Whenever I’m part of a debate about the merits of free markets, I ask my leftist opponent to respond to my never-answered question.

Cite an example, I beg them, of big government producing prosperity.

Cite an example, I beg them, of big government producing prosperity.

Inevitably, that person either dodges the question or gives an inaccurate answer.

Based on his new column in the Washington Post, I’m guessing that Joe Stiglitz would dodge the question.

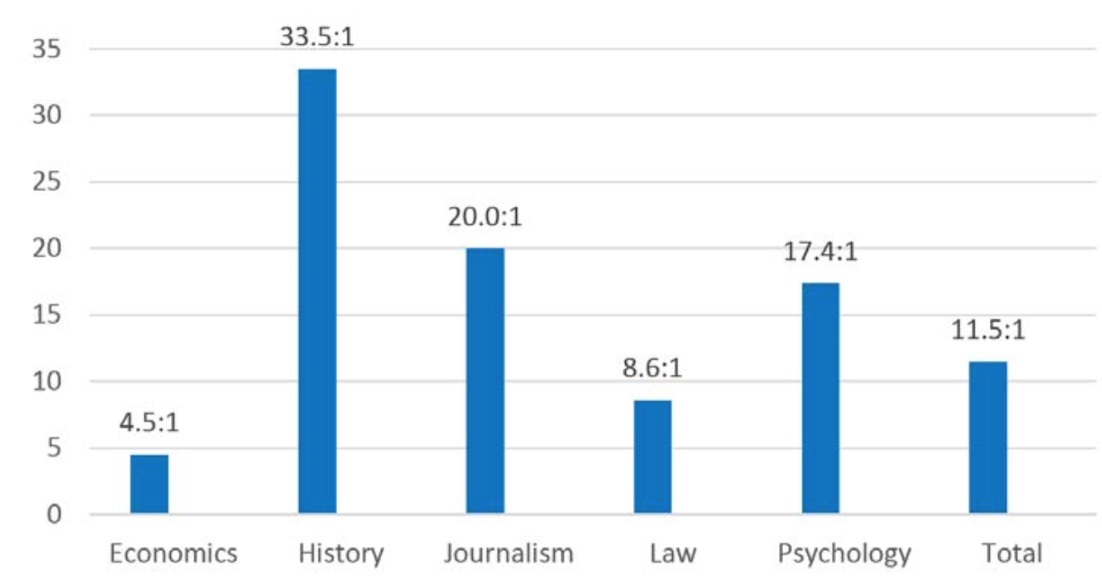

As you can see from these excerpts, he makes lots of assertions about the supposed superiority of big government, but he offers no evidence for that proposition.

We’ve now had four decades of the neoliberal “experiment,” beginning with Ronald Reagan and Margaret Thatcher. The results are clear. Neoliberalism expanded the freedom of corporations and billionaires to do as they will and amass huge fortunes, but it also exacted a steep price: the well-being and freedom of the rest of society.

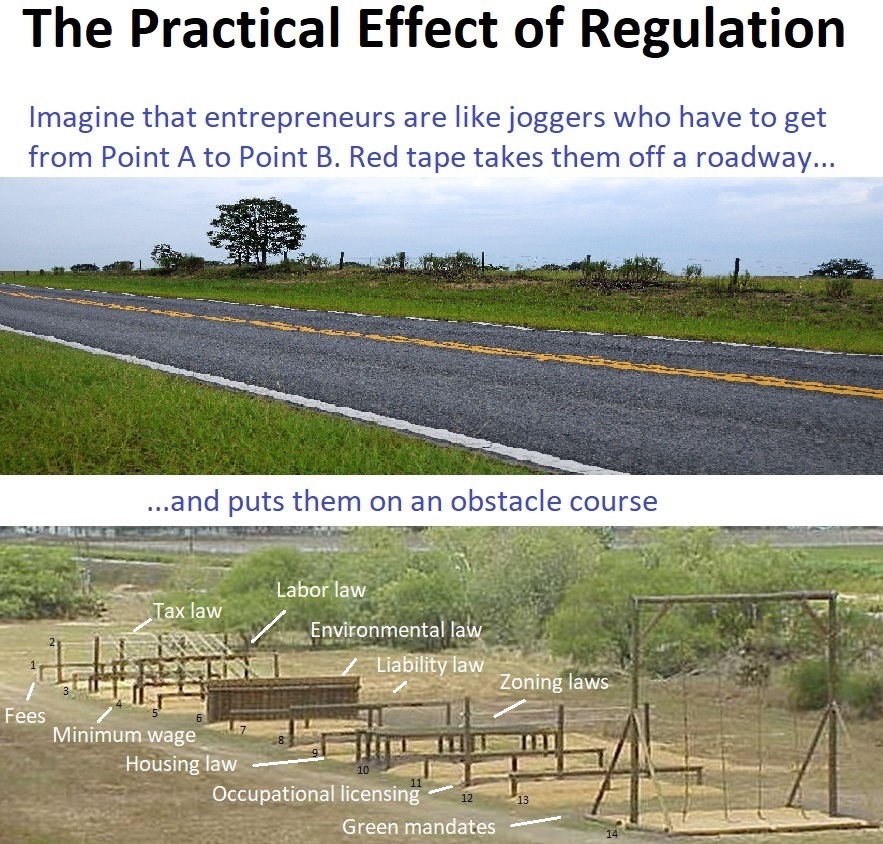

…there are two kinds, positive and negative; freedom to do and freedom from harm. “Free markets” alone fail to provide economic stability or security against the economic vagaries they create… Government is needed to deliver both. …Neoliberal capitalism has thus failed in its own economic terms: It has not delivered growth, let alone shared prosperity. …and it has instead set us on a populist route raising the prospects of a 21st-century fascism. …There is an alternative. …I call this new set of economic arrangements “progressive capitalism.” Central are government regulations and public investments, financed by taxation.

Before giving my response, I’ll make two points to help readers understand Stiglitz’s points.

- It may seem odd to Americans, but “neoliberal” often is a term for laissez-faire, especially in other nations (and usually intended as a slur). The same thing is true when folks on the left use terms like “free-market fundamentalist” or “zombie Reaganite.”

- The “two kinds of freedom” refer to the right to be left alone (negative liberty) and the supposed right to taxpayer-financed goodies (positive liberty). President Franklin Roosevelt’s so-called Second Bill of Rights would be an example of positive liberty.

With those definitional issues out of the way, I already noted that my main criticism is that Stiglitz offers no evidence to back up his assertions.

But there are a couple of other points worth making.

