I’ve shared some notable tweets this year.

- Most enjoyable

- Most savage

- Most succinct

- Most clueless

- Most informative

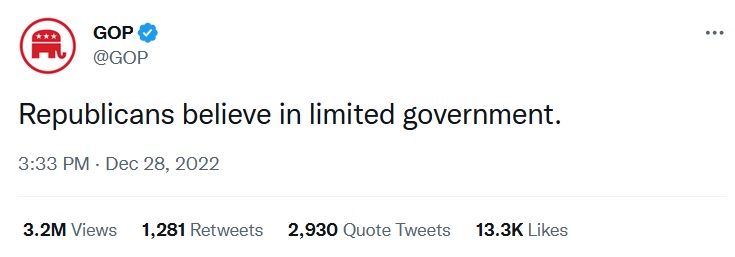

Today, we’re going to expand on this list with the “most laughable” tweet of 2022. But this tweet from the Republican National Committee is a case of accidental humor rather than deliberate humor.

As you might expect, the RNC did not bother trying to prove its statement.

That’s because the Republican party generally does a terrible job. Donald Trump expanded government. George W. Bush expanded government. And George H.W. Bush expanded government.

You have to go all the way back to Ronald Reagan to find a Republican who actually was on the side of taxpayers (and before him, you have to go all the way back to Coolidge).

You have to go all the way back to Ronald Reagan to find a Republican who actually was on the side of taxpayers (and before him, you have to go all the way back to Coolidge).

Indeed, Republicans usually wind up expanding government faster than Democrats.

And that’s not because of the defense budget. Even when looking at just domestic spending, Republicans (other than Reagan) have a worse track record.

I have to wonder whether the folks at the RNC were doing hallucinogenic drugs when they sent out that tweet? Or was it a naive intern who heard a few speeches and was tricked into thinking the GOP actually cared about shrinking government.

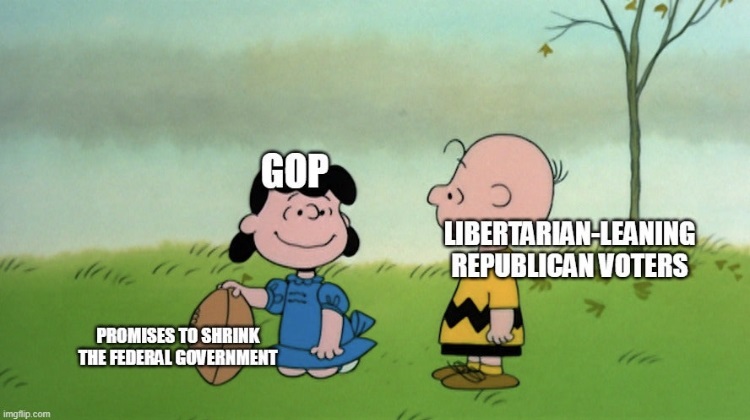

The latter possibility is a good excuse to share this cartoon.

But let’s also look at some serious analysis.

Here are some excerpts from a column in the Wall Street Journal by Kimberley Strassel. She was motivated by a pork-filled handout to the tech industry this past summer, but then proceeded to list many other sins.

The GOP that is assisting in this quarter-trillion-dollar spendathon is the same GOP that last year provided the votes for a $1 trillion infrastructure boondoggle. The same GOP that in 2020 signed on to not one, not two, three or four, but five Covid “relief” bills, to the tune of some $3.5 trillion.

The same GOP that…blew through discretionary spending caps. The same GOP that has unofficially re-embraced earmarks. The party occasionally takes a breather—say to gripe about the Democrats’ $1.9 trillion Covid bill in 2021—but then it’s right back to the spending grindstone. When was the last time anyone heard a Republican talk about the need to reform Social Security or Medicare? That disappeared with the election of Donald Trump (opposed to both)… Instead, a growing faction of the party sees a future in buying the votes of working- and middle-class voters with costly new entitlement proposals of their own, such as expanded child tax credits.

I don’t know whether to laugh or cry.

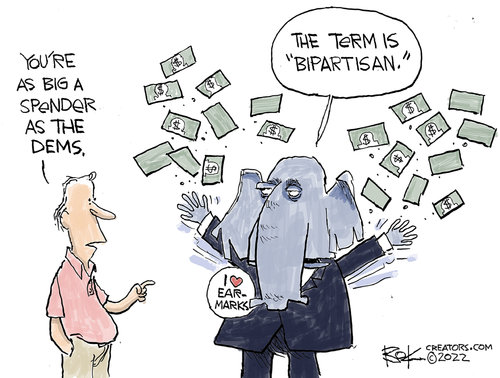

But since laughing is more fun, here’s a cartoon about earmarks (which recently were endorsed by Republican lawmakers).

I’ll close with a tiny bit of optimism.

I’ve dealt with hundreds of politicians over the years, most of whom were Republicans.

By and large, they usually understand that big government is bad for prosperity. But there are two things that have an impact on their voting behavior.

- They are afraid of being rejected by voters who want freebies (especially the ones they already are receiving).

- But they might be willing to cast courageous votes if there is a real chance of a long-run change in policy.

To elaborate on the second point, there have been three periods of spending restraint in my lifetime: 1) the Reagan years, 2) the Clinton years, and 3) the Tea Party years.

In all three cases, there was a critical mass of lawmakers who were willing to do the right thing in spite of the usual incentives in Washington to do the wrong thing.

Is there a 4th period in our future? That depends on whether the GOP returns to Reaganism.

[…] The Most Laughable Tweet of 2022 […]

[…] The Most Laughable Tweet of 2022 […]

[…] The Most Laughable Tweet of 2022 […]

[…] The Most Laughable Tweet of 2022 […]

[…] The Most Laughable Tweet of 2022 […]

[…] But I start with very low expectations, so I guess I’m happy that Republicans are at least pretending to care once again about excessive government […]

[…] But I start with very low expectations, so I guess I’m happy that Republicans are at least pretending to care once again about excessive government […]

And I quadrupled my need to be careful to always make sure data is adjusted for inflation! You are absolutely right about the marketplace of ideas. That is the genius of Voltaire. What scares me about today’s “woke” society is their desire to limit people to “correct” speech. But who knows what that is? Today’s incorrect speech might be tomorrow’s correct speech and vice versa, but how will we ever know if we can’t go against the present standards (the very idea that there are standards for right speech is itself outrageous)? The best answer to bad speech is good speech, not goon squads. Humans are intelligent enough to make good decisions in the long run. I’m a big fan of Steven Pinker. He argues that over time civilization has been improving as good ideas crowd out bad ones. And I favor property rights, free markets and all the aspects of capitalism. Were you and I to have lunch together, I think we’d have a good time.

Well, I probably quadrupled my learning about hunter-gatherers!! Really, you made me think through various topics, which is a valuable thing. Too many people today are offended by views that differ from theirs. Or they want to live in an echo chamber. I still believe in the give-and-take of “the marketplace of ideas.” Perhaps THE best feature of both capitalism and ‘democracy’ is that they are flexible, with mechanisms for course-corrections. Problems and mistakes are inevitable in every area, and more will always crop up. Therefore, I think the advantage goes to systems that tend to produce the best and the quickest responses. In the political sphere this means regular elections. In the economic sphere this means economic freedom. But course correction relies on the marketplace of ideas.

[…] The Most Laughable Tweet of 2022 — International Liberty […]

Hi John,

I hope this does not violate my pledge to offer you the last word (if you had, in fact, even wanted to write anything further). : )

I’m with you on being burned out.

I figured you might already know about Bergeron, but I had to say something just in case you didn’t. Because I knew you would love it! (I do as well)

We’ve had our rough moments, but I’m glad that we’ve ended amicably. And maybe we’ve even learned something from each other. I know I have from you. All the best to you,

Phil

Hi Phil. I’m still not interested in spending time on this, but I will say this. I have read Harrison Bergeron, and I did love it!

Hi John,

My heart’s not really in this after our exchange of a couple days ago, but I will try to reply to most of your points here and then give you the last word. Given the graciousness of your last post, that seems only fair.

