Regular readers know that good fiscal policy takes place when government spending grows slower than the private economy.

Nations that maintain this Golden Rule for extended periods of time shrink the relative burden of government spending, thus enabling more growth by freeing up resources for the productive sector of the economy and creating leeway for lower tax rates.

And when countries deal with the underlying disease of too much spending, they automatically solve the symptom of red ink, so it’s a win-win situation whether you’re a spending hawk or a so-called deficit hawk.

With this in mind, let’s look at some interesting new research from the Heritage Foundation. They’ve produced a report entitled Europe’s Fiscal Crisis Revealed: An In-Depth Analysis of Spending, Austerity, and Growth.

It focuses on fiscal policy over the past few years and is an important contribution in two big ways. First, it shows that the Keynesian free-lunch approach is counterproductive. Second, it shows that the right kind of fiscal consolidation (i.e., spending restraint) generates superior results.

Here are some excerpts from the chapter by Professor Alberto Alesina of Harvard of Veronique de Rugy of the Mercatus Center. They look at some of the academic evidence.

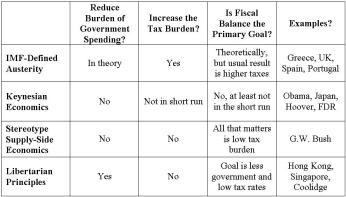

The debate over the merits of austerity (the implementation of debt-reduction packages) is frustrating. Most people focus only on deficit reduction, but that can be achieved in many different ways. Some ways, such as raising taxes, deeply hurt growth… The data show that austerity has been implemented in Europe. However, with some rare exceptions, the forms of austerity were heavy on tax increases and far from involving savage spending cuts. …spending-based adjustments are more likely to reduce the debt-to-GDP ratio, regardless of whether fiscal adjustments are defined in terms of improvements in the cyclically adjusted primary budget deficit or in terms of premeditated policy changes designed to improve a country’s fiscal outlook. …Other research has found that fiscal adjustments based mostly on the spending side are less likely to be reversed and, as a result, have led to more long-lasting reductions in debt-to-GDP ratios. …successful fiscal adjustments are often rooted in reform of social programs and reductions in the size and pay of the government workforce rather than in other types of spending cuts. …tax increases failed to reduce the debt and were associated with large recessions. …growing evidence suggests that private investment tends to react more positively to spending-based adjustments. For instance, data from Alesina and Ardagna and from Alesina, Favero, and Giavazzi show that private-sector capital accumulation increases after governments cut spending.

The basic message of the Alesina-de Rugy chapter is that bad outcomes are largely unavoidable when nations spend themselves into fiscal trouble, but the damage can be minimized if policy makers impose spending restraint.

The Heritage Foundation’s Salim Furth is the editor of the report, and here’s some of what he wrote in Chapter 3, which looks at what’s happened in recent years as countries dealt with fiscal crisis.

Tax austerity is very harmful to growth, while spending cuts are partially replaced by private-sector activity, making them less harmful. …Estimating growth effects on private GDP, the difference between tax and spending multipliers grows predictably. A two-dollar decline in private GDP is associated with every dollar of tax increases, but spending cuts are associated with no change in private GDP. …fiscal consolidation that relied 60 percentage points more on spending cuts was associated with 3.1 percentage points more GDP growth from 2009 to 2012, when average growth was just 3.3 percent over the entire period. In other words, a country that had a fiscal consolidation composed of 80 percent of spending cuts and 20 percent of tax increases would grow much more rapidly than a country in which only 20 percent of the consolidation was spending cuts and 80 percent was tax increases. The association is slightly stronger for private GDP.

Salim then cites a couple of powerful examples.

