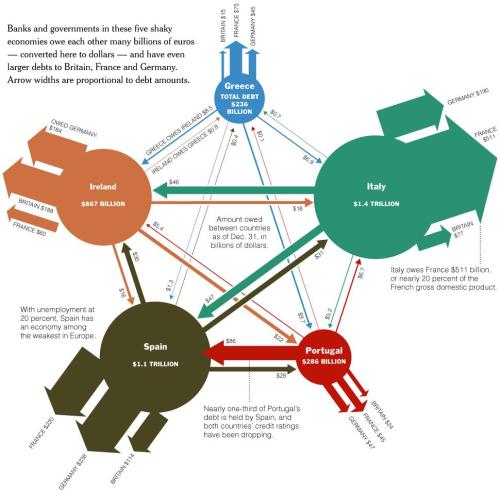

Here’s a great chart put together by the New York Times. It shows the degree to which government debt issued by profligate nations such as Greece and Spain is owned by banks in Germany, France, and the United Kingdom. It is quite reasonable to describe what happened as an indirect bailout of domestic banks dressed up as a bailout of the Mediterranean nations.

The Real Reason for the European Bailout

May 14, 2010 by Dan Mitchell

Posted in Bailout, Big Government, Greece, Uncategorized | Tagged Bailouts, Big Government, Greece | 34 Comments

34 Responses

Leave a comment

This site uses Akismet to reduce spam. Learn how your comment data is processed.

-

Join 4,848 other subscribers

-

Recent Posts

Pages

- 100 Tragic Years of Communism

- Bureaucrat Hall of Fame

- Bureaucrat Humor (pending)

- Collectivism Humor

- Five Things About Me

- Government in Cartoons and Images

- Gun Control Satire

- Honest Leftists

- Libertarian Humor

- Libertarian Quandaries

- Mocking Europeans

- Moocher Hall of Fame

- Poverty Hucksters

- Sex and Government

- Victims of Government

Visitors (beginning December 23, 2010)

- Big Government Bureaucracy Bureaucrats Class warfare Competitiveness Constitution Corporate income tax Corporate tax Corruption Crime Cronyism Debt Deficit Dependency Donald Trump Economics Education England Entitlements Europe Fiscal Crisis Fiscal Policy Flat Tax Free Markets Government-run healthcare Government intervention Government Spending Government stupidity Government Thuggery Government waste Gun control Health Care Health Reform Higher Taxes Humor International bureaucracy IRS Jobs Joe Biden Keynesian Economics Laffer Curve Libertarianism Liberty Local government News Appearance Obama Obamacare OECD Political Humor Politics Poverty Protectionism Redistribution Regulation Republicans School Choice Socialism Social Security States Statism stimulus Supply-side economics Taxation Tax Competition Tax Haven Tax Increase Tax Increases Tax Reform Trade Unemployment United Kingdom Value-Added Tax VAT Welfare Welfare State