OMG… now my heart’s really not in it. I was about three-fourths of the way through when I somehow managed to lose everything. I guess I will just answer a couple items at a time – spread over the course of the next couple days – until I get through it all.

Yes, life is not fair. But I from my perspective, I don’t think you go far enough in suggesting we have, “… a modest safety net to bridge people between job changes and to support those who are incapable of supporting themselves.”

Those are tough situations, but I can think of many others. Let mem give you just one.

We have a single parent (male or female) trying to raise a couple pre-school age children. The best thing for the parent would be to stay at home with the kids and give them the kind of one-on-one nurture from someone who loves them that no day care center can duplicate. But, of course, that’s not feasible. That would be asking the taxpayer to pay the person’s entire income since they’re not working at all. So, yes, they have to work. And that means day care. Chances are, by the time you take day care costs out of wages, the family does not have enough for sufficiency. I think the government needs to step in. One could say that the problem is the fault of the parent who left (and I would go after them with a vengeance and force them to pay child care), but do we really want to take that out on the kids?

I know we won’t find all the deadbeat parents, but we can find many and if they can’t pay up I would toss them in prison for a while and then make them do community service and then see how they feel about dodging their responsibility to the child they created. If they, themselves, are receiving government assistance, a portion of it should be taken away and given to the parent who is raising the child. That will lessen the amount the government has to chip in to that parent. If the deadbeat parent has to live below the line of “sufficiency” for a while, that’s a part of their penalty. If Kennedy was right that we could get to the moon “by the end of the decade” then I say let’s get to the deadbeat parents by the end of this decade. We should take those extra 80,000 workers or whatever it is that Biden wants to add to the IRS and send them after deadbeat parents. Those who end up in prison should have to take a prison job (are they still making license plates?) and all their earnings go to the parent who is raising their child or children. When they get out of prison they are on probation and have to provide for their child (or children). This isn’t rocket science. We can do it.

Concerning natural rights, you write: “…. We gave up those rights in relation to govt, but not in relation to our fellow citizens.” This may be a matter of semantics. When you give up the right to shout “fire” in crowded theater (assuming there is no fire, or else you can yell your lungs out!), are you giving up your right in relation to government or in relation to the well-being of your fellow citizens? Can you raise hogs in your backyard if the stench is overwhelmingly noxious to your neighbors (I’m assuming you don’t live on a farm)? If the government says you can’t, you are giving up your right by virtue of government decree, but in the end, isn’t the ultimate cause, as Aristotle would say, the well-being of your fellow citizens? Maybe the best example is the Constitutional right to assemble. If your assembly to protest something gets quite large, it will require a permit, police will be called in to keep watch and streets will likely be closed off. Going back to your original statement concerning natural rights ““I quite like the American concept of natural rights that says something is a right only if it doesn’t violate the rights of others or require others to give something up,” your assembly is requiring me to give something up: funds for the needed police and freedom of movement because of the blocked off streets.

It’s worth noting, perhaps, that what people have come to understand as “to promote the general welfare” has taken on different meaning over the years.

Natural rights are grounded in natural law, and the first few lines from Wikipedia on the topic of lateral law are interesting:

“Natural law[1] (Latin: ius naturale, lex naturalis) is a system of law based on a close observation of human nature, and based on values intrinsic to human nature that can be deduced and applied independently of positive law (the express enacted laws of a state or society).[2] According to natural law theory (called jusnaturalism), all people have inherent rights, conferred not by act of legislation but by ‘God, nature, or reason.”[3] Natural law theory can also refer to “theories of ethics, theories of politics, theories of civil law, and theories of religious morality.’”[4

Is it possible that those rights you find in the Constitution, and call natural rights, would be better labeled as the flourishing of “positive law”? I’m no legal scholar. Just food for thought.

After all, what is “natural” about something created by a finite group of men in the 1780s. They certainly didn’t recognize the natural rights of black slaves to be free, but would anyone deny that as a right today? Perhaps “natural rights” are always in flux.

Concerning Norway, the list of what is considered natural resources seems to me to be very inadequate. The U.S. has the second greatest amount of farmland in the world (second only to China, although we dwarf them in farmland per capita). And when it comes to quality of farmland, we are second to none. Throw that into the mix, which I think is a fair thing to do if we are talking about natural resources and I think that changes the picture considerably. Oil is responsible for 17 percent of Norway’s GDP (according to the World Atlas and a website called “Life in Norway” – I can’t swear to the accuracy of that, but it sounds plausible); agriculture, food and related industries made up 5 percent of ours; oil and natural gas make up 8 percent of ours; put those latter two together and we’re not that far from Norway’s 17 percent.

You are right about the U.S. having the highest median income numbers in the world. But the gap between us and the countries below us is not nearly so great as Dan shows on that infamous horizontal bar graph we disagreed about eons ago which makes it look like the U.S. is far out ahead of everyone. One also has to take into account (I know I’m sounding like a broken record) what the U.S. citizen has to pay for out of his or her income that the western European citizen does not. It’s beyond me, of course, to do all that accounting, but I suspect that if it were done, we probably would be passed up by at least the three or four countries closest to us. But that’s OK. We don’t have to be number one in everything. For all our faults (and no country is without faults), many people still want to come here. Even people from wealthy western European countries. That says something about us.

One really can’t argue much with another’s preference, so with regard to vacation I can only say that I think your observation works well for white collar jobs. But does the guy serving you at the convenience store or stocking the shelves at Walmart even have the opportunity to make choices about paid vacation? Is that even on the table? Maybe requiring paid vacation as an opportunity for those on the lower end of the economic spectrum should be part of the safety net. I think it is certainly an issue of mental health.

You raise an interesting point about big government being more reasonable in smaller countries and less reasonable in a large and diverse country like ours. But consider this: the 60s saw the beginning of the end of legal discrimination against people because of the color of the skin. In a big sprawling country like ours, where no one could stop Mississippi from doing what they wanted to do, big government was essential to bringing about justice. Or consider the plight of the poor. In a big sprawling country, you’re likely to have bigger differences between different regions. And so it is in the U.S. There is a great deal of wealth in New England and the far West and much less in the Southeast or Southwest or deep South. How is a safety net going to catch the poor unless it’s done by the federal government? Do such differences in wealth occur between different regions in Norway or Denmark or Switzerland? I don’t know, but my guess would be “no.”

Aristotle thought happiness was the purpose of life, or the ultimate goal. Maybe we should be thinking about that before economy. I would agree with you that happiness is not much related to the economy, except that I do think a person has to have enough income to meet basic needs (sufficiency) if they are to have a chance at real happiness. I agree about positive relationships with others and involvement with a greater purpose, but I don’t think you have much chance to gain those if you’re worried about being evicted, or worried about finding food for your children, or getting them the education you didn’t get. I.e. Money doesn’t buy happiness, but a certain amount of it may be necessary to be able to achieve happiness.

I said I would give you the last word and I will.

And may you be happy.

P.S. If you’ve never read Kurt Vonnegut’s short story, Harrison Bergeron (available to read online), you really should. You would love it.

Phil,

I agree it isn’t fair that some people are better off economically than others. It isn’t fair that some people get two attentive parents while others get one neglectful parent. It isn’t fair that some people are better-looking and smarter than others. It isn’t even fair that some people are more ambitious and have a stronger work ethic. Life is simply unfair. The issue is what to do about it. I say leave it up to free markets to sort things out, with a modest safety net to bridge people between job changes and to support those who are incapable of supporting themselves. Not perfect, but better than lots of govt intervention.

I suspect your definition of ‘sufficiency’ is more generous than I’d like to see. If the world was idealistically perfect and if the safety net took care of only those people incapable of supporting themselves, I’d actually be fine with a larger safety net. Yes, I said that! The problems come in when the real world isn’t perfect, and the safety net covers people who are able-bodied. Criminals try to defraud the system. Some able-bodied people are lazy enough to cheat the system. Some people would let govt bring them up to ‘sufficiency’ when they could achieve it themselves. Because moral hazard exists in the real world, I can’t feel good about making the safety net more generous.

