First, some good news.

The United States is in much better shape than most other developed nations, particularly if you look at broad measures of prosperity and living standards.

The United States is in much better shape than most other developed nations, particularly if you look at broad measures of prosperity and living standards.

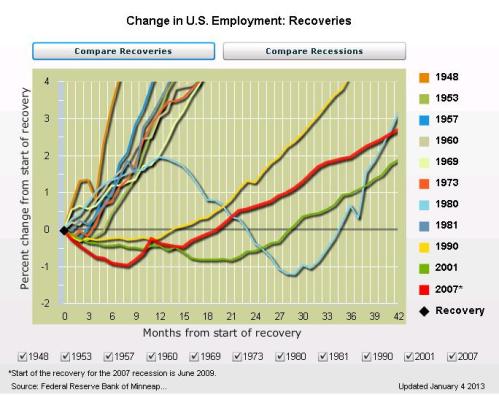

And our economy is growing and the private sector is creating jobs.

That’s the glass-half-full way of looking at things.

But if you’re a glass-half-empty person, the news is not so cheerful. The economy is expanding and jobs are being created, but both at a slow rate.

In this interview, I share this dour perspective as I grouse about how Obama’s policies of higher taxes and bigger government are somewhat responsible for the weak job market. And I also explain that the anemic employment situation is partially to blame for low levels of saving for many households.

On the topic of the low savings rate, I should have explained that government policies undermine savings, both because of the tax code’s pro-consumption bias and because reasons to save are diminished thanks to government-provided subsidies for things such as housing, education, retirement, and health care.

In my second soundbite, I jump to a different topic. I assert that it’s a good thing that we’re going to have gridlock for the next couple of years – particularly if the alternative is the kind of damaging legislation such as the faux stimulus and Obamacare that we got in the President’s first two years.

But I do warn that permanent gridlock is not a good idea. We need genuine entitlement reform at some point in the not-so-distant future if we want to avoid becoming another Greece.

And don’t delude yourself. If policy is left on auto-pilot, the burden of government spending is going to skyrocket. Indeed, both the Bank for International Settlements and the Organization for Economic Cooperation and Development estimate that America’s long-run fiscal problems are more severe than those is most European welfare states.