Jeffrey Sachs of Columbia University is a big booster of the discredited notion that foreign aid is a cure-all for poverty in the developing world, but he is now branching out and saying silly things about policy in other areas.

In a column for the Financial Times, he complains that tax competition is forcing governments to “race to the bottom” with regards to tax rates. The answer, he wants us to believe, is some sort of global tax cartel. Sort of an “OPEC for politicians” that will facilitate the imposition of higher tax rates.

Only international co-operation can now solve what is becoming a runaway social crisis in many high-income countries. …With capital globally mobile, moreover, governments are now in a race to the bottom with regard to corporate taxation and loopholes for personal taxation of high incomes. Each government aims to attract mobile capital by cutting taxes relative to others. …countries cannot act by themselves. Even the social democracies of northern Europe, with their balanced budgets and high tax rates, are increasingly being pulled into the vortex of tax cutting and the race to the bottom. …recent trends…require increased, not decreased, taxation of higher incomes, including corporate profits; and that tax and regulatory co-ordination across countries are vital to prevent a ruinous fiscal race to the bottom.

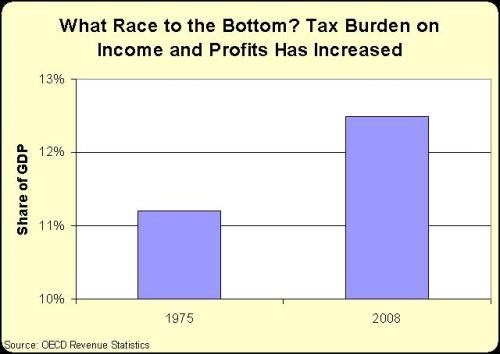

If this overwrought rhetoric is true, it would mean that governments have been starved of revenue because of race-to-the-bottom tax cuts for evil corporations and sinister rich people. Well, it is true that tax competition over the past 30-plus years has resulted in lower tax rates. But do lower tax rates mean less tax revenue, as implied by Sachs’ analysis?

At the risk of being impolite and shattering anyone’s illusions, let’s actually see what happened to the overall tax burden on both personal and corporate income.

This chart, showing the average for industrialized nations, shows that Sachs and his ilk are wrong. Way wrong. Tax rates have come down, but the overall tax burden actually has increased. So while there may be a race to less-destructive tax rates, there certainly isn’t a race to bottom for tax revenue.

Hmmm….lower tax rates and higher tax revenue. That seems vaguely familiar. Maybe it has something to do with “supply-side economics.” One can only wonder if Sachs has heard about that strange idea known as the Laffer Curve.

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic […]

[…] the so-called race to the bottom, even the IMF and OECD have admitted that lower corporate tax rates have not led to lower corporate […]

[…] lower corporate tax rate won’t necessarily reduce corporate tax revenue, particularly over time as there’s more investment and job […]

[…] get some sympathetic quotes about capitalism from leftists such as Gordon Brown, Larry Summers, and Jeffrey Sachs at the end of the […]

[…] and their flunkies grouse about a “race to the bottom” when tax competition exists, not because tax rates would ever drop to zero (we should be so […]

[…] Once again, they are brutally honest. They unabashedly state that they want harmonized rules so they can eliminate tax competition (the left fears a “race to the bottom“). […]

[…] are at achieving the sustainable development goals. Jeffrey Sachs was the lead author, so perhaps we shouldn’t be too surprised to discover that there are some very odd […]

[…] though they would prefer to do the opposite. Let’s hope the United States joins this “race to the bottom” before it’s too […]

[…] though they would prefer to do the opposite. Let’s hope the United States joins this “race to the bottom” before it’s too […]

[…] P.P.S. It’s worth remembering that the “race to the bottom” is actually a race to better policy and more growth. And politicians should be comforted by the fact that this doesn’t necessarily mean less revenue. […]

[…] lower corporate tax rate won’t necessarily reduce corporate tax revenue, particularly over time as there’s more investment and job […]

[…] lower corporate tax rate won’t necessarily reduce corporate tax revenue, particularly over time as there’s more investment and job […]

[…] lower corporate tax rate won’t necessarily reduce corporate tax revenue, particularly over time as there’s more investment and job […]

[…] our friends on the left are terrified of a “race to the bottom” but their real motive seems to be a desire for more money to prop up […]

