Some honest statists understand and acknowledge that you can’t have bigger government unless you target middle-income taxpayers.

- The New York Times endorsed higher taxes on the middle class in 2010.

- The then-House Majority Leader Steny Hoyer also gave a green light that year to higher taxes on the middle class.

In 2012, MIT professor and former IMF official Simon Johnson argued that the middle class should pay more tax.

In 2012, MIT professor and former IMF official Simon Johnson argued that the middle class should pay more tax.- The Washington Post also called for higher taxes on the middle class a few years ago, as did Vice President Joe Biden’s former economist.

- A New York Times columnist also called for broad-based tax hikes on the middle class in 2012.

- A Senior Fellow from Demos also argued for higher taxes on all Americans that year, specifically targeting the middle class.

- In 2013, the New York Times again (!) editorialized in favor of higher tax burdens on the middle class.

And why do all these statists want higher taxes on ordinary people?

The answer is that they understand you can’t finance a giant welfare state unless there’s a huge increase in the tax burden on lower-income and middle-income taxpayers.

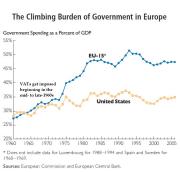

Which is exactly what’s happened in Europe.

Of course, you don’t need to favor that outcome to predict (of fear) that it will happen. My opposition to tax hikes, for instance, is precisely because I don’t want America to have a Greek-style fiscal future.

It’s a simple matter of math. The income tax simply isn’t capable of generating enough revenue to fulfill the fantasies of folks like Hillary Clinton and Bernie Sanders.

Robert Samuelson, writing in the Washington Post, explains that the middle class will need to be targeted if politicians actually want to finance an ever-expanding welfare state.

Democrats retort that raising taxes on the rich will provide needed revenues to expand progressive government. …They obviate the need for middle-class tax increases to pay for government. …of Democrats’ faith in soaking the rich. …The trouble is that the math doesn’t match the rhetoric, as a new Brookings Institution study shows. In it, economists William Gale, Melissa Kearney and Peter Orszag asked this question: What would happen if the top income tax rate were increased from 39.6 percent to 50 percent? The answer — less than you think. …it would raise about $100 billion in tax revenues…, but it’s actually slightly less than a quarter of the $439 billion budget deficit for fiscal 2015. …Even if the $100 billion were directly distributed to the poorest fifth of Americans (an average $2,650 per household), the effect on overall inequality would be “exceedingly modest,” the authors say. …tax policies don’t come close to covering the real costs of government.

In other words, there aren’t enough rich people to finance big government, even if you somehow assume that huge tax hikes don’t have negative effects on taxable income (and the evidence from the 1980s shows that upper-income taxpayers have very strong responses to changes in tax rates).

So, given all this evidence, what’s Samuelson’s bottom line?

If middle-class Americans need or want bigger government, they will have to pay for it. Sooner or later, a tax increase is coming their way.

And he’s right.

Which makes it all the more puzzling that some good lawmakers want to give the other side a value-added tax.

One of my colleagues at the Cato Institute, Chris Edwards, wrote a column on this topic for National Review. Here are some key excerpts.

Senators Ted Cruz and Rand Paul are strong advocates of limited government. …That is why their embrace of the value-added tax (VAT) in their presidential campaigns is so baffling. VATs are the revenue engine of big-government welfare states, not a proper funding source for the small federal government that both senators favor for America. …the candidates hide behind innocuous names — “business flat tax” for Cruz and “business transfer tax” for Paul.

But calling something a “business tax” doesn’t mean the burden is borne by businesses.

The tab for taxes collected from businesses is ultimately passed through to individuals in the form of lower wages, reduced dividends, or higher prices. …VATs have huge bases. That’s because — unlike income taxes — they do not allow businesses to deduct employee compensation when calculating the taxable amount. …The result would be that tax revenues from businesses under the Cruz and Paul VATs would be enormous.

In other words, the VAT is – among other things – a withholding tax on labor income. And that’s why this levy generates a huge amount of revenue.

To make matters worse, this giant tax is hidden from voters.

Because Cruz and Paul shift much of the collection to businesses, more of the tax burden gets hidden from citizens and voters. …If the government is going to take our money, it should mug us on the street in broad daylight, rather than sneak into our homes at night and burglarize us unnoticed. The VAT would encourage more burglary.

And this hidden tax also will give statists an easy method of financing an ever-expanding burden of government spending

And this hidden tax also will give statists an easy method of financing an ever-expanding burden of government spending

Cruz and Paul want smaller government, but down the road, other politicians looking to shore up entitlement programs will say, “They could be financed with just a small tax increase on businesses.” But each “small” increase in the VAT rate would transfer huge amounts of additional cash from the private economy to the government.

Amen.

When I wrote about Sen. Cruz’s plan and Sen. Paul’s plan, I specifically pointed out that the VATs needed to be jettisoned.

But Chris makes an even stronger case. And he’s correct. Adopting a VAT would be a cataclysmic error for advocates of limited government.

It would be a truly perverse tragedy if the other side eventually gets a VAT because well-meaning (but misguided) conservatives paved the way.

P.S. The left also is salivating for a broad-based energy tax.

