I repeatedly write about inequality, largely in hopes of helping people, especially my left-leaning friends, understand that we should instead focus on other issues, such as economic opportunity and poverty reduction. In other words, let’s try to help the less fortunate rather than tear down successful people

I specifically try to convince them that they shouldn’t be bothered if someone gets rich (assuming wealth is being earned rather than the result of handouts, bailouts, and subsidies from politicians). What matters is “growing the pie” so all of us have a chance to enjoy more prosperity.

But what if someone gets rich because of good luck? In other words, instead of becoming wealthy because of hard work, intelligence, or entrepreneurship, what if someone is simply the beneficiary of being attractive? Or being tall?

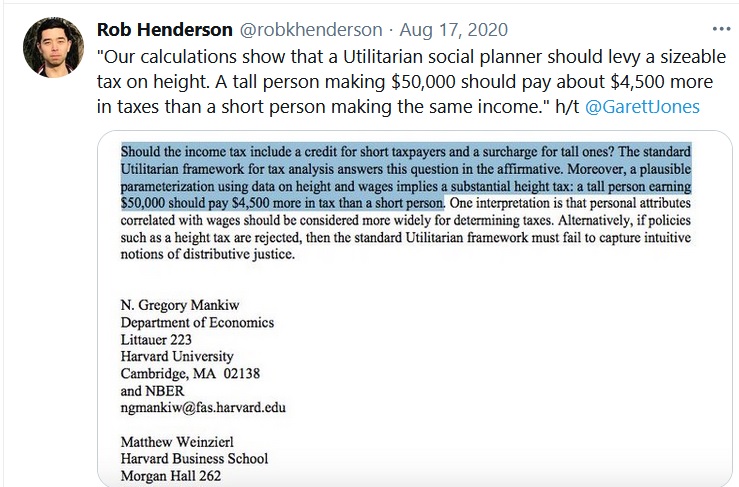

As captured by this tweet from Rob Henderson, this is not mere speculation.

I actually referenced Prof. Mankiw’s work when writing about this issue back in 2010.

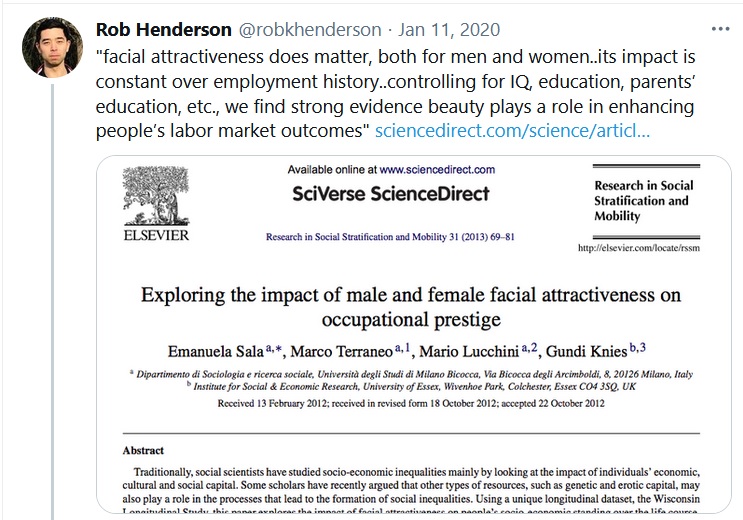

And I periodically come across new research on the economic advantages enjoyed by attractive folks.

Highly attractive women’s salaries are one-tenth higher than the average even at similar education and competence levels, a low attractivity means a loss of 4 percent, according to a study presented by sociologist Petra Anyzova at a workshop

based on a job market research project today. …Anyzova said that the results are similar to the findings of other studies and the trend suggests that men are disadvantaged if they display more feminine traits and women are disadvantages if they display more masculine traits.In the case of men, the impact of physical attractiveness on being able to secure a higher socio-economic status is significant.

And here’s another study Henderson tweeted about.

So what are the policy implications of this research? And the other research that I cited back in 2018 and 2019?

As far as I’m concerned, there aren’t any.

Yes, some people are very lucky because of their looks or their height and they wind up with extra income because of those random characteristics, but that shouldn’t be a reason for government-coerced redistribution.

The same thing is true for those fortunate enough to be born into the right families.

As I wrote two years ago.

…taller people and better-looking people earn more money and have better lives. That’s genuine unfairness, just like having better parents is a source of genuine unfairness. Yet not even Bernie Sanders or AOC have proposed taxes to equalize those sources of real unfairness.

Yes, the research suggests that life isn’t fair.

But government intervention isn’t the answer, as I explained back in 2011.

The real issue is whether this discrimination is real and whether it justifies government intervention. …I don’t doubt that “lookism” exists. …But does that mean we should have some sort of government bureaucracy with the power to sue, fine, arrest, or otherwise harass based on whether people claim they didn’t get promotions because of their appearance?

Just imagine, for instance, if government tried to redistribute sexual opportunities, as suggested by this example of Elizabeth Warren satire?