[…] our friends on the left are terrified of a “race to the bottom” but their real motive seems to be a desire for more money to […]

[…] Thomas Piketty was on the list, which is hardly a surprise. Along with Jeffrey Sachs, who also has a track record of favoring more statism. Another predictable signatory is Olivier Blanchard, the former top […]

[…] When I debunked Jeffrey Sachs on the “race to the bottom,” I showed that lower tax rates do not mean lower tax […]

[…] When I debunked Jeffrey Sachs on the “race to the bottom,” I showed that lower tax rates do not mean lower tax […]

[…] about being pressured to lower tax rates since these reforms generally led to more growth, which generated significant revenue feedback. In other words, the Laffer Curve […]

[…] The ideological reason is that statists strongly prefer one-size-fits-all systems because government has more power and there’s no jurisdictional competition (which they view as a “race to the bottom“). […]

[…] though there’s no evidence of a problem, even from the perspective of revenue-hungry […]

[…] made similar points, incidentally, when debunking Jeffrey Sachs’ assertion that tax competition has caused a “race to the […]

[…] made similar points, incidentally, when debunking Jeffrey Sachs’ assertion that tax competition has caused a “race to the […]

[…] It certainly is true that tax competition has pressured politicians to lower tax rates, and the academic research shows that this is a good thing, notwithstanding complaints by leftists economists such as Jeffrey Sachs. […]

[…] must be a schizophrenic country. Something strange is happening, after all, if a statist like Jeffrey Sachs and a rabid libertarian like yours truly both cited it as a role model in our remarks last month at […]

[…] Professor Jeffrey Sachs of Columbia University was a statist, as one would expect based on what I wrote about him last year. We clashed the most, arguing about everything from tax havens to the size of government. […]

[…] must be a schizophrenic country. Something strange is happening, after all, if a statist like Jeffrey Sachs and a rabid libertarian like yours truly both cited it as a role model in our remarks last month at […]

[…] must be a schizophrenic country. Something strange is happening, after all, if a statist like Jeffrey Sachs and a rabid libertarian like yours truly both cited it as a role model in our remarks last month at […]

[…] must be a schizophrenic country. Something strange is happening, after all, if a statist like Jeffrey Sachs and a rabid libertarian like yours truly both cited it as a role model in our remarks last month at […]

[…] Professor Jeffrey Sachs of Columbia University was a statist, as one would expect based on what I wrote about him last year. We clashed the most, arguing about everything from tax havens to the size of government. […]

[…] Professor Jeffrey Sachs of Columbia University was a statist, as one would expect based on what I wrote about him last year. We clashed the most, arguing about everything from tax havens to the size of government. […]

[…] Professor Jeffrey Sachs of Columbia University was a statist, as one would expect based on what I wrote about him last year. We clashed the most, arguing about everything from tax havens to the size of government. […]

[…] I understand this passage correctly, I disagree. Tax competition does not drive tax rates to zero. It just encourages better policy. There’s pressure to lower tax rates, and there’s pressure to […]

[…] I understand this passage correctly, I disagree. Tax competition does not drive tax rates to zero. It just encourages better policy. There’s pressure to lower tax rates, and there’s pressure to […]

[…] Jeffrey Sachs and the Fictional “Race to the Bottom” Caused by Tax Competition « I… […]

Is this guy for real? He’s like the Bizarro Dan Mitchell.

Nobody cares about this, but Sachs is the keynesian that I dislike the most, because of his arrogance.

I knew about him alleging for keynesian pseudoscience, for global warming pseudoscience and for the usual pseudo science that alleges that we need more foreing aid while it is clear that Hong Kong and Singapore, the 1960s dirt poor countries that never had foreign aid and that refused the “counsel” by keynesian economists and nobel prize winners became richer than Sweden, the 1960s “rich kid” while Subsaharan African countries that accepted such “counsel” became nations among the poorest and that have the most inequal distribution of income. But I never knew about Sachs alleging for this “tax competition is bad” pseudoscience.

Such pseudoscience is very often used for promoting more opressive power, control and trillions for the political class, already Sub saharian africa has the highest tax rates according to World Bank’s Doing Business methodology http://doingbusiness.org/data/exploretopics/paying-taxes