I’ve put together a collection of political cartoons that show government as a bloated, clumsy, and sometimes malicious person.

This isn’t because of any special animus, but rather because the unintended consequences of government intervention are almost always harmful.

Consider the issue of higher education. Politicians start with the warm and fuzzy notion that it would be good to help more people go to college.  So they create loans and grants to help them pay for tuition.

So they create loans and grants to help them pay for tuition.

Sounds nice and noble, right? And just think of the votes that can be harvested from grateful parents!

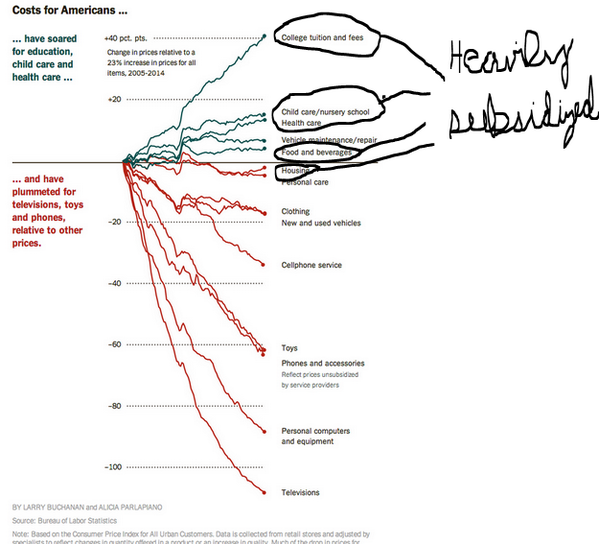

So is this a win-win situation for both politicians and students? Well, let’s look at the real-world results.

As explained in this video, there’s a lot of evidence that these loans and grants are the reason that higher education is now far more expensive (just as there is powerful data showing that subsidies lead to higher costs in other areas as well).

And additional research is confirming this concern. A new study by Professor Grey Gordon of Indiana University and Professor Aaron Hedlund of the University of Missouri finds that government subsidies for higher education wind up benefiting colleges and universities and hurting students.

Here are the key findings.

We develop a quantitative model of higher education to test explanations for the steep rise in college tuition between 1987 and 2010. …We measure how much changes in underlying costs, reforms to the Federal Student Loan Program (FSLP), and changes in the college earnings premium have caused tuition to increase. All these changes combined generate a 106% rise in net tuition between 1987 and 2010, which more than accounts for the 78% increase seen in the data. Changes in the FSLP alone generate a 102% tuition increase.

Robby Soave of Reason reports on the new research.

…skyrocketing college tuition costs are the result of all-too-generous student loan policies. The study, authored by Grey Gordon and Aaron Hedlund, used a computer model to measure the effects of various economic forces on college costs. According to the model, no factor had more to do with rising tuition prices than loan subsidies. “Looking at individual factors, we find that expansions in borrowing limits drive 40% of the tuition jump and represent the single most important factor,” wrote the study’s authors. In fact, the “Bennett hypothesis”—the idea, first proposed by President Ronald Reagan’s Education Secretary William Bennett, that increasing student aid encourages colleges to jack up prices—fully explains all the tuition increases between 1987 and 2010, according to the study. …A recent study by the New York Federal Reserve reached a similar, albeit less dramatic, conclusion regarding the link between loans and tuition.

Regarding the study from the N.Y. Fed, here’s Robby’s report on that research.

The bottom line is that politicians want us to believe that subsidies are needed because college is getting more expensive.  But what’s really happening is that college is getting more costly because of the subsidies!

But what’s really happening is that college is getting more costly because of the subsidies!

Now let’s move to a separate question. We know that colleges and universities are getting a big windfall as a result of students loans and other subsidies. So how are they spending the money?

Not very well, according to researchers.

And that’s probably because much of this money is mostly being wasted on more bureaucracy. Here’s a chart showing trends in recent years.

Even more depressing, the research also shows that all this spending doesn’t improve human capital, so there’s a negative impact on overall economic performance.

P.S. Politicians who complain about “cuts” in spending for higher education are either dishonest or ignorant.

P.P.S. Speaking of which, Hillary Clinton’s plan for higher education is a recipe to enable even higher costs for colleges and universities.

P.P.P.S. Some folks hope that there’s a soon-to-pop bubble in higher education, which means that tuition will soon become more affordable. But I’m worried that higher education is more like health care rather than housing, which means that prices will climb even higher over time.

