state of Queensland (alternately described as Australia’s Alabama or Florida). …Progressive Australians are—to understate things—“hurting,”…(only they’re threatening to move to New Zealand instead of Canada). …Labor’s environmental stance, while not actually all that bold, hurt it in coal-friendly Queensland and among voters worried about the costs of acting on climate change… Progressive Australians are reeling because any lingering illusions that we were a “fair” nation have been shattered. Whatever Labor’s political shortcomings, Australians in general voted against a detailed platform that aimed to seriously address climate change, raise wages, increase cancer funding, make child care free or significantly cheaper, close tax loopholes for corporations and the wealthy, fund the arts, fund the underfunded public broadcaster… Instead, they voted for … not much of anything (other than some tax cuts).

…Expected swings against the coalition in several regions of the country didn’t materialize, while there was a crucial 4 percent swing against Labor in the state of Queensland (alternately described as Australia’s Alabama or Florida). …Progressive Australians are—to understate things—“hurting,”…(only they’re threatening to move to New Zealand instead of Canada). …Labor’s environmental stance, while not actually all that bold, hurt it in coal-friendly Queensland and among voters worried about the costs of acting on climate change… Progressive Australians are reeling because any lingering illusions that we were a “fair” nation have been shattered. Whatever Labor’s political shortcomings, Australians in general voted against a detailed platform that aimed to seriously address climate change, raise wages, increase cancer funding, make child care free or significantly cheaper, close tax loopholes for corporations and the wealthy, fund the arts, fund the underfunded public broadcaster… Instead, they voted for … not much of anything (other than some tax cuts).

Since I’m a wonk, I’m much more interested in the policy implications rather than the political machinations.

The good news is that Labor’s defeat means Australia will be spared some costly tax increases and some expensive green intervention.

But it’s unclear whether there will be many pro-growth reforms.

The right-of-center Liberal-National Coalition has promised some tax relief, but I don’t know if it will be supply-side rate reductions or merely the distribution of favors using the tax code.

For what it’s worth, Australia needs to lower its top tax rate on households, which is nearly 50 percent. European-type tax rates are always a bad idea, and they are especially senseless for a country that has to compete with Hong Kong and Singapore.

It would also be nice if the newly reelected government chooses to fix some of the housing policies that have made Australian cities very unfriendly to families.

Joel Kotkin explains why this is a problem in an article for City Journal.

Few places on earth are better suited for middle-class prosperity than Australia. From early in its history, …the vast, resource-rich country has provided an ideal environment for upward mobility… Over the last decade, though, Australia’s luck has changed… Despite being highly dependent on resource sales to China—largely coal, gas, oil, and iron ore—Australia has embraced green domestic politics more associated with Manhattan liberals or Silicon Valley oligarchs than the prototypical unpretentious Aussie…  Historically, the Australian Labor Party, like its counterpart in Britain, was a party of the working class. …These views seem almost quaint today, particularly for a Labor Party increasingly dominated by those operating outside the tangible economy, as part of the professional class—media, finance, public service—and concentrated in the largely family-free urban cores. …Australia’s commitment to renewable energy dwarfs that of even the most committed green-leaning countries. Per capita, Australia has installed roughly five times as many renewable-energy installations as the E.U., the U.S., or China, and even two-and-a-half times more than climate-obsessed Germany. …The most pernicious assault on Australia’s middle class comes from regulation of land and expenditures to promote urban density. …In Australia, only 0.3 percent of the country is urban. As in major cities in Great Britain, Australia, the U.S., and Canada, “smart growth” has helped turn Australia’s once-affordable cities into some of the world’s costliest. …Sydney’s planning regulations, according to a Reserve Bank study, add 55 percent to the price of a home. In Perth, Melbourne, and Brisbane, the impact exceeds $100,000 per house. Australian cities once filled with family-friendly neighborhoods are becoming dominated by dense apartments. …Today, many Australians face an uncharacteristically bleak future. Urged to settle where the planners and pundits prefer, they’re stuck in places both unaffordable and inhospitable, as part of a needless governmental drive to make life there more like that of the more congested, socially riven metropoles of Britain.

