People sometimes think I’m strange for being so focused on the economic harm that results from third-party payer. But bear with me and we’ll see why it’s a very important issue.

If you’re not already familiar with the term, third-party payer exists when someone other than the consumer is paying for something. And it’s a problem because people aren’t careful shoppers when they have (proverbially) someone else’s credit card.

Moreover, sellers have ample incentive to jack up prices, waste resources on featherbedding, and engage in inefficient practices when they know consumers are insensitive to price.

I’ve specifically addressed the problem of third-party payer in both the health-care sector and the higher education market.

But I’ve wondered whether my analysis was compelling. Is the damage of third-party payer sufficiently obvious when you see a chart showing that prices for cosmetic surgery, which generally is paid for directly by consumers, rise slower than the CPI, while other health care expenses, which generally are financed by government or insurance companies, rise faster than inflation?

Or is it clear that third-party payer leads to bad results when you watch a video exposing how subsidies for higher education simply make it possible for colleges and universities to increase tuition and fees at a very rapid clip?

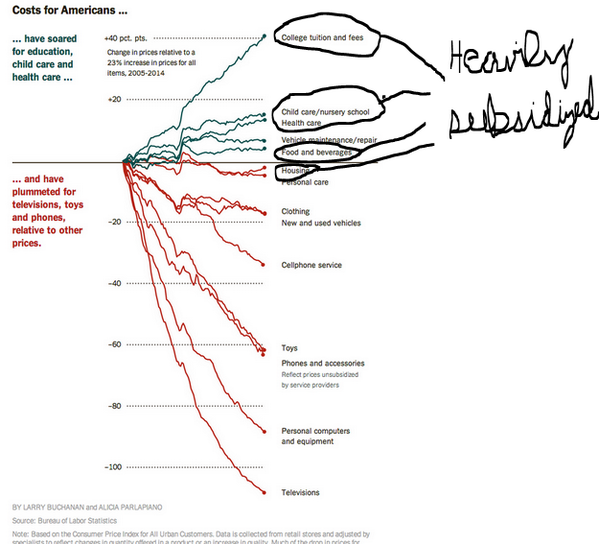

That should be plenty of evidence, but I ran across a chart that may be even more convincing. It shows how prices have increased in various sectors over the past decade.

So what make this chart compelling and important?

Time for some background. The reason I saw the chart is because David Freddoso of the Washington Examiner shared it on his Twitter feed.

I don’t know if he added the commentary below, or simply passed it along, but I’m very grateful because it’s an excellent opportunity to show that sectors of our economy that are subsidized (mostly by third-party payer) are the ones plagued by rising prices.

It’s amazing to see that TVs, phones, and PCs have dropped dramatically in price at the same time that they’ve become far more advanced.

Yet higher education and health care, both of which are plagued by third-party payer, have become more expensive.

So think about your family budget and think about the quality of PCs, TVs, and phones you had 10 years ago, and the prices you paid, compared with today. You presumably are happy with the results.

Now think about what you’re getting from health care and higher education, particularly compared to the costs.

That’s the high price of third-party payer.

P.S. This video from Reason TV is a great illustration of how market-based prices make the health care sector far more rational.

[…] key insight is that consumers have little incentive to be smart shoppers when they perceive that other people […]

[…] Yesterday’s column explained that Biden’s proposals to expand the welfare state were bad news, in part because government subsidies often lead to inefficiency and higher prices. […]

[…] Yesterday’s column explained that Biden’s proposals to expand the welfare state were bad news, in part because government subsidies often lead to inefficiency and higher prices. […]

[…] Yesterday’s column explained that Biden’s proposals to expand the welfare state were bad news, in part because government subsidies often lead to inefficiency and higher prices. […]

[…] Yesterday’s column explained that Biden’s proposals to expand the welfare state were bad news, in part because government subsidies often lead to inefficiency and higher prices. […]

[…] You may recognize the chart. As I pointed out last year, it shows that prices rise rapidly in areas where government subsidies distort the market. […]

[…] You may recognize the chart. As I pointed out last year, it shows that prices rise rapidly in areas where government subsidies distort the market. […]

[…] especially with regards to the final sentence. Student loans and other subsidies are the reason colleges and universities can get away with […]

[…] especially with regards to the final sentence. Student loans and other subsidies are the reason colleges and universities can get away with […]

[…] for selected goods and services over the past 21 years, and the inescapable conclusion (as I noted when writing about the 2014 version of his chart) is that we get higher relative prices in sectors where there’s the […]

[…] for selected goods and services over the past 21 years, and the inescapable conclusion (as I noted when writing about the 2014 version of his chart) is that we get higher relative prices in sectors where there’s the […]

[…] for selected goods and services over the past 21 years, and the inescapable conclusion (as I noted when writing about the 2014 version of his chart) is that we get higher relative prices in sectors where there’s […]

[…] I’ll close with the observation that the state and local tax deduction created the fiscal version of a third-party payer problem. It reduced the perceived cost of state and local government, which made it easier for politicians to increase taxes (much as government subsidies for healthcare and higher education have made it easier for hospitals and colleges to increase prices). […]

