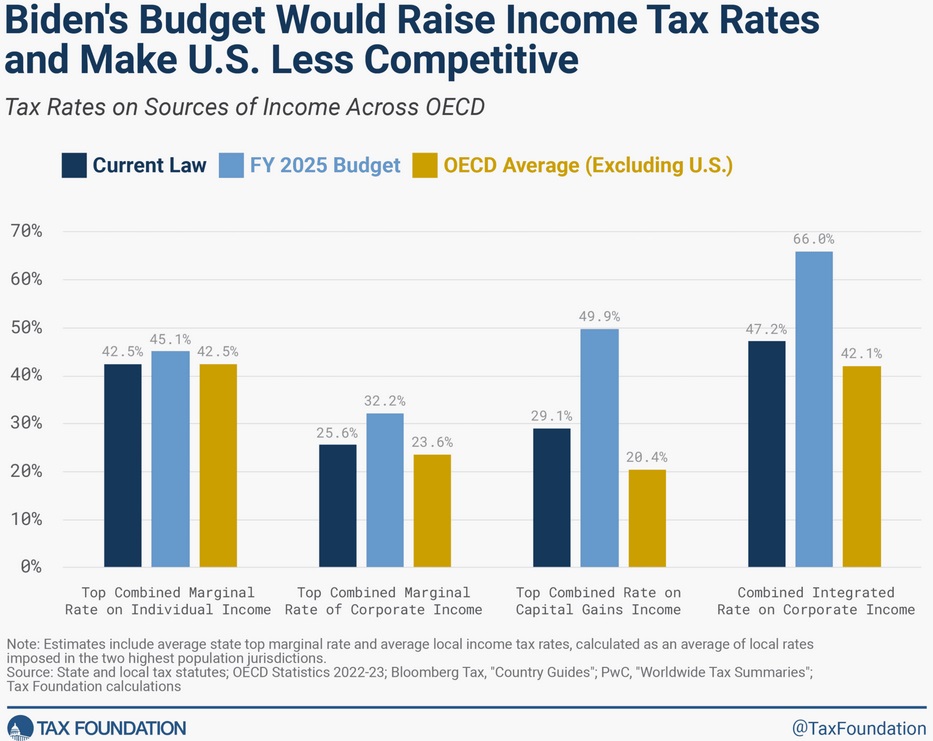

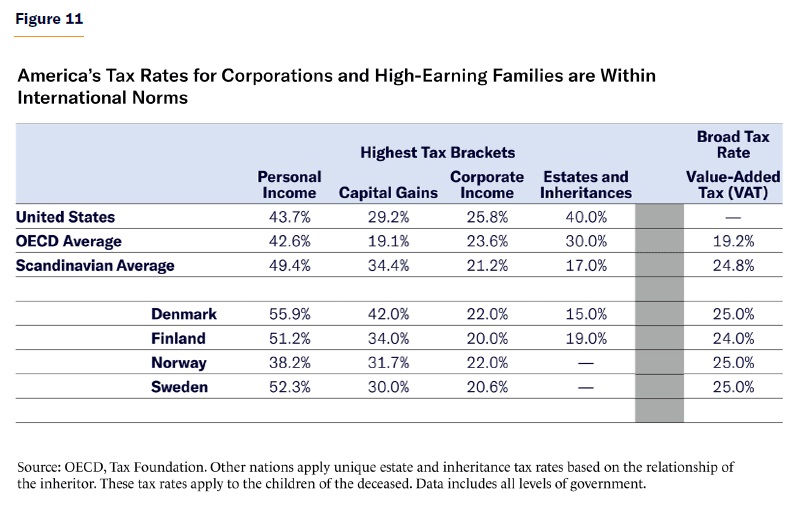

Less than two months ago, I shared a chart looking at tax burdens on saving and investment in the industrialized world.

The nation with the lowest tax burden on capital was Lithuania (unsurprisingly, all of the Baltic countries scored well).

The country with the worst tax treatment of capital, by contrast, was Canada.

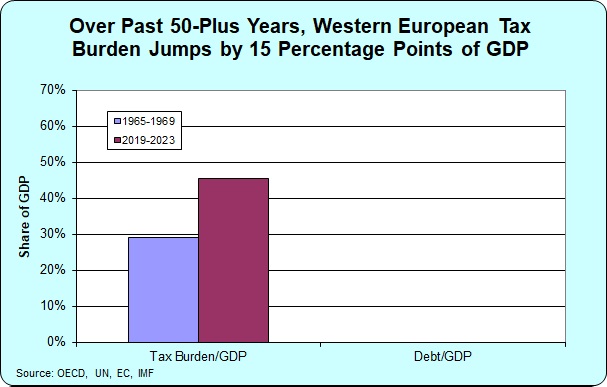

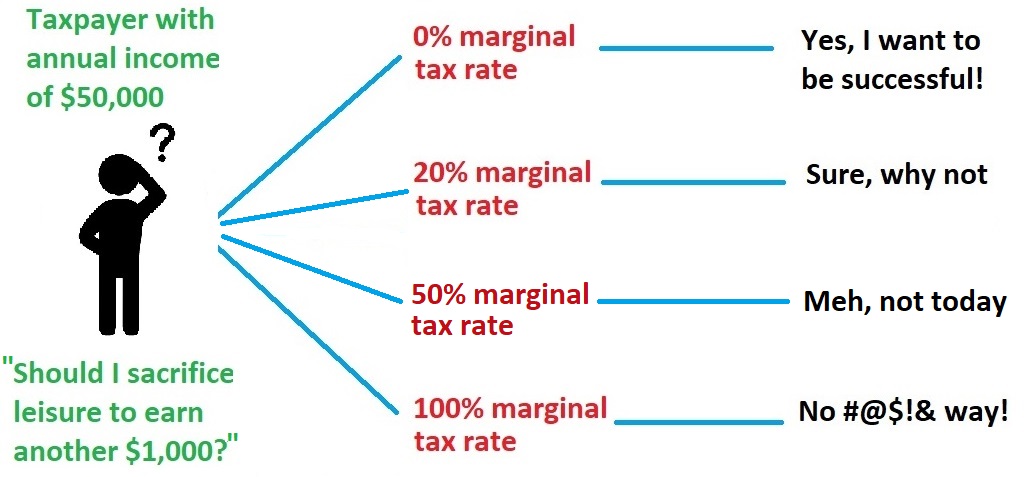

As you can see, the average tax burden on saving and investment is 50 percent. That’s even worse than Denmark and France.