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

Recent Comments

Categories

- 2nd Amendment

- Academic Bias

- African-Americans

- Al Gore

- Alarmism

- Antitrust

- Argentina

- Arizona

- Asset Forfeiture

- Atlas Shrugged

- Australia

- Austrian Economics

- Ayn Rand

- Bailout

- Balanced Budget

- Barney Frank

- Baseball

- Basic Income

- Belgium

- Bernanke

- Bernie Sanders

- Big business

- Big Government

- Bob Dole Award

- Boondoggle

- Boris Johnson

- Botswana

- Brain drain

- Brazil

- Brexit

- Bulldogs

- Bureaucracy

- Bureaucrats

- Bush

- Buttigieg

- California

- Canada

- Capital Gains Tax

- Carbon Tax

- cash for clunkers

- Cato Institute

- Cayman Islands

- CBO

- Center for Freedom and Prosperity

- Central planning

- Centralization

- Charity

- Chile

- China

- Chris Christie

- Civil Disobedience

- Class warfare

- Climate change

- Clinton

- Cold War

- Collectivism

- Colorado

- Communism

- Competitiveness

- Congress

- Congressional Budget Office

- Connecticut

- Constitution

- Convergence

- Coolidge

- Corbyn

- Corporate income tax

- Corporate tax

- Corruption

- Cost-Benefit Analysis

- Creative Destruction

- Crime

- Cronyism

- Cuba

- Dan Hannan

- David Cameron

- Dawgs

- Death Tax

- Debt

- Deferral

- Deficit

- Delaware

- Democrats

- Demographics

- Denmark

- Dependency

- Deposit Insurance

- Discrimination

- Donald Trump

- Double Taxation

- Drug War

- Earmarks

- Easy money

- Economic Rankings

- Economics

- Education

- EITC

- Election

- Elitism

- Elizabeth Warren

- Eminent Domain

- England

- Entitlements

- Environmentalism

- Equality

- Estonia

- Euro

- Europe

- European Commission

- European Union

- Executive pay

- Fair Tax

- Fannie Mae

- Fascism

- Fatal conceit

- FATCA

- Federal Reserve

- Federalism

- Financial Crisis

- Financial Privacy

- Finland

- Fiscal Crisis

- Fiscal Policy

- Flat Tax

- Florida

- Food and Drug Administration

- food nazi

- Food Stamps

- Foreign Aid

- Foreign Policy

- France

- Freddie Mac

- Free Markets

- Free Speech

- Free State Project

- Freedom

- Gas Tax

- Geithner

- General Motors

- Georgia

- Germany

- Gingrich

- Global Taxation

- Global warming

- Gold Standard

- Gordon Brown

- Government Inefficiency

- Government intervention

- Government Spending

- Government stupidity

- Government Thuggery

- Great Depression

- Greece

- Green New Deal

- Gross domestic product

- Gun control

- Harmonization

- Hayek

- Health Care

- Health Reform

- Higher Taxes

- Hillary Clinton

- Homeschooling

- Hong Kong

- Hoover

- Housing

- HUD

- Human Rights

- Humor

- Hungary

- Hypocrisy

- Iceland

- Illinois

- Immigration

- Income tax

- India

- Industrial Policy

- Inequality

- Inflation

- Infrastructure

- International bureaucracy

- International Criminal Court

- International Monetary Fund

- International Taxation

- Iowa

- Iran

- Ireland

- IRS

- Israel

- Italy

- Janet Yellen

- Japan

- Javier Milei

- JCT

- Jimmy Carter

- Jobs

- Joe Biden

- John Stossel

- Joint Committee on Taxation

- Joker

- Jurisdictional Competition

- Jury Nullification

- Justin Trudeau

- Kamala Harris

- Kelo

- Keynes

- Keynesian

- KPMG

- Laffer Curve

- Lakers

- Leviathan

- Libertarianism

- Liberty

- Licensing

- Liechtenstein

- Liz Truss

- Lobbying

- Local government

- Los Angeles

- Macron

- Mandate

- Margaret Thatcher

- Marginal Tax Rate

- Massachusetts

- Media Bias

- Medicaid

- Medicare

- Mexico

- Michael Bloomberg

- Michigan

- Migration

- Minimum Wage

- Minnesota

- Mitchell's Golden Rule

- Mitchell's Law

- Mitchell's Theorem

- Mobility

- Monaco

- Monetary Policy

- Money Laundering

- Moral Hazard

- nanny state

- National Education Association

- National Sales Tax

- Netherlands

- New Hampshire

- New Jersey

- New York

- New Zealand

- News Appearance

- Nixon

- North Carolina

- North Korea

- Norway

- Obama

- Ocasio-Cortez

- OECD

- Organization for Economic Cooperation and Development

- Panama

- PATRIOT Act

- Patriotism

- Patriots

- Paul Krugman

- Paul Ryan

- Paulson

- Payroll Taxation

- Pelosi

- Pets

- Philippines

- Podcast

- Poland

- Political Correctness

- Political Humor

- Politicians

- Politics

