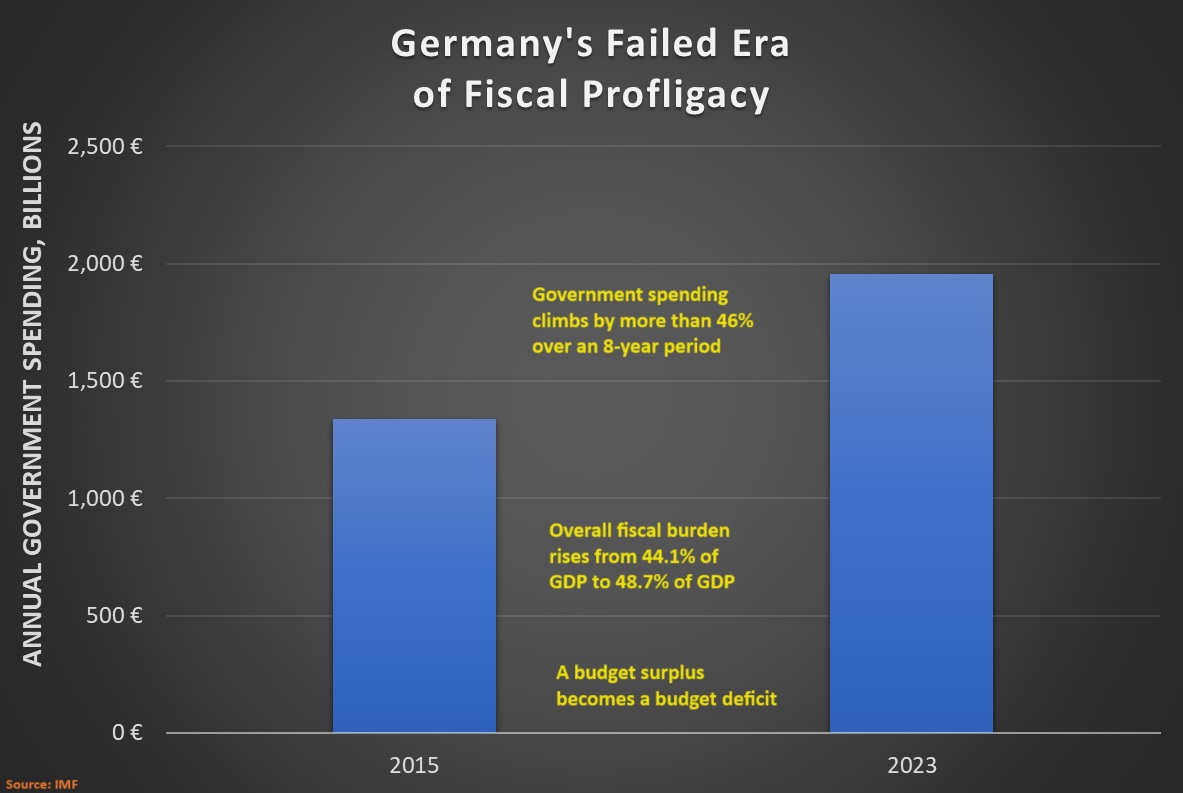

I wrote last November that Germany is in a period of fiscal decay.