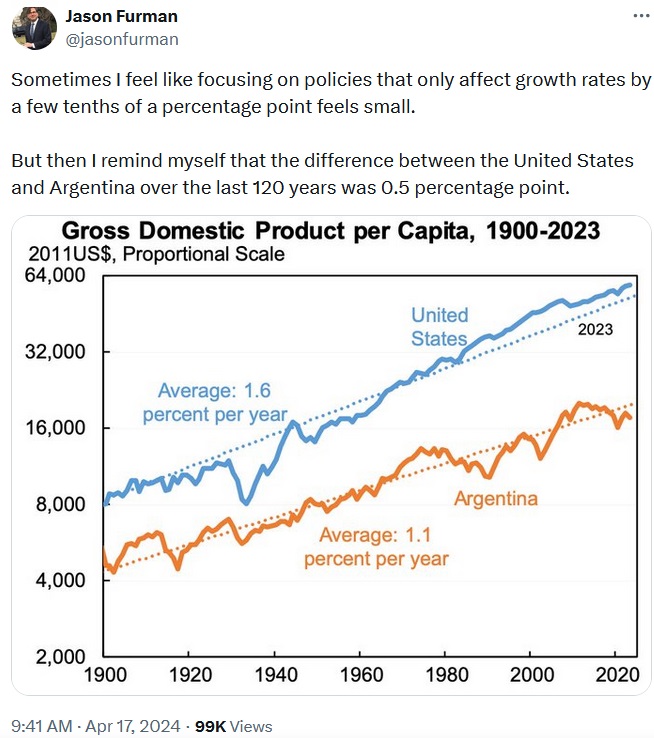

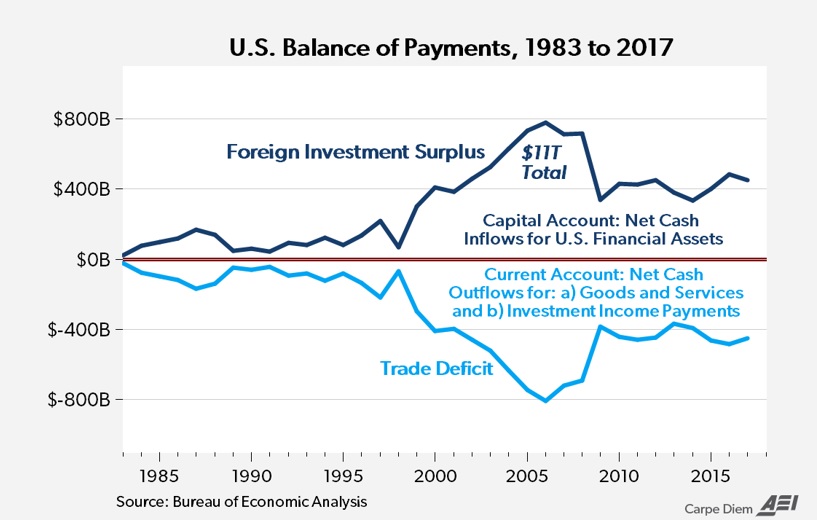

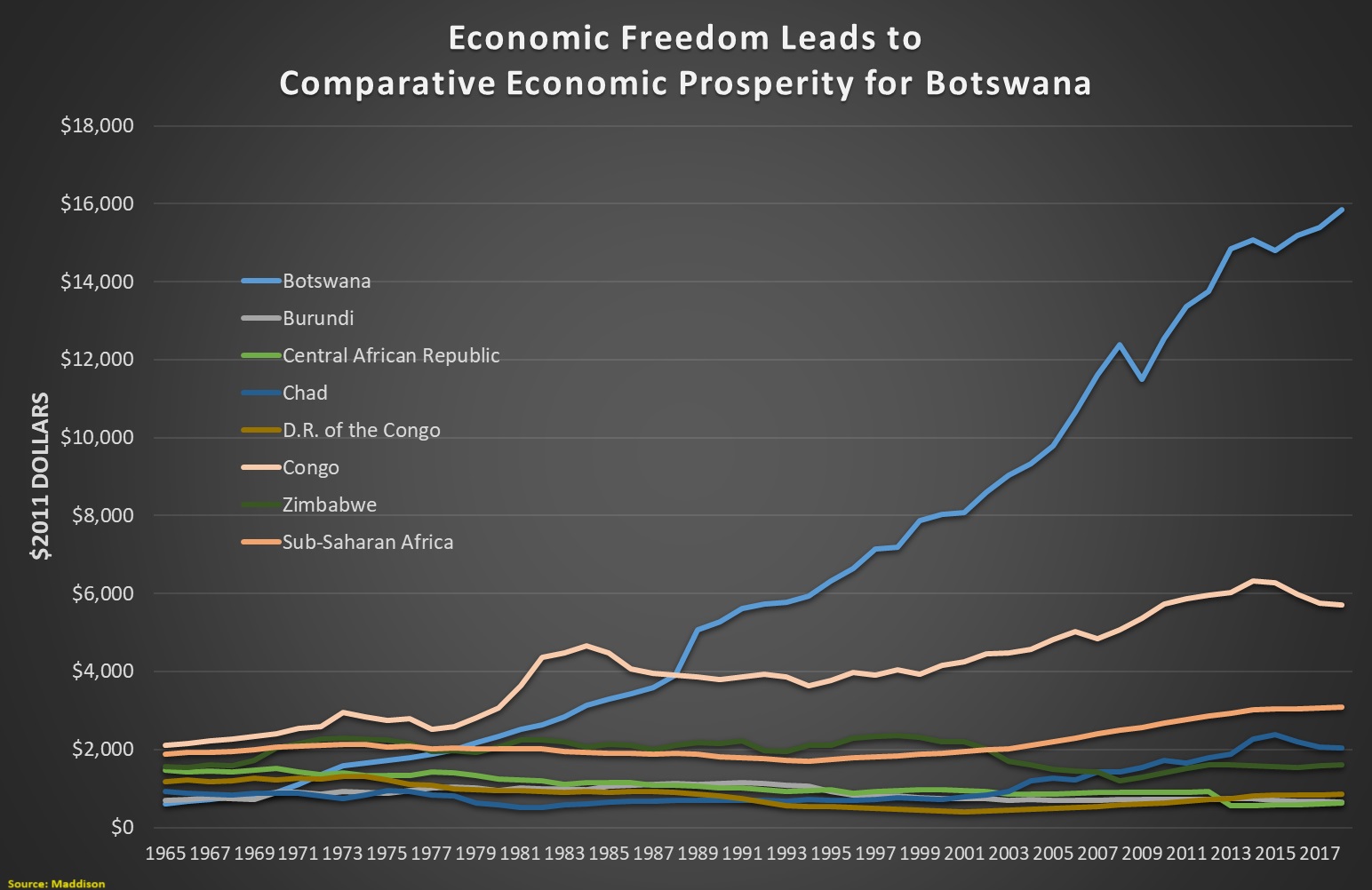

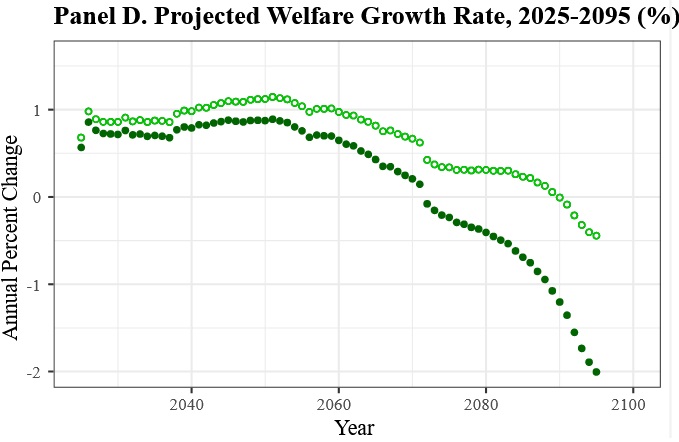