- Polling Data

- Pope Francis

- Portugal

- Postal Service

- Poverty

- Price Controls

- Privacy

- Privatization

- Productivity

- Prohibition

- Property Rights

- Property Tax

- Prostitution

- Protectionism

- Public Choice

- Public Goods

- Public Opinion

- Race

- Rahn Curve

- Rand

- Rand Paul

- Rankings

- Reagan

- Recession

- Redistribution

- Regulation

- Rent Control

- Republicans

- Rishi Sunak

- Roads

- Roman Polanski

- Romney

- Roosevelt

- Rule of Law

- Russia

- Sales Tax

- Savings

- School Choice

- Scotland

- Singapore

- Sleaze

- Slovakia

- Snow

- Soccer

- Social Capital

- Social Security

- Social Security Privatization

- Socialism

- Societal Capital

- Softball

- South Africa

- South Korea

- Sovereignty

- Spain

- Spending

- Spending Cap

- States

- Statism

- stimulus

- Subsidies

- Supercommittee

- Supply-side economics

- Supreme Court

- Swedem

- Sweden

- Switzerland

- TABOR

- Taiwan

- TARP

- Tax avoidance

- Tax Competition

- Tax Compliance

- Tax evasion

- Tax Harmonization

- Tax Haven

- Tax Increase

- Tax Loophole

- Tax Reform

- Taxation

- Taxpayer Ripoff

- Tea Party

- Territorial Taxation

- Terrorism

- Texas

- Thanksgiving

- Theresa May

- Third party payer

- Thomas Sowell

- Tobacco

- Tobin Tax

- Toilet Paper

- Trade

- Transportation

- TSA

- Ukraine

- Uncategorized

- Underground Economy

- Unemployment

- Union Bosses

- United Kingdom

- United Nations

- United States

- Value-Added Tax

- Vaping

- VAT

- Venezuela

- Video

- Virginia

- Vouchers

- Wages

- Wagner's Law

- Walter Williams

- Warren Harding

- Waste

- Wealth Tax

- Weekly Economics Lesson

- Welfare

- Welfare State

- World Bank

- World Health Organization

- World Trade Organization

- Worldwide Taxation

- Yankees

- Zimbabwe

- Zoning

[…] to make payments on its debt). Interest rates would spike, financial markets would get shaky, banks would be a risk, and there would be a lot of pressure for a Greek-style […]

[…] fiscal ha empeorado mucho, en gran parte gracias al FMI y los diversos rescates (que en realidad fueron diseñados para rescatar a los bancos irresponsables en países como Francia y […]

[…] fiscal policy has become much worse, thanks in large part to the IMF and various bailouts (which actually were designed to bail out irresponsible banks in nations such as France and […]

[…] all intents and purposes, the Greek bailout was a bank bailout. And the same would be true for an Italian […]

[…] welfare state. And the “troika” made a bad situation worse with bailout funds (mostly to protect big banks that unwisely lent money to Greek politicians, but that’s a separate […]

[…] state. And the “troika” made a bad situation worse with bailout funds (mostly to protect big banks that unwisely lent money to Greek politicians, but that’s a separate […]

[…] Does globalism mean agreeing with the IMF’s support for bailouts and higher taxes, policies which arguably are only for the benefit of politically connected big banks? […]

[…] a fiscal crisis by enabling more bad policy, while also rewarding spendthrift politicians and reckless lenders (as I predicted when Greece’s finances first began to […]

[…] and also explaining that politicians like Merkel only got involved because they wanted to bail out their domestic banks that foolishly lent lots of money to the Greek […]

[…] politicians and bureaucrats, driven by an ideological belief in centralization (and a desire to bail out their big banks), instead decided to undermine the euro by creating a bigger mess in Greece and sending a very bad […]

[…] worse, her motives have always been suspect because of fears that she’s mostly concerned about protecting German banks that foolishly lent a lot of money to profligate […]

[…] bailout. That approach has several undesirable implications. It will a) exacerbate moral hazard by rewarding the investors who bought Italian bonds, b) it will enable Italian politicians to incur more debt, and c) it will enable the Italian people […]

[…] that senior bureaucrats routinely make the mistake of bailing out profligate governments (often as a back-door way of bailing out banks that foolishly lent to those governments), and they compound that mistake by then insisting on big […]

