Why does the tax code require more than 10,000,000 words and more than 75,000 pages?

There are several reasons and none of them are good. But if you had to pick one cause for all the mess, it would be the fact that politicians have worked with interest groups and lobbyists to create myriad deductions, credits, exclusions, preferences, exemptions, and other loopholes.

to create myriad deductions, credits, exclusions, preferences, exemptions, and other loopholes.

This is a great deal for the lobbyists, who get big fees. It’s a great scam for politicians, who get lots of contributions. And it’s a great outcome for interest groups, who benefit from back-door industrial policy that distorts the economy.

But it’s not great for the American people or the American economy.

Writing for Reason, Veronique de Rugy of the Mercatus Center explains that the net result is a Byzantine tax code that imposes very harsh compliance costs on the productive sector.

According to a 2012 study from the Internal Revenue Service (IRS) and the Treasury Department, …corporations alone spent $104 billion complying with the tax code in 2012. …The cost to individuals may be even higher. According to a 2013 study by Jason Fichtner and Jacob Feldman of the Mercatus Center, Americans face nearly $1 trillion annually in hidden tax-compliance costs. …Why does tax compliance cost so much? The answer is largely that the Internal Revenue Code…is riddled with exclusions, exemptions, deductions, preferential rates, and credits.

And she also points to a solution.

Genuine reform would cut out loopholes that tilt the playing field in favor of those with political connections. It would also aim to provide lower tax rates, fewer tax brackets, and less double taxation of income that is saved and invested. Such measures would be good for growth, but they would also mean taking on the interest groups that benefit from swapping tax preferences for campaign cash.

Since I want to rip up the tax code and replace it with a simple and fair flat tax, this is music to my ears.

Of course, achieving genuine tax reform won’t be easy.

There’s the obvious political obstacle since all the groups that benefit from the current system (politicians, lobbyists, bureaucrats, cronyists, interest groups, and other insiders) will fiercely resist reform.

There’s also a policy obstacle because many people oppose loopholes in theory but they haven’t paid sufficient attention to the nuts-and-bolts details.

With that in mind, let’s set out a set of guiding principles for the elimination of tax loopholes and the creation of a neutral tax system.

1. A loophole exists when income isn’t taxed – In libertarian Nirvana, the central government is so small that there’s no need for an income tax. Until we get to that point, though, we’re stuck with the internal revenue code and the goal should be to collect revenue (hopefully a modest amount) in a way that minimizes the economic damage per dollar collected. And that means a tax code that doesn’t have loopholes, which are best defined as provisions that enable people to avoid any tax based on how they earn income or how they spend income. In a neutral system, all income is taxed one time.

2. The economy performs better without a loophole-riddled tax code – Most people understand that high tax rates are bad for growth because they penalize people for earning income. They also generally understand that double taxation of saving and investment is bad for growth because it creates a bias against capital formation. But there’s not nearly enough appreciation of the fact that loopholes in the code are bad for growth since they are a back-door form of industrial policy that exist for the purpose of incentivizing people to make decisions on the basis of tax rather than on the basis of what makes economic sense. A neutral tax system means less economic damage.

3. It’s not a loophole to protect income from double taxation or to require income to be measured correctly – The bad news is that the current system forces taxpayers to overstate their income and it also imposes multiple layers of tax on income that is saved and invested. The good news is that there are provisions in the tax code – such as IRAs, 401(k)s, deferral, bonus depreciation – that seek to mitigate these biases. These parts of the system oftentimes are needlessly complex and they frequently will alleviate penalties in a discriminatory manner, but they are not loopholes. In a neutral system, all income is taxed only one time.

multiple layers of tax on income that is saved and invested. The good news is that there are provisions in the tax code – such as IRAs, 401(k)s, deferral, bonus depreciation – that seek to mitigate these biases. These parts of the system oftentimes are needlessly complex and they frequently will alleviate penalties in a discriminatory manner, but they are not loopholes. In a neutral system, all income is taxed only one time.

4. Loopholes should be eliminated as part of a plan to lower tax rates, not in order to give politicians more money – If loopholes are a corrupt and distorting dark cloud, the silver lining to that cloud is that all the special favors in the tax code deprive the government of tax revenue. Even the most egregious of loopholes, such as ethanol, have this redeeming feature. This is why loopholes should only be eliminated as part of an overall tax reform plan that also lowers tax rates and reduces double taxation. A neutral tax system shouldn’t enable bigger government.

