A reader from New York has a follow-up question for me.

Referencing a “Question of the Week” from last month, in which I expressed guarded optimism that America could be saved, she wants to know what I would do if things go the wrong way.

In other words, what if things go really wrong and America suffers a Greek-style fiscal collapse? And imagine how bad that might be since there wouldn’t be an IMF or European Central Bank capable of providing bailouts to the United States.

Perhaps because of an irrational form of patriotism, I’m fairly certain that I will always live in the United States and I will be fighting to preserve (or restore) liberty until my last breath.

But I probably would want my children someplace safe and stable, so I’ll answer the question from that perspective.

The obvious first choice is a zero-income tax jurisdiction like the Cayman Islands that is prosperous and reasonably well governed.

But I’m not sure about the long-run outlook for the Cayman Islands, in part because the politicians there have flirted with an income tax and in part because the jurisdiction inevitably would suffer if the United States was falling apart.

So what’s a place that is stable and not overly tied to the American economy.

Then the obvious choice is Switzerland. That nation’s long-run fiscal outlook is relatively favorable because of modest-sized government and a very good spending control mechanism.

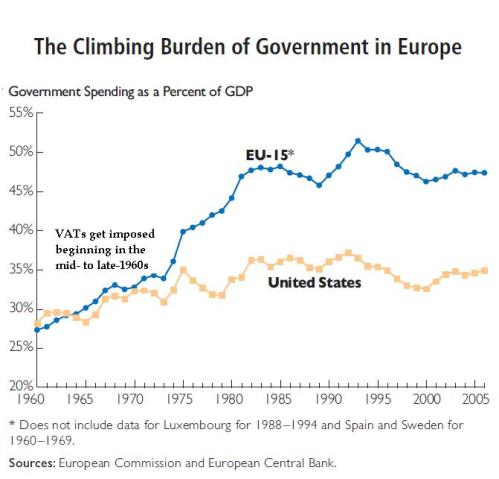

But while Switzerland is not dependent on the U.S. economy, it is surrounded by European welfare states. And I’m fairly certain that nations such as France, Italy, and (perhaps) Germany will collapse before America.

And even though most Swiss households have machine guns and the nation presumably can defend itself from barbarian hordes in search of a new welfare check, Switzerland’s probably not the ideal location.

Estonia is one of my favorite countries, and they’ve implemented some good reforms such as the flat tax. But I worry about demographic decline. Plus, I’m a weather wimp and it’s too chilly most of the year.

Another option is a stable nation in Latin America, perhaps Chile, Panama, or Costa Rica. I haven’t been to Chile, but I’m very impressed by the nation’s incredible progress in recent decades. I have been to Panama many times and it is one of my favorite nations. I’ve only been to Costa Rica two times, but it also seems like a nice country.

The bad news is that I don’t speak Spanish (and my kids don’t speak the language, either). The good news is that Hispanics appear to be the world’s happiest people, so that should count for something.

“G’day mate, we’ve privatized our social security system!”

This brings me to Australia, the country that probably would be at the top of my list. The burden of government spending in Australia is less than it is in the United States.

But the gap isn’t that large. The reason I like Australia is that the nation has a privatized Social Security system (called Superannuation) and the long-run fiscal outlook is much, much better than the United States.

Plus the Aussies are genuinely friendly and they speak an entertaining form of English.

So if America goes under, I recommend going Down Under.