…the difference between Germany’s 8 percent growth from 2009 to 2012 and the 1 percent growth in the Netherlands is largely accounted for by Germany’s cut-spending, cut-taxes approach and the Netherlands’ raise-spending, raise-taxes approach. The U.K. and Italy enacted similarly-sized austerity packages, but Italy’s was half tax increases while the U.K. favored spending cuts. Neither country excelled, but over half of the gap between the U.K.’s 3 percent growth and Italy’s negative growth is explained by Italy’s tax increases.

By the way, it’s not as if Germany and the United Kingdom are stellar examples of fiscal restraint. It’s just that they’re doing better than nations that traveled down the path of even bigger government.

Regarding supposed Keynesian stimulus, Salim makes a very important point that more government spending seems positive in the short run, sort of like the fiscal version of a sugar high.

But that sugar high produces a bad hangover. Nations that try Keynesianism quickly fall behind countries with more prudent policy.

Government spending boosts GDP instantly and then crowds out private spending slowly. The incentive effects of taxation may take effect over several years, but they are permanent and especially pronounced in investment. If anything, this recent crisis shows how brief the short run is: Countries whose spending-focused stimulus put them one step ahead in 2010 were already two steps behind in 2012.

There’s a lot more in the report, so I encourage readers to give it a look.

I particularly like that it emphasizes the importance of properly defining “austerity” and “fiscal consolidation.” These are issues that I highlighted in my discussion with John Stossel.

Another great thing about the report is that it has all sorts of useful data.

Another great thing about the report is that it has all sorts of useful data.

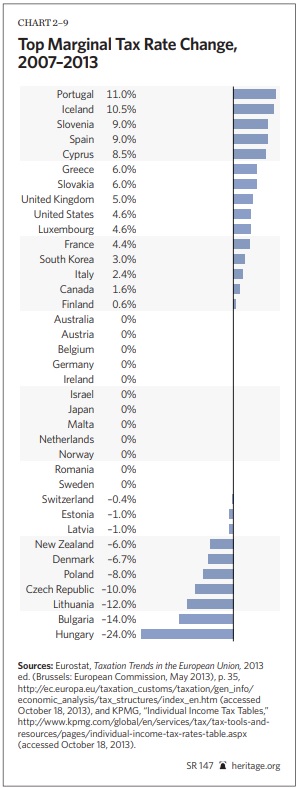

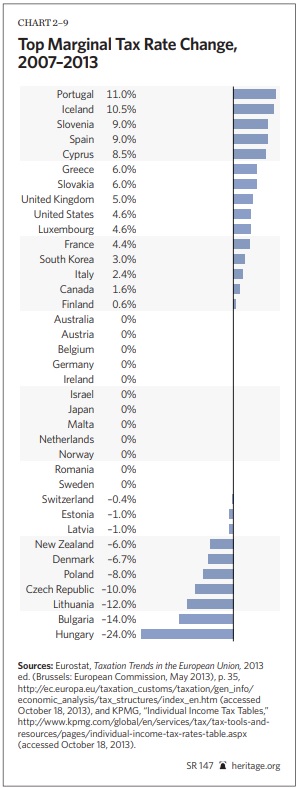

Though much of it is depressing. Here’s Chart 2-9 from the report and it shows all the countries that have increased top marginal tax rates between 2007 and 2013.

Portugal wins the booby prize for the biggest tax hike, though many nations went down this class-warfare path. Including the United States thanks to Obama’s fiscal cliff tax increase.

The United Kingdom is an interesting case. It raised its top rate by 10 percentage points, but then cut the rate by 5 percentage points after it became apparent that the higher rate wasn’t collecting any additional revenue.

We should give credit to the handful of nations that have lowered tax rates, several of which replaced discriminatory systems with simple and fair flat taxes.

Though it’s also important to keep in mind where each nation started. Switzerland lowered it’s top rate by only 0.4 percentage points, which seems small compared to Denmark, which dropped its top rate by 6.7 percentage points.

But Switzerland started with a much lower rate, whereas Denmark has one of the world’s most punitive tax regimes (though, paradoxically, it is very laissez-faire in areas other than fiscal policy).

