I despise the death tax. It should be abolished.

My main objection is that it is immoral. If a person earns money, pays tax on the money, and then responsibly saves and invests the money (which generally requires paying another layer of tax),  it is reprehensible that politicians want to tax the money yet again simply because the person dies.

it is reprehensible that politicians want to tax the money yet again simply because the person dies.

But I’m also an economist, so I don’t like the tax because it is the most pernicious form of double taxation. The levy not only drains capital from the private sector, it also discourages the building and creating of wealth in the first place, while also lining the pockets of accountants and tax lawyers.

None of that is good for those of us who will never have enough money to get hit by the tax.

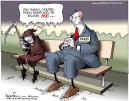

The only silver lining to this dark cloud is that we get very interesting stories of what people are willing to do to escape this unfair and destructive levy.

Jeanne Calment’s apparent longevity turned her into a global celebrity before she died at the age of 122 years and 164 days in 1997. However, that age is being challenged… Yuri Deigin, a genealogist,

claims that Mrs Calment actually died in 1934 and that her daughter, Yvonne, usurped her identity… The genealogist said that Mrs Calment, born in 1875, and Fernand, her husband, were the joint owners of a department store in Arles, in Provence. If Mrs Calment’s death had been registered, Mr Calment would have had to pay inheritance tax of up to 38 per cent on his wife’s half of the business. …Mr Deigin said that Mr Calment avoided the bill by telling officials that it was his daughter who had died. The daughter then passed herself off as her mother for the rest of her life.

Not everyone accepts Mr. Deigin’s analysis and it’s possible that will be genetic testing of Mrs. Calment’s remains.

For what it’s worth, I’m guessing the story is accurate. We already have lots of evidence that people will take extraordinary steps to protect family funds from this additional layer of tax.

- Straight men will marry each other.

- Gay men will adopt their lovers.

- People will live longer to escape the tax.

- People will die earlier to escape the tax.

Sadly, I don’t have to worry about the death tax. But if I did, I would do everything in my power to make sure my kids got my money rather than the despicable people in Washington.

So I admire Mrs. Calment. Yes, she broke the law, but that doesn’t bother me when the law is unjust.

P.S. I’ll defend just about anybody who benefits from dodging the death tax, even if they are hypocrites or buffoons.

P.P.S. Sadly, the U.S. death tax is more punitive than the French death tax.

[…] the greatest-ever act of tax avoidance, or the most licentious, but what he did probably ranks in the top […]

[…] Pretending you are your mother. […]

[…] In France, people changed who they were because of the death […]

[…] If you want other odd examples of international taxation, click here, here, here, here, here, here, here, and […]

[…] belong with the other “great moments in tax avoidance” that I have cited (see here, here, and […]

[…] Here’s a story about the greatest-ever tactic for escaping […]

[…] most-read column from 2019 discussed a very impressive (and very understandable) example of tax avoidance from […]

[…] politicians. Until that happens, I recommend they copy the clever tax-avoidance tactics of their French, Spanish, Irish, and Austrian […]

[…] just horrible! It is a moral abomination. I would avoid that tax however possible. So if Calment did that, good […]

We’d be far better off with Estate Taxes only. Investment would then be based on the best return not the best after tax return which politicians use to favour their own constituents and donors.

Never going to happen though.

Perhaps the greatest act of tax avoidance ever was Steinbrenner, who left the New York Yankees to his son by dying in that one year in which the estate tax rate was 0%.

Near the end, you suggest that violating laws that are unjust is okay. I disagree. We do not get to violate laws that we do not like — that way lies anarchy, which leads to tyranny.

Dan, long ago you called me a “Paul Wellstone wannabe” because of my arguments concerning tax avoidance planning involving international inversions by corporations. Be that as it may, I agree with your opposition to the U.S. estate and gift tax. It is inefficient, difficult to comply with, and expensive to enforce.

The purpose of the federal tax system is to raise revenues for government operations. Tax policy should be about raising revenues, not social engineering. The federal tax system needs to be streamlined and simplified. Repealing the estate and gift tax would be a good first step. Repealing the corporate income tax would be another good step.

I am second to none in my support of President Trump, but additional taxes to pay off the debt never works in Washington.

Any additional money Congress gets, they borrow off of and spend three times as much. We have a spending problem, not a tax revenue problem.

I hated George Steinbrenner (OK, granted, I never knew him, and thus I could not have hated HIM, but I hate the Yankees and he owned them and turned them into a superpower, so….) but I felt great admiration for his ability to hang on until 2010, when the death tax took a holiday, and his entire estate passed to his kids tax-free. Finally, the man did something right in my book.

Death tax is how the shiny-faced vulture known as Warren Buffet makes part of his vast fortune, along with refusing to pax owed taxes while cheerleading tax increases on us. He swoops in and buys family-owned businesses for pennies on the dollar to keep the inheritors from losing the business to gov’t death taxes.

!!!!!!!!!! Imagine the feeding frenzy! — “He’s only 32, and in great health, but his company’s IPO was spectacular. Let’s declare him DEAD RIGHT NOW …”

I see that in the UK , Professor of Practice Richard J Murphy (@MurphyCandidTax ) is mulling over an advance death tax. The downside to inheritance tax as it’s called there is the long wait to collect it, and the proposal is to give the Revenue Authorities the power to declare a person dead at what they deem to be the revenue maximising point in their lives, and collect the tax due at that point.

The mechanism for the declaration point isn’t clear, thank goodness – when Power of Attorney passes to the children, or spikes in the value of shares or housing might trigger it.

Dear Dan … You are a young fellow. Your heirs may very well be hit by the death tax. Some of the state death taxes already affect average folks. And is there much reason to believe the feds won’t impose death taxes on all estates? Or quite modest estates? An inheritance is a privilege, after all … and many Americans are quite intent on abolishing all privilege.

Happy New Year!

Reblogged this on Truth Is Power.

[…] Source: The Greatest-Ever Act of Tax Avoidance? | International Liberty […]

President Trump so despised the estate tax (please don’t call it a death tax) that he recommended a temporary tax on net wealth that was high enough to pay off the national debt in two years. The wealth tax (of 14%) and the estate tax would end after the national debt was paid. See Trump’s book, “The America We Deserve”. Trump is an expert on debt and his suggestion was no joke.