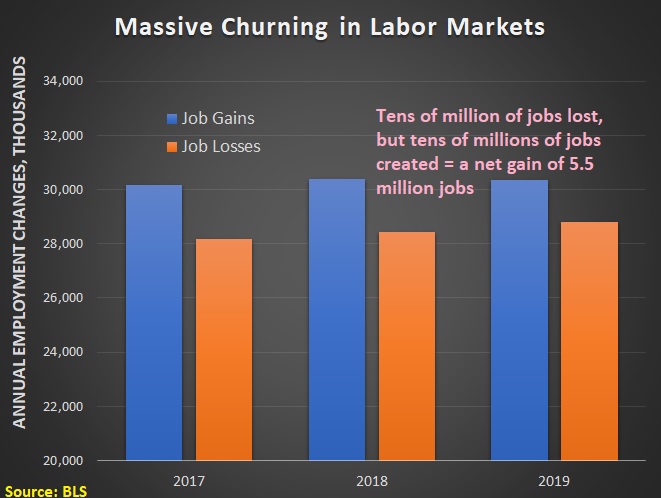

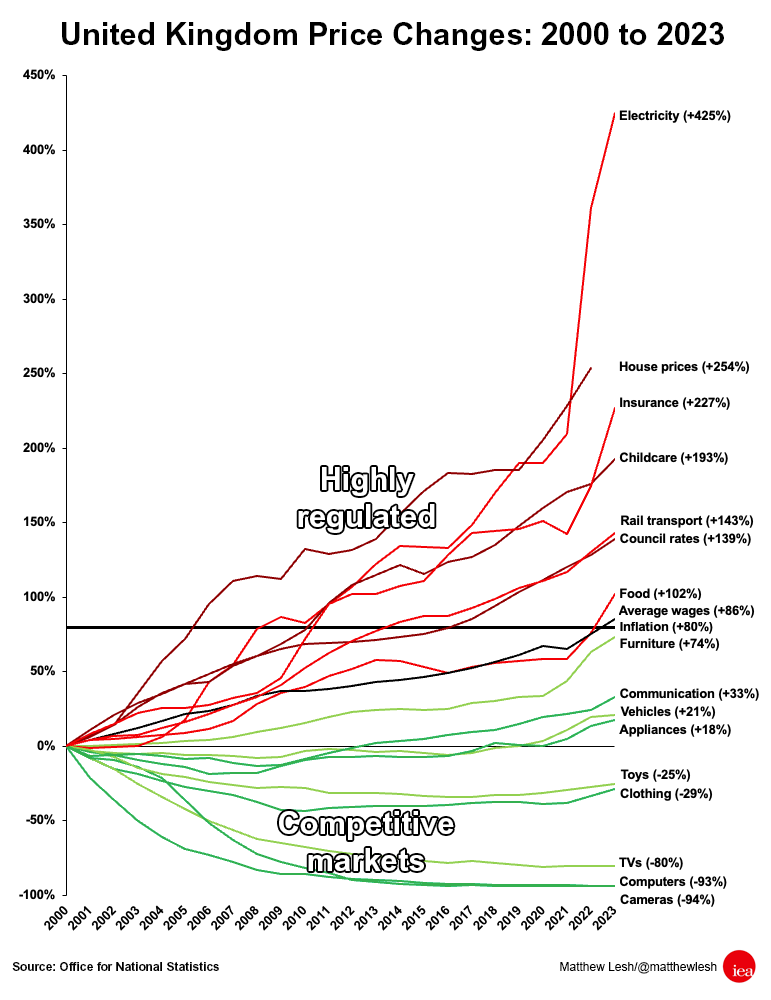

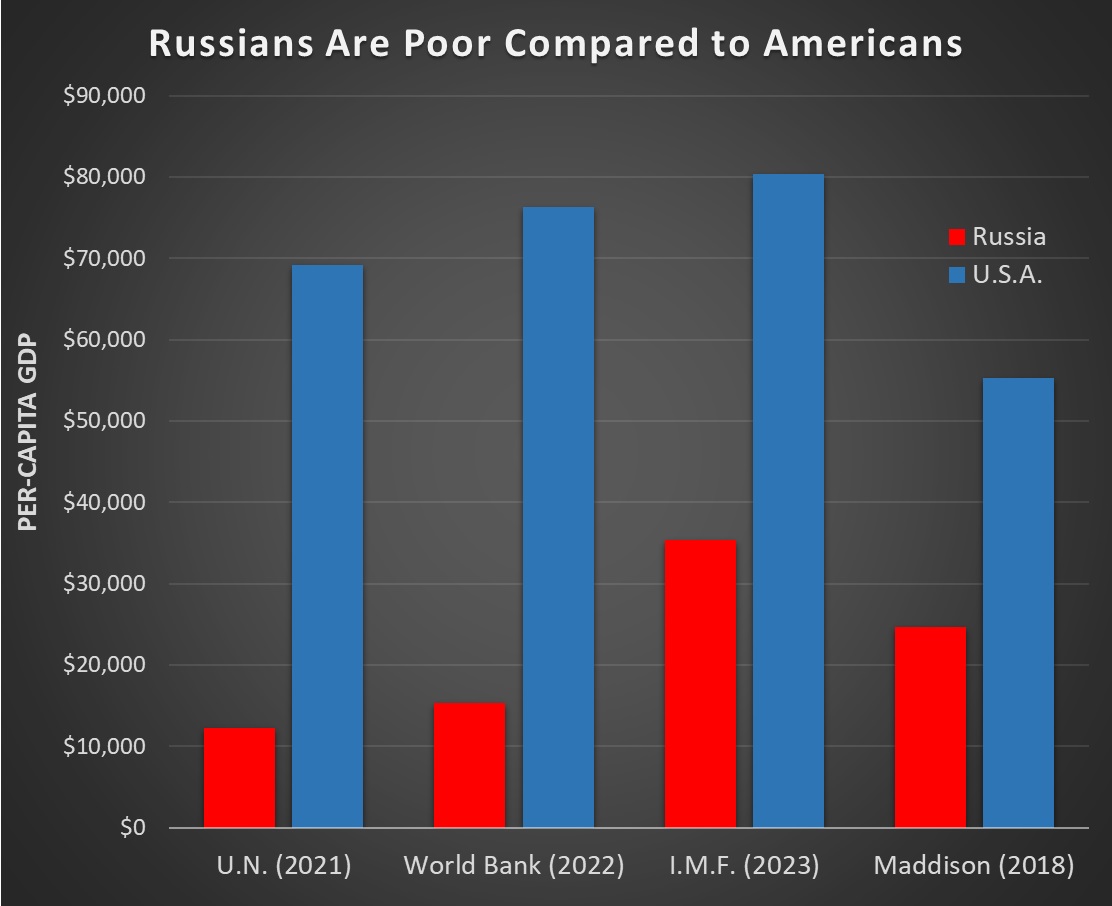

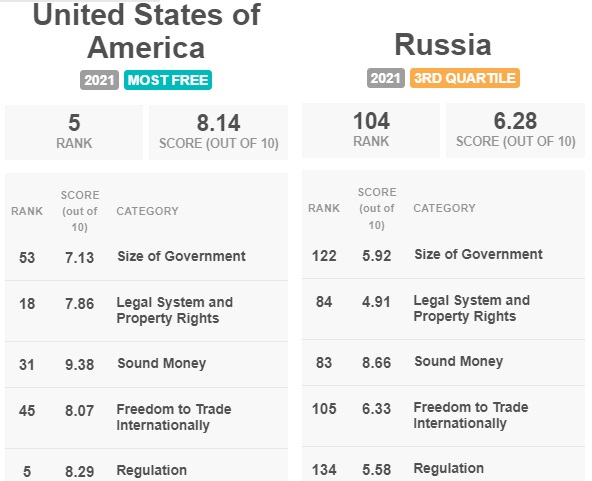