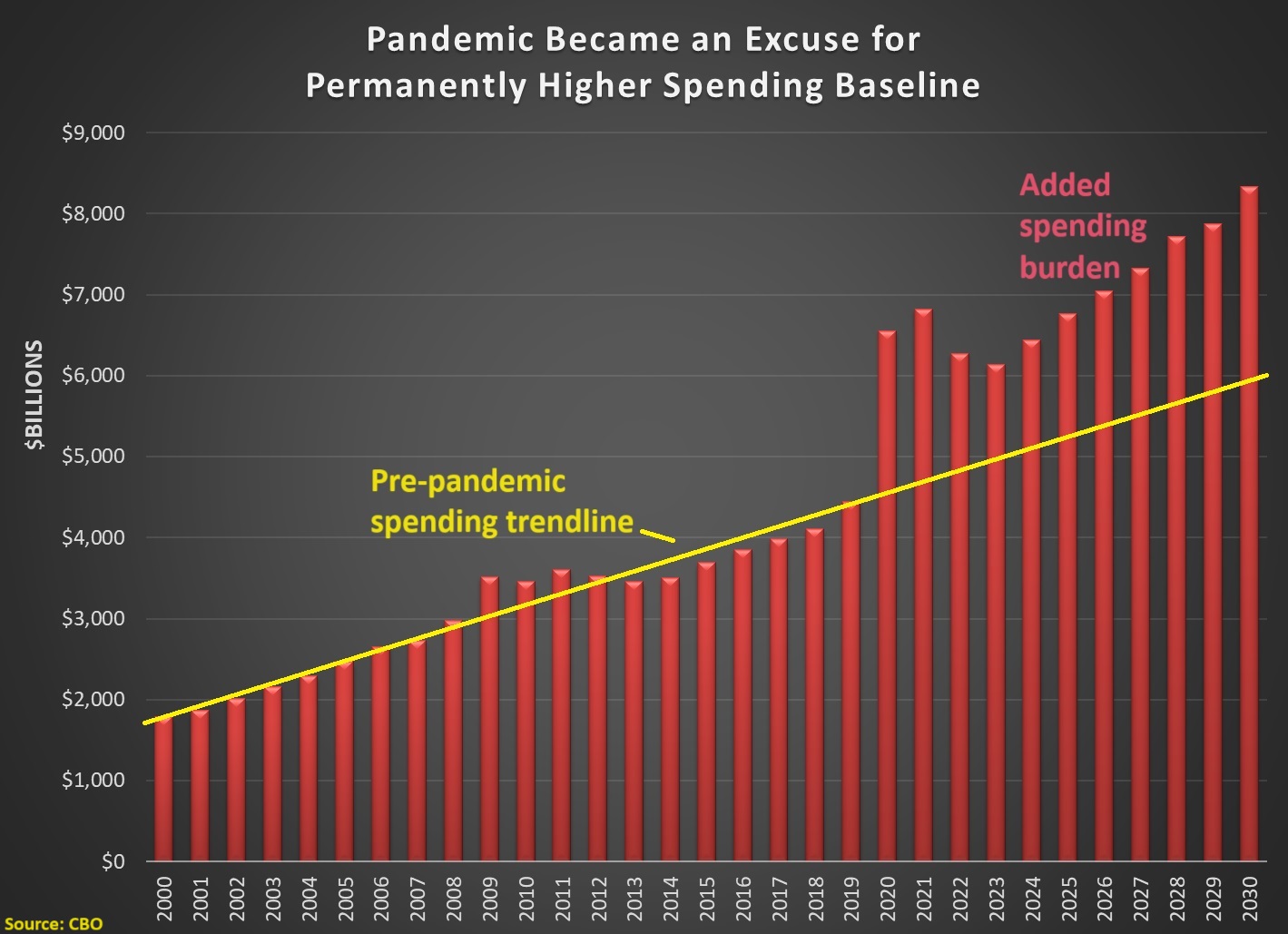

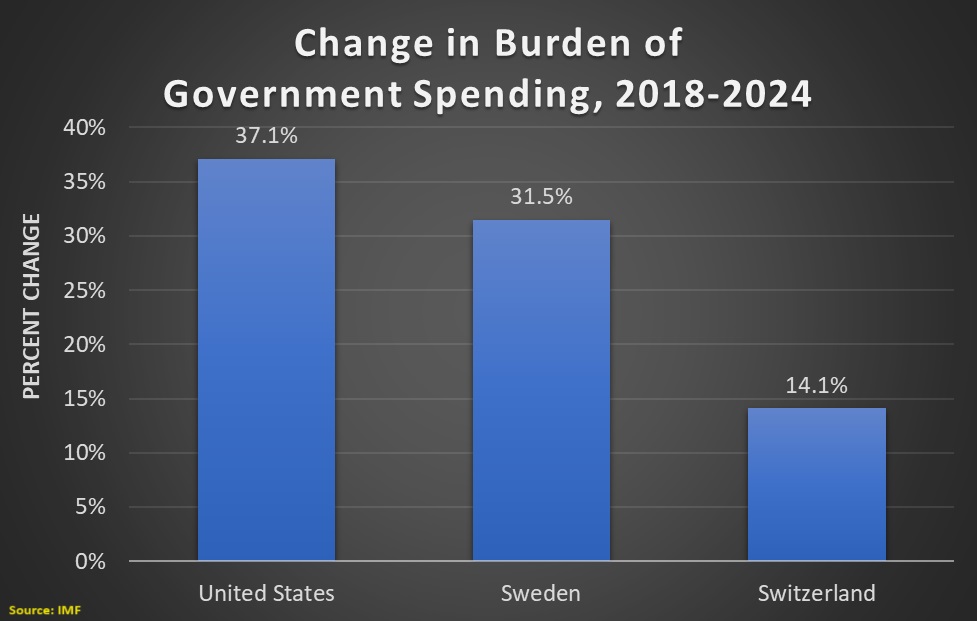

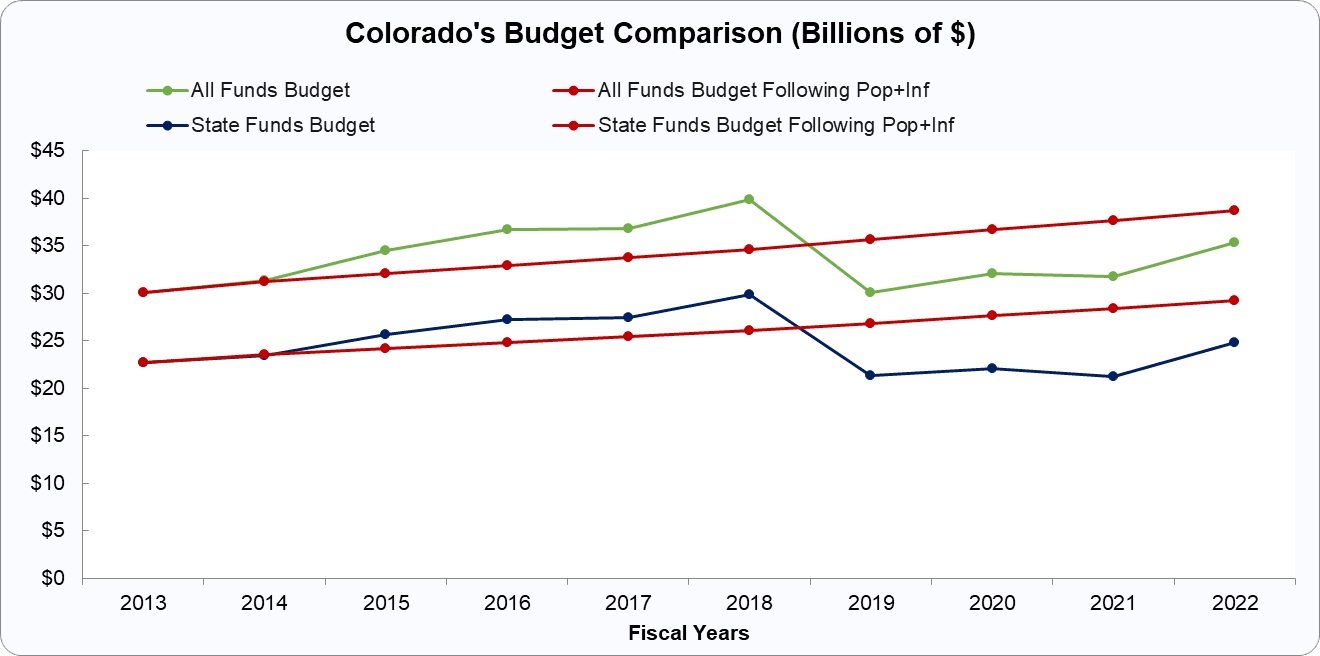

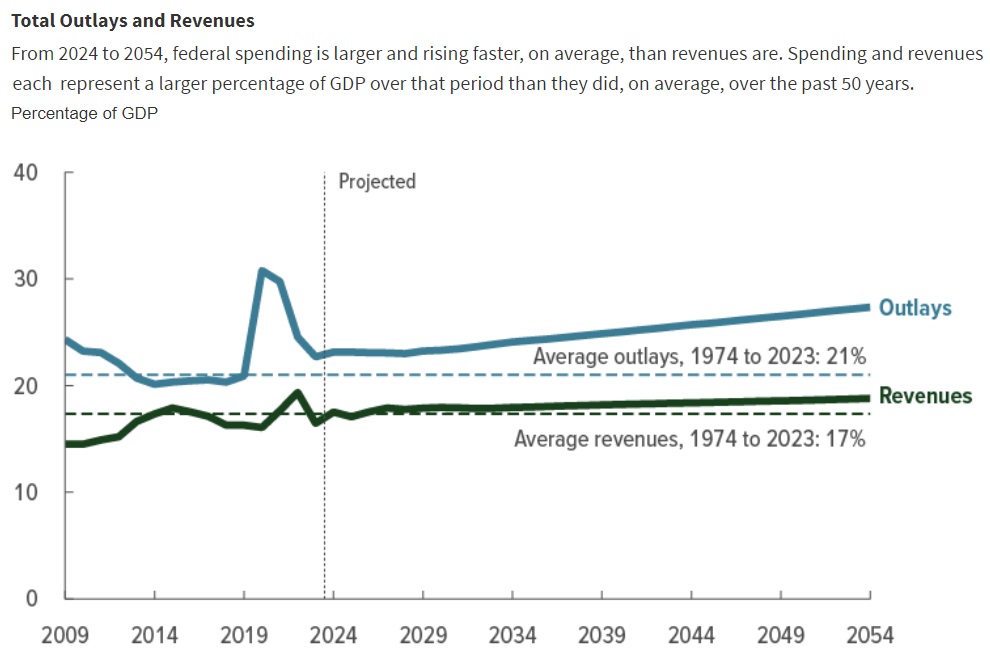

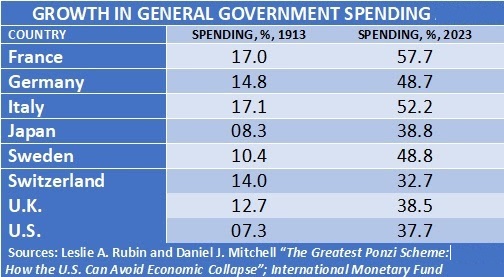