I’ll conclude with the observation that if we don’t try to address inequalities caused by random luck, such as looks and height, then why would we want politicians to impose taxes and redistribution to deal with inequalities that are the result of attributes over which we have considerable control, such as diligence, productivity, responsibility, and effort?

P.S. For what it’s worth, research suggests conservatives generally are viewed as more attractive and stronger than folks on the left (though that research also suggests that libertarians generally are perceived as being dorks).

[…] I’ve written on the economics of “lookism,” I agree that physical appearance is important for people. Not just for their psychological […]

[…] there’s a serious point to be made. As noted by Prof. Robin Hanson, there is a great deal of attractiveness inequality yet nobody seriously (at least so far!) is proposing government-coerced redistribution of […]

Reblogged this on boudica.us.

Agreed

@jroyola

Maybe instead of punishing successful parents for giving their children better education and job experience with their own hard earned money, you could help poor and normal children have better access to high quality education through reforms such as school choice and ending student loan subsidies. Also make the job market better for unskilled teens by abolishing the minimum wage and easing up regulations.

I love Dan’s blogs. They are effective pieces that distract readers from the most important features that really matter in a policy debate about material random factors that decide our fortunes.

Instead of a person’s beauty, height, gender or hair color, Dan could examine parents’ income and wealth. These are random attributes that will really mark an offspring’s future success in life.

A widely held belief in US is that every child born here has an equal chance of becoming as well-off as their parents. That belief can be tested with data on inter-generational mobility.

The statistical and anecdotical evidence doesn’t support the myth of equal chance of success at birth. Growing income and wealth disparity is growing in the US and other countries.

The key policy questions are (1) whether the government should take action to reduce the growing wealth and income disparities (2) what effective tools are available to reduce the observed growing disparities?

There’s a tax rule that promotes disparity, big time. It’s known as the step-up in tax basis. This rule benefits persons with millions in financial assets.

I’m not sure if Dan knows how wealthy are his readers. Do most own a house, a small business and at most $20 million in financial assets? These are not the major beneficiaries of the step-up tax rule. We are talking about the exclusive group of billionaires who comprise less than 1 percent of all households in America.

This exclusive group has several tax tools to ensure the success of their offsprings. They give million-size donations to private educational institutions, tax-free, Their offspring have a reserved place in an Ivy-League university, irrespective of their SAT score.

This exclusive group can create 501-C3 foundations that hire their offsprings with big salaries to manage their donated wealth, also tax free. Foundations that pursue the wishes of their deceased parents, forever.

And this exclusive group can use the step-up in tax basis rule to pass on their financial wealth tax free.

See https://darrowwealthmanagement.com/blog/step-up-in-basis-on-certain-inherited-assets/

See: https://www.sciencedirect.com/topics/economics-econometrics-and-finance/intergenerational-mobility

Begging your Pardon, please … A thorough review of the literature shows libertarians are perceived as ATTRACTIVE DORKS.

I seldom read the posts from Social Epistemology Review and Reply Collective (SERRC) but get a chuckle just reading their headlines and dreaming about earning incremental income from research grants to do some of these ridiculous sounding studies.

“Contextualising Epistemic Injustice in Aid: On Colliding Interests, Colonialism and Counter-Movements, Susanne Koch”

https://wordpress.com/read/feeds/861174/posts/3178642908

I spotted that headline after I skimmed the first couple of paragraphs of this post and it sounded relevant.

I used to wander the halls at the university campus where my wife works. They would put up posters about the studies they were doing and many made me laugh.

“Life-cycle of mold on student lunches” Not a real study, the titles were usually much longer with bigger more obscure words, but just as ridiculous sounding.

I’m on fire today. Only took 5 min. to search through the tens of thousands of articles I have flagged but not read.

Short Women Only Want To Date Tall Men💑

https://generaldispatch.whatfinger.com/short-women-only-want-to-date-tall-men%f0%9f%92%91/

Dang it. I was just skimming this post and the comments and remember in the last couple of days flagging an article which said “short women prefer tall men”, and I can’t find that right now. I will even if it takes all day.

Taxing the tall would only produce the same result as increasing taxes generally — it would drive the people affected to look for lower-taxed places to live; and if they don’t move away (or until they do) it would reduce their incentive to work, and thus the country’s productivity.

But I do see a way in which governments can reduce the problem of poverty among disadvantaged people, and that is to get rid of the dole, so that it will no longer pay the less productive among us to breed.

The answer to the tall problem is in Ken Schoolland’s book “The Adventures of Jonathan Gullible.” Yes, indeed, tax the tall ! ! In the book Schoolland illustrates this by having all the tall people on their knees, even when moving around, so they can avoid the tall tax.

Attractiveness comes in many forms: friendliness, cheeriness, etc. These are all attributes that will serve the person well in the job. Part of the interview is to select individuals that will fit in well.

Differences in salary are dependent on how the individual impresses the interviewer. Is it government’s job to compensate those that interview poorly?