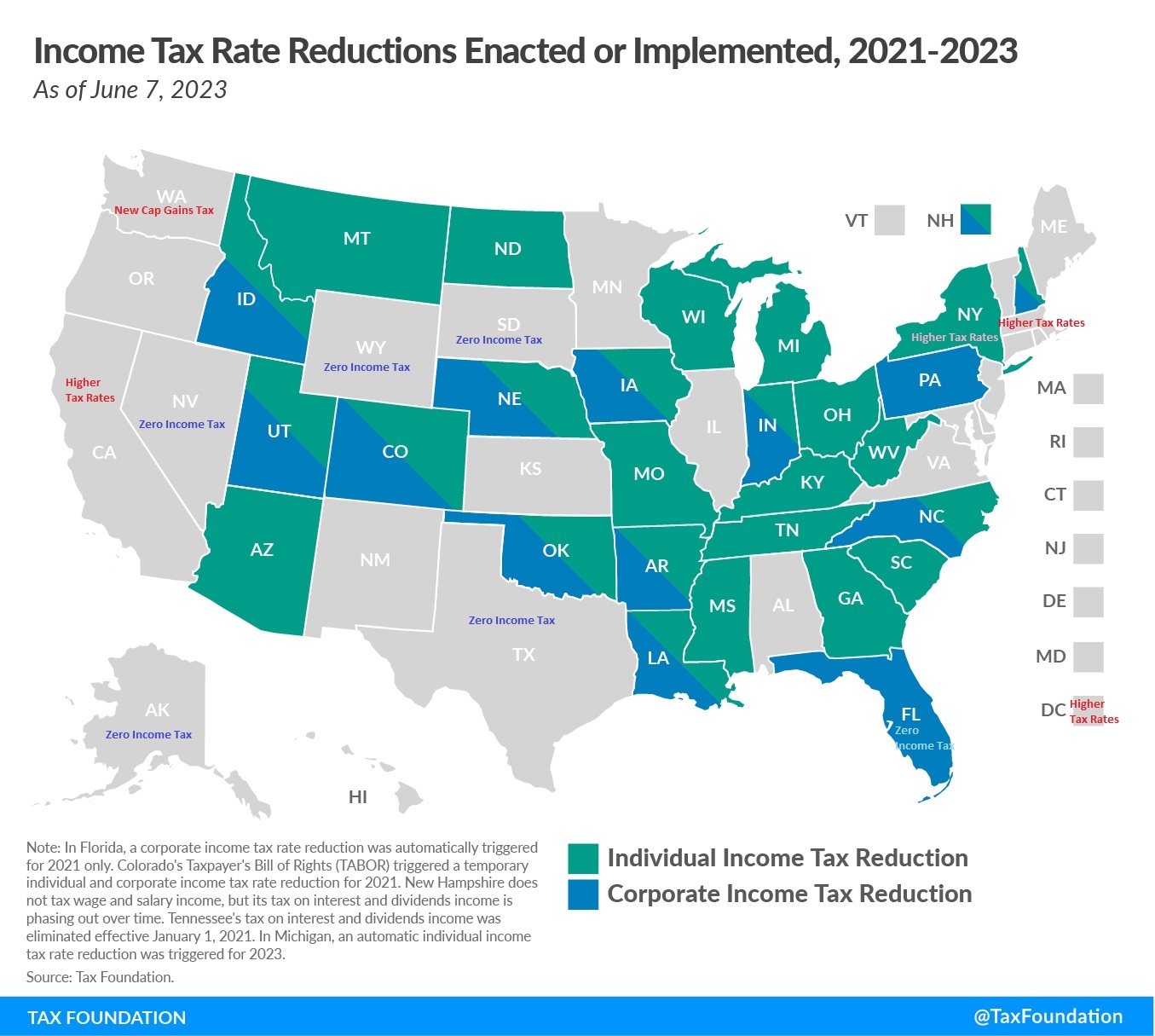

Assuming the goal is to boost prosperity and competitiveness, the logical response to this depressing data is for Canada to lower taxes on capital.

