Back in the 1980s and 1990s, there was a widespread consensus that high tax rates were economically misguided. Many Democrats, for instance, supported the 1986 Tax Reform Act that lowered the top tax rate from 50 percent to 28 percent (albeit offset by increased double taxation and more punitive depreciation rules).

And even in the 1990s, many on the left at least paid lip service to the notion that lower tax rates were better for prosperity than higher tax rates.  Perhaps that’s because the overwhelming evidence of lower tax rates on the rich leading to higher revenue was fresh in their minds.

Perhaps that’s because the overwhelming evidence of lower tax rates on the rich leading to higher revenue was fresh in their minds.

The modern left, however, seems completely fixated on class-warfare tax policy. Some of them want higher tax rates even if the government doesn’t collect more revenue!

I’ve already shared a bunch of data and evidence on the importance of low tax rates.

A review of the academic evidence by the Tax Foundation found overwhelming support for the notion that lower tax rates are good for growth.

An economist from Cornell found lower tax rates boost GDP.

Other economists found lower tax rates boost job creation, savings, and output.

Even economists at the Paris-based OECD have determined that high tax rates undermine economic performance.

Today, we’re going to augment this list with some fresh and powerful evidence.

Lots of new evidence. So grab a cup of coffee.

The New York Times, for instance, is noticing that high taxes drive away productive people. At least in France.

Here are some excerpts from a remarkable story.

A year earlier, Mr. Santacruz, who has two degrees in finance, was living in Paris near the Place de la Madeleine, working in a boutique finance firm. He had taken that job after his attempt to start a business in Marseille foundered under a pile of government regulations and a seemingly endless parade of taxes. The episode left him wary of starting any new projects in France. Yet he still hungered to be his own boss. He decided that he would try again. Just not in his own country.

What pushed him over the edge? Taxes, taxes, and more taxes.

…he returned to France to work with a friend’s father to open dental clinics in Marseille. “But the French administration turned it into a herculean effort,” he said. A one-month wait for a license turned into three months, then six. They tried simplifying the corporate structure but were stymied by regulatory hurdles. Hiring was delayed, partly because of social taxes that companies pay on salaries. In France, the share of nonwage costs for employers to fund unemployment benefits, education, health care and pensions is more than 33 percent. In Britain, it is around 20 percent. “Every week, more tax letters would come,” Mr. Santacruz recalled.

Monsieur Santacruz has lots of company.

…France has been losing talented citizens to other countries for decades, but the current exodus of entrepreneurs and young people is happening at a moment when France can ill afford it. The nation has had low-to-stagnant economic growth for the last five years and a generally climbing unemployment rate — now about 11 percent — and analysts warn that it risks sliding into economic sclerosis. …This month, the Chamber of Commerce and Industry of Paris, which represents 800,000 businesses, published a report saying that French executives were more worried than ever that “unemployment and moroseness are pushing young people to leave” the country, bleeding France of energetic workers. As the Pew Research Center put it last year, “no European country is becoming more dispirited and disillusioned faster than France.”

But it’s not just young entrepreneurs. It’s also those who already have achieved some level of success.

Some wealthy businesspeople have also been packing their bags. While entrepreneurs fret about the difficulties of getting a business off the ground, those who have succeeded in doing so say that society stigmatizes financial success. …Hand-wringing articles in French newspapers — including a three-page spread in Le Monde, have examined the implications of “les exilés.” …around 1.6 million of France’s 63 million citizens live outside the country. That is not a huge share, but it is up 60 percent from 2000, according to the Ministry of Foreign Affairs. Thousands are heading to Hong Kong, Mexico City, New York, Shanghai and other cities. About 50,000 French nationals live in Silicon Valley alone. But for the most part, they have fled across the English Channel, just a two-hour Eurostar ride from Paris. Around 350,000 French nationals are now rooted in Britain, about the same population as Nice, France’s fifth-largest city. …Diane Segalen, an executive recruiter for many of France’s biggest companies who recently moved most of her practice, Segalen & Associés, to London from Paris, says the competitiveness gap is easy to see just by reading the newspapers. “In Britain, you read about all the deals going on here,” Ms. Segalen said. “In the French papers, you read about taxes, more taxes, economic problems and the state’s involvement in everything.”

Let’s now check out another story, this time from the pages of the UK-based Daily Mail. We have some more news from France, where another successful French entrepreneur is escaping Monsieur Hollande’s 75 percent tax rate.

François-Henri Pinault, France’s third richest man, is relocating his family to London. Pinault, the chief executive of Kering, a luxury goods group, has an estimated fortune of £9 billion. The capital has recently become a popular destination for wealthy French, who are seeking to avoid a 75 per cent supertax introduced by increasingly unpopular Socialist President François Hollande. …It has been claimed that London has become the sixth largest ‘French city’ in the world, with more than 300,000 French people living there.