There are some important implications that follow from these four guiding principles.

As a practical matter, we can now identify provisions in the tax code that are clearly loopholes, such as the healthcare exclusion, the municipal bond exemption, and the state and local tax deduction (the mortgage interest deduction is misguided, but isn’t technically a loophole since one of the goals of tax reform is to give business investment the same tax-income-only-one-time treatment now reserved for residential real estate).

We also know that the capital gains tax rate isn’t a “preferential” loophole, but instead is the mitigation of a penalty that shouldn’t exist. Similarly, it’s not a loophole when companies deduct expenses when calculating income. And you’re not getting some sort of handout simply because Uncle Sam isn’t imposing double taxation on your retirement account. At the risk of repeating myself, all income should be taxed in a neutral system, but only one time.

Let’s close by looking at a few secondary – but still important – implications of a neutral tax code.

First, getting rid of loopholes won’t put a burden on poor and middle-income taxpayers for the simple reason that an overwhelming share of the benefits of these provisions go to high-income taxpayers.

First, getting rid of loopholes won’t put a burden on poor and middle-income taxpayers for the simple reason that an overwhelming share of the benefits of these provisions go to high-income taxpayers.

I’ve already shown how the vast majority of charitable deductions are taken by those making more than $200,000 per year.

The same is true for the state and local tax deduction and the healthcare exclusion.

And the Washington Post just editorialized that the home mortgage interest deduction is a boon for rich taxpayers as well.

The mortgage interest deduction is also a significant cause of after-tax income inequality: The top 20 percent of earners get 75 percent of the benefits; the top 1 percent get 15 percent, according to the Congressional Budget Office. …Specifically, 10 metropolitan “hot spot” counties (among them Los Angeles in California and Fairfax in Virginia) with the greatest number of mortgages larger than $500,000 accounted for 45.1 percent of all such mortgages nationally. Just eight California urban and suburban counties accounted for 40 percent of the national total. Outside of such tony coastal precincts, the only big-mortgage hot spots were resort destinations such as Martha’s Vineyard, Mass., and Vail, Colo. — where many homes are vacation places, not primary residences.

To be sure, the Post is misguided in that it wants to restrict tax preferences in order to finance a larger burden of government spending.

So I’m not expecting the editors to join a coalition for pro-growth tax reform.

The second implication is that a neutral tax system means less corruption.

To cite one example, consider the oleaginous way that politicians deal with so-called tax extenders. Marc Short and Andy Koenig explain in a column they wrote for the New York Times.

Congress will soon take up the so-called tax extenders package, which has more than 50 tax breaks affecting a variety of industries and issues. …this bill mostly helps the wealthy and the well connected.

The fact that rich insiders benefit is no surprise, but what makes “tax extenders” so odious is that what began in 1988 as a supposedly one-time fix now has become a regular part of the process, a scam that gives lobbyists and politicians a way of generating fees and contributions.

The first tax-extender package…opened a door that lobbyists and lawmakers were all too willing to run through. …A 2014 analysis by Americans for Tax Fairness found that more than one out of every 10 lobbyists in Washington focused specifically on the extenders package. Given that this bill comes up about every year or two, special interests constantly have the opportunity to demand new handouts.

By the way, some of the extenders actually are good policy. They’re in the mitigation-of-penalties category I discussed above.

But those good provisions should be made permanent and the bad provisions should be jettisoned.

Unfortunately, that’s not in the interests of the politicians and lobbyists who benefit from an annual extender package, so the problem doubtlessly will fester.

Last but not least, let’s consider the moral component.

For those of us who believe in justice, it is ethically offensive that some rich and powerful taxpayer get better treatment simply because they know how to manipulate the political process.

This violates the important principle that the law should treat everyone alike. Yet another reason to have a simple and fair flat tax.

P.S. At the risk of being a nit-picker about my own writing, I should confess that a flat tax is not a purely neutral tax system. There will still be a penalty on earning income. But the penalty presumably will be modest if there is a low rate and that penalty won’t be exacerbated by penalties and loopholes that distort how people earn income and spend income.