NATURAL RIGHTS: Just because govt can force us to spend time on jury duty, quarter troops in time of war, and relinquish our property under eminent domain doesn’t mean we don’t possess the general rights to spend our time as we wish, use our homes as we wish, and use our property as we wish. We gave up those rights in relation to govt, but not in relation to our fellow citizens. You ask, “Who is to determine what can be given up for the greater good?” Rephased, how do we determine which rights individuals gave up for govt? That’s what the Constitution is for. It spells out the responsibilities of govt, which is equivalent to spelling out which rights we have relinquished to govt. Unless you come up with something better, I’m comfortable sticking with my conception of natural rights.

NORWAY: The point is, oil is a much bigger impact for Norway than the US! To illustrate, the same $100 billion of oil production spread over 5 million of population is $20,000 GDP per capita, whereas spread over 330 million it’s a measly $303. Or here’s a different metric from World Bank: “natural resource rents.” This says natural resources are 15 times more important to the Norwegian economy than to the US economy (6.1% of GDP versus only 0.4%).

AVERAGE VS MEDIAN INCOME: Yes, the US has lots of high earners. It’s no accident the tech industry is strongest here and Europe lags. Yes, US high earners increase the average. But it’s not only about the high earners! The median American does quite well. The US has the highest “median disposable income per person” in the world. 20% to 60% higher than the western Europe countries. (easier to get from Wikipedia than the OECD database: https://en.wikipedia.org/wiki/Median_income)

VACATION, ETC: I prefer the US to not have a nationwide govt mandate on paid leave. I’m quite comfortable with pay and benefits being agreed upon in a marketplace of employers and employees. If some employers and employees want to agree on generous paid leave, that’s OK. If other employers and employees prefer less paid leave and more base pay, that’s also OK.

The US is not Europe. The US is different. It’s much larger and more diverse than any of those countries (the UK is diverse). The US has a different culture.

‘Government’ is what society agrees to do collectively. It’s easier for a society to agree on collective action if it’s smaller and more homogeneous (Denmark, Sweden, Switzerland, etc). It’s more difficult when a society is sprawling and diverse, like the US. Therefore, bigger govt is more reasonable in the former and less reasonable in the latter. Especially when you consider one of the most important aspects of American culture is the value placed on individual liberty paired with individual responsibility.

HAPPINESS: My point was that when cold hard facts show the US economy performing well compared to the lefty-preferred social democracies, then lefties change the subject to happiness. Or anything else that makes the US look worse. Personally, I don’t think happiness is much related to the economy. I’d say happiness is more about positive interpersonal relationships with other people, and involvement with some greater purpose (doesn’t have to be grandiose).

Hi John,

Before I respond to your last post, I would hope sometime to get an answer to a question I raised before regarding poverty here and in Europe:

“What is really interesting is to look at where some of these countries were 40 years ago.

“The U.S. was at 27.0%. So we have come down 11 percentage points. But Sweden was at 58.48%, Norway 38.49%, Netherland 50.0%, Denmark 18.49%, Belgium 46.75%, Austria 16.99%, Australia 44.33%. France 48.49%, Finland 40.49%, UK 56,25%. Yes, I know about the law of diminishing returns. It’s easier to drop 11 percentage points if you start at 50% than if you start at 27%. But that argument goes out the window when so many countries actually go below us.

What’s my point? Many of these countries were still recovering from WWII devastation that we can’t imagine. But somehow, they have managed to draw near to us, or in many cases pass us, even while engaging in the kind of social democracy practices you say will stifle growth. How is that possible?

I apologize for sounding sanctimonious in my last post. I will say that I, myself, sometimes (not necessarily as I’m going to sleep: that’s just an often-used cliché) sit and wonder how fair is it that I, a middle to upper middle class person (not sure exactly where the line is) enjoy all the things I enjoy, when, for reasons beyond their control, children are out there not all that many miles from my home, trying to sleep with growling stomachs (I realize that virtually no one starves to death in this country, but millions are undernourished or malnourished, or whatever you want to call it). I also realize that there are a great number of people who work much harder than I do, shuffling back-and-forth between two jobs to try to pay the rent and buy food. Most of these people are living virtually paycheck to paycheck. Even if they have income, they don’t have wealth. If they get sick, or their place of work is torched by some demented BLM terrorists, they lose their income and maybe their home/apartment.

Speaking of wealth, it’s a topic that hasn’t come up in our conversations, but the gap between the wealth of the lower income folks and the wealth of the upper income folks greatly exceeds the differences in income. So even if you have a lower 20 percentile individual earning as close to a middle 20 percentile person as Phil Gramm claims (more on that later), there is still a wide gulf between the two when it comes to wealth.

And who has such wealth? Well, according to Pew Research (“America’s wealth gap between middle-income and upper-income families is widest on record”), lower income families saw their net wealth actually drop between 1983 and 2013 from $11,400 to $9,300. Middle income families saw their net wealth barely budge during that same 30 year period (up from $94,300 to $96,500). Meanwhile, upper income families saw their net worth grow from 318,100 to 639,400. So much for that “Post-Reagan Affect.”

You write: “I know poverty well enough and I’m still quite comfortable with a minimal government safety net. One, because I know stronger economic growth is better for poor people in the long run than handing them free stuff today. Two, the more generous a safety net becomes, the more it will discourage some able-bodied from working. Three, because I believe it is our personal responsibility to help poor people, and I don’t want govt to crowd that out.”

With regard to number “one,” I agree in the abstract. Unfortunately, economic growth can’t be summoned on command, and there are many who are hungry or without a roof over their heads or without medical care (I.e. without “sufficiency”) who can’t wait for a growing economy to bring them a job. Furthermore, even in a growing economy, there will still be those working their butts off who will not earn enough for sufficiency because of lack of skills, poor health, discrimination, or just bad luck (the place where they were working goes out of business, for example). These people don’t have nest eggs to fall back on. I’m not talking about the government providing a full wage for able-bodied workers. I have more than once said that all able-bodied workers should be required to work, and if their income doesn’t reach whatever we deem is necessary for sufficiency, then the government can fill in the difference. Anything less than providing for sufficiency is not, in my opinion, a generous enough safety net. Do you want to punish children with less than sufficiency because of forces over which they have no control?

With regard to number “two,” I’m REQUIRING” that able-bodied people work.

With regard to number “three,” relying largely on charity to meet the needs of the poor (there has always been some government involvement gong back to the colonial days) will never work, There is simply not enough there. We did do it that way for a time in our country (although never without some government involvement, however minimal). The results were disastrous. Read about the history of Poorhouses.

My argument about what you said about the American concept of natural rights is not weak at all, but rather a basic principle from Logic 101. An absolute statement is invalidated with a single counterexample. You wrote: “I quite like the American concept of natural rights that says something is a right only if it doesn’t violate the rights of others or require others to give something up.” That’s an absolute statement. I gave an example where others are in fact required to give something up, so your argument is not valid. You then backpedaled by saying, “we the people relinquish some rights to the government so it can do some things for the greater public good.” Ah… but who is to determine what can be given up for the greater good? You’ve let the camel’s nose under the tent. Why not a strong social safety net as something that we do for the greater good? The legality of a safety net is already accepted (even by you). Now we’re just quibbling over how strong it should be. You can raise economic arguments to buttress your position, but your appeal to the American concept of natural rights doesn’t hold water.

I didn’t deny that Norway is an anomaly. I simply added that so is the U.S. And while oil will someday be obsolete, and Norway left with no great advantage over others in terms of natural resources, the U.S. will continue to be one of the nations most blessed with natural resources. Currently, according to Investopedia, we are number two behind Russia with a wide array of natural resources. Norway, by the way, isn’t in the top ten.