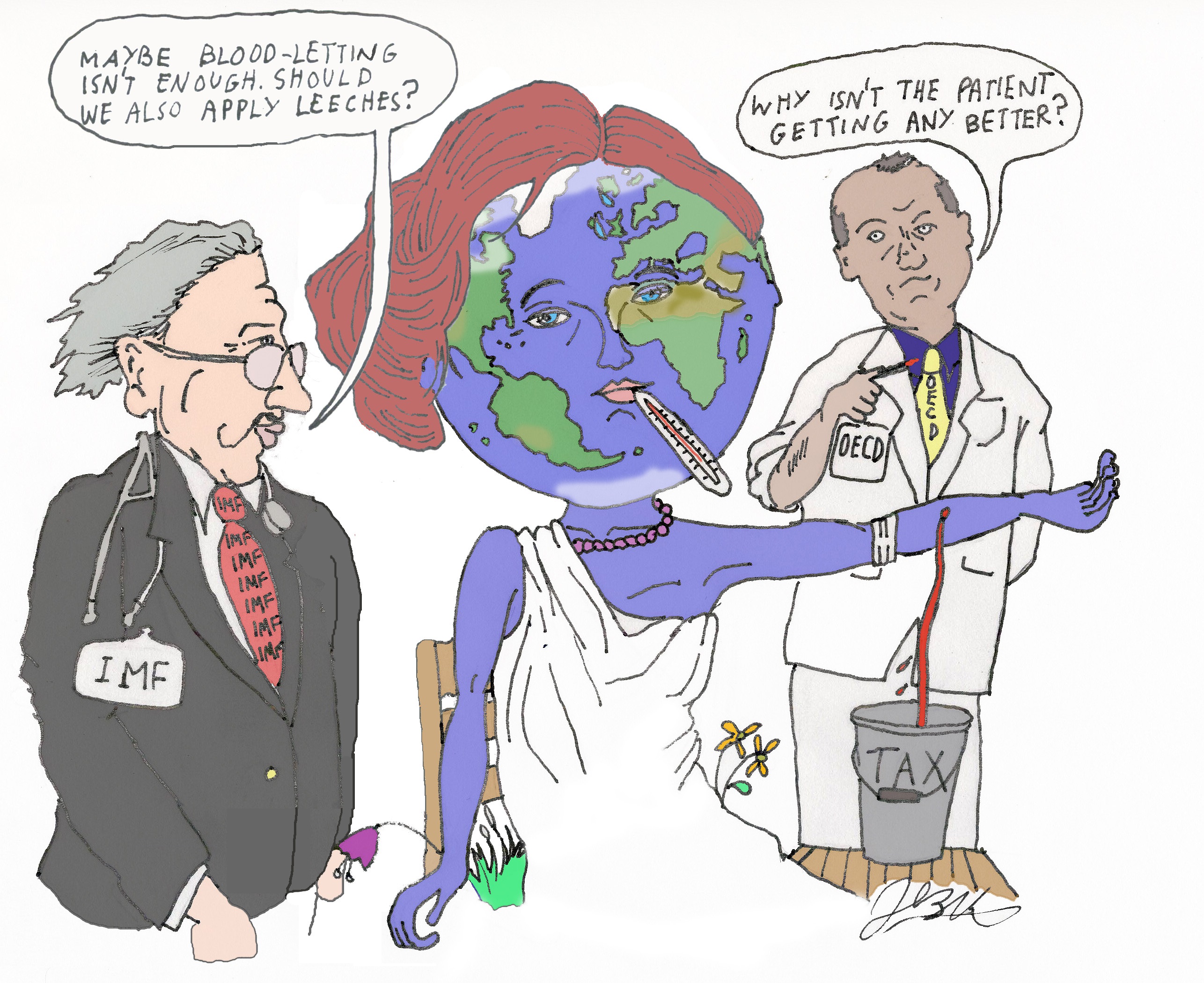

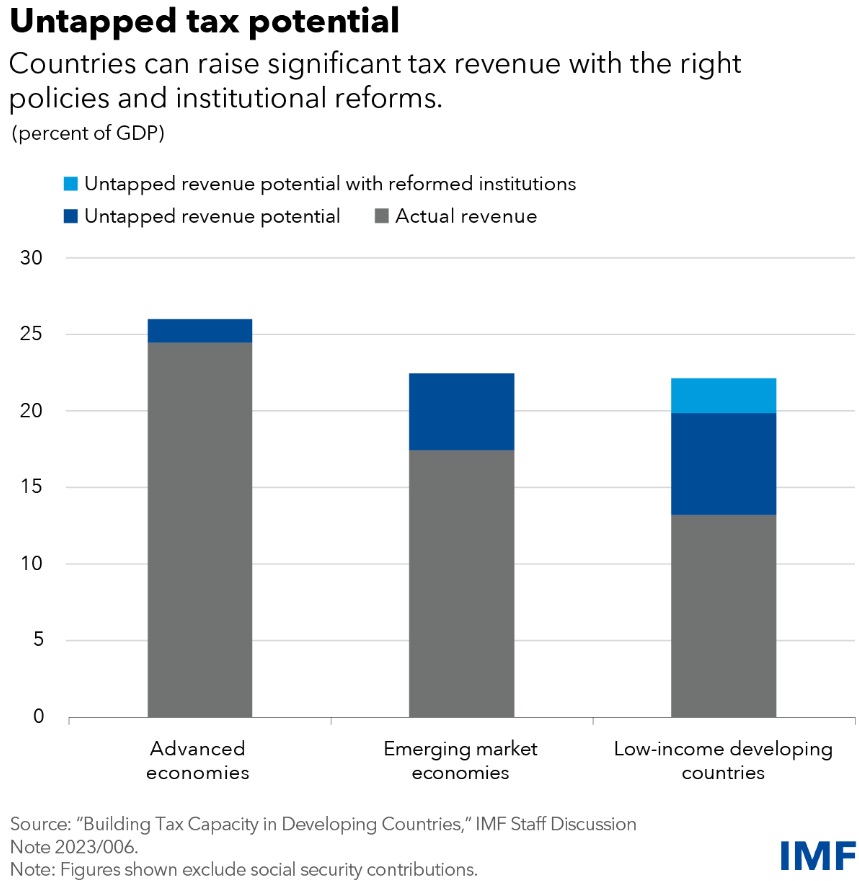

The International Monetary Fund, however, is not logical. That bureaucracy recently assessed the Canadian economy.