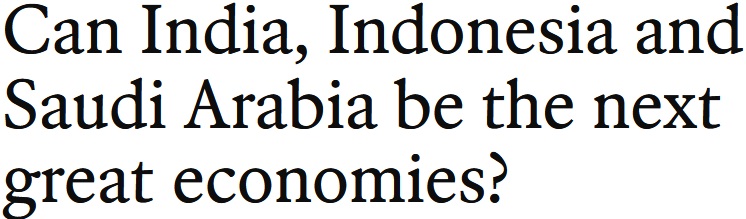

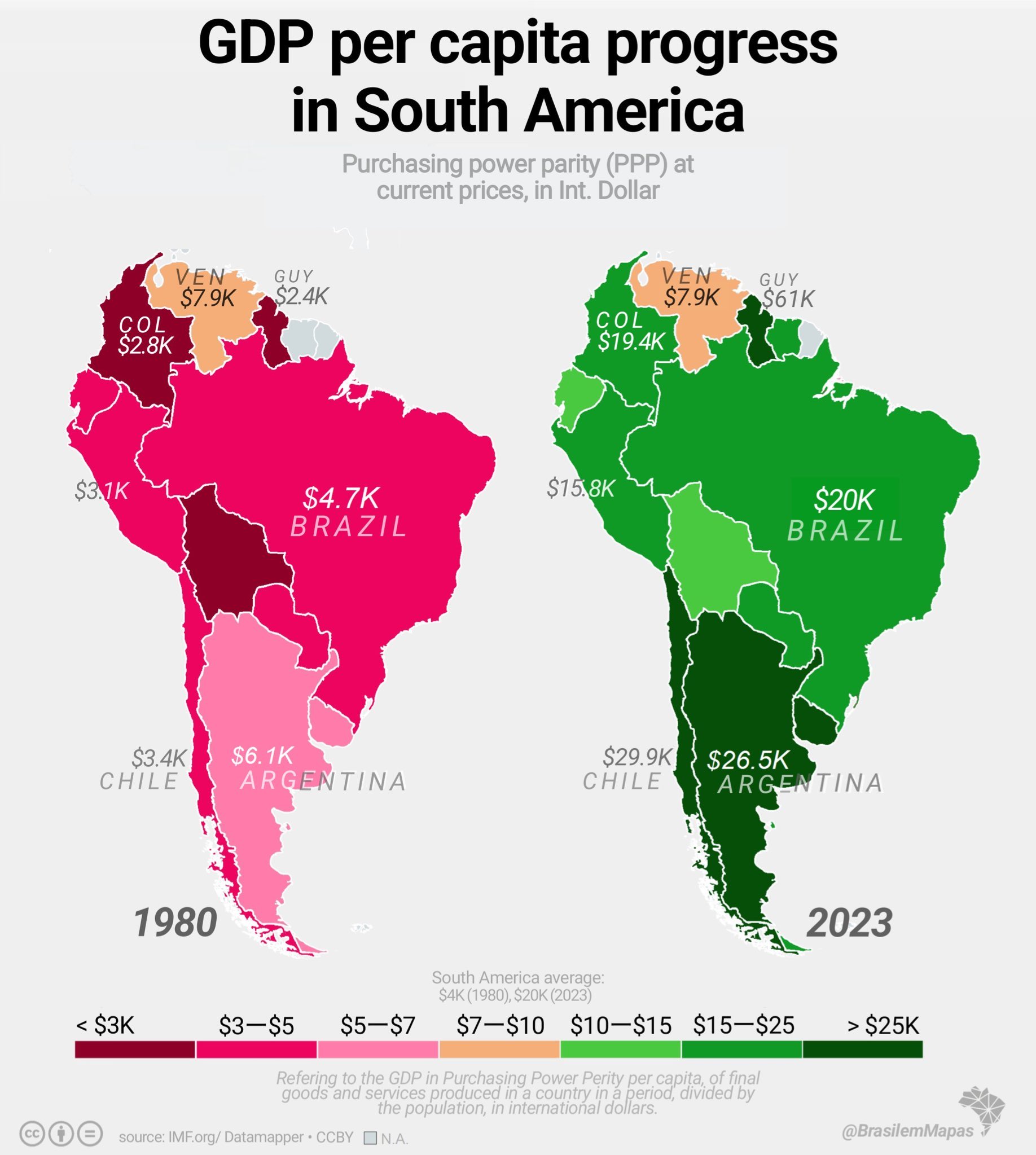

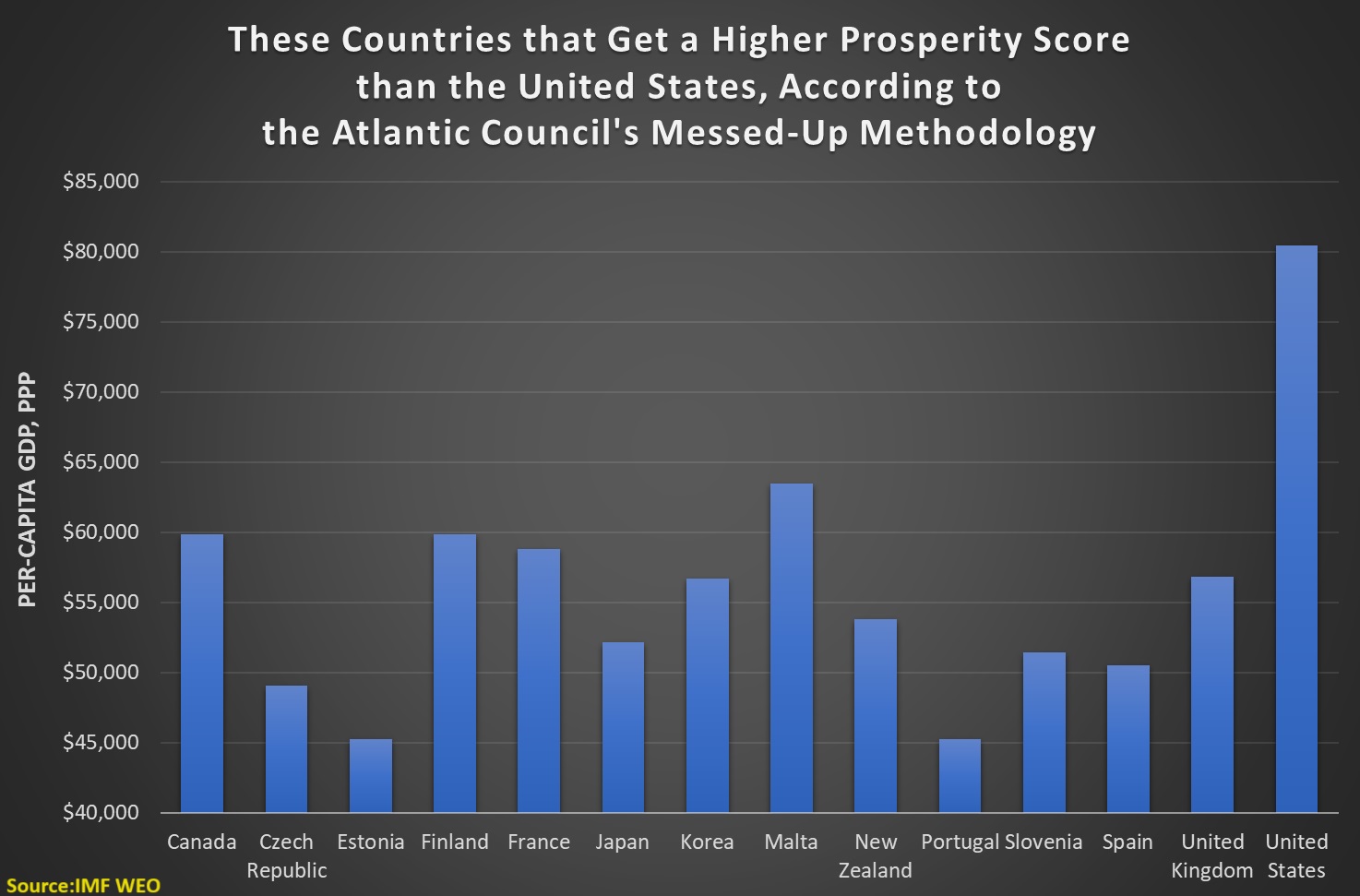

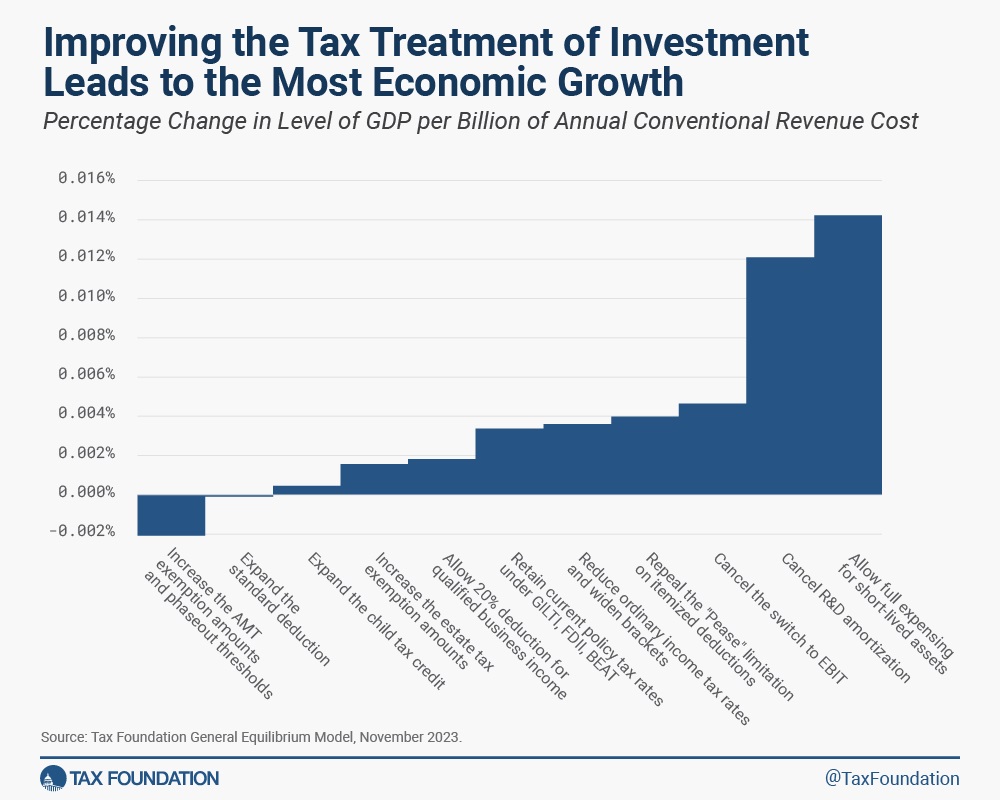

First, Stiglitz claims that capitalism “has not delivered growth, let alone shared prosperity.” Nonsense. There is a very strong correlation become market friendly policies and national prosperity.

