I applauded when Joe Biden used clever tax strategies to reduce his (apparently unpatriotic) tax bill to the IRS. I also applauded when Bill and Hillary Clinton engaged in clever tax avoidance, as well as John Kerry and Gov. Pritzker of Illinois.

In the spirit of bipartisanship, I also applaud when Donald Trump does the same thing, and that part of what we’re going to discuss today.

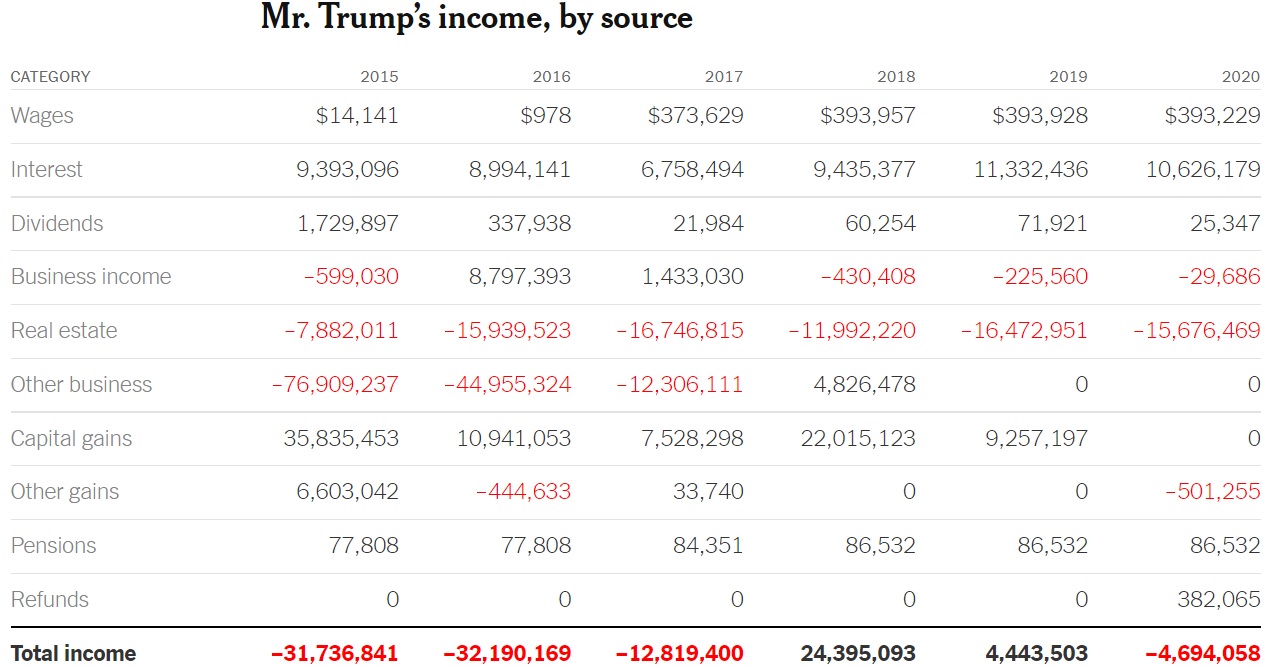

First, some background: The ongoing battle over Donald Trump’s personal tax information has finally ended. If you’re curious, the New York Times has a detailed report on what Trump earned (or lost) in recent years.

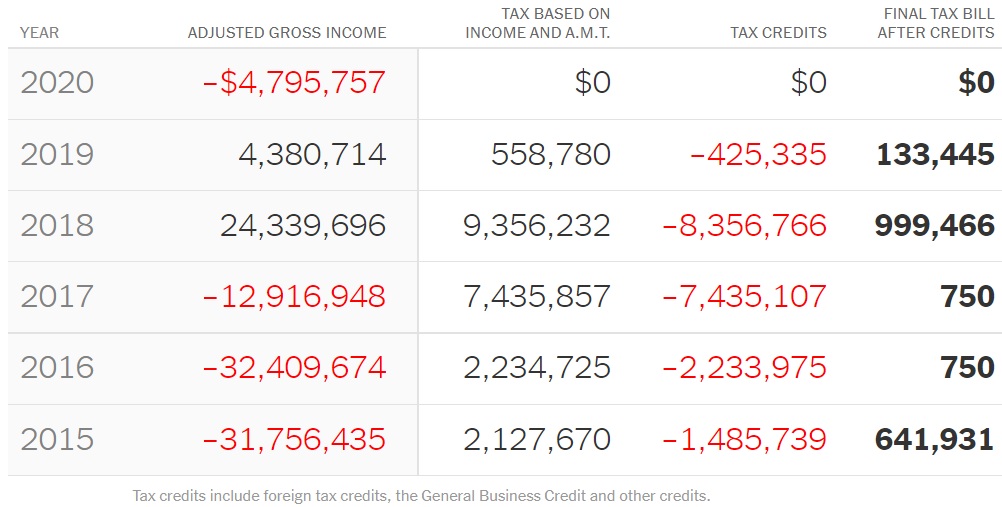

And the NYT also tells us how much tax he paid during those years.

When I look at these numbers, my first thought is that Trump is not a very good businessman since he has a negative income most years.

My second thought is that I’m glad he paid a low tax rate of about 3 percent in 2018 and approximately 4 percent in 2019, the two years when his income was positive.