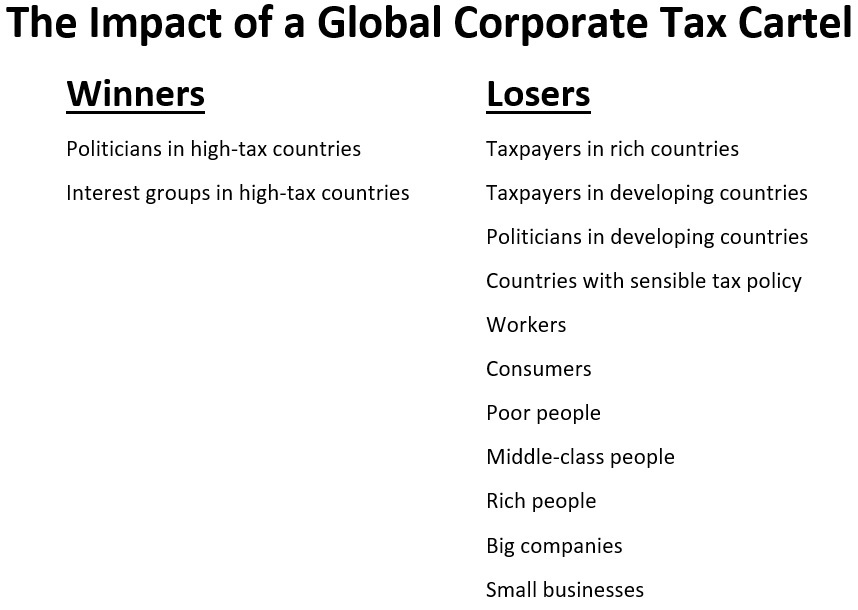

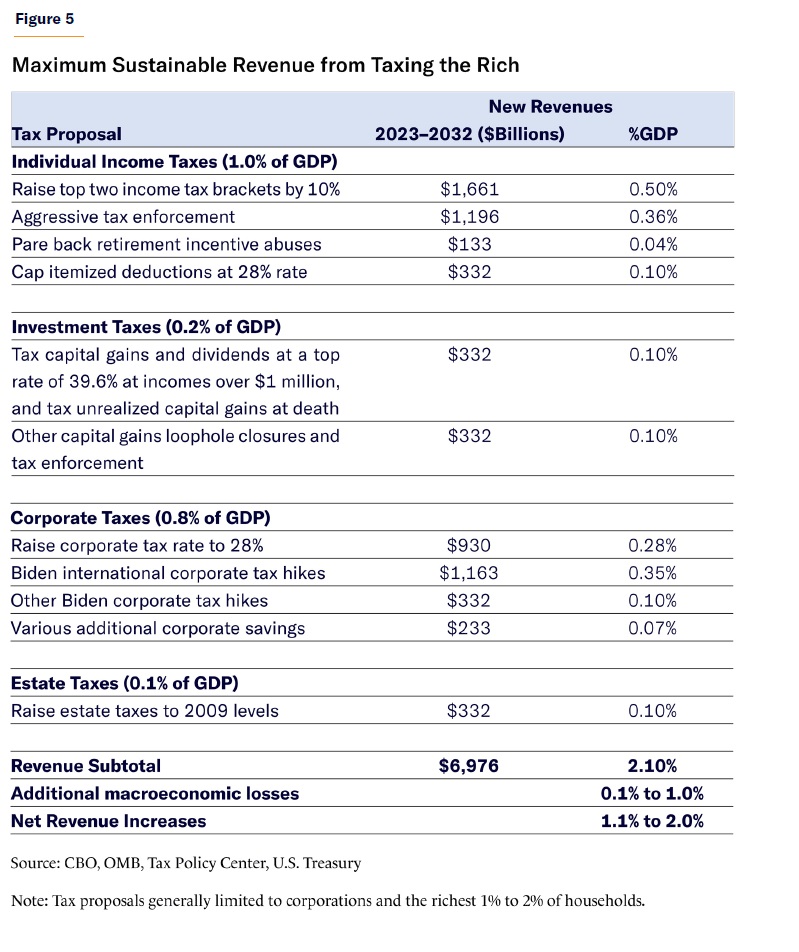

Not only did the bureaucrats recommend tax increases (the IMF’s reflexive answer to any question) and a bigger burden of spending, they actually endorsed higher taxes on capital.

I’m not joking, Here are some excerpts.

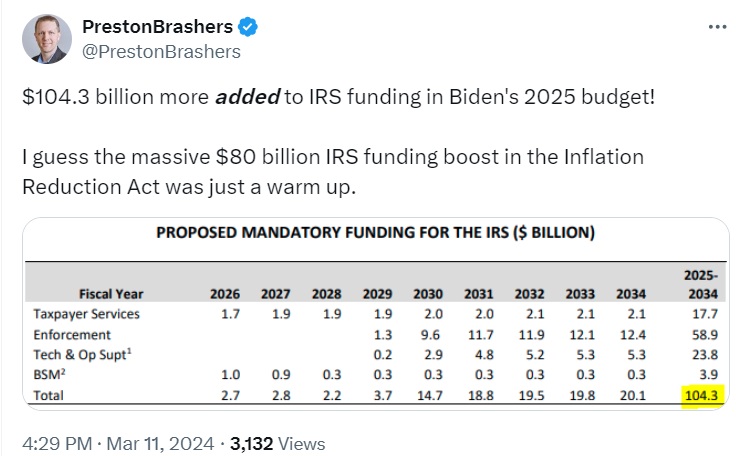

…further consolidation will put Canada in a stronger position to address…structural spending needs related to climate, defense, healthcare, and other critical areas.