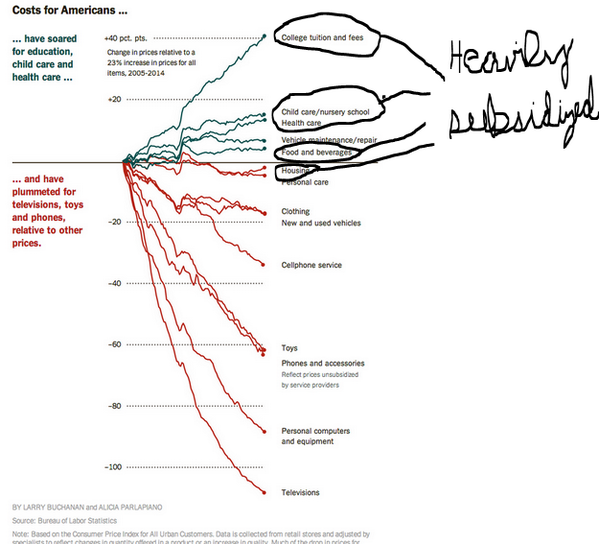

P.P.S. Here, in one image, is all you really need to know about the economics of taxation.

Read Full Post »

(not in my backyard) zoning policies have ensured that the area constructs only a fraction of the housing it needs. The San Francisco metro area added 373,000 new jobs between 2012 and 2017, but it allowed the construction of only 58,000 new units of housing. …Per Lawrence Yun, an economist who studies housing trends, the norm is for one housing unit to be built for every two jobs created. In the San Francisco area, there is less than one unit built for every six jobs created. …under Harris’s proposal, the currently homeless would remain homeless, while renters would receive some very short-term relief at the cost of other taxpayers.

income-tax revenue to the federal government. To start with, individuals and businesses must pay the government the $1 in revenue plus the costs of their own time spent filing and complying with the tax code; plus the tax collection costs of the IRS; plus the tax compliance outlays that individuals and businesses pay to help them file their taxes. In a study published last week by the Laffer Center, my colleagues Wayne Winegarden, John Childs and I estimate that these costs alone are a staggering $431 billion annually. This is a cost markup of 30 cents on every dollar paid in taxes. And this is not even a complete accounting of the costs of tax complexity. …David Keating of the National Taxpayers Union provides a useful perspective on how big the tax compliance industry is. According to his research, as of 2009 the income-tax industry employed “more workers than are employed at the five biggest employers among Fortune 500 companies—more than all the workers at Wal-Mart Stores, United Parcel Service, McDonald’s, International Business Machines, and Citigroup combined.” Without diminishing in any way the professionalism of tax attorneys, accountants and financial planners, all of these efforts produce nothing other than, well, tax compliance. …A tax reform to a simple flat-rate tax with no deductions would significantly reduce the current complexity inherent in our progressive tax system, which is full of loopholes, exemptions and special interest carve-outs. Based on the estimates from our new study, if a static, revenue-neutral flat-tax reform were to reduce the tax complexity in half, the long-term growth in our economy would increase by around one-half of 1% per year.

income-tax revenue to the federal government. To start with, individuals and businesses must pay the government the $1 in revenue plus the costs of their own time spent filing and complying with the tax code; plus the tax collection costs of the IRS; plus the tax compliance outlays that individuals and businesses pay to help them file their taxes. In a study published last week by the Laffer Center, my colleagues Wayne Winegarden, John Childs and I estimate that these costs alone are a staggering $431 billion annually. This is a cost markup of 30 cents on every dollar paid in taxes. And this is not even a complete accounting of the costs of tax complexity. …David Keating of the National Taxpayers Union provides a useful perspective on how big the tax compliance industry is. According to his research, as of 2009 the income-tax industry employed “more workers than are employed at the five biggest employers among Fortune 500 companies—more than all the workers at Wal-Mart Stores, United Parcel Service, McDonald’s, International Business Machines, and Citigroup combined.” Without diminishing in any way the professionalism of tax attorneys, accountants and financial planners, all of these efforts produce nothing other than, well, tax compliance. …A tax reform to a simple flat-rate tax with no deductions would significantly reduce the current complexity inherent in our progressive tax system, which is full of loopholes, exemptions and special interest carve-outs. Based on the estimates from our new study, if a static, revenue-neutral flat-tax reform were to reduce the tax complexity in half, the long-term growth in our economy would increase by around one-half of 1% per year.