The best referendum result of 2020 (indeed, the best policy development of the year) was when the people of Illinois voted to preserve their flat tax, thus delivering a crushing defeat to the Prairie State’s hypocritical governor, J.B. Pritzker.

The worst referendum result of 2020 was when the people of Arizona voted for a class-warfare tax scheme that boosted the state’s top tax rate from 4.5 percent to 8 percent.

In one fell swoop, Arizona became a high-tax state for investors, entrepreneurs, innovators, and business owners. That was a very dumb choice, especially since there are zero-income tax states in the region (Nevada, Texas, and Wyoming), as well as two flat-tax states (Utah and Colorado).

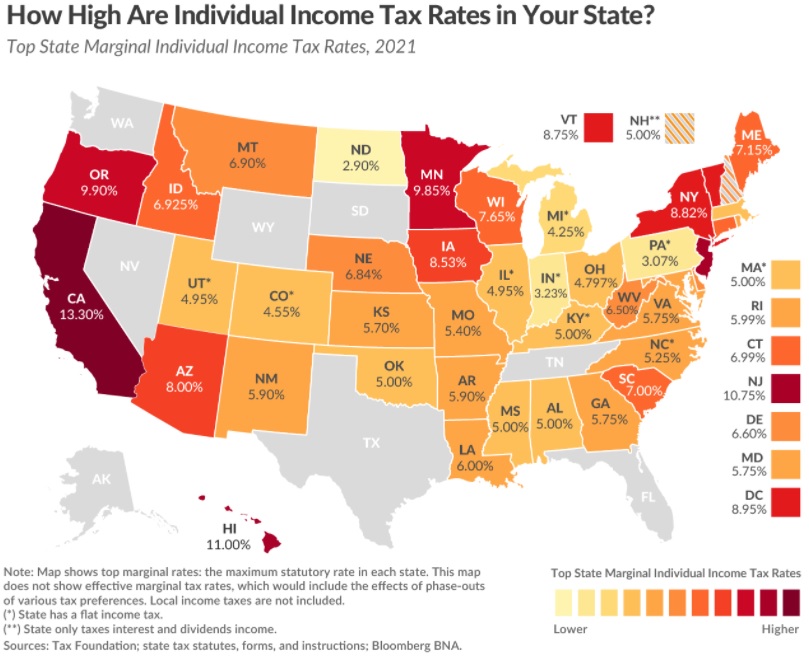

You can see Arizona’s problem in this map from the Tax Foundation. It’s great to be grey and good to be yellow, but bad to be orange (like Arizona), red, or maroon.

That’s the bad news.

The good news is that lawmakers in have just approved a plan that will significantly lower tax rates and restore the state’s competitiveness.

The Wall Street Journal opined this morning about this positive development.

Arizona currently taxes income under a progressive rate structure, starting at 2.59% up to 4.5%. The ballot last November carried an initiative to add a 3.5% surtax on earnings above $250,000 for single filers. It narrowly passed, meaning the combined top rate was set to hit 8%, higher than all of Arizona’s neighbors except California. …Mr. Ducey’s budget will cut rates for all taxpayers.

The Legislature can’t repeal the voter-approved surtax, so above the 2.5% flat rate, there will still be a second bracket on income over $250,000. But the budget also has a provision adjusting the flat tax downward for those Arizonans, so no one will pay a top rate above 4.5%. …the same as today. …No Arizonan will have to pay the threatened 8% rate, since the provisions forestalling it are immediate. …“Every Arizonan—no matter how much they make—wins with this legislation,” Mr. Ducey said. “It will protect small businesses from a devastating 77 percent tax increase…and it will help our state stay competitive so we can continue to attract good-paying jobs.” That’s worth celebrating.

A story from the Associated Press gave the development a much more negative spin.

After slashing $1.9 billion in income taxes mainly benefiting upper-income taxpayers and shielding them from higher taxes approved by voters in an initiative last year, the Republican-controlled House returned Friday and passed more legislation targeting Proposition 208. The House approved the creation of a new tax category

for small business, trusts and estates that will eliminate even more of the money that the measure approved by voters in November was designed to raise for schools. The proposal passed despite unified opposition from minority Democrats. …The governor has expressed disdain for the voter-approved tax, saying it would hurt the state’s economy and vowing in March to see it gutted either though Legislation or the courts. …The budget-approved tax cuts set a flat 2.5% tax on all income levels that will be phased in over several years once revenue projections are met, with those subject to the new education tax paying 4.5% at most.

If nothing else, an amusing example of bias from AP.

I have two modest contributions to this discussion.

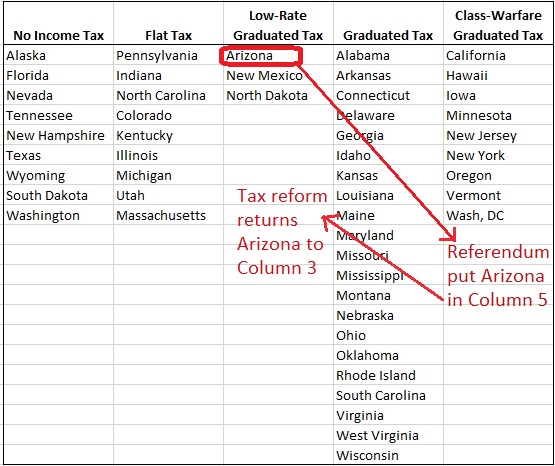

First, it’s not accurate to say that Arizona adopted a flat tax. Maybe I’m old fashioned, but a flat tax has to have only one rate. Arizona’s reform is praiseworthy, but it doesn’t fulfill that key equality principle.

Second, the main takeaway is not that lawmakers did something good. It’s more accurate to say that they protected the state from something bad.

I’ve updated this 2018 visual to show how the referendum would have pushed Arizona into Column 5, which is the worst category, but the reform keeps the state in column 3.

P.S. North Carolina made the biggest shift in the right direction in recent years, followed by Kentucky, while Kansas flirted with a big improvement and settled for a modest improvement. Meanwhile, Mississippi is thinking about making a huge positive jump.

P.P.S. Since Arizona voters made a bad choice and Arizona lawmakers made a wise choice, this is evidence for Prof. Garett Jones’ hypothesis that too much democracy is a bad thing.