And it’s worth noting that free markets have produced mass prosperity. Indeed, capitalism is the only system in the world to ever deliver that result.

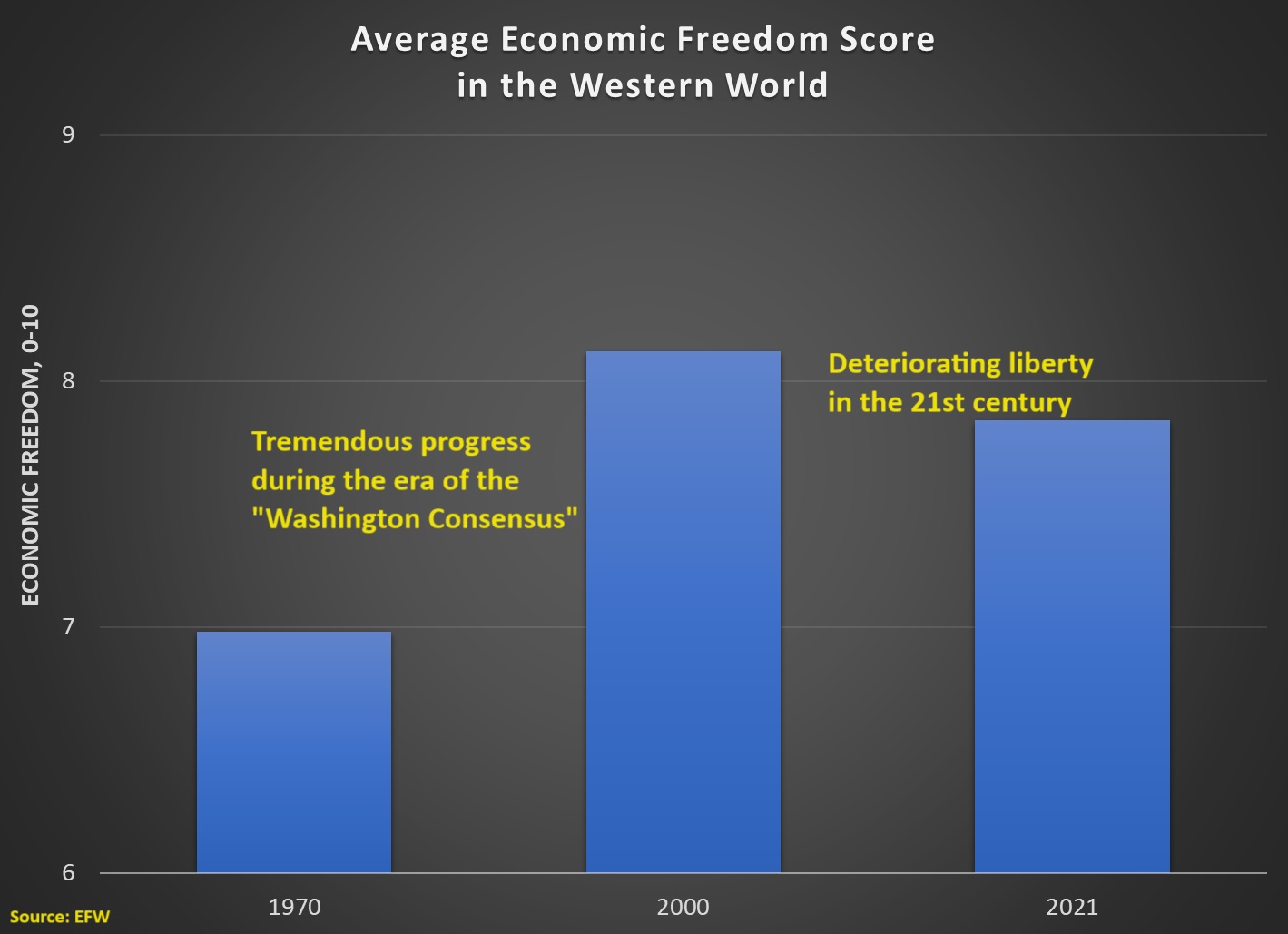

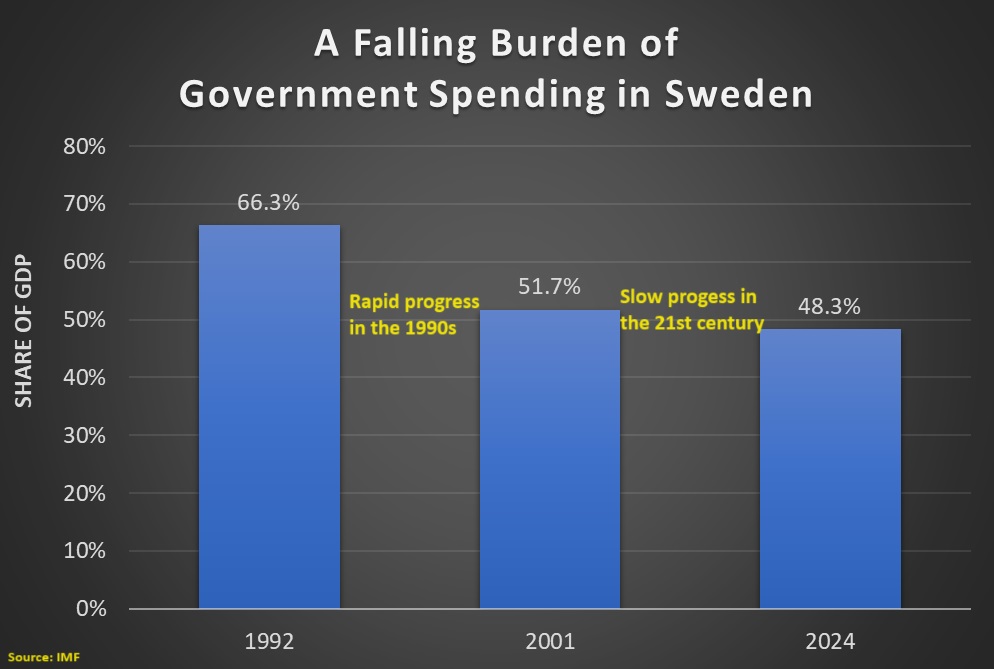

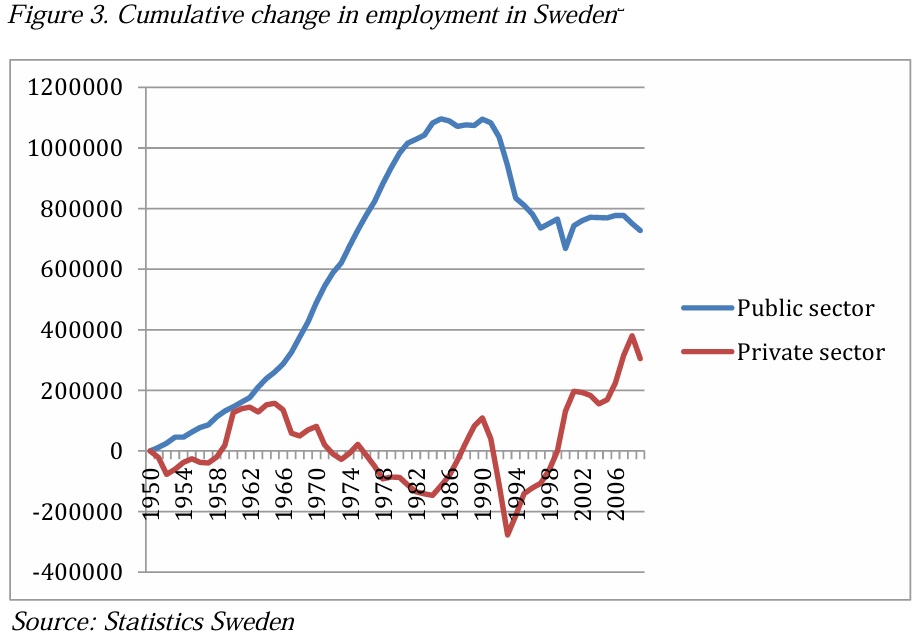

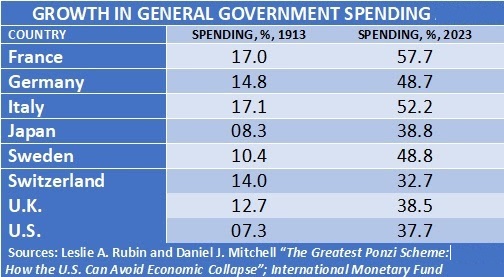

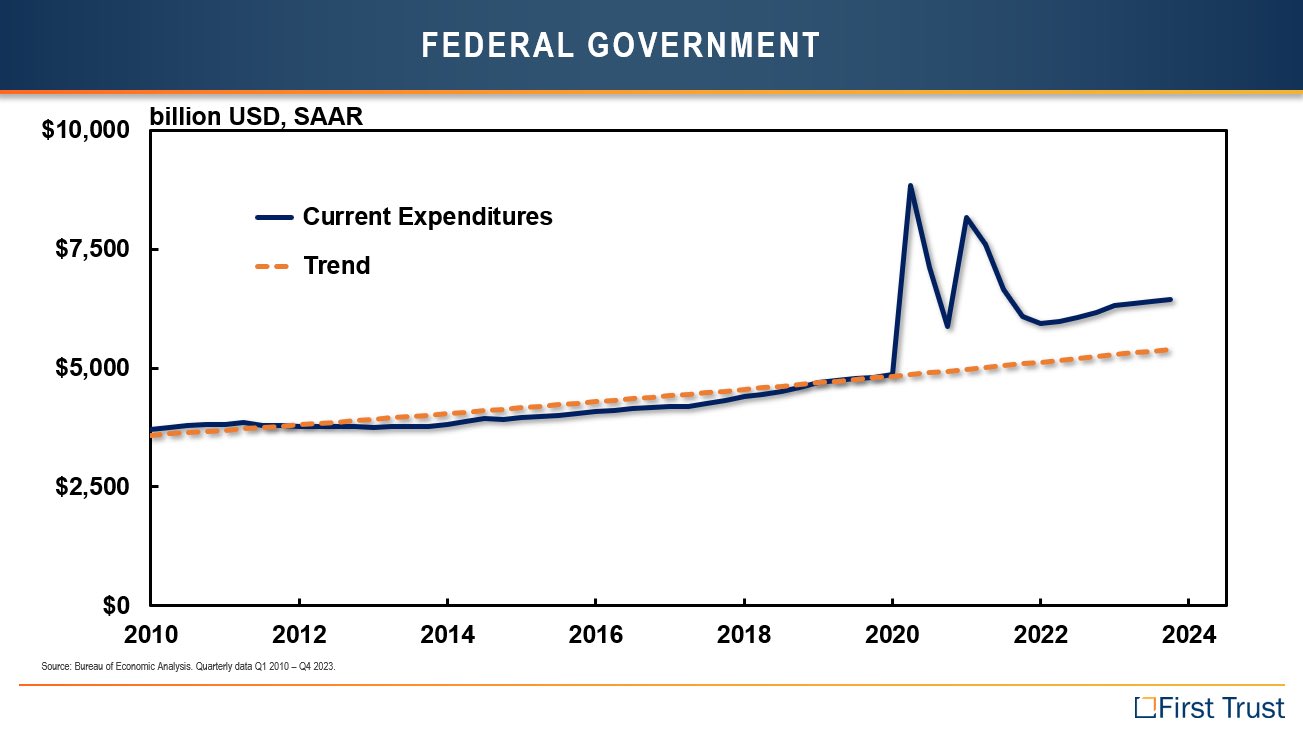

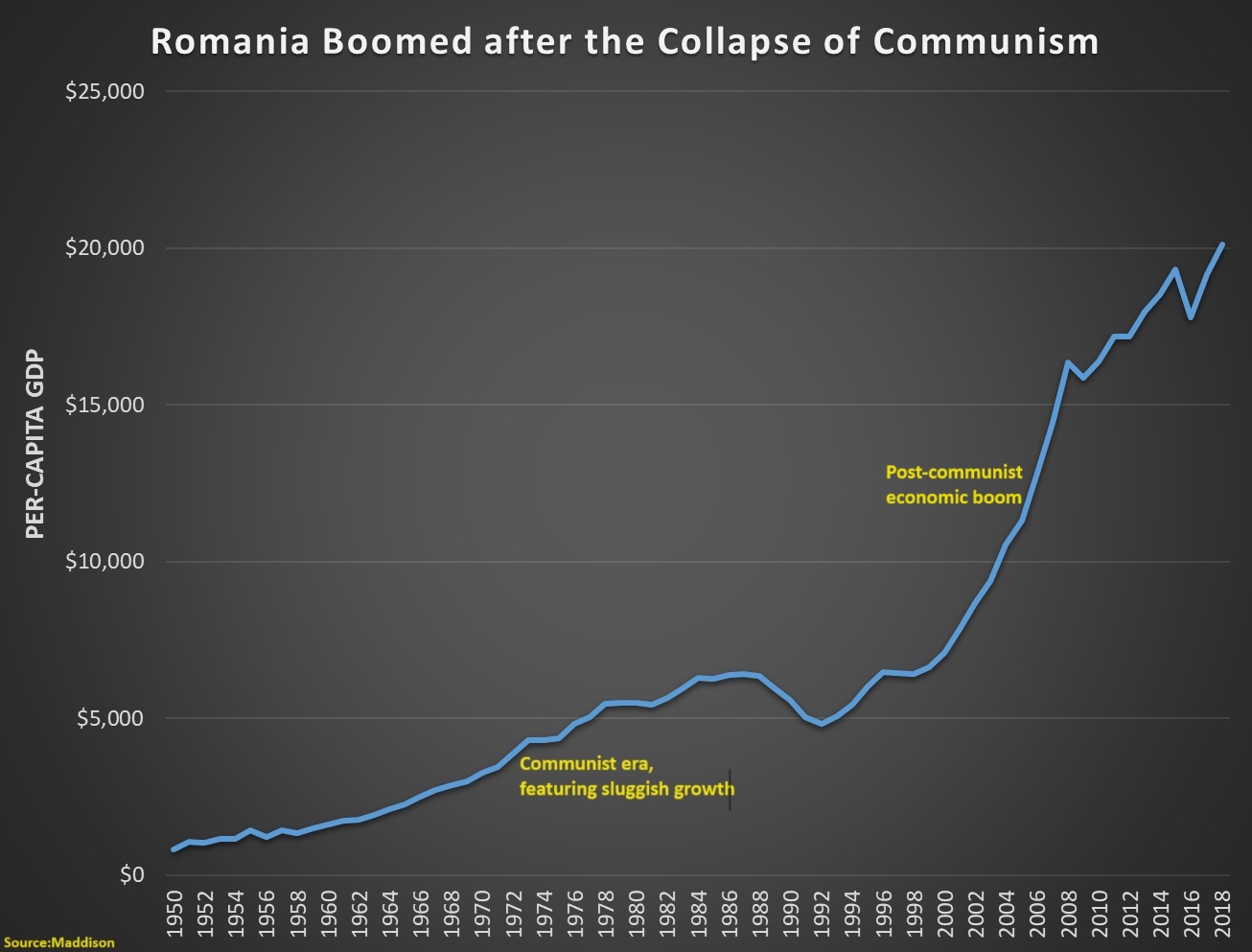