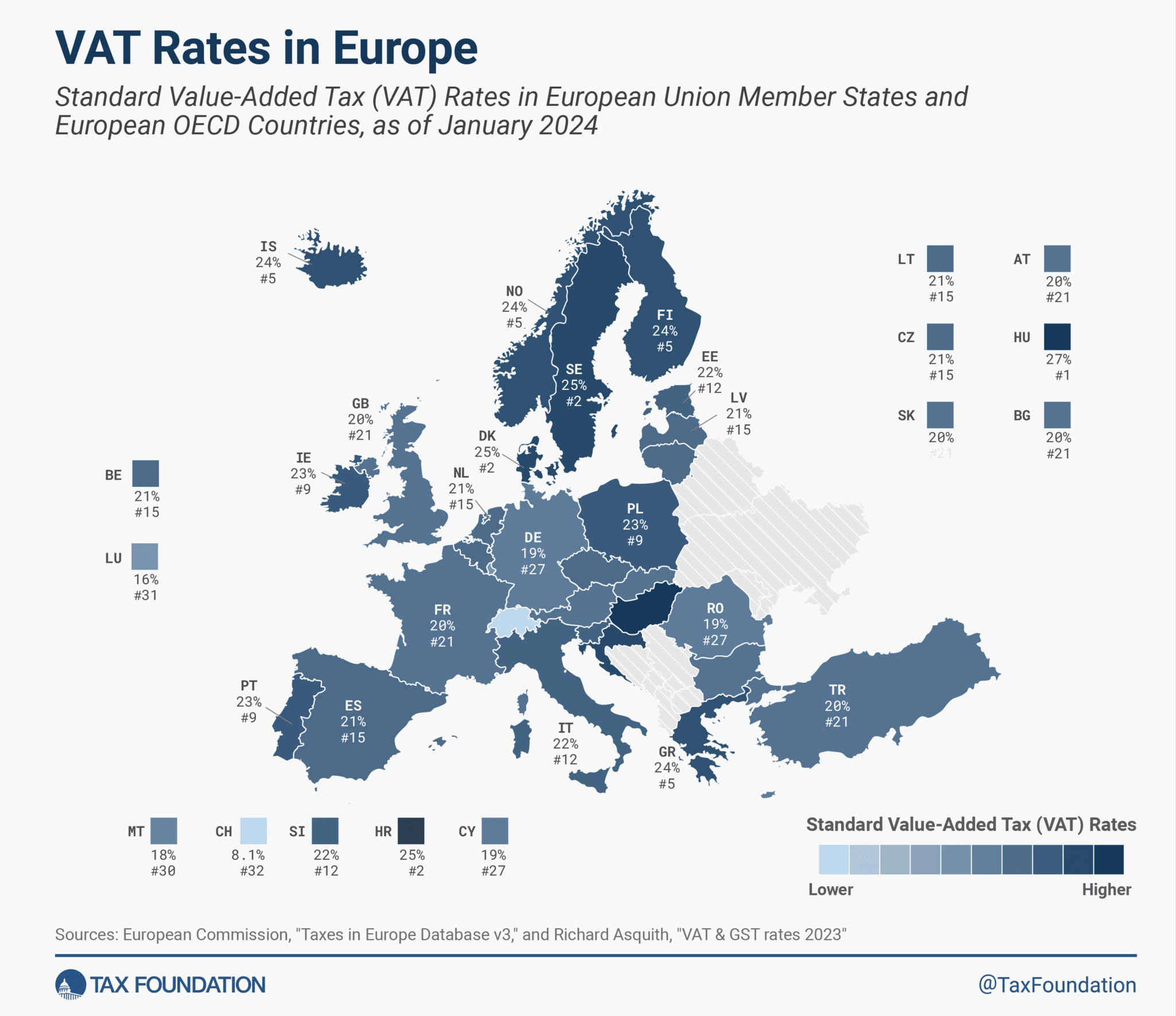

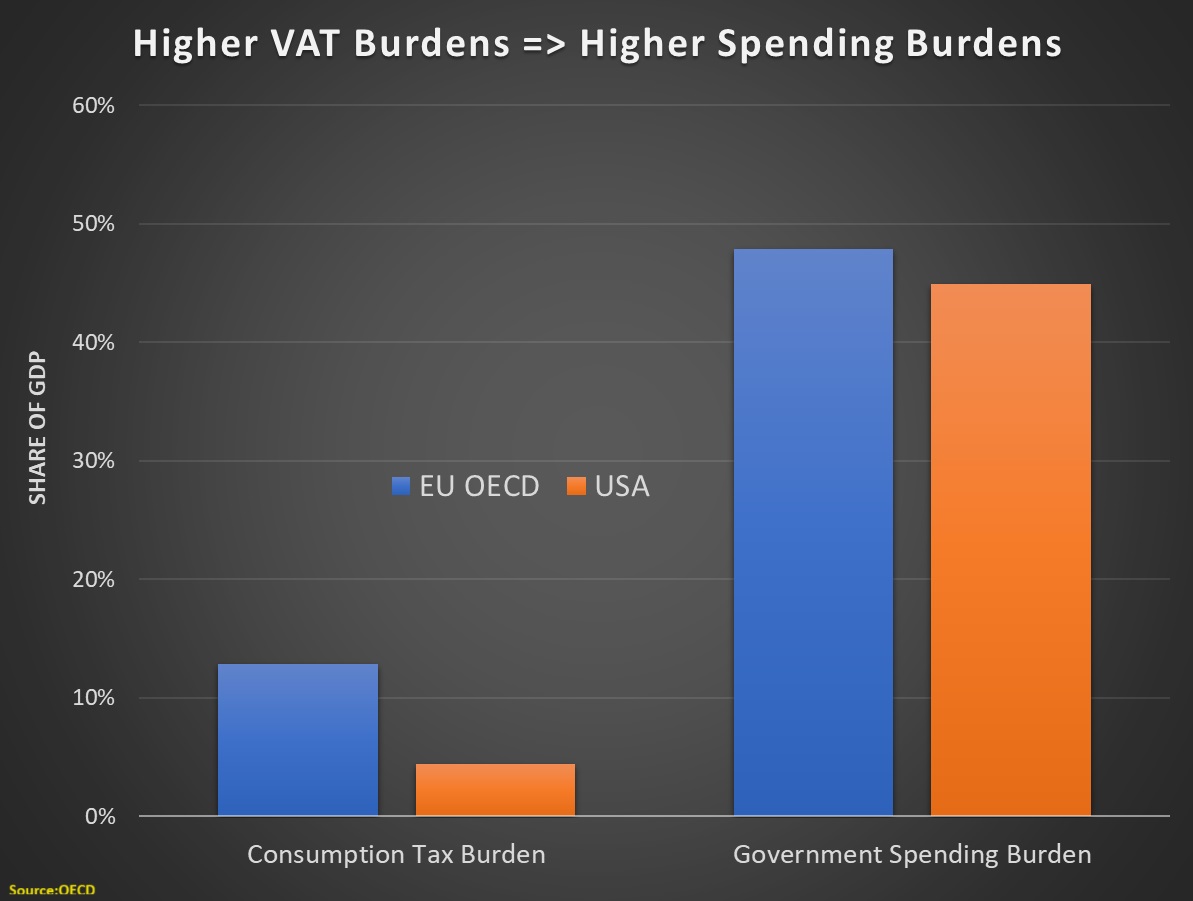

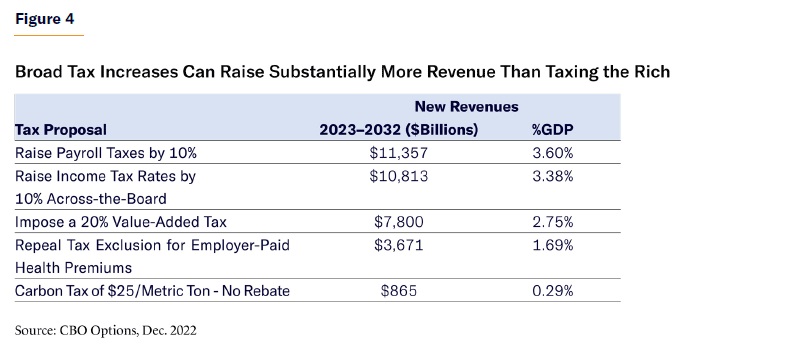

Thus, while the spending initiatives in the federal budget are appropriate, they should have been offset through greater revenue mobilization. The increase in the capital gains inclusion rate improves the tax system… Consideration could be given to other changes—such as an increase in the GST rate.

This is awful advice.

