I frequently call attention to the “anti-convergence club” because of the many real-world examples showing that nations with free markets and limited governments enjoy much better economic performance.

Here are just a few case studies.

All this seems like a strong argument for smaller government. And it is.

But all this data I’ve been sharing may understate the case for economic liberty.

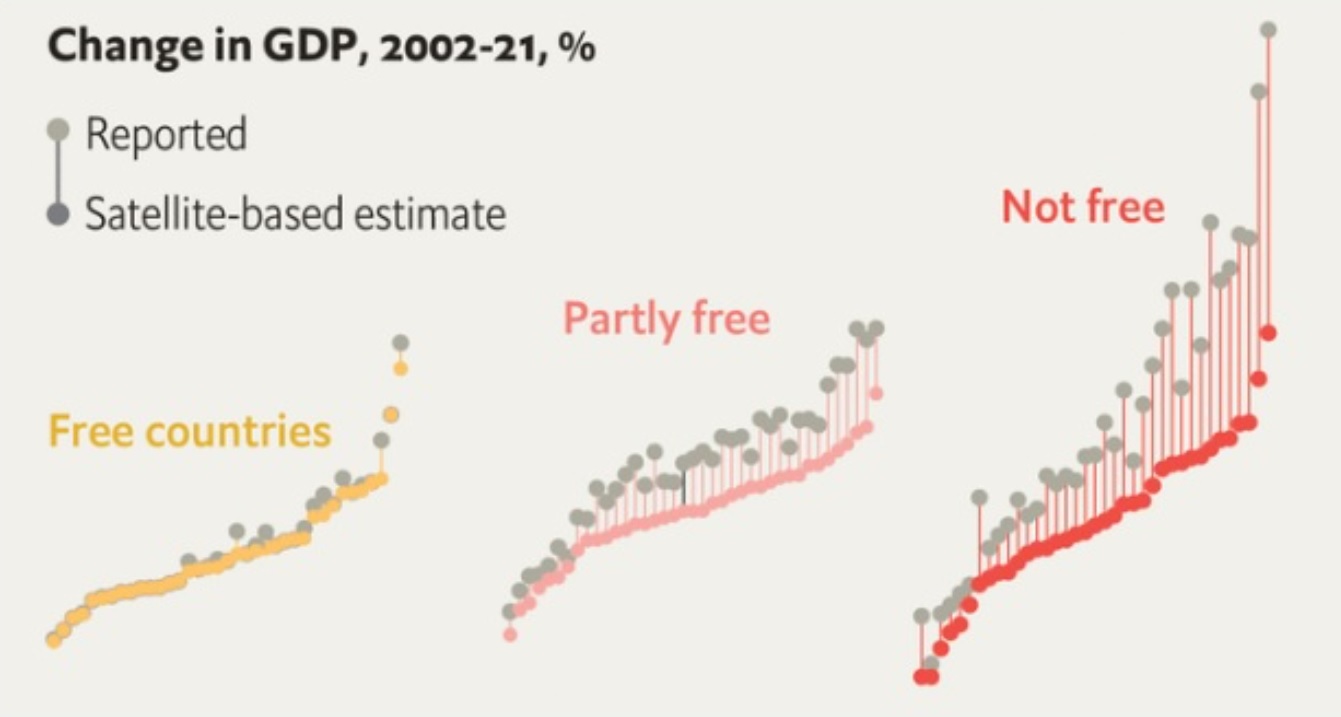

I wrote last October about how satellite-based measures of nighttime light (a proxy for economic vitality) show that nations with less political freedom have a tendency to exaggerate economic performance.

I wrote last October about how satellite-based measures of nighttime light (a proxy for economic vitality) show that nations with less political freedom have a tendency to exaggerate economic performance.

So what happens if we measure the relationship between economic liberty and economic performance using this more-accurate satellite-based data?

Sean P. Alvarez, Vincent Geloso, and Macy Scheck answered that question. Here are some excerpts from their new study.

…the well-documented proclivity of dictators to fudge GDP numbers biases our estimations of the effects of economic freedom on economic development. Since dictatorships are generally also countries with low economic freedom, overstated GDP numbers can fool us into finding more modest effects of economic freedom. To test our argument, we employed newly generated adjustments to GDP numbers

based on artificial nighttime light intensity that corrected for the overstatements that dictators made… Swapping unadjusted and adjusted GDP numbers as dependent variables in similar econometric setups allowed us to estimate how large is the bias. For income levels between 1992 and 2013, we find that the true effect of economic freedom is between 1.1 and 1.33 times larger than estimations based on manipulated GDP numbers. For income growth, we find smaller effect for the economic freedom index as a whole but some signs that some components (size of government and the security of property rights) have underestimated positive effects that should not be neglected.

