I wrote last month about the risk of Trump harming American workers, consumers, and producers by pulling the United States out of NAFTA.

That’s still a danger to the U.S. economy, but it’s been pushed to the back burner by a more immediate threat –  the President’s unilateral decision to impose big tax increases on steel and aluminum imports.

the President’s unilateral decision to impose big tax increases on steel and aluminum imports.

American trade law (specifically the Trade Expansion Act of 1962) does give Trump the authority to impose such taxes, but it’s worth noting that Congress has the power to change the law and negate the President’s short-sighted actions.

To be sure, such a change presumably would require two-thirds support to override a Trump veto. And I have no idea how many congressional Republicans are loyal to free markets rather than Trump, and I also don’t know how many congressional Democrats would vote against Trump’s protectionism, either because they support trade or because they simply don’t like the President.

But I do know that there would be lots of support. In today’s Washington Post, Charles Koch makes a principled case for open trade and condemns the President’s protectionism.

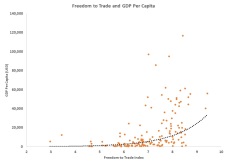

Countries with the freest trade have tended to not only be the wealthiest but also the most tolerant. Conversely, the restriction of trade — whether through tariffs, quotas or other means — has hurt the economy and pitted people against each other. Tariffs increase prices, limit choices, reduce competition and inhibit innovation.

Equally troubling, research shows that they fail to increase the number of jobs overall. …History is filled with examples of administrations that have implemented trade restrictions with devastating results. At the dawn of the Great Depression, the Smoot-Hawley Tariff Act raised U.S. tariffs on more than 20,000 imported goods, which accelerated our decline instead of correcting it. More recently, President George W. Bush’s 30 percent steel tariff led to increased consumer costs and higher unemployment. And President Barack Obama’s 2009 decision to raise tariffs on Chinese tires ultimately burdened consumers with $1.1 billion in higher prices. The cost per job saved was nearly $1 million , not considering all the lost jobs that went unmeasured.

And he specifically condemns the new trade taxes Trump has imposed.

The administration’s recent decision to impose major steel and aluminum tariffs — on top of higher tariffs on washing machines and solar panels — will have the same harmful effect. …those who can least afford it will be harmed the most. Having just helped consumers keep more of their money by passing tax reform, it makes little sense to take it away via higher costs.

Mr. Koch also observed that we’ve become richer during a period when trade taxes fell.

It is no coincidence that our quality of life has improved over the years as the average U.S. tariff on imported goods has fallen — from nearly 20 percent in 1932 to less than 4 percent in 2016.

This is an under-appreciated point. I’ve argued – and shared evidence – that trade liberalization played a key role in offsetting the damage of higher fiscal burdens in the post-WWII era. Yet Trump wants to reverse some or all of this progress.

The Wall Street Journal also opined on this issue.

President Trump could reduce the benefits of his tax cuts and regulatory rollback with protectionism. This risk became more serious after the Commerce Department

…recommended broad restrictions on aluminum and steel imports that would punish American businesses and consumers. …the wide-ranging economic damage from restricting imports would overwhelm the narrow benefits to U.S. steel and aluminum makers.

The protectionists try to justify tariffs on the basis of national defense, but this is a silly argument since we’re not relying on potential enemies.

Canada accounts for 43% of aluminum imports—more than twice as much as China and Russia combined. Steel imports are also diversified with Canada (17%), South Korea (12%) and Mexico (9%) accounting for three of the top four foreign sources. China accounts for about 2% of steel and 10% of aluminum imports.

The WSJ then lists some of the harmful effects of trade taxes.

About 16 times more workers are employed today in U.S. steel-consuming industries than the 140,000 American steelworkers. Economists Joseph Francois and Laura Baughman found that more U.S. workers lost jobs (200,000) due to George W. Bush’s 2002 steel tariffs than were employed by the entire steel industry (187,500) at the time. …Raising the cost of steel and aluminum inputs would impel many manufacturers to move production abroad to stay competitive globally. Does Mr. Trump want more cars made in Mexico? …Oh, and don’t forget that other countries could retaliate with trade barriers that hurt American exporters. …Why would Mr. Trump undercut his achievements with trade barriers that harm American workers and consumers?