Historically, the Australian Labor Party, like its counterpart in Britain, was a party of the working class. …These views seem almost quaint today, particularly for a Labor Party increasingly dominated by those operating outside the tangible economy, as part of the professional class—media, finance, public service—and concentrated in the largely family-free urban cores. …Australia’s commitment to renewable energy dwarfs that of even the most committed green-leaning countries. Per capita, Australia has installed roughly five times as many renewable-energy installations as the E.U., the U.S., or China, and even two-and-a-half times more than climate-obsessed Germany. …The most pernicious assault on Australia’s middle class comes from regulation of land and expenditures to promote urban density. …In Australia, only 0.3 percent of the country is urban. As in major cities in Great Britain, Australia, the U.S., and Canada, “smart growth” has helped turn Australia’s once-affordable cities into some of the world’s costliest. …Sydney’s planning regulations, according to a Reserve Bank study, add 55 percent to the price of a home. In Perth, Melbourne, and Brisbane, the impact exceeds $100,000 per house. Australian cities once filled with family-friendly neighborhoods are becoming dominated by dense apartments. …Today, many Australians face an uncharacteristically bleak future. Urged to settle where the planners and pundits prefer, they’re stuck in places both unaffordable and inhospitable, as part of a needless governmental drive to make life there more like that of the more congested, socially riven metropoles of Britain.

For all intents and purposes, I want Australian lawmakers to rekindle their reformist zeal.

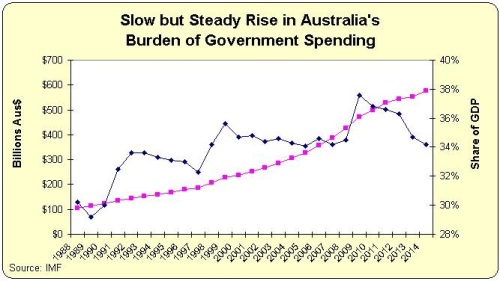

If you look at the historical data from Economic Freedom of the World, you can see that Australia enjoyed a big jump in economic liberty between 1975-2000.

Basically climbing from 6 to 8 on a 0-10 scale.

Sadly, there hasn’t been much reform this century. That being said, Australia’s era of liberalization last century is still paying dividends. The country is routinely ranked in the top-10 for economic liberty.

Interestingly, many of the changes between 1975-2000 happened when the Labor Party was led by reformers such as Bob Hawke and Paul Keating.

Mr. Hawke, incidentally, just passed away. His obituary in the New York Times acknowledges that he liberalized the economy.

Bob Hawke, Australia’s hugely popular prime minister from 1983 to 1991, who presided over wrenching changes that integrated his nation into the global economy…, died on Thursday… Rising to power as a trade union leader, Mr. Hawke led his center-left Australian Labor Party to four consecutive election victories in a tenure of nearly nine years, in which Australia emerged dramatically from relative isolation… Confronting chronic strikes, soaring inflation, high unemployment and trade deficits, Mr. Hawke revolutionized the economy. He cut protective tariffs, privatized state-owned industries…reined in powerful unions… “We are now living in a tough, new competitive world in which we have got to make it on our own merits,” Mr. Hawke told The New York Times in 1985.

to four consecutive election victories in a tenure of nearly nine years, in which Australia emerged dramatically from relative isolation… Confronting chronic strikes, soaring inflation, high unemployment and trade deficits, Mr. Hawke revolutionized the economy. He cut protective tariffs, privatized state-owned industries…reined in powerful unions… “We are now living in a tough, new competitive world in which we have got to make it on our own merits,” Mr. Hawke told The New York Times in 1985.

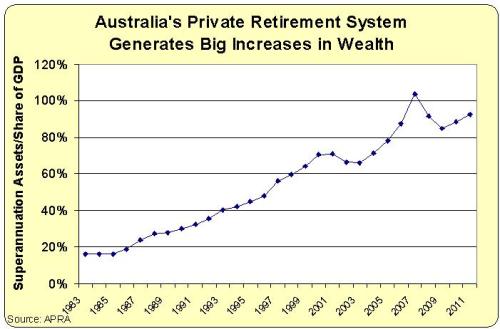

I’m irked, though, that the article doesn’t mention that Hawke (in power from 1983-91) began Australia’s system of personal retirement accounts.

That excellent reform, which was expanded by the Keating government (in power from 1991-96), is paying big dividends to Australia.

Indeed, let’s wrap up today’s column with some excerpts from a laudatory article in the Economist.