But it’s not just England. Other high-income French citizens, such as Gerard Depardieu and Bernard Arnault, are escaping to Belgium  (which is an absurdly statist nation, but at least doesn’t impose a capital gains tax).

(which is an absurdly statist nation, but at least doesn’t impose a capital gains tax).

But let’s get back to the story. The billionaire’s actress wife, perhaps having learned from all the opprobrium heaped on Phil Mickelson when he said he might leave California after voters foolishly voted for a class-warfare tax hike, is pretending that taxes are not a motivating factor.

But despite the recent exodus of millionaires from France, Ms Hayek insisted that her family were moving to London for career reasons and not for tax purposes. …Speaking about the move in an interview with The Times Magazine, the actress said: ‘I want to clarify, it’s not for tax purposes. We are still paying taxes here in France. ‘We think that London has a lot more to offer than just a better tax situation.

And if you believe that, I have a bridge in Brooklyn that I’m willing to sell for a very good price.

Speaking of New York bridges, let’s go to the other side of Manhattan and cross into New Jersey.

It seems that class-warfare tax policy isn’t working any better in the Garden State than it is in France.

Here are some passages from a story in the Washington Free Beacon.

New Jersey’s high taxes may be costing the state billions of dollars a year in lost revenue as high-earning residents flee, according to a recent study. The study, Exodus on the Parkway, was completed by Regent Atlantic last year… The study shows the state has been steadily losing high-net-worth residents since 2004, when Democratic Gov. Jim McGreevey signed the millionaire’s tax into law. The law raised the state income tax 41 percent on those earning $500,000 or more a year. “The inception of this tax, coupled with New Jersey’s already high property and estate taxes, leaves no mystery about why the term ‘tax migration’ has become a buzzword among state residents and financial, legal, and political professionals,” the study, conducted by Regent states. …tax hikes are driving residents to states with lower tax rates: In 2010 alone, New Jersey lost taxable income of $5.5 billion because residents changed their state of domicile.

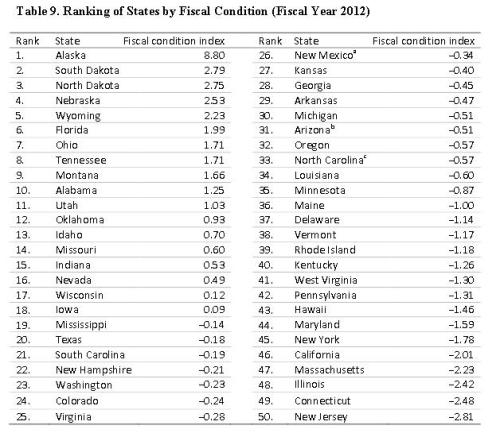

No wonder people are moving. New Jersey is one of the most over-taxed jurisdictions in America – and it has a dismal long-run outlook.

And when they move, they take lots of money with them.

“The sad reality is our residents are suffering because politicians talk a good game, but no one is willing to step up to the plate,” Americans for Prosperity New Jersey state director Daryn Iwicki said. The “oppressive tax climate is driving people out.” …One certified public accountant quoted in the study said he lost 95 percent of his high net worth clients. Other tax attorneys report similar results. …Michael Grohman, a tax attorney with Duane Morris, LLP, claimed his wealthy clients are “leaving [New Jersey] as fast as they can.” …If the current trend is not reversed, the consequences could be dire. “Essentially, we’ll find ourselves much like the city of Detroit, broke and without jobs,” Iwicki said.

By the way, make sure you don’t die in New Jersey.

The one bit of good news, for what it’s worth, is that Governor Christie is trying to keep matters from moving further in the wrong direction.

Here’s another interesting bit of evidence. The Wall Street Journal asked the folks at Allied Van Lines where wealthy people are moving. Here’s some of the report on that research.

Spread Sheet asked Allied to determine where wealthy households were moving, based on heavy-weight, high-value moves. According to the data, Texas saw the largest influx of well-heeled households moving into the state last year, consistent with move trends overall. South Carolina and Florida also posted net gains. On the flip side, Illinois and Pennsylvania saw more high-value households move out of state than in, according to the data. California saw the biggest net loss of heavy-weight moves. Last year, California had a net loss of 49,259 people to other states, according to the U.S. Census. …Texas had the highest net gain in terms of domestic migration—113,528 more people moved into the state than out last year, census data show. Job opportunities are home-buyers’ top reason for relocating to Texas, according to a Redfin survey last month of 1,909 customers and website users.

The upshot is that Texas has thumped California, which echoes what I’ve been saying for years.