[…] and its main role now is to bail out insolvent nations (what that really means, of course, is that it exists to bail out big banks that foolishly lend money to profligate third-world […]

[…] her motives have always been suspect because of fears that she’s mostly concerned about protecting German banks that foolishly lent a lot of money to profligate […]

[…] applies to the Greek fiscal fight. Simply stated, there are lots of people and institutions that own Greek government bonds and they are afraid that their investments will lose value if Greece decides to fully or partially […]

[…] money after bad with another bailout. Well, if you’re a politician from Germany or France and your big banks (i.e., some of your major campaign contributors) foolishly bought lots of government …, the answer might be yes. After all, screwing taxpayers to benefit insiders is a longstanding […]

[…] on their editorial pages, this powerful expose of IRS abuse by a business columnist, and this great graphic on the connection between big banks and government bailouts in Europe. Rate this:Share […]

[…] If you have any French government bonds, sell them now. If you don’t believe me, look at this graphic from the New York Times. GA_googleAddAttr("AdOpt", "1"); GA_googleAddAttr("Origin", "other"); […]

[…] But when you strip away the hysterical rhetoric, what they’re really saying is that bailouts are needed for the banks in their own nations that foolishly lent too much money to reckles…. […]

[…] that politicians from rich nations are trying to indirectly protect their banks, which – as shown in this chart – are in financial trouble because they foolishly thought lending money to reckless welfare […]

[…] is that politicians from rich nations are trying to indirectly protect their banks, which – as shown in this chart – are in financial trouble because they foolishly thought lending money to reckless welfare […]

[…] that politicians from rich nations are trying to indirectly protect their banks, which – as shown in this chart – are in financial trouble because they foolishly thought lending money to reckless welfare […]

[…] money after bad with another bailout? Well, if you’re a politician from Germany or France and your big banks (i.e., some of your major campaign contributors) foolishly bought lots of government …, the answer might be yes. After all, screwing taxpayers to benefit insiders is a longstanding […]

[…] money after bad with another bailout. Well, if you’re a politician from Germany or France and your big banks (i.e., some of your major campaign contributors) foolishly bought lots of government …, the answer might be yes. After all, screwing taxpayers to benefit insiders is a longstanding […]

[…] money after bad with another bailout. Well, if you’re a politician from Germany or France and your big banks (i.e., some of your major campaign contributors) foolishly bought lots of government …, the answer might be yes. After all, screwing taxpayers to benefit insiders is a longstanding […]

[…] of the big nations, which means that they are indirectly attentive to interest groups (such as big banks) that have political power in those big […]

[…] The Real Reason for the European Bailout It is quite reasonable to describe what happened as an indirect bailout of domestic banks dressed up as a bailout of the Mediterranean nations. […]

[…] Some people have asked me why German politicians are so willing to bail out Greek politicians. This picture explains everything. The bailout is really a backdoor giveaway to the big European banks that foolishly lent money to […]

[…] Some people have asked me why German politicians are so willing to bail out Greek politicians. This picture explains everything. The bailout is really a backdoor giveaway to the big European banks that foolishly lent money to […]

[…] Some people have asked me why German politicians are so willing to bail out Greek politicians. This picture explains everything. The bailout is really a backdoor giveaway to the big European banks that foolishly lent money to […]

[…] The bailout happened in part because politicians and international bureaucrats (when they’re not getting arrested for molesting hotel maids) have a compulsion to squander other people’s money. But it also should be noted that the Greek bailout was a way of indirectly bailing out the big European banks that recklessly lent money to a profligate government (as explained here). […]

[…] The bailout happened in part because politicians and international bureaucrats (when they’re not busy molesting hotel maids) have a compulsion to squander other people’s money. But it also should be noted that the Greek bailout was a way of indirectly bailing out the big European banks that recklessly lent money to a profligate government (as explained here). […]

[…] rich to exploit the poor. This accusation actually is true, but not in the way Mr. da Silva means. This post, using a chart put together by the New York Times, shows that the bailouts are mostly for the purpose of bailing out the big European banks that […]