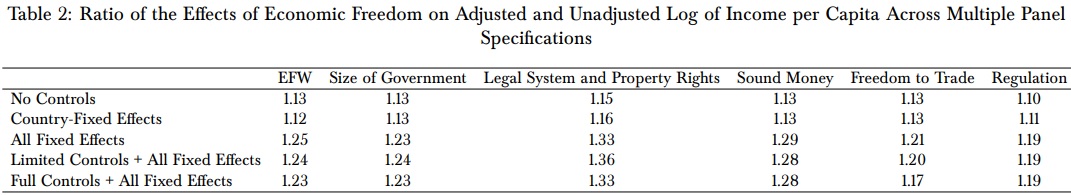

Wonky readers may be interested in the results contained in Table 2 from the study.

And here’s some of the text discussing those results.

…the use of adjusted GDP figures suggests that the effect of economic freedom (i.e., the aggregate index) is roughly 25% larger than estimated with unadjusted GDP figures. For the different components of the index, the use of adjusted GDP figures has an uneven effect. For example, regulation and freedom to trade suggest that the true effects are roughly 20% larger than when using the unadjusted GDP figures. In contrast, the true effects for the component that speaks to the protection of property rights are more than 33% stronger. These are economically significant results that speak to a large bias against finding a pro-development effect of economic freedom.

The bottom line is that economic liberty apparently matters even more than we thought – about 25% more.

So if you want to know why I’ve been so critical of Bush, Obama, Trump, and Biden, that’s part of the answer.

[…] more economic liberty is strongly correlated with more national […]

[…] stated, libertarianism is good because limited government and individual freedom produce widely shared prosperity and societal […]

[…] The lesson from Romania and other nations is that the key to national prosperity is freedom. Especially if freedom is properly measured. […]

[…] obvious lesson (which I’ve discussed on other occasions) is that the post-Soviet nations with more economic liberty have enjoyed the best recoveries from […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

[…] The moral of the story is that jurisdictions that want more prosperity should limit the size and scope of government. […]

[…] The moral of the story is that jurisdictions that want more prosperity should limit the size and scope of government. […]

[…] That means enacting policies that expand the economic pie. […]

[…] word is toxic to some people and instead use terms like “free enterprise” and “economic liberty.” Or maybe I should jsut call it “the […]

[…] Back in early 2009, the Center for Freedom and Prosperity released this video to explain the universal recipe for growth and prosperity. […]

[…] moral of the story is that big government doesn’t work well on the national level, it doesn’t work well on the state level, and it doesn’t work […]

[…] When we look at the degree of economic freedom in various nations, we find evidence that good policies produce good results. […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

[…] ranks very high for economic liberty, and this (predictably) translates into widespread […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

[…] no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as […]

Hi Phil. You ask, does greater prosperity move people toward greater freedom and respect for the individual? I’m not sure. For me, it’s easy to conceptualize how economic freedom leads to prosperity. Freedom means fewer barriers will impede inventors, entrepreneurs, producers, and consumers from working together to pursue innovations and economic value. Also important, people are free to adapt as they see fit to various catastrophes and world events, which are inevitable. Freedom means enough government to provide a stable backdrop with rule of law and property rights (and yes, some safety net!), but not so much govt that it stifles creativity and work. If all this is done right, AND if the culture values work and business success, and these conditions persist for years, then prosperity is quite likely to follow. All this seems logical to me and is generally supported by empirical evidence.

I’m less sure about things going the other way, with prosperity encouraging greater economic freedom. I wouldn’t give a definitive no. Complex webs, feedback effects, and so on. But I would say the “prosperity leads to greater economic freedom” path seems much less likely than the “economic freedom leads to greater prosperity” path.

Hi John,

It will turn out well for China when they realize the full fruits of the Enlightenment! In the meantime, I agree that some degree of economic freedom will yield greater prosperity. Are you open to the idea that it can also work in reverse? I.e. synchronously? Does greater prosperity open imaginations and move people toward greater freedom (and greater respect for the individual)? Just wondering. Thanks for the thoughtful exchange.