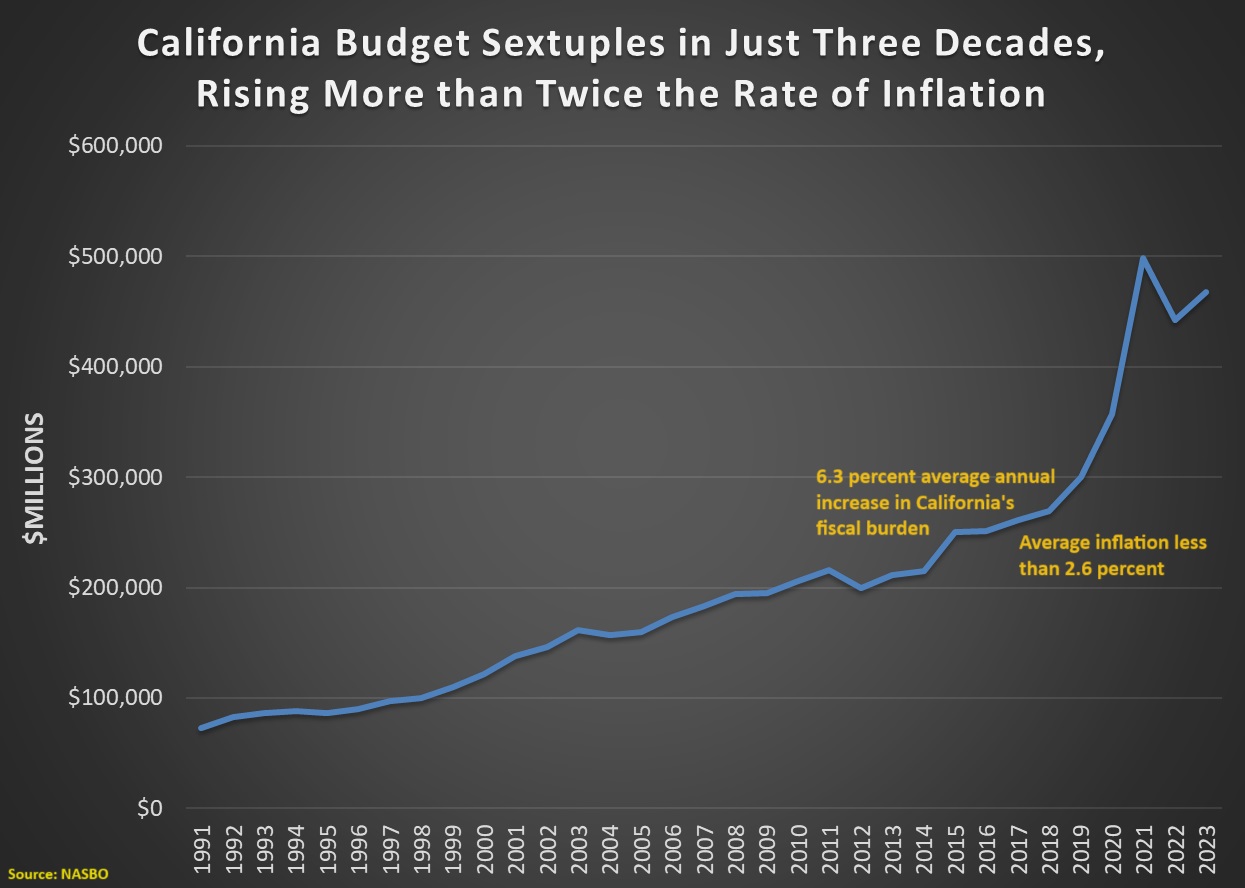

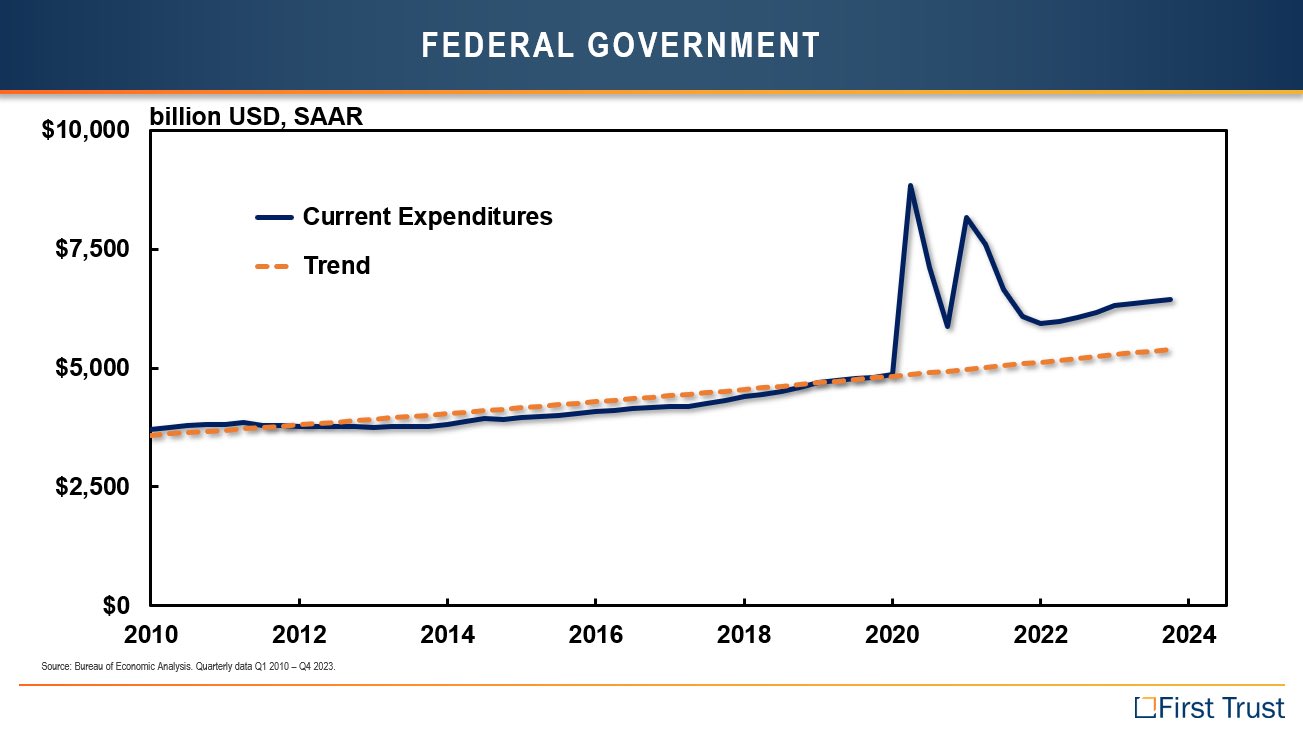

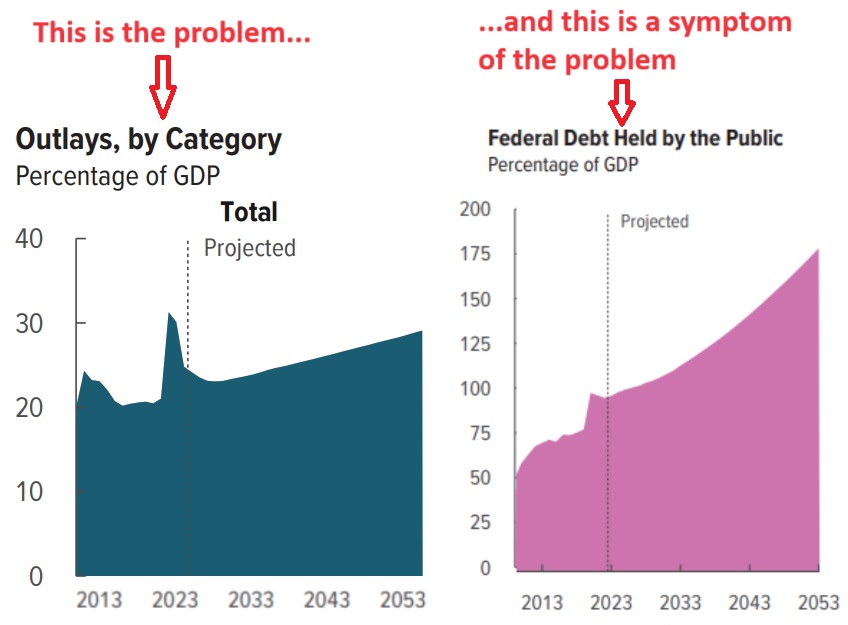

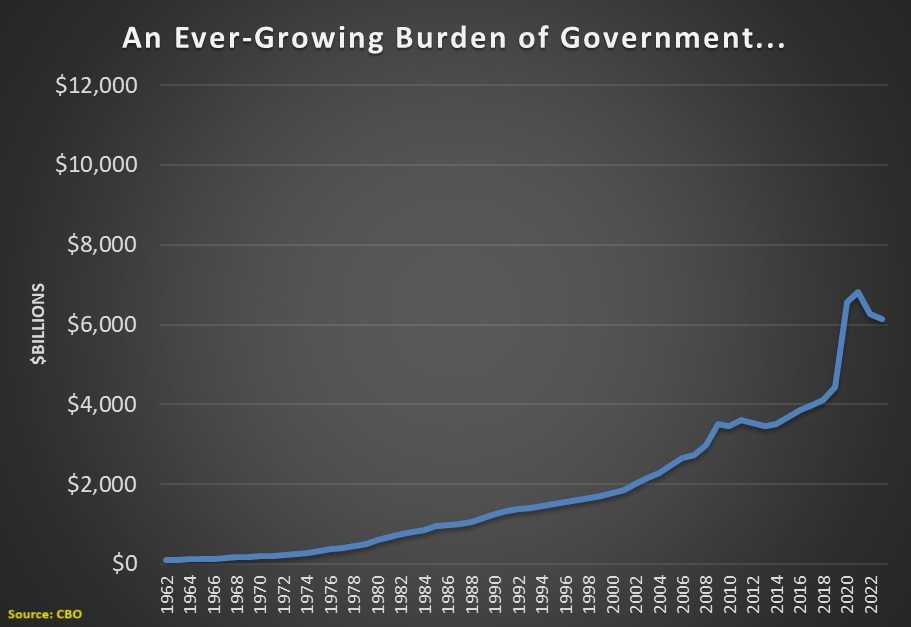

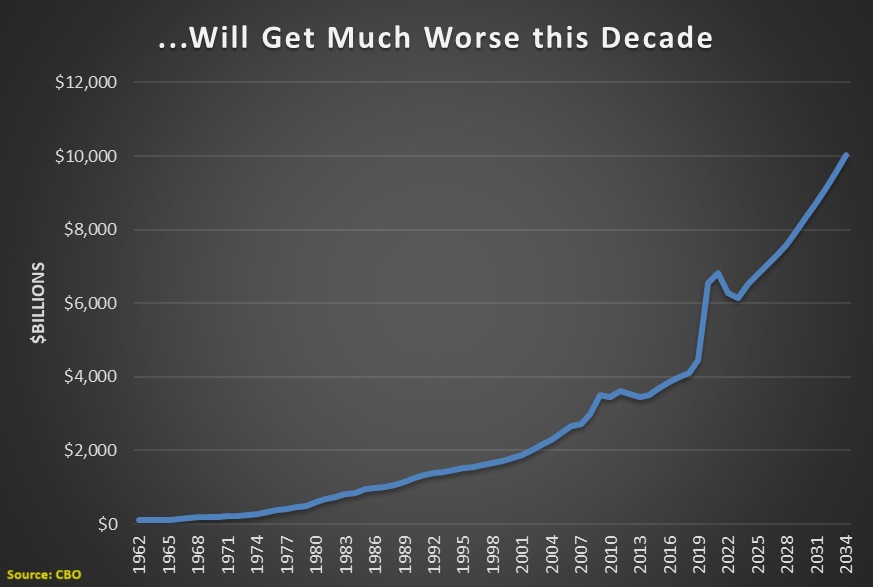