One can only imagine what will happen over the next few years given the punitive impact of the higher tax rate imposed on the “rich” by spiteful California voters.

One can only imagine what will happen over the next few years given the punitive impact of the higher tax rate imposed on the “rich” by spiteful California voters.

If I haven’t totally exhausted your interest in this topic, let’s close by reviewing some of the research included in John Hood’s recent article in Reason.

Over the past three decades, America’s state and local governments have experienced a large and underappreciated divergence. …Some political scientists call it the Big Sort. …Think of it as a vast natural experiment in economic policy. Because states have a lot otherwise in common-cultural values, economic integration, the institutions and actions of the federal government-testing the effects of different economic policies within America can be easier than testing them across countries. …And scholars have been studying the results. …t present our database contains 528 articles published between 1992 and 2013. On balance, their findings offer strong empirical support for the idea that limited government is good for economic progress.

And what do these studies say?

Of the 112 academic studies we found on overall state or local tax burdens, for example, 72 of them-64 percent-showed a negative association with economic performance. Only two studies linked higher overall tax burdens with stronger growth, while the rest yielded mixed or statistically insignificant findings. …There was a negative association between economic growth and higher personal income taxes in 67 percent of the studies. The proportion rose to 74 percent for higher marginal tax rates or tax code progressivity, and 69 percent for higher business or corporate taxes.

Here are some of the specific findings in the academic research.

James Hines of the University of Michigan found that “state taxes significantly influence the pattern of foreign direct investment in the U.S.” A 1 percent change in the tax rate was associated with an 8 percent change in the share of manufacturing investment from taxed investors. Another study, published in Public Finance Review in 2004, zeroed in on counties that lie along state borders. …Studying 30 years of data, the authors concluded that states that raised their income tax rates more than their neighbors had significantly slower growth rates in per-capita income. …economists Brian Goff, Alex Lebedinsky, and Stephen Lile of Western Kentucky University grouped pairs of states together based on common characteristics of geography and culture. …Writing in the April 2011 issue of Contemporary Economic Policy, the authors found “strong support for the idea that lower tax burdens tend to lead to higher levels of economic growth.”

By the way, even though this post is about tax policy, I can’t resist sharing some of Hood’s analysis of the impact of government spending.

Of the 43 studies testing the relationship between total state or local spending and economic growth, only five concluded that it was positive. Sixteen studies found that higher state spending was associated with weaker economic growth; the other 22 were inconclusive. …a few Keynesian bitter-enders insist that transfer programs such as Medicaid boost the economy via multiplier effects… Nearly three-quarters of the relevant studies found that welfare, health care subsidies, and other transfer spending are bad for economic growth.

And as I’ve repeatedly noted, it’s important to have good policy in all regards. And Hood shares some important data showing that laissez-faire states out-perform their neighbors.

…economists Lauren Heller and Frank Stephenson of Berry College used the Fraser Institute’s Economic Freedom of North America index to explore state economic growth from 1981 to 2009. They found that if a state adopted fiscal and regulatory policies sufficient to improve its economic freedom score by one point, it could expect unemployment to drop by 1.3 percentage points and labor-force participation to rise by 1.9 percentage points by the end of the period studied.

If you’ve made it this far, you deserve a reward.  We have some amusing cartoons on class-warfare tax policy here, here, here, here, here, here, and here.

We have some amusing cartoons on class-warfare tax policy here, here, here, here, here, here, and here.

And here’s a funny bit from Penn and Teller on class warfare.

P.S. Higher tax rates also encourage corruption.

Read Full Post »

according to the Institute for Truth in Accounting. It bears some $234 billion in debt, including about $100 billion in unfunded pension liabilities. A recent Pew study estimated that, between 2003 and 2017, the state spent $1 for every 91 cents in revenue it collected. …Before the pandemic, Murphy had proposed a $40.7 billion budget for fiscal 2021, a spending increase of 5.4 percent. …The administration has taken only marginal steps to reduce spending by, for instance, delaying water infrastructure projects. Many other cuts Murphy has announced involve simply shelving plans to spend more money.

by nearly 2 percentage points, giving New Jersey one of the highest state tax rates on wealthy people in the country. …The new tax in New Jersey…is expected to generate an estimated $390 million this fiscal year… With every call for a new tax comes criticism from Republicans and some business leaders who warn that higher taxes will lead to an exodus of affluent residents.

Two years ago, Democrats increased the top rate to 10.75% on taxpayers making more than $5 million. …New Jersey’s bleeding budget can’t afford to lose any millionaires. In 2018 New Jersey lost a net $3.2 billion in adjusted gross income to other states, including $2 billion to zero-income tax Florida, according to IRS data. More will surely follow now.