Phil,

It’s pretty factual that prosperity is correlated with economic freedom. I’d say yes, economic freedom is the goose that laid the golden egg.

After that, it veers into opinion. My thoughts are that economic freedom doesn’t occur in a vacuum. Things like freedom of the press and judicial rights would generally accompany economic freedom, meaning all the freedoms are somewhat connected. So, yeah, maybe the Enlightenment is the goose that laid all the eggs. But it’s economic freedom that leads to economic prosperity.

I think all the rights and freedoms are connected because they seem to stem from a respect for the individual that was not typical in world history. The individual can self-govern, has a right to own and use property as he she wishes, has a right to not be capriciously abused by the judicial system, has a right to employ his labor however he wishes and reap the fruits of his labor, etc.

More recently, some countries like China have seen this history of economic improvement, and they try to implement the economic freedom without really respecting the individual. We’ll see how that turns out.

Hi John,

The problem I had with your sample is that you picked the 30 least free countries in the world and compared them with the 30 freest countries. That’s a little too easy, don’t you think? I would expect not only better economic freedom in the latter group, but better freedom all around. In fact, I would bet you find better mail service and better fire departments and better schools in the latter group and so on. Let’s face it. The 30 least free countries are despotic regimes about which very little good could be said.

Your greater sample in your most recent post is more persuasive. Your explanations of UAE and Saudi Arabia are solid. But Chile and a few others remain unexplained. I would agree that they could be outliers. But I wish Dan would address the data that doesn’t fit what he’s trying to conclude.

As for “fuzzy” and “baseline,” the following is from Dan’s article: “they’re saying the benefit of economic freedom is 20% larger with the light-adjusted GDP than with the normal as-reported GDP.” OK, but how much is that benefit to begin with? One point eight is 20 percent bigger than one point five, but not exactly eye-opening.

I am all for capitalism, free markets, private property rights and the like. I.e. economic freedom. But I bet that freedom of the press, or judicial rights, would correlate about as much with the wealthy countries as does economic freedom. So is economic freedom the goose that laid the golden egg, or is the Enlightenment the goose that laid all of the above?

Good post. Thanks.

Phil,

‘FUZZY’ BASELINE: Dan’s post is about a study that compared nighttime light measured by satellites to GDP as reported by countries. The authors concluded less-free countries appear to inflate their GDP figures. They adjusted country GDP by some factor for nighttime light, which reduced GDP for some less-free countries. Therefore, the benefit of economic freedom looks larger for light-adjusted GDP than for as-reported GDP. So, when the authors say, “the true effects are roughly 20% larger than when using the unadjusted GDP figures,” they’re saying the benefit of economic freedom is 20% larger with the light-adjusted GDP than with the normal as-reported GDP.

CORRELATION ECON FREEDOM VS GDP: I find it hard to believe that my sample size of SIXTY countries was too small. However, now I’ll show you median GDP per capita for all 176 ranked countries. This is eight groups of 22 countries each:

Group 1: $54,111 (most free)

Group 2: $36,248

Group 3: $16,802

Group 4: $11,072

Group 5: $5,869

Group 6: $6,955

Group 7: $4,493

Group 8: $4,683 (least free)

UAE / SAUDI ARABIA: Sure, economic freedom is always helpful. But economic freedom is NOT “necessary to allow them to benefit from [oil].” An oil rich country could be terrible on property rights, and the government could seize all oil rights. The govt could also be very corrupt, and allow foreign investment only in the oil industry. All of which means other private sector industries would likely be less successful. BUT… if that country has lots of oil and govt extracts it and sells it on the world market, GDP per capita would still be high even if overall economic freedom is weak.

NZ VS SWEDEN: Your point about NZ vs Sweden is valid. I don’t know enough about NZ to know why their GDP per capita isn’t higher than it is. Here’s the only thing that pops into my head. I know someone who saw statistics that NZ had very few electricians per capita, so he moved to NZ to supply his electrician services. Whoops, NZ has few electricians because most people do their own electrical work! The point is electrical work performed by homeowners is not included in GDP. If NZ is unusual in employing lots of self-help instead of hired help, this would hold down GDP. Or maybe the reason is they have freedom but culturally they have preferred to stay agricultural instead of industrializing. I don’t know for sure. Regardless, this two-country comparison doesn’t invalidate the overall correlation between economic freedom and higher incomes.