I don’t know about the $30 question either, so I’ll move on. When you write: “…the average American is far better off, materially” I assume you are referring to that famous graph Dan likes to use and which we have argued about before. Because it uses average, rather than median, it is rather meaningless. The huge number of incredibly wealthy Americans, compared to what is found in other countries, completely skews the data if you use average. Furthermore, being better off includes more than just material things. Money can buy, for example, leisure time (western Europeans get far more of it than do Americans – four to six weeks of paid vacation is the norm in just about every western European country, and I believe (but am not sure that) the mode tilts toward six). According to CBS News “1 in 4 workers in U.S. don’t get any paid vacation time or holidays” (5/24/19):

Vacation season is heating up, but for many U.S. workers it may be difficult to take time off. That’s because America is the only advanced economy in the world that does not federally mandate paid vacation days or holidays.

Workers in 21 advanced economies, including 16 European countries, Australia, Canada, Japan and New Zealand, are all guaranteed paid time off by federal law, according to a report from Center for Economic and Policy Research, a Washington think tank.

However, American workers have to rely on their employers to set the minimum, meaning they may not get any paid time off. Indeed, about one in four American workers don’t get any paid vacation days or holidays, the CEPR reports.

And the average U.S. worker in the private sector receives 10 paid vacation days and six paid holidays — small change compared to what workers in other advanced economies get.

“In the U.S., paid vacation and holiday benefits are based on luck in the boss lottery, not federal policy,” said Eileen Appelbaum, co-director at CEPR. “Since we first did this study in 2007, there’s been no progress on the national front to catch up with other rich countries.”

“We can’t depend on the largess of employers to do the right thing,” Appelbaum continued.

Some legislators are working to change that. New York City Mayor Bill de Blasio in January announced a proposal to require employers to give workers 10 days’ paid vacation; if it passes, New York would be the first city in the U.S. to mandate paid vacation time.

Workers in the European Union are guaranteed at least 20 paid vacation days per year, while six European nations — Austria, Denmark, Finland, Norway, Spain and Sweden — guarantee 25 vacation days with an additional 9 to 14 paid holidays.

Spain offers the most total paid days off, with combined 39 vacation days and holidays. Austria follows with 38 total days.

Money can also help buy another non-material thing: time on this planet. Western Europeans far outpace us in life expectancy (this, and the above point, may well be related). Maybe that explains why, when people talk about happiness, they are not as impressed as you think they should be by data on GDP per capita or economic growth rates.

You really want to talk about college costs? I know you are aware of the college loan crisis we have in this country.

I was puzzled beyond belief about Senator Gramm’s book when I clicked on your link. The first graph shows that the middle quintile, even after all the transferring is taken into account, earning about 50 percent more than the second quintile and about 100 percent more than the bottom quintile. Furthermore, according to the report, “Because of the progressive structure of means-tested transfers and federal taxes, the distribution of income after transfers and taxes was more even than the distribution of income before transfers and taxes. In 2018, those transfers and taxes boosted the lowest quintile’s share of total income by nearly 4 percentage points…” Seriously? Four percentage points and Gramm thinks it’s time for a book?

I haven’t read the book, but it doesn’t seem to me that it passes the smell test. Here is the second footnote from the CBO report: “Each quintile (or fifth) of the distribution contains approximately the same number of people but slightly different numbers of households.” “Slightly” different number of households will not be enough to move the needle very far.

I won’t quote from it (this is already getting too long), but if you want to read a review critical of Gramm’s book, Google: “Phil Gramm Thinks Poor People Have it Too Easy.” The review is by Timothy Noah. He does mention one thing that might help us to resolve the $30 question – in my favor. : ) He says that most OECD nations do not count government medical care as income.

I wish you a happy day as well!

Phil,

OK, maybe that’s my fault for using the vague term “overly generous safety net.” I’ll say it this way: Friedman and McCloskey would support a much smaller safety net than you would.

I volunteer every week feeding inner-city poor people, so please spare me the sanctimonious “drive through ghettoes and see how well I sleep at night.” I know poverty well enough and I’m still quite comfortable with a minimal government safety net. One, because I know stronger economic growth is better for poor people in the long run than handing them free stuff today. Two, the more generous a safety net becomes, the more it will discourage some able-bodied from working. Three, because I believe it is our personal responsibility to help poor people, and I don’t want govt to crowd that out.

Your argument against the American concept of natural rights is very weak. The foundational idea of government is that we the people relinquish some rights to the government so it can do some things for the greater public good. Jury participation, quartering troops, and eminent domain are all examples of that. This is hardly evidence against the American concept of natural rights.

I don’t know why you can’t understand that oil makes Norway an anomaly. Lots of oil, small population. Like Qatar. Oil production per capita in Norway is more than 700% higher than in the US!!! Maybe they didn’t talk about this issue in Switzerland, but when I was in Europe a lot in the 90s, it was a hot topic. People from multiple countries complained about how lucky those Norwegians were.

I didn’t respond to your point that $30 in the US and $30 in Denmark is apples and oranges because I don’t know how that $30 is defined and calculated. I looked for their methodology but couldn’t find it. That $30 might include all govt benefits, or only some, or none at all. Without knowing that, I don’t know enough to agree or disagree. (Just as you don’t really know how apples and oranges it is.)

HOWEVER, I know the average individual consumption numbers that Dan likes to quote DO include govt expenditures. Those show the average American as far better off materially than the average Dane, Swede, German, etc. Yes, I know the average person is not the same as the bottom 16% covered by the $30 poverty metric, but it still means something. Including the impact of both private sector economy and government programs, the average American is far better off, materially.

Also, it’s not like the US has no safety net. The average household in the bottom quintile receives over $15,000 of means-tested transfers (this is from the same CBO report I’ve mentioned: https://www.cbo.gov/publication/57404#_idTextAnchor001). Poor people also get tons of help paying for college, even though the US doesn’t provide ‘free’ college. The US offers plenty of help for poor people.

And there are limits to how much more can be done. Gramm and Early have a new book out (The Myth of American Inequality) that shows after accounting for all government transfers and taxes, and adjusting for equal-sized households, the bottom 3 quintiles wind up with pretty similar ‘incomes.’ They base this on working-age households only. After the adjustments, the average middle-quintile household ends up with ‘income’ only 7.8% higher than the average bottom-quintile household.

Yet the people in middle-quintile households do a lot more working than the people of the bottom quintile (work participation 26% higher, and twice as many hours worked per worker). I would think some middle-class folks might resent working so much harder to be only a little better off. Seems to we should be careful about increasing antipoverty assistance further.

I know you like to talk about happiness a lot. I have to tell you, in my experience people start talking about happiness when they don’t like the answers given by hard facts like GDP per capita and economic growth rates. I’m not saying that’s you, just explaining why I have a jaundiced view of the happiness metric. Happiness is a good thing. I sincerely wish you a happy day!

Hi John,

You write that Friedman and McCloskey wouldn’t support an “overly generous welfare state.” Neither would I. Sufficiency is the key. I simply want to make sure that everyone had the ability to have a decent life (not worrying about where the next meal will come from, having a solid roof over their home, not having to settle for taking their children to the emergency room for band-aid treatment because they can’t afford a family physician, being able to afford college… I guess those are enough examples to give you the idea). If that’s “overly generous.” What on earth is “generous” or, even more importantly, what would you consider “less than generous.”? Drive through the ghettoes of some of our most impoverished cities, or rural Appalachia, keep an eye on the children, and see how well you sleep at night.

You write: “I quite like the American concept of natural rights that says something is a right only if it doesn’t violate the rights of others or require others to give something up.” Sorry. That cat’s already out of the bag. The American concept of rights guarantees the right to a trial by jury. For you to have that right, those jurists have to give something up: their time. The government also maintains the right to use your home for quartering troops in time of war (Third Amendment). So you have to give up space and privacy. And, of course, the government may take your property (for just compensation – Fifth Amendment). So you may have to give up your home. So the right of some to have an interstate built can require others to give something up.

Concerning von Mises: it was my FIRST post in this thread and the von Mises material was the bulk of that relatively short and succinct post (shorter than several of your posts). You responded to that post by commenting on a peripheral matter and completely ignored the bulk of the material (the von Mises material).