[…] (Supposedly) pro-student policies that hurt students. […]

[…] But the long-run problem with student loans is that colleges and universities have responded by increasing tuition and then using the extra loot to subsidize bureaucratic bloat. […]

[…] But the long-run problem with student loans is that colleges and universities have responded by increasing tuition and then using the extra loot to subsidize bureaucratic bloat. […]

[…] I then added some of my analysis to show that government subsidies – such as student loans – were the underlying problem. […]

[…] loans take money from taxpayers and gives the funds to other people (the real beneficiaries are college administrators rather than students, but that a topic for another […]

[…] whether focused on the specific problemof the bailout or the broader issue of how student loans enable colleges to increase tuition (the third-party payer […]

[…] whether focused on the specific problem of the bailout or the broader issue of how student loans enable colleges to increase tuition (the third-party payer […]

[…] to much higher tuition and fees, the higher-education sector became more bloated, with much more bureaucracy and much lighter […]

[…] In addition to much higher tuition and fees, the higher-education sector became more bloated, with much more bureaucracy and much lighter […]

[…] and universities predictably responded by increasing tuition so they could grab this additional […]

[…] and universities predictably responded by increasing tuition so they could grab this additional […]

[…] points to drive home the point that higher education is absurdly over-pricedtoday precisely because of government intervention to supposedly make it more […]

[…] of exclamation points to drive home the point that higher education is absurdly over-priced today precisely because of government intervention to supposedly make it more […]

[…] previously pointed out that grants and loans are bad policy because they lead to higher tuition and fees, as well as […]

[…] be more explicit, tuition expenses have skyrocketed becausecolleges and universities have raised prices to capture all the extra loot politicians are dumping […]

[…] be more explicit, tuition expenses have skyrocketed because colleges and universities have raised prices to capture all the extra loot politicians are dumping […]

[…] They also favor big subsidies for higher education, which mostly benefit kids from well-to-do families (and well-paid college bureaucrats). […]

[…] They also favor big subsidies for higher education, which mostly benefit kids from well-to-do families (and well-paid college bureaucrats). […]

[…] They also favor big subsidies for higher education, which mostly benefit kids from well-to-do families (and well-paid college bureaucrats). […]

[…] a chart I shared a few years ago. I’m sure the problem is even worse […]

[…] Now let’s focus on the problem of ever-expanding bureaucracy. […]

[…] Now let’s focus on the problem of ever-expanding bureaucracy. […]

[…] economy that is subsidized. This is why health care keeps getting more expensive. It’s why higher education keeps getting more […]

[…] good news is that the no-subsidy approach also would reduce tuition costs since there no longer would be a third-party-payer […]

[…] Higher education. […]

[…] But even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is an especially shocking example. […]

[…] But even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is an especially shocking example. […]

[…] problems at the collegiate level are third-party payer and the inevitable negative effects of bureaucratic bloat and […]

[…] problems at the collegiate level are third-party payer and the inevitable negative effects of bureaucratic bloat and […]

[…] When income is shielded from taxation, either based on how it is earned or how it is spent, that creates an incentive for taxpayers to make economically irrational decisions solely to benefit from the special tax preference. And just as the healthcare exclusion has led to ever-higher prices and ever-greater levels of bureaucracy and inefficiency in the health sector, a deduction for childcare expenses will have similar effects in that sector of the economy. Providers will boost prices to capture much of the benefit (much as colleges have jacked up tuition to capture the value of government-provided loans and grants). […]

[…] they build bureaucratic empires with ever-larger numbers of administrators while money devoted to the classroom […]

[…] they build bureaucratic empires with ever-larger numbers of administrators while money devoted to the classroom […]

[…] they build bureaucratic empires with ever-larger numbers of administrators while money devoted to the classroom […]

[…] they build bureaucratic empires with ever-larger numbers of administrators while money devoted to the classroom […]

[…] they build bureaucratic empires with ever-larger numbers of administrators while money devoted to the classroom […]

[…] In other words, artificially low interest rates are distorting economic decisions by making something (debt) seem cheaper than it really is. Sort of financial market version of the government-caused third-party payer problem in health care and higher education. […]

[…] a big chunk of the additional money that’s been funneled to colleges and universities has been used for bureaucratic empire building rather than classroom […]

After studying the student debt issue for two years and approaching a nervous breakdown and severe disorientation, I have concluded that no one understand the matter really – but that College loans are the worst kind of public policy tool ever invented, which takes failures of public high schools and pushes them upstream to the University to be funded by the taxpayer

15% of applicants are seeking grad school funds and are using 30% of the Federal funds dispensed, (How many more blinking MAs in Sociology or “studies” do we need?). One third of 2014 graduates are not working in their major and 1/3 are not working. Stem and Business grads have the highest positive tuition ROE.

Read Hesse’s Magister Ludi, or the glass bead game, it is analogized perfectly

[…] This is a guest post by Dan Mitchell […]

The money went where it was intended to go. The student was never intended to be the beneficiary.