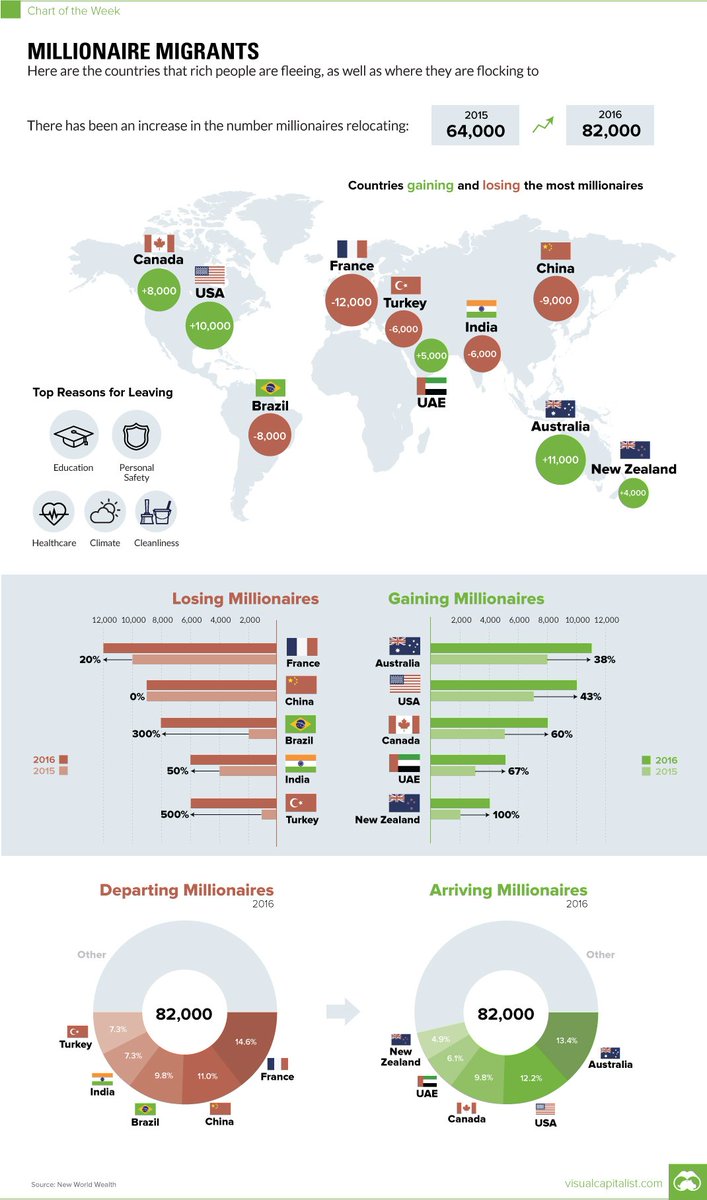

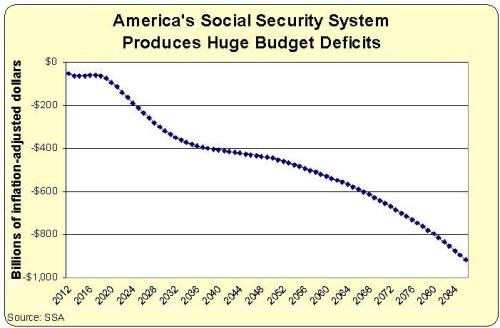

The last time Australia suffered a recession, the Soviet Union still existed and the worldwide web did not. …No other rich country has ever managed to grow so steadily for so long. …Public debt amounts to just 41% of GDP— one of the lowest levels in the rich world. That, in turn, is a function not just of Australia’s enviable record in terms of growth, but also of a history of shrewd policymaking. Nearly 30 years ago, the government of the day overhauled the pension system. Since then workers have been obliged to save for their retirement through private investment funds.

one of the lowest levels in the rich world. That, in turn, is a function not just of Australia’s enviable record in terms of growth, but also of a history of shrewd policymaking. Nearly 30 years ago, the government of the day overhauled the pension system. Since then workers have been obliged to save for their retirement through private investment funds.

It’s noteworthy that the system of personal accounts, known as superannuation, manages to attract praise from unlikely quarters.