If Norway is a statistical anomaly in the sense of nations growing wealthy, then so is the U.S. This country was (is) blessed with tremendous natural resources and had the advantage of growing into the greatest economic power in the world while protected by two large oceans from potential outside mischief makers. This is a fact of U.S. history that has been recognized by many scholars. It’s hard to think of another country in the world which shares those advantages.

Finally, you have never responded to my point that $30 here and $30 in Denmark is like comparing apples to oranges. Don’t forget that an American living on $30 a day has to figure out a way to provide for health care, day care, and post-high school education, just to name three things the Dane doesn’t have to pay for out of his or her $30. Thirty dollars in the hands of a poor American and thirty dollars in the hands of a poor Dane are not the same thing. Likewise for most other western Europeans.

Let me add a word about quality of life. Most western European nations require 4-6 weeks of paid vacation, their people live several years longer (there may be a connection between the two), and they mostly rank as happier than us (there may be a connection between all three).

I do agree with you that the U.S. works well for most people. And we are a heckuva lot closer to the top of the Happiness Index than we are to the bottom – or even the middle.

Phil,

You keep mentioning Friedman and McCloskey support for a government-guaranteed income as if it means more than it does. Friedman only suggested it might be better to put our safety net in the form of a negative income tax instead of having lots of govt assistance programs. He most certainly was not advocating an expansion of the safety net. Based on her writings, I assume McCloskey also doesn’t support an overly generous safety net. Supporting a certain type of framework doesn’t mean they support a larger welfare state.

The US Constitution doesn’t explicitly guarantee equality based on socioeconomic status like some other countries do. Sure. I’m glad we don’t. It’s OK with me if the US has a different culture than say, France. I quite like the American concept of natural rights that says something is a right only if it doesn’t violate the rights of others or require others to give something up. So, I have a right to free speech, but I don’t have a right to free housing.

On not reading your Mises stuff. Maybe I did. We wouldn’t have these issues if you made it easier on your reader by staying focused and succinct.

For the $30 dollar per day poverty countries, I wasn’t trying to cherrypick the countries. I picked France, Germany, and UK simply because they plus Italy are the largest countries of Western Europe. Then I excluded Italy because I knew they’d look bad. However, let’s expand the view. Excluding Sweden and Australia because their poverty rate isn’t much lower than the US, there are seven countries in the entire world with less poverty (by this definition) than the US. Really, only six, since Norway is a huge statistical anomaly because they’re a small country that discovered they owned lots of oil. You can be embarrassed by this US performance if you want. I’m not. Sure, I’d rather be in first place. But it’s pretty good for a large, multiracial, multi-religion country. If we tracked the incomes of people who left those six or seven countries and moved to the US, I’m pretty sure all six groups (Swiss-American, Danish-American, etc) would show higher incomes than the people in the old country. The US works well for most people.

Hi Dan,

I hope you see this. I never thought you were trying to “censor” or “ban” me when I was having trouble posting. I just figured it was a glitch in the system.

I really admire the way you allow anyone to voice their opinion, even when they often disagree with you as I often have… but not always… I have written a couple posts supportive of your point of view.

I think I share the same basic values of the Enlightenment with you such as private property and free markets. And I think that those values will lift the lives of most people. I do, however, believe that the Enlightenment placed a great value on greater aid for the poor, for those unable to care for themselves.

By contrast with your openness, the religious denomination I belong to, the United Church of Christ, banned me from being able to post on their Facebook page. When I asked why, they didn’t respond. I told them that a denomination that is always talking about “justice” certainly owed me an explanation. Of course, I knew the reason why. I had often been critical of positions they took. The United Church of Christ is a far-left progressive group (at the national level). They don’t want to hear dissenting voices. They prefer an echo chamber in which all they hear are the sounds of people patting each other on the back and relishing in their supposed righteousness. It’s really quite sickening.

Thanks, again, for your openness and sense of fair play.

Hi John,

I, too, believe in free markets and private property rights and all those good things springing forth from the Enlightenment that have so enriched the world (and I have said so more than once). Oh, and I believe in one more thing the Enlightenment gave us: a greater role for the government in helping the poor, providing for schools, enacting prison reform, etc. This was not just a matter of throwing out some crumbs, but was seen as a true moral demand on society. When Ed Meese, who had Reagan’s ear about as much as anyone, could say that progressive taxation is immoral, I can only shake my head in disbelief that anyone could be so callous.

Our western European peers plus a few other countries like Canada, Australia, Japan, and New Zealand, to name four, all have capitalistic economic systems. They have free markets. Not unfettered free markets, of course, but, then, neither do we. I just wonder what people are thinking when they call such countries socialist states. Socialism actually means something. It means that the control of the means of production and exchange are in the hands of the state. That’s not Sweden, that’s not Canada, that’s not Switzerland, etc. One term that I can live with for those countries is “social democracy.” And a good number of social democratic countries have done a better job than we have at providing for the downtrodden. I’m not saying that we have done a horrible job, but I do think they have a greater sense of social responsibility and have done a better job. We could learn something from them.

Of course, it is preferable when someone can lift themselves out of poverty by working, and many in this country have. But not everyone can. Life doesn’t deal us all an equal hand. I have already mentioned the support that the idea of a guaranteed annual income received from both Friedman and McCloskey. My positions would be that every able-bodied individual should be required to work. If what they can earn falls short of whatever amount we consider “sufficient” for a decent life (to borrow Frankfurt’s term), then the government can make up the difference. It would be a bit complicated (though no more so than our tax system), but it could be done. Friedman certainly thought so as he was the first modern economist to float the idea, and that was 51 years ago.

I don’t know Dan’s full methodology for assessing presidential spending, but I do know some of it because YOU gave it to me. From your post of January 5: “1) remove defense spending…” I see no logic behind that. If a president happened to incur an unusual number of natural disasters in his or her presidency (say, not one but two or three Katrinas, and throw in a massive earthquake in California), do we exempt the costs of dealing with that? Some reasonable increases in defense spending would be defensible (pun intended), but Reagan spent like mad. He was like a kid in a toy store. That goes a long way to explaining why he tripled the national debt, something no other president in the last 75 years has come remotely close to doing (and no single-term president was on pace to do the same). The number of federal employees grew during Reagan’s presidency. I have no idea how you can call all of this “small government conservatism.” You once said, that limiting government was something in Reagan’s heart (or something to that effect). Well, that may be, but the truth is in the pudding.

You write:” It’s more like which president did the best to limit govt and therefore allow space for capitalism and liberty. Defense spending is different in this regard than social programs.” Why? Skyrocketing defense spending can hardly be described as limited government, and social programs hardly inhibit capitalism and liberty. Take a program which provides for the educational needs of children who might otherwise fall through the cracks. Those are future entrepreneurs. And liberty means little to those who can’t feed their children, get evicted, or live on the streets. But if those people can be helped to become productive citizens they can participate in the blessings of liberty.

Yes, some forms of government spending have more Constitutional support than others. But that is not a ranking. Does defense rank above or below establishing justice? And remember the preamble: “We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare…”

With regards to promoting the general welfare, consider the following:

“It is a constitutional law truism that wealth and class are not suspect classifications, nor does the government have a substantive due process obligation to fund abortions or provide most government benefits. This is because our Constitution is generally seen as containing negative rights, not affirmative obligations. But there are exceptions. For example, the Sixth Amendment means that the government must pay for an indigent criminal defendant’s attorney. In his new article, Wealth, Equal Protection, and Due Process, Brandon Garrett argues that there are more exceptions than we usually think there are. Garrett shows that the Supreme Court has ruled that poor individuals are entitled to fair government treatment, creating a wider swath of government obligations to fund than we generally assume. The article’s reasoning and conclusions are powerful, especially at a time of great social inequality. Moreover, Garrett’s careful doctrinal analysis commendably avoids overreach.”

