It usually is not fun writing about public policy, given my libertarian sentiments.

After all, politicians have a natural tendency to expand their powers and diminish our liberties.

So where there is occasional good news, I like to relish the moment.

For instance, I’ve been getting immense enjoyment from the progress on school choice over the past couple of years. Particularly the enactment of state-wide choice programs in West Virginia, Arizona, Iowa, and Utah.

Another area were we’ve seen big progress is state tax rates. I’ve also written about that topic, showing earlier this month how average top personal income tax rates have declined in recent years.

Today, let’s let a couple of maps tell the same story.

Here’s the Tax Foundation’s new map showing top personal tax rates for 2023. At the risk of stating the obvious, it’s best to be grey. But if you’re not grey, it’s good to be a lighter color and bad to be a darker color.

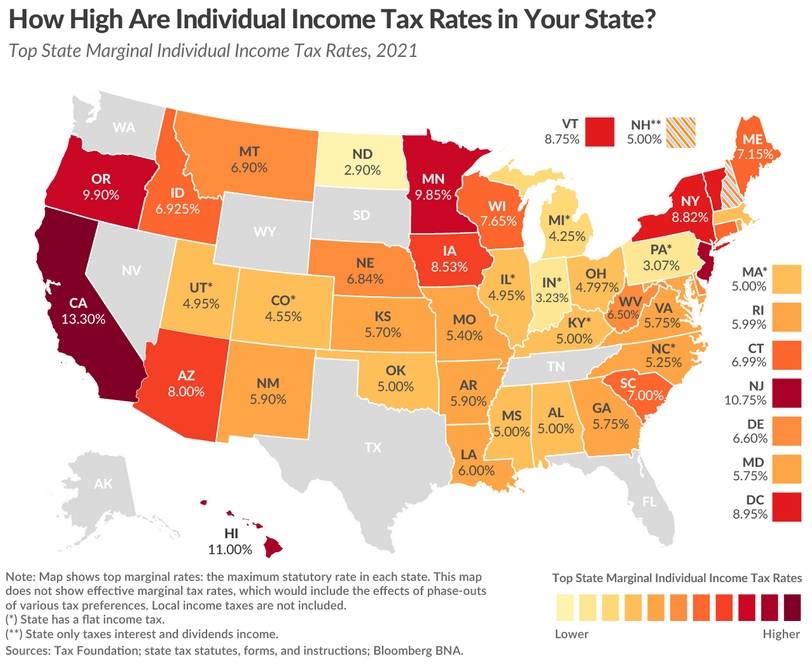

Now compare that map to the 2021 version. You’ll easily notice more dark-colored states.

But since the color schemes for the maps are not exactly the same, the best thing to compare numbers for specific states.

You’ll see some states have made huge progress, most notably Arizona and Iowa, but also incremental progress in most states.

By contrast, only a few states have moved in the wrong direction, most notably Massachusetts (thanks to a terrible referendum last November) and New York.

As you might expect, given the chance to “vote with their feet,” people and businesses are moving from high-tax states to low-tax states.

Yet that’s not stopping politicians in some high-tax states from agitating to push policy even further in the wrong direction. A very strange form of slow-motion economic suicide.

[…] Perhaps because Florida has no state income tax while California has the nation’s highest income tax rate. […]

[…] Perhaps because Florida has no state income tax while California has the nation’s highest income tax rate. […]

[…] people want warm weather as well, there are even more zero-tax options (Texas, Florida, etc) and flat-tax options (Arizona, North Carolina, […]

[…] people want warm weather as well, there are even more zero-tax options (Texas, Florida, etc) and flat-tax options (Arizona, North Carolina, […]

[…] There’s been great progress in recent years with regards to state tax policy. […]

I’m not seeing a big migration toward low tax states. Of the ten states receiving the highest number of people moving in (2021 being the most recent data I could find), six are pretty high tax states according to your map: Utah (4.95%), North Carolina (5.25%), Georgia (5.75%), Idaho (6.9%), South Carolina (7.0%), and Arizona (8.0%).

But who is suffering from tax cuts? Mostly children.

Kansas City Beacon Headline (4-12-22)

“Turnover among child protection workers in Kansas City region far outpacing Missouri’s average, deputy says”

[my note: The article deals largely with the difficulty of keeping caseworkers workers employed, obviously hurting the children they are assigned to.]

“Recruitment efforts are facing just as much difficulty. Rogers said that between March 2020 and October 2021, the number of applicants fell by 76%. At a recent hiring event in Kirksville, Missouri, no one showed up, Missey said.

“Those within the division and many lawmakers point to pay. Missouri’s caseworkers, who must have earned a bachelor’s degree to qualify, receive a starting salary of around $34,666. Iowa, Nebraska and Illinois all pay on average $10,000 higher as a starting salary. In Arkansas, where a bachelor’s degree is not required, the starting salary is nearly $2,000 higher than Missouri’s, at $36,000. The starting salary in Kansas was raised to $40,000 in 2018.

“Caseworkers in Missouri are supposed to manage 15 cases for children who are under the care of the state, according to accreditation standards. Missey said he has been talking with workers across the state, and not a single worker has had only 15 cases. One employee in Liberty, Missouri, was managing 38 cases, he said.

“High caseloads make it next to impossible for social workers to do anything more than meet the minimum mandates, instead leaving workers “triaging,” Ingle said.

“’I can tell you that the Children’s Division has an absolute crisis,’” she said. ‘That means that the kids of the state of Missouri and the families in the state of Missouri are in crisis.’”

But, of course, who cares about the plight of poor children when we can line the pockets of the wealthy? According to an independent analysis of the plan reported by the Kansas City Beacon on October 4, 2022, those earning $55,000 could expect to receive a $66 tax break. Those earning $550,000 could expect a $4,200 tax break. So, earn ten times as much and get 64 times as much tax break. Tax rates will continue to fall each year. By the time the Missouri plan is fully in place, the middle 20 percent earners would be saving an average of $131 a year, while the top 1% would be saving over $9,500. Dickens would have loved this.