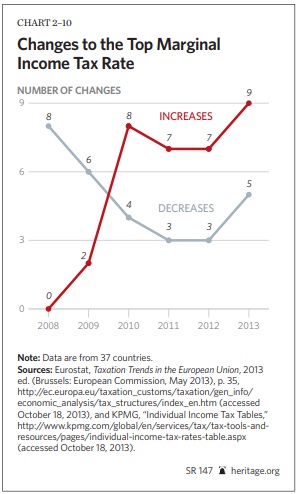

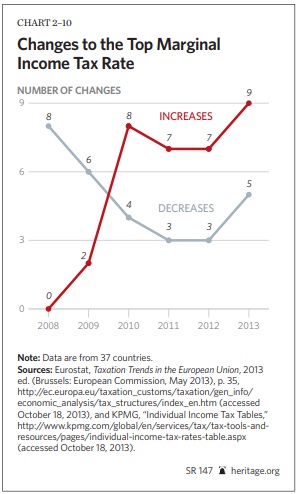

Let’s look at the same data, but from a different perspective. Chart 2-10 shows how many nations (from a list of 37) raised top rates or lowered top rates each year.

Let’s look at the same data, but from a different perspective. Chart 2-10 shows how many nations (from a list of 37) raised top rates or lowered top rates each year.

The good news is that tax cutters out-numbered tax-hikers in 2008 and 2009.

The bad news is that tax increases have dominated ever since 2010.

Many of these post-2009 tax hikes were enabled by a weakening of tax competition, which underscores why it is so important to preserve the right of jurisdictions to maintain competitive tax systems.

And don’t forget that tax policy will probably get even worse in the future because of aging populations and poorly designed entitlement programs.

Let’s close with some more numbers.

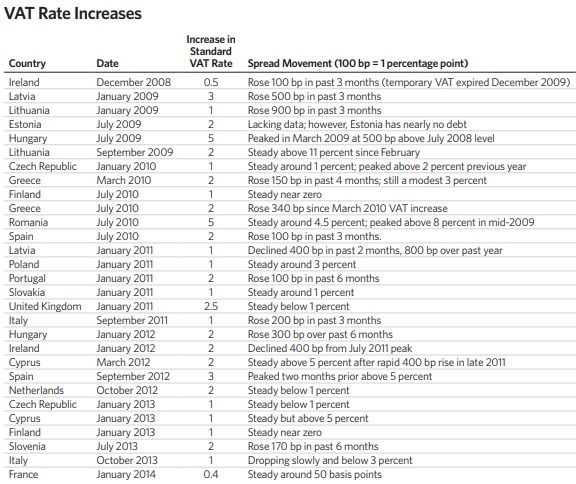

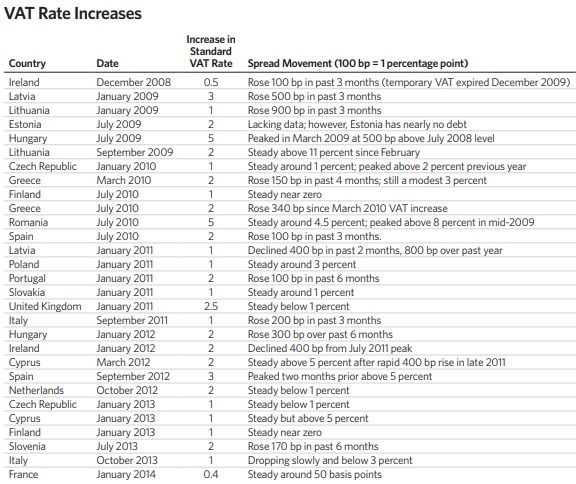

Here’s Table 2-5 from the report. It shows changes in the value-added tax (VAT) beginning in December 2008.

The key thing to notice is that there’s no column for decreases in the VAT. That’s because no nation lowered that levy. Practically speaking, this hidden form of a national sales tax is a money machine for bigger government.