(From “Constitutional “Equal Process” and the Problem of Poverty” a review of Brandon Garrett, “Wealth, Equal Protection and Due Process,” Duke Law School Public Law and Legal Theory)

It is unfortunate that our Constitution is not more explicit on the matter. In ”Should the Constitution Protect the Poor” we read:

“Unlike the majority of constitutions globally, the U.S. Constitution fails to prohibit discrimination based on income or other aspects of socioeconomic status — and the consequences for our democracy may be profound.

“In a new study, we looked in detail at the 193 U.N. member countries’ constitutions, examining their protections for equal rights. What we found was that 59 percent of constitutions explicitly guarantee equality based on socioeconomic status. The United States does not.”

If you don’t know what the von Mises Institute had to say about Reagan and budgets, then I have to wonder if you’re reading much of what I’ve written. The statement from that Institute made up the bulk of my very first post (Dec. 20) on this thread (a fairly brief post). Just scroll down to the bottom. I have no idea how you could have missed the von Mises material since you responded to that post.

You listed a few countries and the percentages of their populations that lived on less than $30/day. You left out many that are below our 16.0 percent. In no particular order:

Switzerland 9.11%

Sweden 15.23 %

Norway 6.29%

Netherlands 11.78%

Denmark 8.35%

Belgium 12.34%

Austria 11.44%

Australia 15.25%

Finland 11.82%

So, yes, rather embarrassing. What is really interesting is to look at where some of these countries were 40 years ago.

The U.S. was at 27.0%. So we have come down 11 percentage points. But Sweden was at 58.48%, Norway 38.49%, Netherland 50.0%, Denmark 18.49%, Belgium 46.75%, Austria 16.99%, Australia 44.33%. France 48.49%, Finland 40.49%, UK 56,25%. Yes, I know about the law of diminishing returns. It’s easier to drop 11 percentage points if you start at 50% than if you start at 27%. But that argument goes out the window when so many countries actually go below us.

What’s my point? Many of these countries were still recovering from WWII devastation that we can’t imagine. But somehow, they have managed to draw near to us, or in many cases pass us, even while engaging in the kind of social democracy practices you say will stifle growth. How is that possible?

Phil,

I don’t identify 100% as a bleeding-heart libertarian, but I also lean that way. I care about the poor. The difference is that people like McCloskey, Friedman and me believe a free-market economy is better for everyone, including the poor. Better poor in the long run, not necessarily in any given year. I know some progressives characterize this debate as “conservatives want poor people to die in the streets,” but that’s an overly simplistic and uncharitable caricature.

You didn’t even know what methodology Dan used for presidential spending, but you criticized it anyway? We’ll just have to agree to disagree on removing defense spending. Spending by a president in the midst of war shouldn’t be judged the same as one in the midst of peace. One could also make a case for excluding interest expense, because prevailing interest rates and inherited debt can both vary. OK, maybe Obama deserves a break because he took over during a recession, but then the same may be true of other presidents as well. Keep in mind, I don’t think Dan approaches this as a bookkeeping exercise accounting for every dollar of spending. It’s more like which president did the best to limit govt and therefore allow space for capitalism and liberty. Defense spending is different in this regard than social programs.

You “didn’t know that different types of spending were Constitutionally ranked?” Wow, really? You don’t think some types of spending have more constitutional support than others? As in, the Constitution specifically mentions national defense as a responsibility of the federal govt but is silent on food stamps.

I don’t know if I ever read what the von Mises think tank had to say about Reagan not being a thrifty spender. You type and copy so many words that things get lost in the shuffle. I like sparring with you on a limited basis, but when you type or copy literally thousands of words… I don’t read all of them.

“The level of poverty here is embarrassing.” OK, here’s the percentage of people living on less than $30 per day with all countries shown separately:

13.0% Germany

16.0% USA

16.3% France

20.5% High-income countries

25.7% UK

Why do you find this embarrassing?

Here is the conclusion to the two posts below:

Hedrick Smith reported in the New York Times, in a 1984 article titled, “REAGAN PROPOSING A BUDGET FOR 1984 OF 848.5 BILLION” reported:

“Nearly $29 billion in saving over five years, $3.1 billion in the fiscal year 1984, are proposed through a freeze in the target prices for farm price support programs and by paying farmers in surplus commodities rather than cash as a means of cutting back farm production and government-held reserves.

“Both that area and the various proposals for cutbacks in programs affecting the poor and the elderly are likely to arouse opposition in Congress.”

Later in the same article:

“But the Administration’s budget summary sought to demonstrate that in spite of such proposed cutbacks, the budget contains $92.7 billion in critical ”safety net” programs for the most needy, up very modestly from $78 billion in fiscal year 1981. These include aid to families with dependent children, welfare aid to the elderly poor, food stamps and nutrition, medicaid, unemployment compensation, and housing and energy subsidies for the poor.”

“Up very modestly” (from $78 billion to $92.7 billion) is misstatement. Hedrick Smith gave the Administration a break. Remembering that the fiscal year begins Oct. 1 of a given year and ends Sept. 20 of the following year, $78 billion dollars in 1981, when adjusted for inflation, becomes 94.7 billion in 1984. So I would label the $92.7 as down, not “up modestly.” And that’s without accounting for a population increase from 228 million to 236 million.

With regard to the 40 and 45 percent figures you give, I can’t find the CBO report in this series of posts nor in our previous series of posts. I have no idea how far back to look. Perhaps you could resend. In any event, you write in that paragraph about “government” assistance. How much was being dumped on the states?

Since Reaganites and even many non-Reaganites believe that his policies had an enduring effect (as shown by your own 25 years before Reagan and 25 years after Reagan numbers, you might want to consider the following:

“For all workers, average real hourly compensation grew only by 39% (1.1% a year) over the thirty years post-Reagan, vs. 100% in the thirty years before.” This is from the same article I cited in the previous post, “The Impact of Reagan: Good for the Rich, Bad for Most.” I encourage you to look at that article and scroll down to the bottom graph. You will find that per-capita incomes for the bottom 90 percent barely budged during the Reagan years, not starting to make some gains until the second Clinton term. Meanwhile the upper ten percent, and even more so the upper five percent, and still even more so the upper one percent saw their incomes skyrocketing.

I’m not sure where you found your GDP per-capita numbers. Here is what I found from the source just above: ”Per capita real GDP and labor productivity still grew following Reagan, but at a slower rate than before. Per capita GDP grew only by 65% in the thirty years following Reagan (1.7% a year), vs. 94% (i.e. 45% higher) in the thirty years before.” The twenty five year comparison is narrower, but the pre-Reagan years still come out ahead. Incidentally, the 1960s saw an average (4.5) higher than 1982-1989.

In any event, per-capita numbers don’t tell us anything about the distribution. In the 80s it was mostly all going to the people at the top.

I don’t normally think of presidential greatness as being measured by a popularity contest – unless the people being surveyed are experts. But in any event, FDR always ranks near the top of such rankings (usually in the top three or four), Are you a big fan of FDR?

Finally, you write: “But here’s some data on absolute poverty. 16.0% of Americans live on less than $30 per day. That’s better than the 18.3% average for France/Germany/UK and also the 20.5% average for all high-income countries.” I find it interesting how you averaged France, Germany, and the UK. I’m guessing that was because the UK had a significantly higher figure than us and you didn’t want to show that Germany’s poverty level was well below us (France and the U.S. were practically in a dead heat).

You also avoided several other OECD countries who are well below us on the poverty scale. But don’t forget that an American living on $30 a day has to figure out a way to provide for health care, day care, and post-high school education, just to name three things the European doesn’t have to pay for out of his or her $30. Thirty dollars in the hands of a poor American and thirty dollars in the hands of a poor Dane is comparing apples to oranges.

Any concern about all those protective agencies cut by Reagan (you know, the ones who have made our air and water cleaner, and ensure that the meat we buy is safe, and so on)?