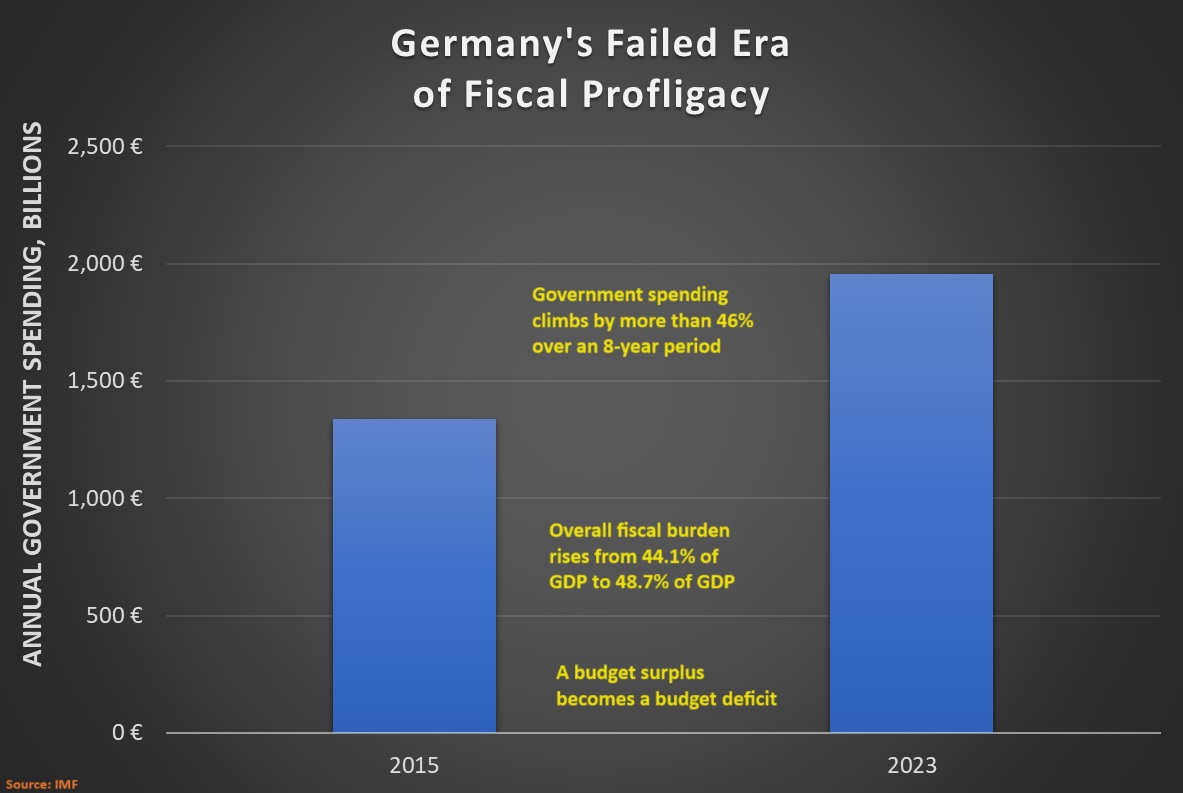

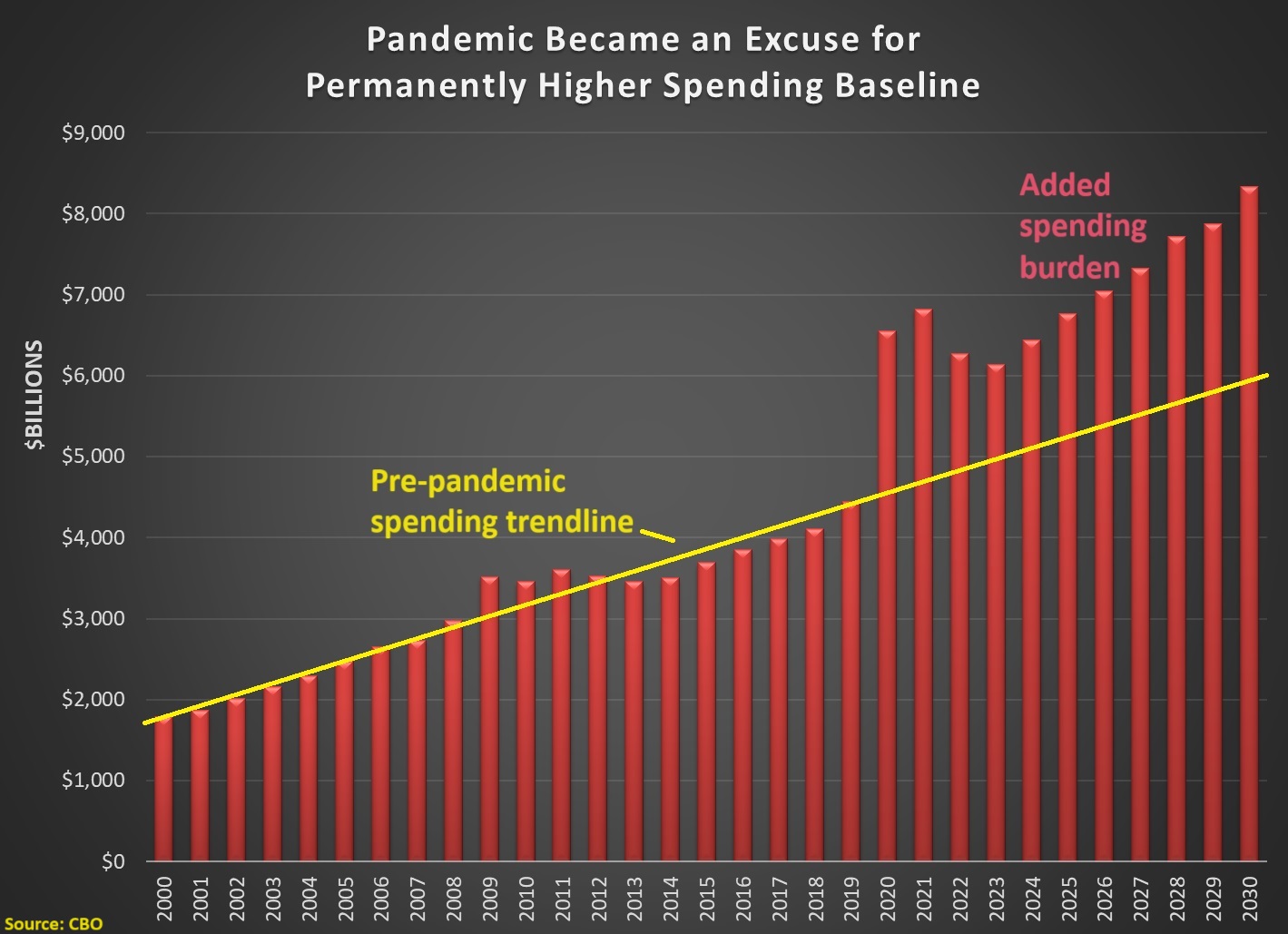

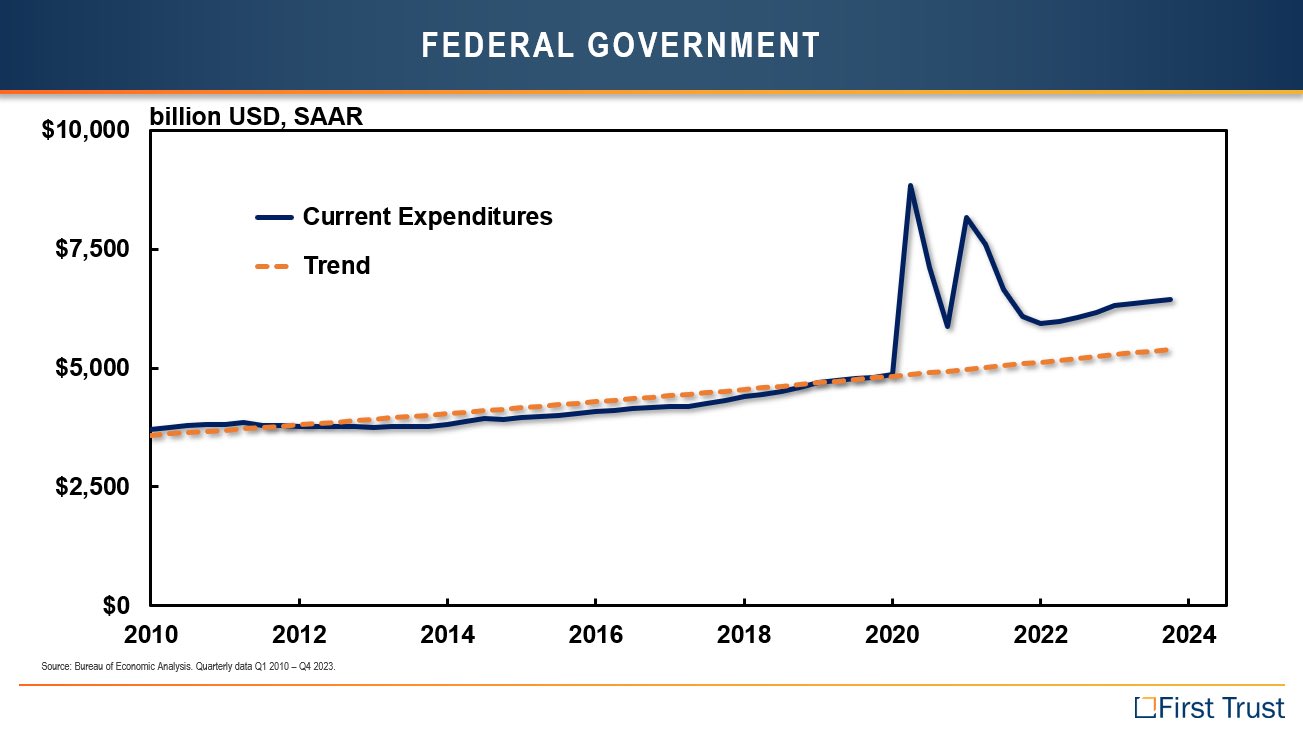

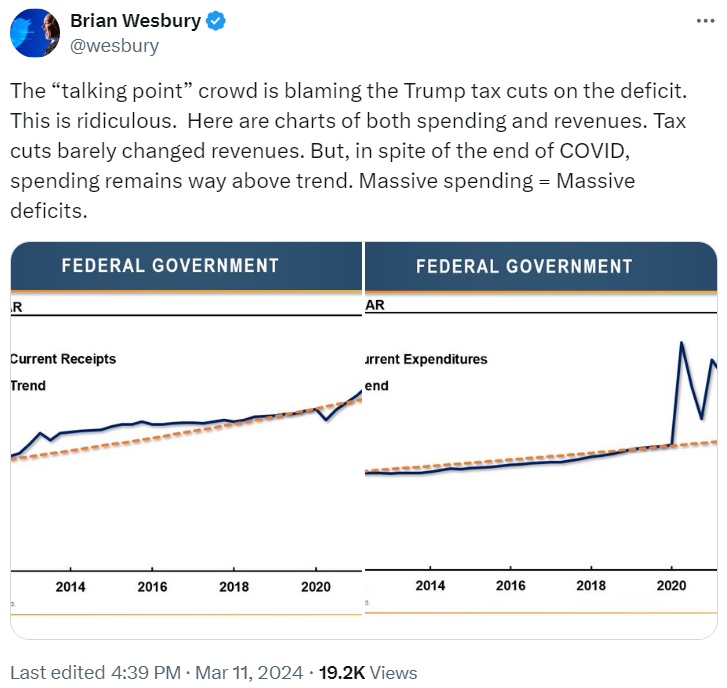

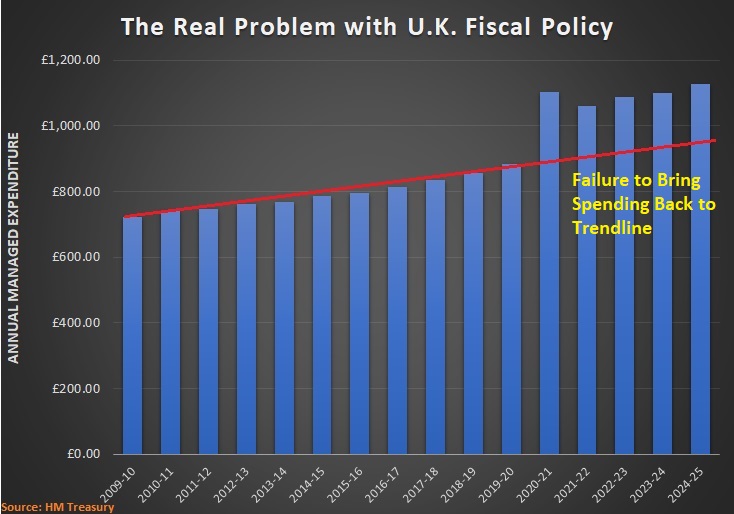

Canada’s fiscal situation is troubling for one simple reason. The current Prime Minister, Justin Trudeau, has been spending too much money (something I warned about shortly after he took office).

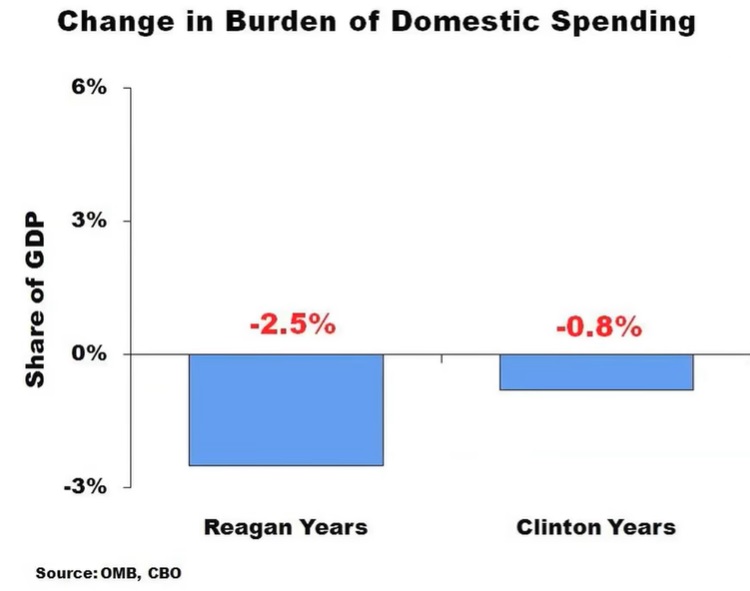

Indeed, according to the IMF’s own data, Trudeau has increased spending twice as fast as inflation since taking office. Reversing that mistake is the advice Canada needs (and it’s an approach that Liberal Party politicians have actually implemented in the past).

But don’t hold your breath waiting for fiscal prudence from Trudeau.

P.S. This is a bit of inside baseball, but the IMF generally tailors its recommendations to match the preferences of the politicians who control a country. This is not that surprising since IMF bureaucrats have very comfy jobs (with tax-free salaries!), so they have an incentive to curry favor with the national governments that have ultimate power over their lavish paychecks. So the IMF and Trudeau deserve joint blame for the latest IMF report.

P.P.S. Another flaw with the IMF report is that it praises Canada for reducing inflation but fails to point out that it was the Canadian government’s bad monetary policy that caused the inflation in the first place. Notwithstanding the vapid comments from one central banker, inflation doesn’t magically materialize out of thin air.