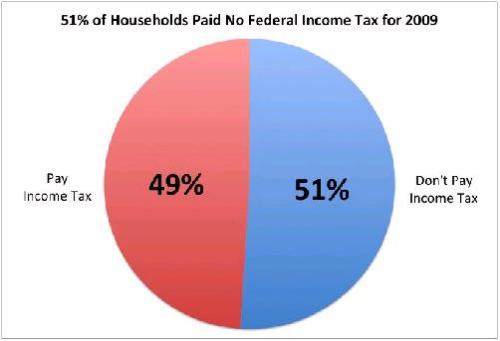

Gloominess and despair are not uncommon traits among supporters of limited government – and with good reason. Government has grown rapidly in recent years and it is expected to get much bigger in the future. To make matters worse, it seems that the deck is stacked against reforms to restrain government. One problem is that 47 percent of Americans are exempt from paying income taxes, which presumably means they no longer have any incentive to resist big government. Mark Steyn recently wrote a very depressing column for National Review Online about this phenomenon, noting that, “By 2012, America could be holding the first federal election in which a majority of the population will be able to vote themselves more government lollipops paid for by the ever shrinking minority of the population still dumb enough to be net contributors to the federal treasury.” Walter Williams, meanwhile, has a new column speculating on whether this cripples the battle for freedom:

According to the Tax Policy Center, a Washington, D.C., research organization, nearly half of U.S. households will pay no federal income taxes for 2009…because their incomes are too low or they have higher income but credits, deductions and exemptions that relieve them of tax liability. This lack of income tax liability stands in stark contrast to the top 10 percent of earners, those households earning an average of $366,400 in 2006, who paid about 73 percent of federal income taxes. …Let’s not dwell on the fairness of such an arrangement for financing the activities of the federal government. Instead, let’s ask what kind of incentives and results such an arrangement produces and ask ourselves whether these results are good for our country. …Having 121 million Americans completely outside the federal income tax system, it’s like throwing chum to political sharks. These Americans become a natural spending constituency for big-spending politicians. After all, if you have no income tax liability, how much do you care about deficits, how much Congress spends and the level of taxation?

Steyn and Williams are right to worry, but the situation is not as grim as it seems for the simple reason that a good portion of the American people know the difference between right and wrong. Consider some of the recent polling data from Rasmussen, which found that “Sixty-six percent (66%) believe that America is overtaxed. Only 25% disagree. Lower income voters are more likely than others to believe the nation is overtaxed” and “75% of voters nationwide say the average American should pay no more than 20% of their income in taxes.” These numbers contradict the hypothesis that 47 percent of Americans (those that don’t pay income tax) are automatic supporters of class-warfare policy.

So why are the supposed free-riders not signing on to the Obama-Reid-Pelosi agenda? There are probably several reasons, including the fact that many Americans believe in upward mobility, so even if their incomes currently are too low to pay income tax, they aspire to earn more in the future and don’t want higher tax rates on the rich to serve as a barrier. I’m not a polling expert, but I also suspect there’s a moral component to these numbers. There’s no way to prove this assertion, but I am quite sure that the vast majority of hard-working Americans with modest incomes would never even contemplate breaking into a rich neighbor’s house and stealing the family jewelry. So it is perfectly logical that they wouldn’t support using the IRS as a middleman to do the same thing.

A few final tax observations:

The hostility to taxation also represents opposition to big government (at least in theory). Rasumssen also recently found that, “Just 23% of U.S. voters say they prefer a more active government with more services and higher taxes over one with fewer services and lower taxes. …Two-thirds (66%) of voters prefer a government with fewer services and lower taxes.”

There is a giant divide between the political elite and ordinary Americans. Rasmussen’s polling revealed that, “Eighty-one percent (81%) of Mainstream American voters believe the nation is overtaxed, while 74% of those in the Political Class disagree.”

Voters do not want a value-added tax or any other form of national sales tax. They are not against the idea as a theoretical concept, but they wisely recognize the politicians are greedy and untrustworthy. Rasumussen found that “just 26% of all voters think that it is even somewhat likely the government would cut income taxes after implementing a sales tax. Sixty-six percent (66%) believe it’s unlikely to happen.”

Fiscal restraint is a necessary precondition for any pro-growth tax reform. If given a choice between a flat tax, national sales tax, value-added tax, or the current system, many Americans want reform, but it is very difficult to have a good tax system if the burden of government spending is rising. Likewise, it would be very easy to have a good tax system if we had a federal government that was limited to the duties outlined in Article I, Section VIII, of the Constitution.

Republicans should never acquiesce to higher taxes. All these good numbers and optimistic findings are dependent on voters facing a clear choice between higher taxes and bigger government vs lower taxes and limited government. If Republicans inside the beltway get seduced into a “budget summit” where taxes are “on the table,” that creates a very unhealthy dynamic where voters instinctively try to protect themselves by supporting taxes on somebody else – and the so-called rich are the easiest target.

Last but not least, I can’t resist pointing out that I am part of a debate for U.S. News & World Report on the flat tax vs. the current system. For those of you who have an opinion on this matter, don’t hesitate to cast a vote.

Read Full Post »

You won’t be surprised to learn that I’m focused on the policy differences between Hayes and Obama.

You won’t be surprised to learn that I’m focused on the policy differences between Hayes and Obama.