Here is the second part of the post below (third part to come)

You write about the good that high income people do for those lower on the ladder. But when inequality reaches the kinds of levels it has in this country, and there isn’t sufficiency at the bottom as Frankfurt says is crucial, it can tear at the social fabric that holds society together. Our OECD peers seem to understand this better than we do, and maybe that’s why so many of them are happier countries than we are. Workers in this country do get upset when they see no pay raises, but the CEOs see significant ones. Especially when the CEO is already making 100 or 500 or 1000 or 10,000 times as much as they are.

In the article: “Ronald Reagan: Budget Cutter,” an article praising Reagan for his cuts, we rad the following:

“President Reagan is the only president to have cut the budget of the Department of Housing and Urban Development in one of his terms (a total of 40.1 percent during his second term).

“President Reagan is the only president to have cut the budget of the Department of Transportation. He cut it by 10.5 percent during his first term and by 7.5 percent during his second term.

“During his first term in office, President Reagan cut the real budget of the Department of Education by 18.6 percent, while President Nixon increased it (that is the education part of what was then the Department of Health, Education, and Welfare) by 19.1 percent. That budget increased by 22.2 percent under Bush 41 and by 38.5 percent under Carter. Our current president has increased it by a whooping 67.6 percent.

“Reagan managed to cut the budget of the Department of Commerce by 29 percent in constant dollars during his first term and by 3 percent during his second one.

“President Reagan is the only president to have cut the budget of the Department of Housing and Urban Development in one of his terms (a total of 40.1 percent during his second term).

“President Reagan is the only president to have cut the budget of the Department of Transportation. He cut it by 10.5 percent during his first term and by 7.5 percent during his second term.

“During his first term in office, President Reagan cut the real budget of the Department of Education by 18.6 percent, while President Nixon increased it (that is the education part of what was then the Department of Health, Education, and Welfare) by 19.1 percent. That budget increased by 22.2 percent under Bush 41 and by 38.5 percent under Carter. Our current president has increased it by a whopping 67.6 percent.

“Reagan managed to cut the budget of the Department of Commerce by 29 percent in constant dollars during his first term and by 3 percent during his second one.”

Most of those cuts hurt programs that were largely dedicated to helping the poor. Contrary to what you say, Reagan did slash the social safety net. You are right in saying that the burden then had to be picked up by the states (what were they going to do, let people starve to death on the streets?), but that means the safety net was being held together by the most regressive taxes.

Sorry… I meant to say my post below.

Dan (or someone who moderates this thing),

Can you tell me why I can’t post the remainder of my post above to John Michael Wagner? When I try it says something to the effect that this is duplicate matter. But it’s not. I don’t get it.

You write about the good that high income people do for those lower on the ladder. But when inequality reaches the kinds of levels it has in this country, and there isn’t sufficiency at the bottom as Frankfurt says is crucial, it can tear at the social fabric that holds society together. Our OECD peers seem to understand this better than we do, and maybe that’s why so many of them are happier countries than we are. Workers in this country do get upset when they see no pay raises, but the CEOs see significant ones. Especially when the CEO is already making 100 or 500 or 1000 or 10,000 times as much as they are.

In the article: “Ronald Reagan: Budget Cutter,” an article praising Reagan for his cuts, we rad the following:

“President Reagan is the only president to have cut the budget of the Department of Housing and Urban Development in one of his terms (a total of 40.1 percent during his second term).

“President Reagan is the only president to have cut the budget of the Department of Transportation. He cut it by 10.5 percent during his first term and by 7.5 percent during his second term.

“During his first term in office, President Reagan cut the real budget of the Department of Education by 18.6 percent, while President Nixon increased it (that is the education part of what was then the Department of Health, Education, and Welfare) by 19.1 percent. That budget increased by 22.2 percent under Bush 41 and by 38.5 percent under Carter. Our current president has increased it by a whooping 67.6 percent.

“Reagan managed to cut the budget of the Department of Commerce by 29 percent in constant dollars during his first term and by 3 percent during his second one.

“President Reagan is the only president to have cut the budget of the Department of Housing and Urban Development in one of his terms (a total of 40.1 percent during his second term).

“President Reagan is the only president to have cut the budget of the Department of Transportation. He cut it by 10.5 percent during his first term and by 7.5 percent during his second term.

“During his first term in office, President Reagan cut the real budget of the Department of Education by 18.6 percent, while President Nixon increased it (that is the education part of what was then the Department of Health, Education, and Welfare) by 19.1 percent. That budget increased by 22.2 percent under Bush 41 and by 38.5 percent under Carter. Our current president has increased it by a whopping 67.6 percent.

“Reagan managed to cut the budget of the Department of Commerce by 29 percent in constant dollars during his first term and by 3 percent during his second one.”

Most of those cuts hurt programs that were largely dedicated to helping the poor. Contrary to what you say, Reagan did slash the social safety net. You are right in saying that the burden then had to be picked up by the states (what were they going to do, let people starve to death on the streets?), but that means the safety net was being held together by the most regressive taxes.

Hedrick Smith reported in the New York Times, in a 1984 article titled, “REAGAN PROPOSING A BUDGET FOR 1984 OF 848.5 BILLION” reported:

“Nearly $29 billion in saving over five years, $3.1 billion in the fiscal year 1984, are proposed through a freeze in the target prices for farm price support programs and by paying farmers in surplus commodities rather than cash as a means of cutting back farm production and government-held reserves.

“Both that area and the various proposals for cutbacks in programs affecting the poor and the elderly are likely to arouse opposition in Congress.”

Later in the same article:

“But the Administration’s budget summary sought to demonstrate that in spite of such proposed cutbacks, the budget contains $92.7 billion in critical ”safety net” programs for the most needy, up very modestly from $78 billion in fiscal year 1981. These include aid to families with dependent children, welfare aid to the elderly poor, food stamps and nutrition, medicaid, unemployment compensation, and housing and energy subsidies for the poor.”

“Up very modestly” (from $78 billion to $92.7 billion) is misstatement. Hedrick Smith gave the Administration a break. Remembering that the fiscal year begins Oct. 1 of a given year and ends Sept. 20 of the following year, $78 billion dollars in 1981, when adjusted for inflation, becomes 94.7 billion in 1984. So I would label the $92.7 as down, not “up modestly.” And that’s without accounting for a population increase from 228 million to 236 million.

With regard to the 40 and 45 percent figures you give, I can’t find the CBO report in this series of posts nor in our previous series of posts. I have no idea how far back to look. Perhaps you could resend. In any event, you write in that paragraph about “government” assistance. How much was being dumped on the states?

Since Reaganites and even many non-Reaganites believe that his policies had an enduring effect (as shown by your own 25 years before Reagan and 25 years after Reagan numbers, you might want to consider the following:

“For all workers, average real hourly compensation grew only by 39% (1.1% a year) over the thirty years post-Reagan, vs. 100% in the thirty years before.” This is from the same article I cited in the previous post, “The Impact of Reagan: Good for the Rich, Bad for Most.” I encourage you to look at that article and scroll down to the bottom graph. You will find that per-capita incomes for the bottom 90 percent barely budged during the Reagan years, not starting to make some gains until the second Clinton term. Meanwhile the upper ten percent, and even more so the upper five percent, and still even more so the upper one percent saw their incomes skyrocketing.

I’m not sure where you found your GDP per-capita numbers. Here is what I found from the source just above: ”Per capita real GDP and labor productivity still grew following Reagan, but at a slower rate than before. Per capita GDP grew only by 65% in the thirty years following Reagan (1.7% a year), vs. 94% (i.e. 45% higher) in the thirty years before.” The twenty five year comparison is narrower, but the pre-Reagan years still come out ahead. Incidentally, the 1960s saw an average (4.5) higher than 1982-1989.

In any event, per-capita numbers don’t tell us anything about the distribution. In the 80s it was mostly all going to the people at the top.

I don’t normally think of presidential greatness as being measured by a popularity contest – unless the people being surveyed are experts. But in any event, FDR always ranks near the top of such rankings (usually in the top three or four), Are you a big fan of FDR?