Hi John,

This will be short because I’m on vacation and because I think the analysis we’ve been given by Dan is way too fuzzy. Just take this sentence as an example: “For example, regulation and freedom to trade suggest that the true effects are roughly 20% larger than when using the unadjusted GDP figures.” Twenty percent larger than what? What’s the baseline?

Anyway, I believe in economic freedom. I’ve said more than once in our previous go-arounds that the right to own property is crucial to economic development (quoting Hernando de Soto, the great Peruvian economist).

I think it’s pointless for both you and Dan to start off with comparisons of dictatorships and non-dictatorships. Or, in your case, the wealthiest countries in the world versus the poorest. You could probably compare mail service in said countries and come to the same conclusion.

I picked the countries I picked to compare because I thought they made for interesting comparisons. (North Korea versus South Korea is not an interesting comparison). I thought Dan’s analysis was way too fuzzy to explain the nations I was looking at. Take Chile as an example. The Wikipedia article on the economic history of Chile has the following to say (after earlier in the article praising its level of economic freedom): “Sound economic policies, maintained consistently since the 1980s, have contributed to steady economic growth in Chile and have more than halved poverty rates.” So I think their discrepancy is a little hard to understand. Furthermore, I don’t see why it should take more than a quarter of a century of rising economic freedom to yield some significant results. They’re up to 20th in economic freedom and only 60th in GDP (PPP) per capita. I would think Dan would have an interest in explaining this.

UAE and Saudi Arabia: oil or no oil, why isn’t economic freedom necessary to allow them to benefit from it? Their are a lot of countries in Africa, for example, with great natural resources. They have not been developed, not because of lack of economic freedom (although that wouldn’t hurt), but because of corrupt dictators.

New Zealand’s economic freedom numbers actually are about as good or maybe even better than Sweden’s over the last 50 years, yet they trail them by quite a bit in wealth. Just saying. 🙂

I think you’ve offered a lot of food for thought. I do find some of your arguments helpful. And you didn’t engage in warm fuzzies as Dan did. Thanks.

P.S. This is short for me. 🙂

Hi Phil. I have some answers for the freedom-vs-income discrepancies you mention. First, I must point out that your examples represent only a small handful (less than 5%) of all the countries ranked. You can usually find oddities in most datasets. If we take a broader view, we can see a very clear connection between economic freedom and GDP per capita. Here’s median GDP per capita for the 30 freest countries and 30 least-free countries:

30 freest: $49,300

30 least-free: $4,700

Looking across 60 countries, incomes in the freest 30 are 10.6 times higher than in the least-free 30. This speaks louder than a few discrepancies.

However, I can offer some explanations for the discrepancies you mention. I don’t know details of every country in the world, and I don’t know all possible reasons, but the explanations below seem plausible to me.

UAE 7 33, Saudi Arabia 27 118

Lots of oil combined with small to smallish populations pushes GDP per capita higher than ‘deserved’ by economic freedom.

U.S. 8 25

Timing is an issue. Historically, the US was one of the freest countries in the world, and this led to high incomes. Economic freedom has dropped since ~2008, but the strong historical base still helps support current incomes. Said differently, it takes time for reduced economic freedom to drag down incomes.

New Zealand 32 4, Estonia 39 7, Latvia 48 18, Chile 60 20

Also timing, but here in the opposite direction of the US. Historically, these countries were not among the freest countries in the world, and this led to low incomes. NZ and Chile didn’t achieve high economic freedom until the mid-1990s, and Estonia and Latvia not until ~2000. The weak historical base helps keep current incomes low. Said differently, it takes time for increased economic freedom to raise incomes to commensurate levels.

It’s easy to compare countries where one is a dictatorship and the other is not. I remember someone once saying that if you want to notice the difference between capitalism and communism, just fly at night over the border between South and North Korea. But that’s picking the low hanging fruit.

How do you explain the following (where either a relatively high prosperity corresponds with a much lower economic freedom ranking – or vice versa)?

Country GDP (PPP) per capita Economic Freedom Ranking

UAE 7 33

U.S. 8 25

FRANCE 25 52

Saudi Arabia 27 118

New Zealand 32 4

Estonia 39 7

Latvia 48 18

Chili 60 20

[…] Courtesy of International Liberty. […]