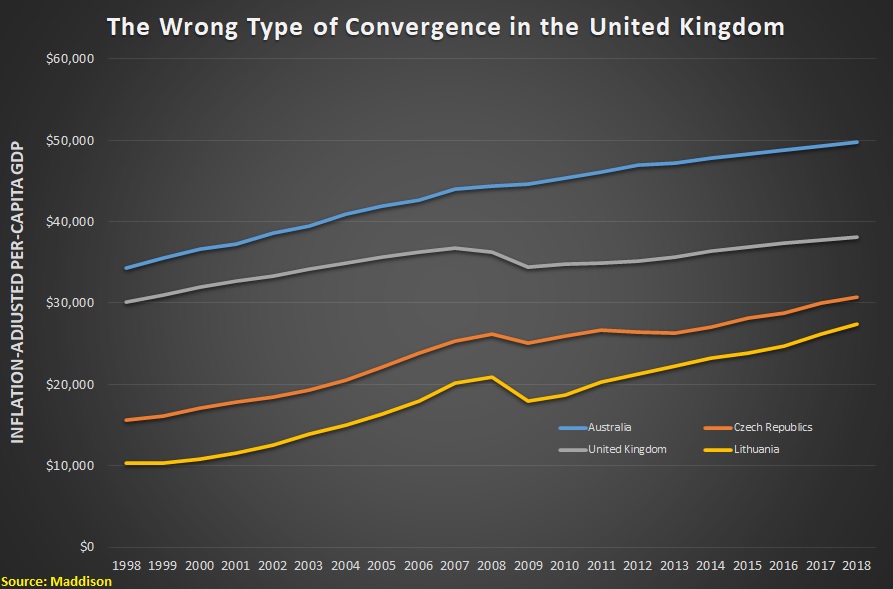

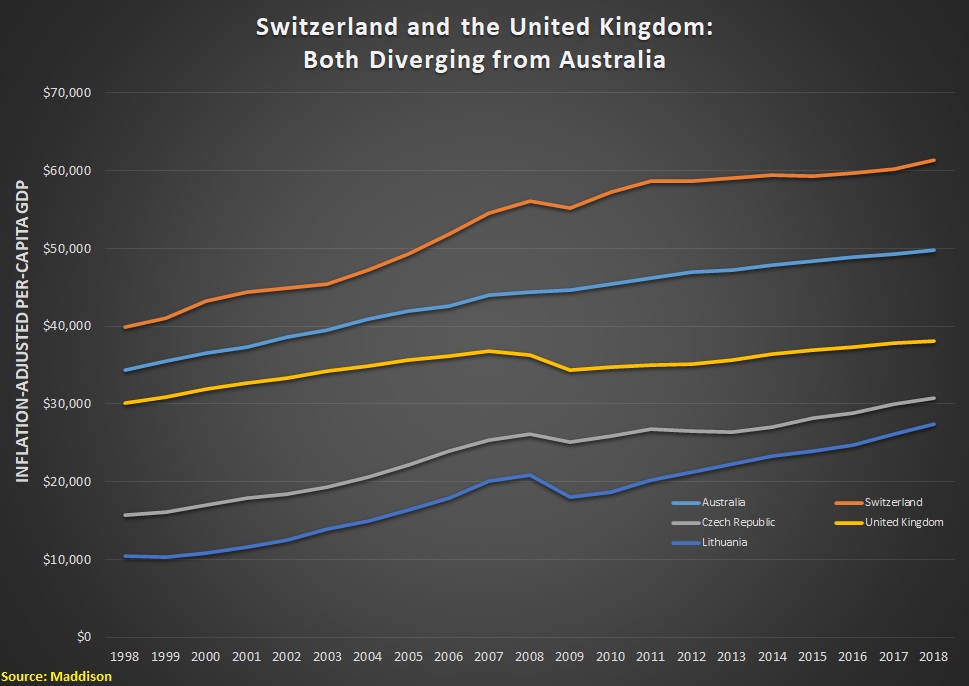

And it is one of the reasons for the country’s success. Here’s an accompanying chart showing that Australia has enjoyed more growth, higher wages, and less debt than other major nations.

Is Australian policy perfect? Of course not.

But does the data from Australia show that better policy leads to better results? Definitely.

P.S. The Aussies also reaped big benefits by unilaterally reducing trade barriers (it would be nice if a certain person residing at 1600 Pennsylvania Avenue learned from that experience).

Read Full Post »