[…] both cases, providers have responded to government intervention with higher prices and massive […]

[…] both cases, providers have responded to government intervention with higher prices and massive […]

[…] that means buyers are not sensitive to price. Which means sellers have little incentive to be efficient and keep prices under […]

[…] bad news is that federal subsidies are making that system increasingly expensive and […]

[…] also shared data on how third-party payer causes higher prices in every sector where it exists and also pointed out that we see falling prices in the few parts of the healthcare sector where […]

[…] even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is […]

Normally, Dan is spot on, but in this case he is not going deep enough. Notice that the top “Subsidized” categories all require human capital, whereas the lower categories benefit from refinements in technology. Many universities are now deploying technology to teach certain subjects online, but the experience is not the same as being on-site. My own University made a conscious decision to avoid online courses because they believe strongly that being on campus is critical for the student.

Healthcare can be improved dramatically, but it is not the same as Televisions because the consumer shares the purchase decision with insurance and / or government. The ideal is for the consumer to be the sole purchaser of Healthcare, but we know that is not feasible because it is usually not purchased by choice, but rather than by need. A buyer can wait to purchase a Television, but not for Healthcare.

[…] stated, government subsidies are a recipe for higher costs and inefficiency, regardless of the product or […]

[…] chart last year and warned that the numbers might be exaggerated. But there’s no question about the trend of more bureaucracy, red tape, and […]

[…] last year and warned that the numbers might be exaggerated. But there’s no question about the trend of more bureaucracy, red tape, and […]

[…] as mentioned above, is exactly what’s happened in other sectors that have received […]

[…] insurance coverage means third-party payer, which means birth control will become more expensive (albeit financed by premiums rather than out of […]

[…] policy is sure to increase costs and lead to inefficiency, just as similar types of intervention have caused problems in both healthcare and higher […]

[…] policy is sure to increase costs and lead to inefficiency, just as similar types of intervention have caused problems in both healthcare and higher […]

[…] even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is […]

[…] even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is […]

[…] even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is […]

[…] even if the data is overstated, I’m sure the numbers are still bad. We see the same thing in other areas of our economy where government-instigated third-party payer enables waste and featherbedding. Higher education is […]

[…] a period of time, 2005-2014, I believe. (I saw it on Twitter, but chased down a nice analysis here.) Some sectors, in green, have costs shooting off the top of the graphic like the one for […]

[…] a sector of the economy gets more expensive and inefficient once government gets […]

[…] a sector of the economy gets more expensive and inefficient once government gets […]

[…] a sector of the economy gets more expensive and inefficient once government gets […]

[…] students almost surely will suffer as well when you consider the indirect effectsof this […]

[…] students almost surely will suffer as well when you consider the indirect effects of this […]

[…] we don’t have details on how the various handouts will work, the net effect surely will be to exacerbate a third-party payer problem that already is leading to childcare costs rising faster than the overall inflation […]

Scott: “insurance” is a contract for payment by the insurer of covered costs or other compensation. A fortuity is required. Such a contract without a fortuity trigger is not insurance at all and is thus misnamed. In any case, the “insurer” is a third party, so Dan’s point holds.

[…] I made the crack about a reverse Midas touch whenever there is government intervention. […]

[…] That’s what I basically was trying to say in the interview when I made the crack about a reverse Midas touch whenever there is government intervention. […]

[…] that these loans and grants are the reason that higher education is now far more expensive (just as there is powerful data showing that subsidies lead to higher costs in other areas as […]

[…] that these loans and grants are the reason that higher education is now far more expensive (just as there is powerful data showing that subsidies lead to higher costs in other areas as […]

[…] all, thanks to third-party payer, the patient doesn’t […]

[…] Some folks believe we can’t get rid of subsidies for health care and education, even though the evidence is overwhelming that such policies increase prices. […]

[…] such, we have a system that produces higher and higher costs accompanied by ever-rising levels of […]

[…] As a result, we have a needlessly expensive system. And because third-party payer requires lots of administration and paper work, bad government policies also have caused absurd levels of inefficiency. […]

[…] That’s the theory on subsidies and prices. How does it work in practice? From Dan Mitchell’s blog: […]

Another example of cost decline is laser surgery for vision correction, which is almost never covered by insurance and costs have plummeted.

Imagine having a restaurant club whose monthly fee was substantially paid by your employer and the deal is that you pay $10 at the restaurant regardless of what you eat. When they bring you the menu, are you going to order the hamburger or the filet mignon?

When someone else foots the bill, you have no incentive to control costs.

But don’t stop there. Look at this from the restaurant’s perspective. They like your business. In fact, 95% of their customers are in the restaurant club, and they understand everyone will be ordering big, so they raise their charges to the restaurant club. The restaurant club itself doesn’t really care what the restaurants charge because it will just pass along those charges with a service charge added.

No one in the entire chain has any incentive to keep costs down.

[…] Subsidies and Third-Party Payer = Inefficiency and Higher Prices … […]

It’s not just third-party payers. It’s also the use of “insurance” to cover basic needs and wants. The same sort of thing would happen if you used “insurance” for groceries even if not a third party paying.