Second, Stiglitz refers to “the four decades of the neoliberal experiment” that started with Reagan and Thatcher.

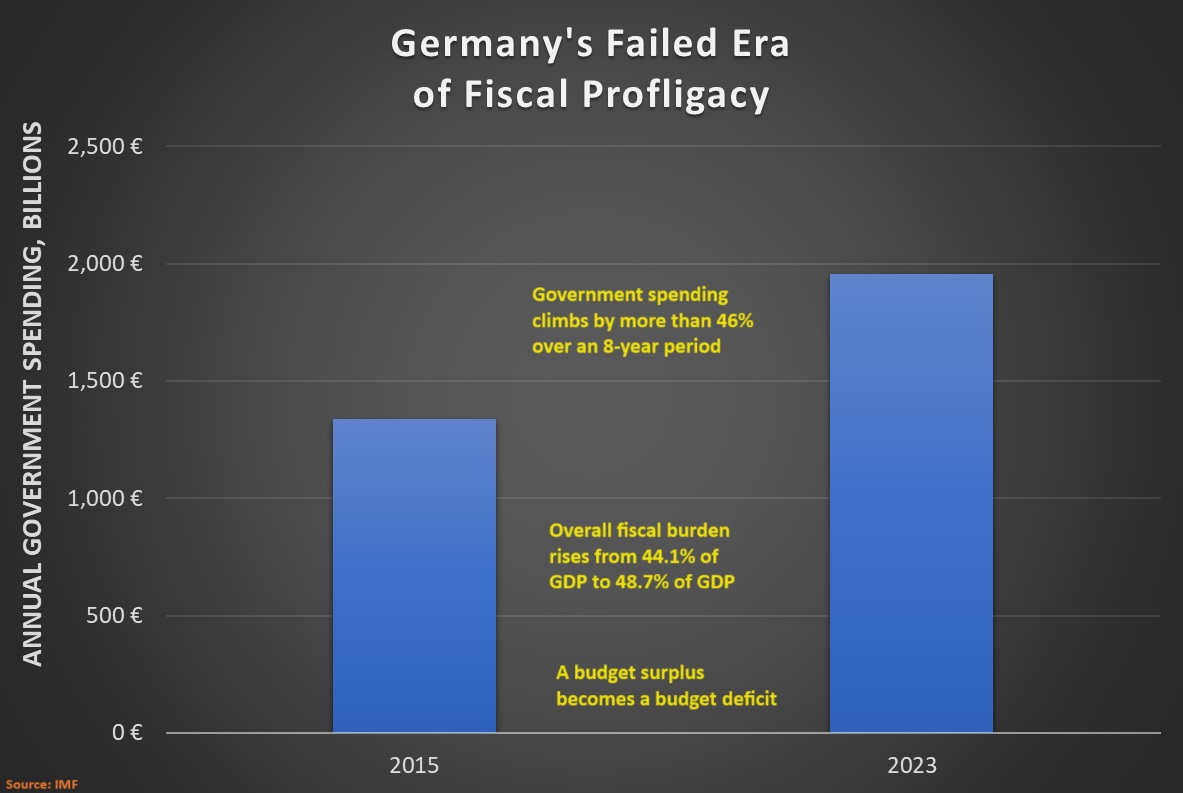

He is right about the starting point. There was an era, starting around 1980, known as the “Washington Consensus” when governments liberalized their economies. But the evidence clearly shows that the drift to statism resumed around the turn of the century.

P.S. I can’t resist sharing one final excerpt from Stiglitz’s column.

Freeing bankers from what they claimed to be excessively burdensome regulations put the rest of us at risk…when the banking system imploded in 2008.

This also is nonsense. Bad government policy (specifically easy money and Fannie/Freddie subsidies) gave us the 2008 crisis.

P.P.S. I also can’t resist pointing out that Stiglitz has cheered the policies that produced terrible outcomes in Greece and Venezuela.