Irwin Stelzer, writing for the Weekly Standard, also is quite critical.

…the president doesn’t like trade deficits—job killers as he sees it—and so he has put tariffs on washing machines and solar panels and now is deciding what costs and restrictions to place on imports of steel and aluminium.

…Never mind that such measures will raise the costs of steel and aluminum-using industries such as autos, making them less competitive with imports that can keep their costs down by buying cheaper, un-tariffed metals. One economic study after George W. Bush imposed tariffs on steel in 2002 concluded that job losses in steel-consuming industries exceeded the number that would have been lost had the entire American steel industry gone out of business. …if that causes job losses scattered among a lot of other industries and states, then so be it. Trump figures that those voters won’t make the connection between the job losses and the steel tariffs.

Last but not least, Tom Mullen eviscerates protectionism in a piece for CapX.

When Adam Smith wrote The Wealth of Nations, it…was to refute the kinds of protectionist ideas championed by conservatives like Edmund Burke and Alexander Hamilton in Smith’s day, Abraham Lincoln eighty years later, and Trump today.

Bastiat remade Smith’s case in 1848. Henry Hazlitt did so again in 1946. …What is unseen is the money American consumers no longer have when the tariffs are put in place. For example, the tariff may result in them paying $200 for the same pair of sneakers they previously paid $100 for. That means they no longer have $100 they previously had after buying the sneakers, which they could spend on other products. Whatever jobs they were supporting with that $100 are now lost. …When the ledger is balanced, Americans, in general, are far better off without the tariff.

Here’s more on the economic poison of protectionism.

The lower prices Americans pay for automobiles, clothing, Apple iPhones, and Bobcats allow them to patronise those American industries which operate more efficiently than their overseas competitors. That’s called “comparative advantage,” something else free market advocates since Adam Smith have been educating people about. …No matter what spurious arguments special interests make in favour of tariffs, they are, at the end of the day, just another tax. …And don’t forget, all the unseen, negative consequences of tariffs apply equally to foreigners. If they are taxing imports on automobiles, their citizens have less money to spend on other products. Their businesses that use imported materials must raise their prices and become less competitive. Any advantage they appear to gain in one sector, they lose in another, with the same overall net loss as we experience.

Amen.

Protectionism is a no-win game. Politicians in Country A take aim at businesses in Country B, but the main casualties are inside their own borders. Consumers lose, taxpayers lose, and all the upstream and downstream businesses in the supply chain lose.

Consumers lose, taxpayers lose, and all the upstream and downstream businesses in the supply chain lose.

Which is why researchers inevitably find that trade barriers are associated with net job losses. In other words, the “unseen” losses are far larger than the “seen” gains.

Which is exactly what Bastiat warned about more than 150 years ago.

P.S. Shifting gears, I’ve periodically complained about the immoral and amoral actions of large corporations. Simply stated, big businesses oftentimes are perfectly happy to use the coercive power of government to grab unearned wealth.

Koch Industries is a noble exception. Here’s another excerpt from Charles Koch’s Washington Post column.

One might assume that, as the head of Koch Industries — a large company involved in many industries, including steel — I would applaud such import tariffs because they would be to our immediate and financial benefit. But corporate leaders must reject this type of short-term thinking, and we have. …We only support policies that are based on equality under the law and that help people improve their lives. This is why we successfully lobbied to end direct ethanol subsidies, despite being one of the largest ethanol producers in the United States. It is why we fought against the inclusion of a border adjustment tax in the tax-reform package, even though it would have greatly increased our profits by increasing costs to consumers.

I’m obviously pleased that the folks at Koch are on the right side of the ethanol and BAT issues, but that’s a secondary matter. What’s praiseworthy is that the company rejects all cronyism. Even when it would benefit.

If more businesses acted that way, there would be a lot more support for free enterprise.