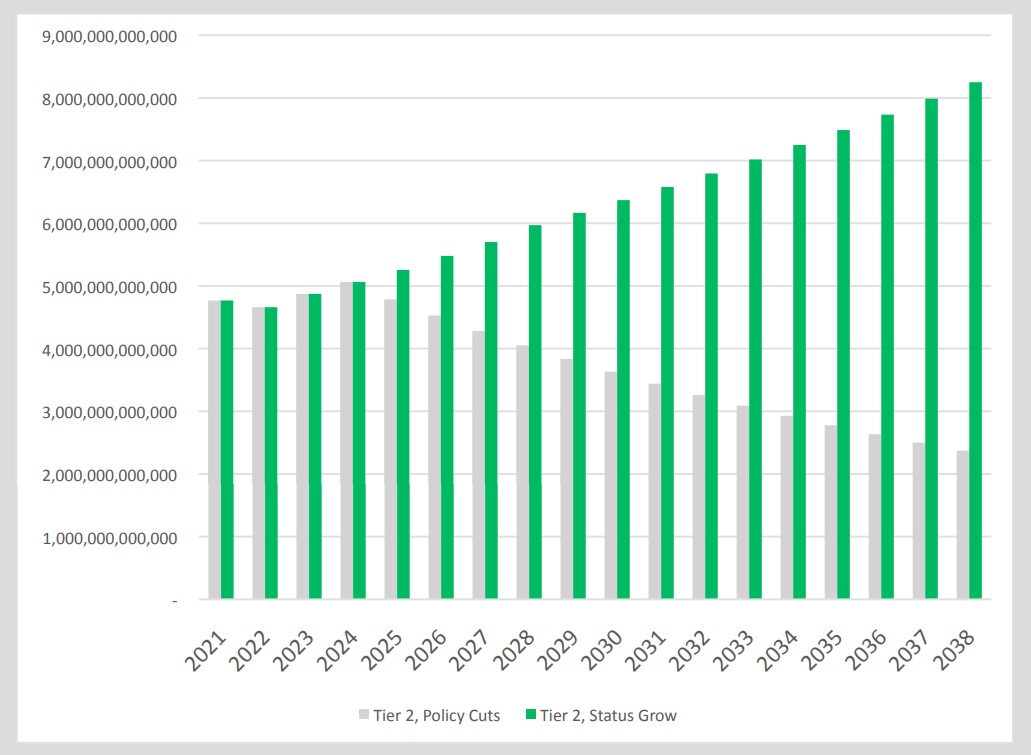

Over the past eight-plus years, the burden of government spending has grown far too fast, violating the Golden Rule of fiscal policy.