But you don’t have to believe me. The International Monetary Fund unintentionally provided the data showing that VATs are the most effective tax for financing bigger government.

Read Full Post »

Given the problems with the U.K.’s National Health Service, that would be like jumping out of the frying pan and into the fire.

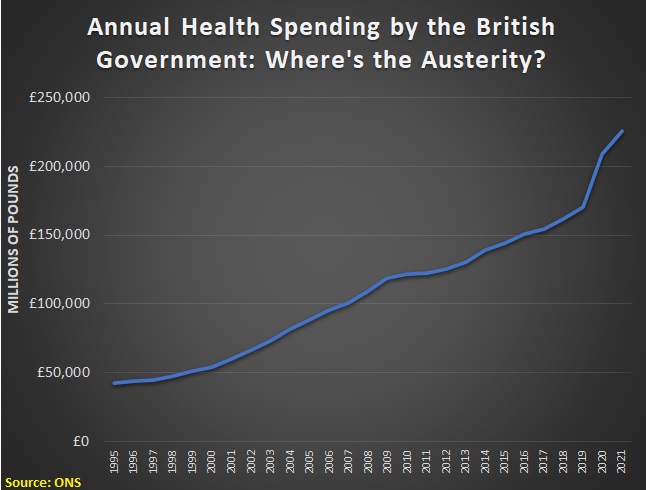

Given the problems with the U.K.’s National Health Service, that would be like jumping out of the frying pan and into the fire.on waiting lists for treatments… That the flagship health care service of one of the wealthiest countries in the world is in such a state is shocking, but not without explanation. Decades of marketization, 10 years of Conservative austerity and a pandemic have hollowed out the N.H.S… A government-commissioned report released last year called the years between 2010 and 2020 the N.H.S.’s “decade of neglect.” …The N.H.S. as Britons have known it — accessible, free at the point of use, cherished — is becoming something else. But as long as there are still people willing to fight for it, it’s not too late to save it.