[…] argument is compelling when I’m speaking to conservatives (though not all of them, apparently!), but I need different arguments when talking to my friends on the […]

[…] argument is compelling when I’m speaking to conservatives (though not all of them, apparently!), but I need different arguments when talking to my friends on the […]

[…] Everything that has happened since that video was released in 2009 underscores why it would be incredibly misguided to give Washington a big new source of tax revenue. And that’s true even if the people pushing a VAT have their hearts in the right place. […]

[…] I’m also not surprised that they embraced a carbon tax or value-added tax. […]

[…] is why many statists are pushing so hard for the VAT. It’s a money machine for big […]

[…] Of course they’ll target the middle class. That’s what they want in Washington. That’s why they want a value-added tax. […]

[…] Growing support for the value-added tax from Republicans – At the risk of hyperbole, I view the value-added tax as the single-greatest threat to the long-run viability of the United States. Simply stated, our ability to restrain the growth of spending will be terribly weakened if politicians get this new source of revenue. Why would they ever reform entitlements, for instance, if they had the ability boost the VAT rate by a point or two every few years? With that in mind, I’m perplexed and horrified that some otherwise sensible lawmakers (including Rand Paul and Ted Cruz) have embraced this money machine for big government. I don’t care if their plans are theoretically sensible. I worry about what will happen in the real world. […]

[…] Rand Paul and Ted Cruz included value-added taxes in their otherwise good tax plans. This was a horrible mistake. A value-added tax may be fine in theory, but giving politicians another source of revenue without […]

[…] also have a separate collection of statists who are honest enough to admit that their real goal is higher taxes on the middle class (mostly by […]

[…] would much rather find additional tax revenues to enable this expansion of the welfare state. And their target is the middle class, which is why they very much want a […]

[…] But the second and more serious response is to point out that lots of statists openly say they want a VAT to make government bigger. […]

[…] my concerns, I was understandably distressed that two lawmakers (and presidential candidates) who normally support smaller government, Rand Paul […]

[…] like about the Paul and Cruz plans, by contrast, is that future politicians could much more easily turn America into France or […]

[…] like about the Paul and Cruz plans, by contrast, is that future politicians could much more easily turn America into France or […]

[…] like about the Paul and Cruz plans, by contrast, is that future politicians could much more easily turn America into France or […]

[…] like about the Paul and Cruz plans, by contrast, is that future politicians could much more easily turn America into France or […]

[…] Ted Cruz are more aggressive taking big steps in the right direction, but the value-added tax is a very worrisome feature of their […]

[…] you don’t have to believe me. Folks on the left openly admit that a VAT is necessary to make America more like […]

[…] Sometimes the best way to help the cause of freedom is to stop a bad idea. And that’s why I’m vociferously opposed to a value-added tax. […]

What if the VAT had an attached amendment requiring a supermajority vote to adjust the rate, similar to what is proposed in the FairTax? Perhaps not a Constitutional amendment, but certainly a requirement for a supermajority in Congress to do so.

It has surprised me that neither Senators Paul nor Cruz took up the FairTax, which would do essentially what Mr. Edwards proposed: “…If the government is going to take our money, it should mug us on the street in broad daylight, rather than sneak into our homes at night and burglarize us unnoticed.”

To clarify, earned income taxes, FairTaxes, NST’s, and VAT’s are all consumption taxes. The only difference is when and how the tax is collected. They are consumption taxes in that taxes collected are built into the final price of the goods, for domestic consumption. Therefore consumers ultimately pay the tax.

Any increase in any of the above taxes increases the final price to consumers.

Since the poor save nothing and the middle class saves little, while top earners save a larger portion of their net pay; consumption taxes land most heavily on the poor and middle class.

A VAT that does not exclude gross salaries paid is a double [cascading] tax, or tax on a tax, if salaries are taxed separately.

VAT, as a broad based regressive tax on the middle class and poor, becomes inevitable in order to counter the progressivist limits of the income tax.

Once the progressive income tax is complemented by the regressive VAT, overall taxation becomes flatter. Everybody pays much higher taxes.

In some perverse way, just as liberals give priority to equality, even if everyone is poorer, some conservatives give priority to flatter overall taxation, even if everyone has to be taxed much more heavily.

This is especially true for conservative politicians. Because while these politicians must talk the smaller government talk to extract a percentage of the vote, the intrinsic interest of the politician is in higher taxes. Higher taxes means more money to manage through the political process, more political power, more importance, more fame, more political jobs.

So as a majority of politicians simultaneously sell a smoothing out of income inequalities AND more government services, heavy taxation of all wealth groups becomes inevitable.

When all taxes are considered, Europe’s middle class and poor pay overwhelmingly higher taxes compared to their American counterparts. Americans are poised to join.

With less income inequality, the middle class becomes the inevitable main tax workhorse.

A less motivated workhorse who then loses (even if marginally so) in worldwide competition — and as a result his country grows at only half the world average, or less, for a few decades, and his country becomes a middle income country by mid-century. He then finds himself in the true middle class. The worldwide middle class. A middle income person, in a middle income country by mid-century.

American voters would only have to bite VAT once. Once established there will be no way back. No country has ever backtracked on the imposition of VAT. And virtually all countries have experienced ever rising VAT rates once the tax is established.

Evidence is mounting that America’s convergence into the middle income country group, by the mid-late twenty first century, is pretty much baked in the cake at this point.

Voters are almost preprogrammed to ferret out of the general population those individuals who either rationally or serendipitously promote catastrophic policies, and elevate those individuals as powerful politicians into high office.

When the voter becomes a lemming there’s no salvation. Democracy becomes apoptotic and the country is fast absorbed into worldwide averagedom. As the pace of everything human irreversibly accelerates, these transformations will conclude in shorter and shorter times. Voter-lemmings will get to sleep in the bed they are making, well within their own lifetimes. The slow era of passing self-destructive decisions onto future generations has irreversibly passed for virtually all humans on this planet. This is a reality the modern voter has yet to assimilate.

[…] Reposted from International Liberty […]