violating the Golden Rule of fiscal policy.

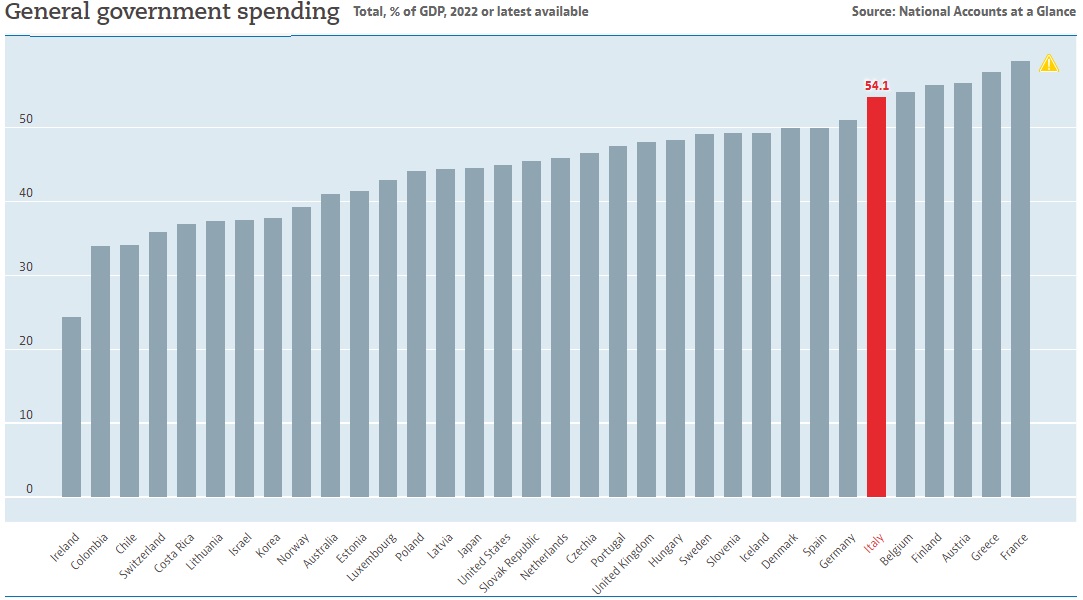

As a result, the share of the economy being consumed by the public sector has jumped from 44 percent to nearly 49 percent.