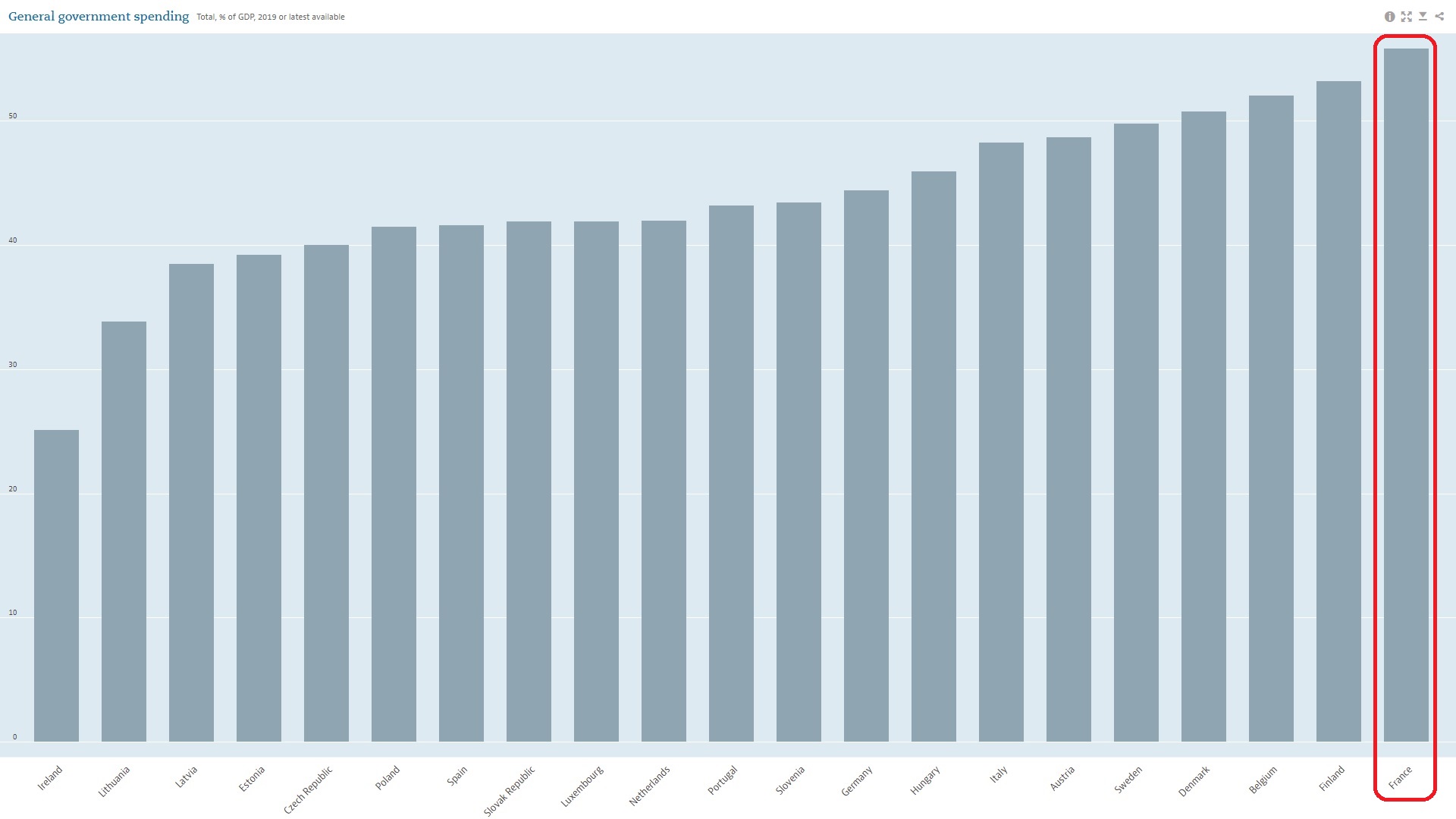

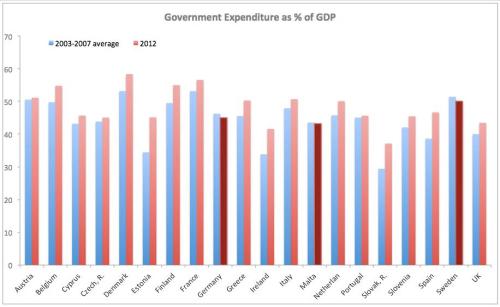

Public service announcement: Never, ever make claims about a country’s economic policies (or actually anything about economics) on the basis of what you think you’ve heard people say. Yes, you often hear people talking about austerity, and the Germans are big on praising and demanding austerity. But have they actually imposed a lot of it on themselves? Not so much.

Public service announcement: Never, ever make claims about a country’s economic policies (or actually anything about economics) on the basis of what you think you’ve heard people say. Yes, you often hear people talking about austerity, and the Germans are big on praising and demanding austerity. But have they actually imposed a lot of it on themselves? Not so much.

increasingly agitated that their gravy train may be derailed.

increasingly agitated that their gravy train may be derailed. Speaking of rage, Paul Krugman is equally dismayed with Prime Minister Cameron’s ostensibly penny-pinching budget. Summoning the ghost of John Maynard Keynes, he asserts that such frugality is misguided when an economy is still weak and people are unemployed. Indeed, Krugman argues that the U.K. economy is weak today precisely because of Cameron’s supposed austerity.

Speaking of rage, Paul Krugman is equally dismayed with Prime Minister Cameron’s ostensibly penny-pinching budget. Summoning the ghost of John Maynard Keynes, he asserts that such frugality is misguided when an economy is still weak and people are unemployed. Indeed, Krugman argues that the U.K. economy is weak today precisely because of Cameron’s supposed austerity.