Finally, you write: “But here’s some data on absolute poverty. 16.0% of Americans live on less than $30 per day. That’s better than the 18.3% average for France/Germany/UK and also the 20.5% average for all high-income countries.” I find it interesting how you averaged France, Germany, and the UK. I’m guessing that was because the UK had a significantly higher figure than us and you didn’t want to show that Germany’s poverty level was well below us (France and the U.S. were practically in a dead heat).

You also avoided several other OECD countries who are well below us on the poverty scale. But don’t forget that an American living on $30 a day has to figure out a way to provide for health care, day care, and post-high school education, just to name three things the European doesn’t have to pay for out of his or her $30. Thirty dollars in the hands of a poor American and thirty dollars in the hands of a poor Dane is comparing apples to oranges.

Any concern about all those protective agencies cut by Reagan (you know, the ones who have made our air and water cleaner, and ensure that the meat we buy is safe, and so on)?

Again, no time to proofread. Hope it’s all readable.

Hi John (I’ve tried to post this several times with no luck, and I don’t have any idea why. It’s not as long as my previous post. In any event, I’m going to try posting part of it here and see if that flies),

No problem. I was probably being overly sensitive.

I’ve had lunch twice with Deirdre McCloskey at her club on Michigan Avenue in Chicago (as well as several emails back- and-forth). I know her pretty well. She identifies as a bleeding-heart libertarian. She cares deeply about the poor. Hence her support for a guaranteed annual income and she would pay for it with a consumption tax. The latter can be as progressive as one wants to make it.

I’m not sure why you needed to suggest that it was funny that I cited Milton Friedman and McCloskey when I had already said it was ironic. But so be it.

If what you write is Dan’s methodology for determining who is the best president for controlling spending, I think he needs to rethink it. For starters, #1 is ridiculous. Remove defense spending? All of it? Every single dime? In other words, some war-mongering president can come in, blow our budget to the sky, and Dan gives him or her a pass. Unbelievable. Contrary to what you say, I don’t think you can talk coherently about national budgets without taking into account defense spending.

If you want to level the playing field, will you give the same break to Obama who came into office when the country was going through the worst recession since the Great Depression? He spent a lot of money initially, but by the end of his 8 years, had not come close to Reagan in terms of blowing up the deficit. They weren’t even in the same ballpark. No president since FDR has come close to Reagan (I gave you those numbers before). Not even those who fought actual wars.

I didn’t know that different types of spending were Constitutionally ranked.

Forgetting for the moment everything I have written, you have never dealt with the arguments of the libertarian Ludwig von Mises think tank. They certainly are not ready to crown Reagan as a thrifty spender. Does Dan not read their stuff?

You write: “Yes, Reagan lowered tax rates.” But you fail to deal with the fact that those cuts were failures (as his experts knew they would be), and he had to raise taxes several different years beginning in 1983.

I don’t consider incomes going up a problem as long as those at the bottom are being helped. In a country as wealthy as we are, the level of poverty here is embarrassing. I have more than once noted the work of the Princeton philosopher Harry Frankfurt who said that sufficiency, not equality, should be the moral focus. But he doesn’t believe we have achieved sufficiency yet in this country.

You write, “Yes, top incomes went up more under Reagan. You seem to regard this as a problem. I call it a good thing.” I had written the following:

“According to a 2012 report from the nonpartisan Congressional Research Service (referenced by the New York Times’ David Leonhardt in a 2012 column), top marginal tax rates and economic growth have not appeared correlated over the past 60 years.”

(Google “FACT CHECK: Do Tax Cuts Grow the Economy?” by Danielle Kurtzleben)

And from the same article: “Likewise, the economic research firm Moody’s found in 2008 that temporary tax cuts (like rebates) could boost GDP, but permanent ones had a much weaker effect. Meanwhile, boosting spending on programs like food stamps and unemployment had a stronger effect, they found.”

You had no response to this, even though I said they were probably the two most important paragraphs in my post. It looks like maybe Reagan should have done more with boosting programs for the poor (food stamps, unemployment and the like) and less with helping the rich. And you are left speechless.

You write: “A progressive tax system means tax cuts will usually benefit higher-income folks more than lower-income folks.” Yes, that’s true, and Reagan kicked the a ball down the road where some of the social safety net issues are concerned, and at the state and local levels where those things ended up, taxes are much more regressive.

By the way, I find it funny that you quote Milton Friedman and Deirdre McCloskey to try to dissuade me. I’ve read countless words from both of them. Trust me, their work agrees with my views much more than it does yours.

Sorry, Phil, wasn’t trying to offend you. I was just trying to explain why I wasn’t providing any data. However, honesty compels me to say I probably do know the tax topic better than you do. Probably economics, too. This doesn’t make me a great person or you a bad one. I’m sure there are other topics you know better than me.

I believe that also addresses your complaint that I didn’t provide enough numbers. In my prior comments I have given you tons of numbers. I just thought I’d try a different approach using just words.

I didn’t address your “Reagan as big spender” argument because we already went back and forth on that a while ago. Dan’s methodology of ranking presidents by spending shows Reagan as the best for controlling spending. I don’t recall Dan’s exact methodology, but it was something like measure the average annual growth rate of spending, adjusted to 1) remove defense spending, 2) remove inflation, and 3) exclude the first year of the president’s term but include the first year of the next president’s term. That methodology seems OK to me. 2 and 3 are self-explanatory. I’m fine with #1, exclude national defense. This levels the playing field since some presidents were burdened with wartime or cold war spending while others weren’t. Also, defense spending is also one of the most constitutionally supported types of spending, and there’s nothing wrong with focusing on government policy outside the realm of national defense.

Yes, Reagan lowered tax rates. Yes, it benefited the top 1% more than low-income people. A progressive tax system means tax cuts will usually benefit higher-income folks more than lower-income folks.

Yes, top incomes went up more under Reagan. You seem to regard this as a problem. I call it a good thing. As mentioned, high-income people do lots of good for OTHER PEOPLE. Also, keep in mind that upper incomes have no real boundary while lower incomes cannot drop below zero.

However, you are wrong that Reagan slashed the social safety net. First, keep in mind that much of it is operated at the local level, not federal, and even more so back in the 1980s. But here’s what actually happened with anti-poverty government assistance. In 1982, the bottom quintile of earners received 40.1% of their income in the form of government assistance. By 1989, this had grown to 45.3%. (From the CBO report I previously sent you.) That may be less anti-poverty assistance than you prefer, but it reflects an increase, not a decrease.

You are also wrong about economic growth. Real (inflation-adjusted) GDP per capita increased by 3.5% per year from 1982 to 1989. This is much higher than 2.3% in the 25 years prior to Reagan and the 1.4% in the 25 years after him. Growth was significantly better under Reagan, and this is a big deal.

All things considered, the picture for Reagan is not as bad you think. I think the American people agree. He was elected in 1980 with the 7th highest ever landslide victory, then reelected in 1984 with the 3rd highest landslide. Also, rankings of the all-time greatest presidents routinely place him in the top ten.

You have way too much other material to address. I’ll address just one more, the idea that the US has more poverty than other nations. The only way you can think this is if you’re looking at relative poverty (e.g., % of population below half the median income). As I previously said, that is more an indication of income distribution than a measure of true poverty. A century from now, Americans with incomes below half the median might literally enjoy a material lifestyle equivalent to a top 10% person of today. Are today’s top 10% poor? Of course not. Neither are the future “half of median” people who live equivalent to today’s 10%.

Real poverty means not being able to have enough food, shelter, clothing, and so on. This kind of measurement for lots of countries is basically impossible. But here’s some data on absolute poverty. 16.0% of Americans live on less than $30 per day. That’s better than the 18.3% average for France/Germany/UK and also the 20.5% average for all high-income countries. (https://ourworldindata.org/grapher/distribution-of-population-between-different-poverty-thresholds-up-to-30-dollars?stackMode=relative&country=~GBR)

Hi John,

I thought we had come to a point of greater civility in our correspondence, but then you come at me with this condescending line “But I get tired of trying to educate you about taxes…” Oh, well. Onward we go.