That’s worse than Denmark!

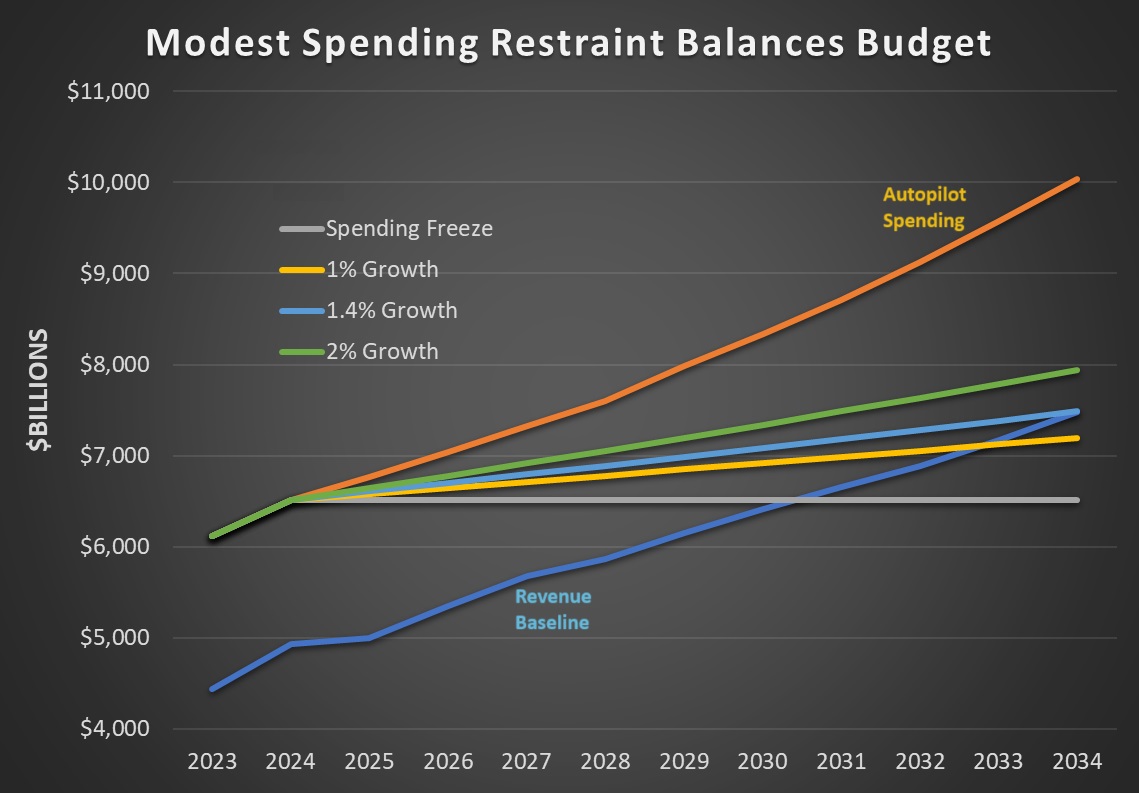

So what should Germany do? A rational person, especially if that person had any knowledge of economics, would urge spending restraint.

But let’s instead look at what the Keystone Cops at the International Monetary Fund are recommending. They want Germany to weaken its fiscal rule to enable even more spending.

