Sometimes Bill Maher, the host of Real Time on HBO, says smart things and sometimes he says not-so-smart things.

His recent monologue on the “college scam” was an example of the former. It’s almost as if he was channeling Professor Daniel Lin.

Maher makes great points about how government subsidies for higher education are a backwards form of redistribution, taking money from lower-income people and giving it to higher-income people.

And I love what he says about credentialism, where people can’t climb the job ladder without getting useless degrees like masters in education.

And I love what he says about credentialism, where people can’t climb the job ladder without getting useless degrees like masters in education.

But his monologue wasn’t perfect. He mentioned how tuition costs have exploded, but he didn’t make the should-be-obvious connection between rising costs and government subsidies.

To be more explicit, tuition expenses have skyrocketed because colleges and universities have raised prices to capture all the extra loot politicians are dumping into the system.

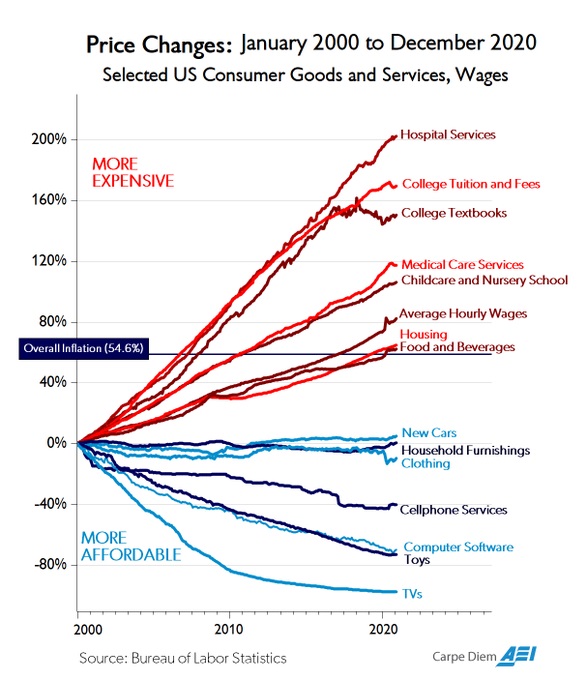

Which, by the way, is what happens in every sector of the economy (health care being an obvious example) where government tries to make things more affordable.

By the way, if you don’t want to trust Maher’s comments because he’s an entertainer rather than a policy expert, you may want to read a column in the Wall Street Journal by Tomas Philipson, an economics professor at the University of Chicago.

Here’s some of his analysis.

The student-loan crisis is rooted in government policy… The Biden administration’s American Families Plan is designed to perpetuate the cycle. The student-loan crisis has a long history but accelerated dramatically in 2010, when lawmakers moved the portfolio onto the Education Department’s balance sheet to “pay” for ObamaCare.

…But Education Department bureaucrats, not experts in lending, didn’t bother with prudent practices, such as underwriting, that are routine in private credit markets. The result: A lender with the lowest cost of capital on the planet is now about $500 billion in the red. …And federal student loans are highly regressive. …The Brookings Institution found in April 2019 that Sen. Elizabeth Warren’s loan-forgiveness proposal would mainly help the rich, with families with income in the top 40% receiving about two-thirds of the benefits. …These policies reward professors and administrators who can then raise the price of their services. …Tuition rising as loan subsidies expand is no different. It isn’t a coincidence that education and health care, the industries in which government subsidies are most pervasive, took the highest price increases over the past 15 years—3.7% and 3.1% a year, compared with the 1.8% average across industries.

Amen, especially with regards to the final sentence. Student loans and other subsidies are the reason colleges and universities can get away with never-ending tuition increases.

And Joe Biden wants to make matters worse, as Bill Maher noted. Not that we should be surprised since that’s what Barack Obama wanted and what Hillary Clinton wanted.

The left is in favor of just about anything, other than the policy that would solve the problem.

P.S. There’s even academic research showing that government spending on higher education has a negative impact on economic performance.