Why am I glad? Because money in private hands is far more likely to be utilized wisely than money that gets diverted to the IRS and then spent by the politicians in Washington.

That’s the first part of today’s column.

The second part of today’s column is to use Trump’s tax return to show why the tax system would be much better if we junked the internal revenue code and replaced it with a simple and fair flat tax.

The flat is based on the principle of equality.

- All income tax taxed at the same low rate.

- No income is exempt from tax, other than a family-based allowance.

- No income is subject to double taxation.

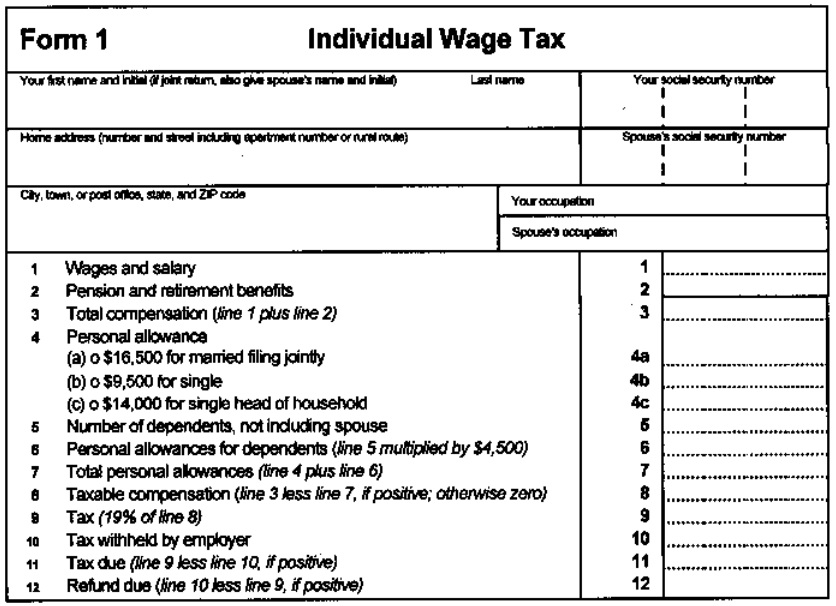

A tax system based on equality also means radical simplicity. The hundreds of different tax forms in today’s tax code would get dumped in the garbage.

All that would be left is a simple tax form for households.

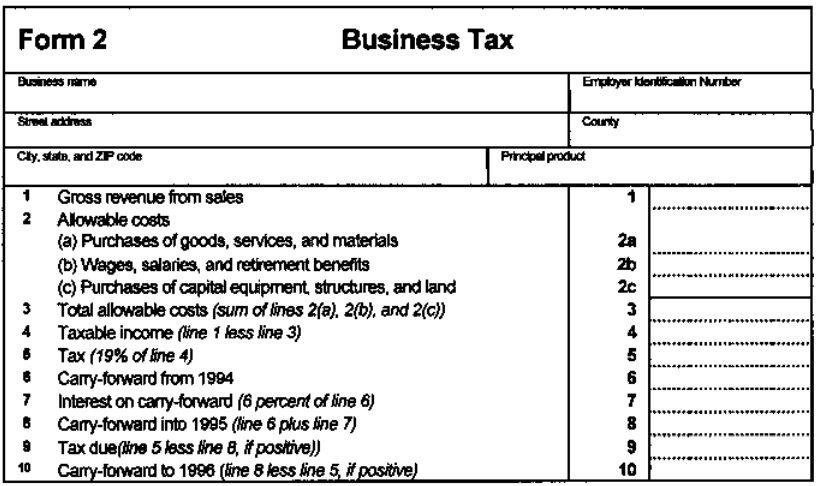

And a simple tax form for businesses.

What would this mean for Trump’s tax returns? I’m sure the implications would be enormous, but I want to focus on just two issues.

First, under the flat tax, business losses can not be used to lower taxes on household income (wages, salaries, and pensions). So that would probably mean a higher tax burden for Trump.

Second, the tax treatment of business changes in ways that would both help Trump and hurt Trump. The most important thing to realize is that the convoluted corporate income tax (as well as parts of the personal income tax such as Schedule C) are replaced by a very simple cash-flow system.

Here’s how Professors Robert Hall and Alvin Rabushka describe the business portion of the flat tax.

The business tax is a giant, comprehensive withholding tax on all types of income other than wages, salaries, and pensions. It is carefully designed to tax every bit of income outside of wages, but to tax it only once.

The business tax does not have deductions for interest payments, dividends, or any other type of payment to the owners of the business. As a result, all income that people receive from business activity has already been taxed. …The resulting simplification and improvement in the tax system is enormous. …Eliminating the deduction for interest paid by businesses is a central part of our general plan to tax business income at the source.

One very important implication of this approach is there there no longer would be a bias for debt. This would not be good news for people like Trump who usually rely on debt to finance their businesses.

On the other hand, the net result would be a tax code more favorable to investment and entrepreneurship. So if Trump is a good businessman, he will benefit.

I’m agnostic on Trump’s entrepreneurial ability, but I’m an unabashed fan of having a better tax system for America. Replacing the internal revenue code with a sensible tax system would mean a more prosperous country and a less corrupt Washington.

P.S. Under a flat tax, a business would be allowed to “carry forward” losses from previous years, just as is usually the case for the current system.

P.P.S. A flat tax also would replace depreciation with expensing, which is another policy favorable to smart entrepreneurs.