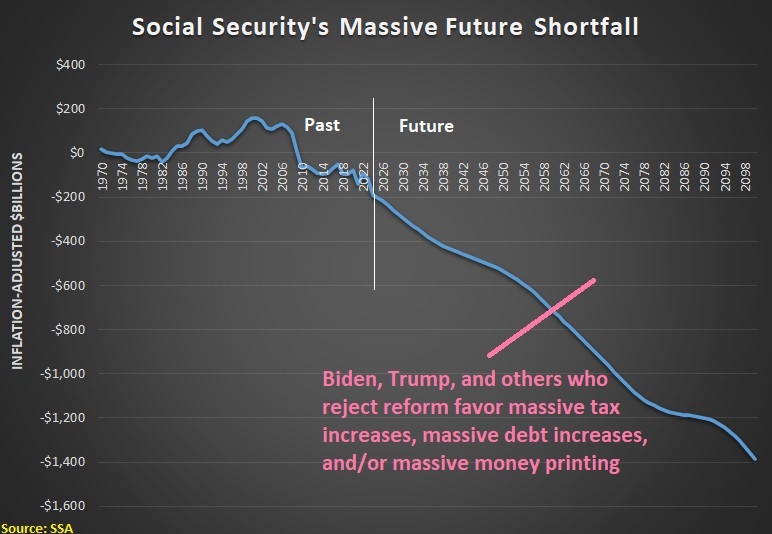

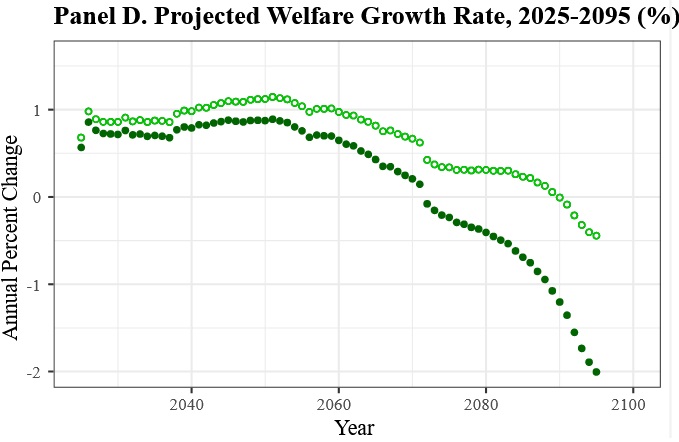

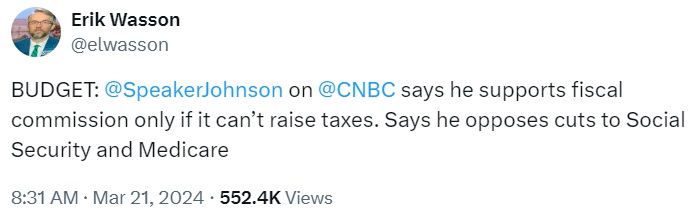

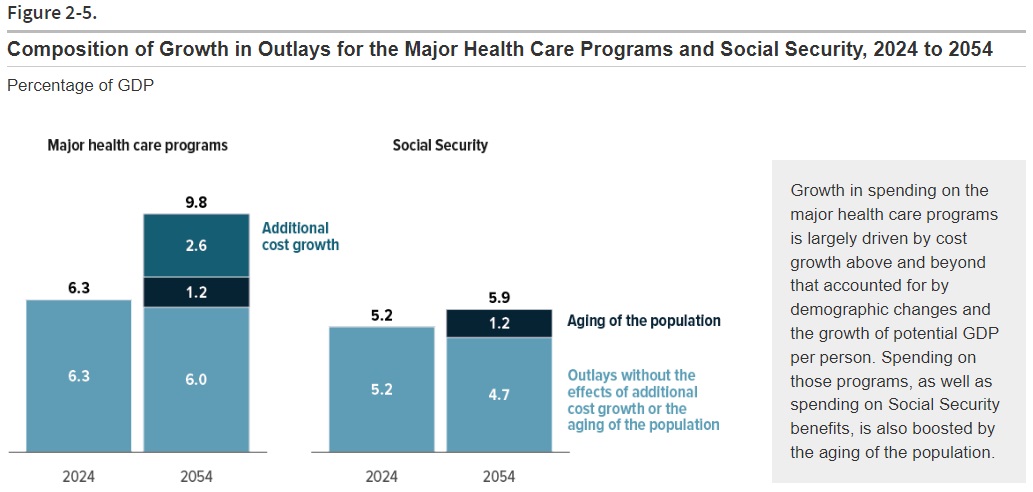

An aging population will also adversely affect public finances as tax revenue growth slows and spending on pensions and healthcare rises. …To accommodate rising spending needs, the authorities should consider moderately e

asing the debt brake. …Germany’s debt brake is set at a relatively tight level, such that the annual limit on net borrowing could be eased by about 1 percentage point of GDP while still keeping the debt-to-GDP ratio on a downward path. Such an easing would allow more room for much-needed public investment and other key priorities.

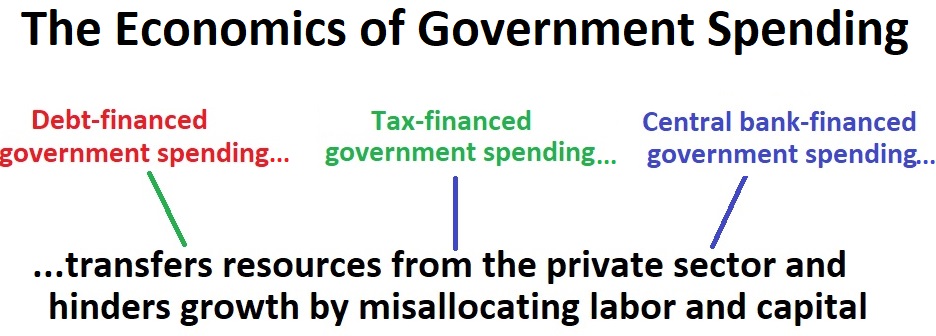

And, keeping with tradition, the bureaucrats at the IMF also want higher taxes in Germany.

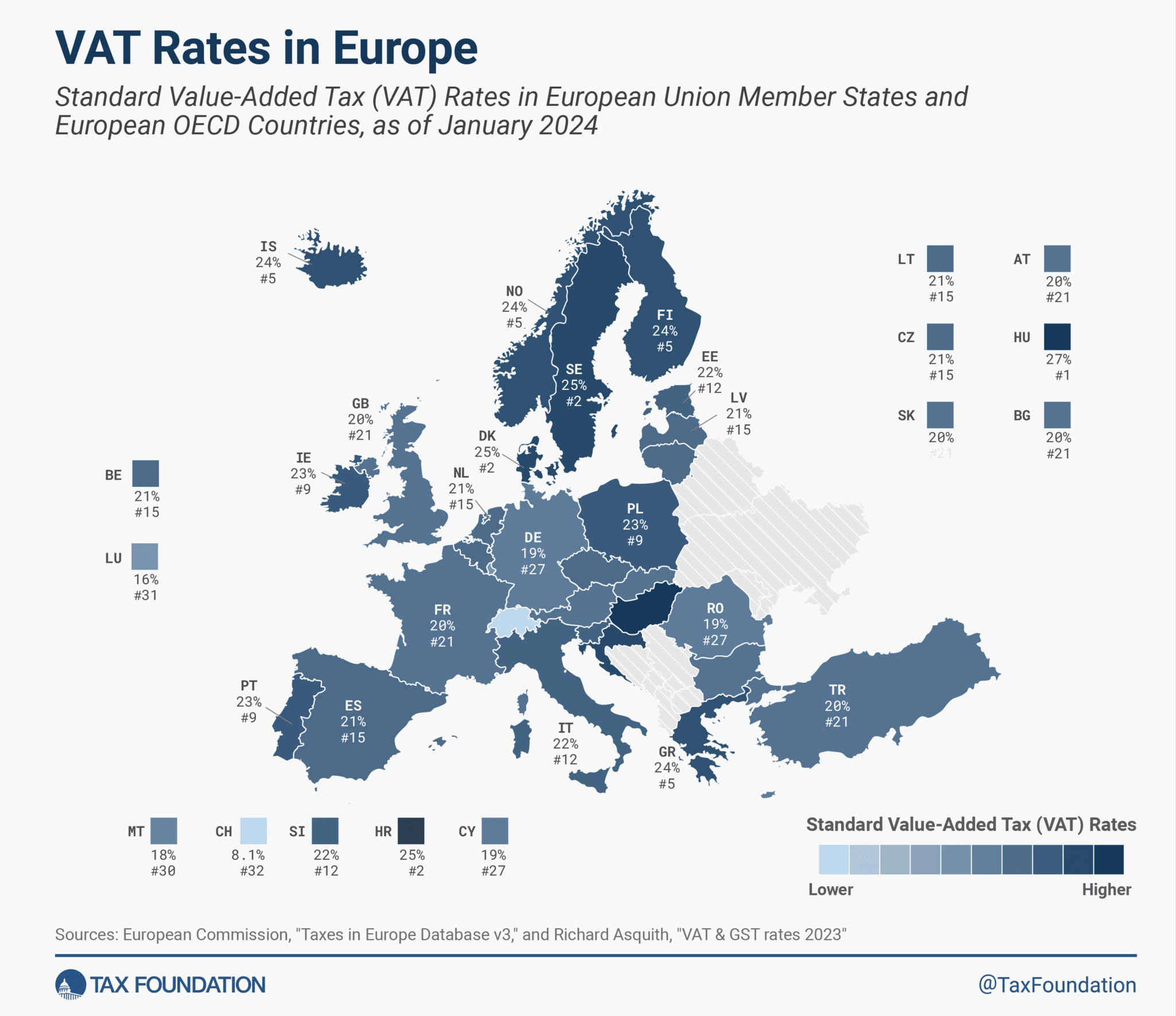

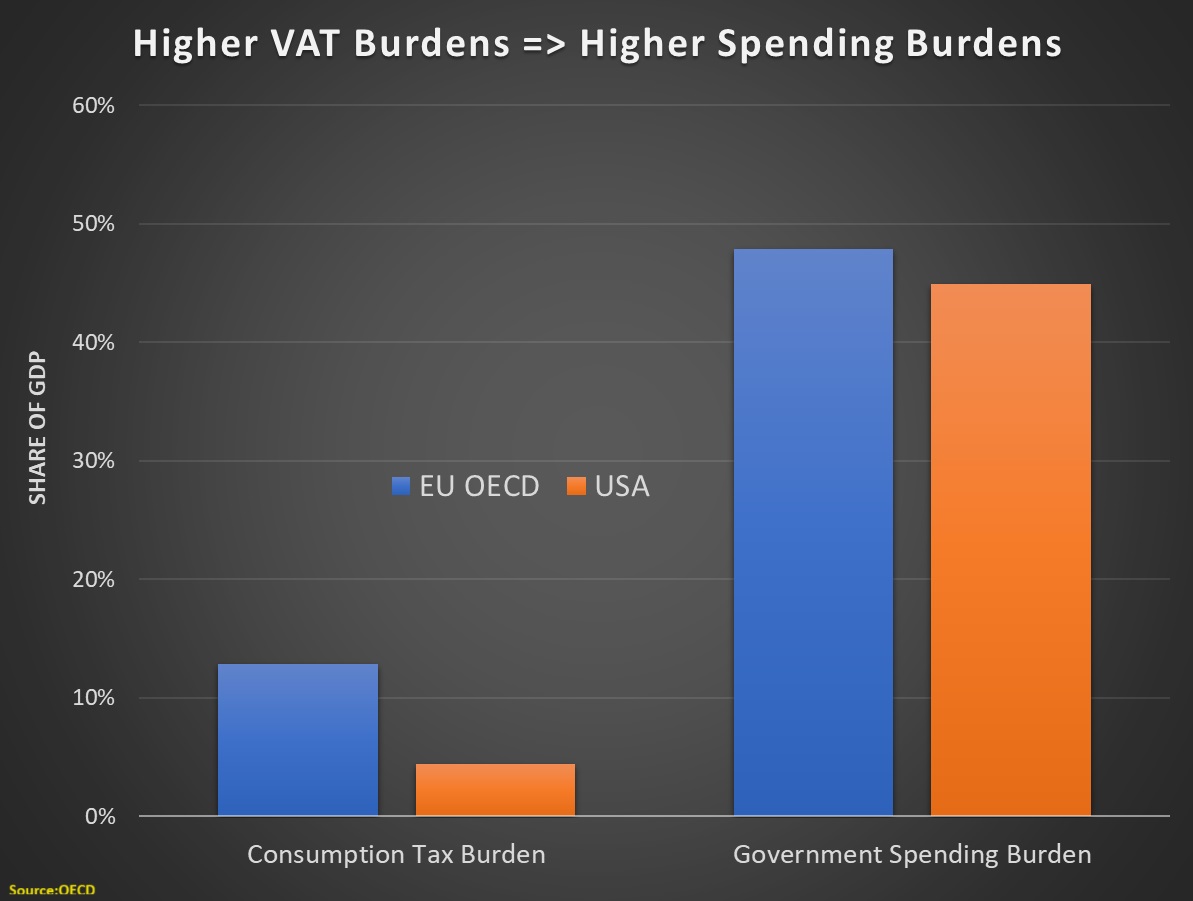

Options that could be explored include eliminating environmentally harmful…tax expenditures, …raising taxes on real estate and on goods and services (as Germany’s revenue from such sources is below the advanced-economy average), and/or closing loopholes in inheritance taxes.

Adding more spending to Germany’s fiscal burden is bad news, but adding more taxes is equally offensive.

That part of the report merits two observations.

- If the IMF cared about growth, it would recommend lower tax rates in the many areas where Germany is above the advanced-economy average, not pushing for higher taxes in the few areas where the German government has demonstrated a bit of restraint.

- It is utterly hypocritical for IMF bureaucrats to push for higher taxes (in Germany or elsewhere) since their generous salaries are exempt from tax. Maybe if they had to pay taxes and live by the same rules as everyone else, they wouldn’t be so quick to urge bad policies.

P.S. I can’t resist citing one final bit of economic illiteracy from the IMF.

High energy prices following the shut-off of Russian gas contributed to surging inflation during 2022-23.

This is nonsense. Higher energy prices cause a shift in relative prices. Bad monetary policy (as we recently experienced in Europe, the United States, Canada, and the United Kingdom) is the reason for the increase in overall prices.

P.P.S. Given this statement by the previous head of the IMF (and current head of the ECB), you’ll understand why there’s a problem with economic literacy at that international bureaucracy.