Compared to most of the world, Japan is a rich country. But it’s important to understand that Japan became rich when the burden of government was very small and there was no welfare state.

Indeed, as recently as 1970, Japan’s fiscal policy was rated by Economic Freedom of the World as being better than what exists today in Hong Kong.

Indeed, as recently as 1970, Japan’s fiscal policy was rated by Economic Freedom of the World as being better than what exists today in Hong Kong.

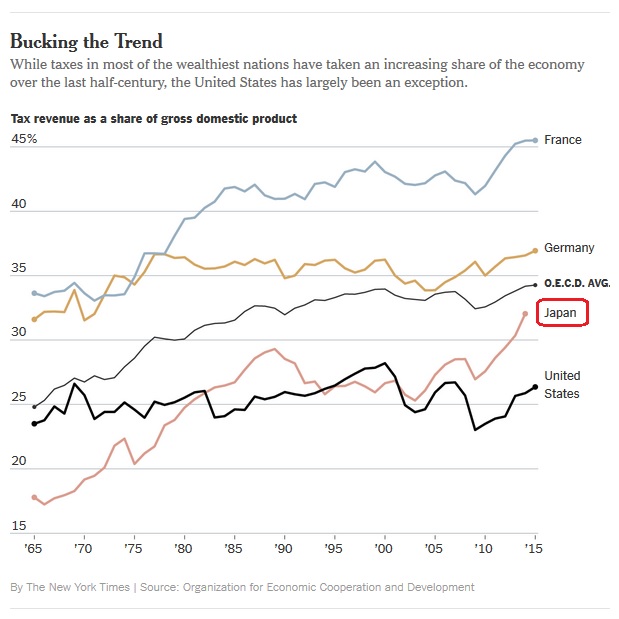

Unfortunately, the country has since moved in the wrong direction. Back in 2016, I shared the “most depressing chart about Japan” because it showed that the overall tax burden doubled in just 45 years.

As you might expect, that rising tax burden was accompanied by a rising burden of government spending (fueled in part by enactment of a value-added tax).

And that has not been a good combination for the Japanese economy, as Douglas Carr explains in an article for National Review.

From 1993 to 2019, the U.S. averaged 2.6 percent growth, …far ahead of Japan’s meager 0.9 percent. …What happened? Big government happened…

Japanese government spending was just 17.5 percent of the country’s GDP in 1960 but has grown, as illustrated below, to 38.8 percent of GDP today. …the island nation’s growth never recovered. The theory that government spending boosts long-term growth has failed… What government spending does is crowd out investment.

Amen. Japan has become a parody of Keynesian spending.

Here’s a chart from Mr. Carr’s article, which could be entitled “the other most depressing chart about Japan.”

As you can see, the burden of government spending began to climb about 1970 and is now represents a bigger drag on their economy than what we’re enduring in the United States.

Unfortunately, the United States is soon going to follow Japan in that wrong direction according to fiscal projections from the Congressional Budget Office.

Carr warns that bigger government in America won’t work any better than big government in Japan.

Rather than a problem confined to the other side of the world, Japan’s death spiral is a pointed warning to the U.S. The U.S. and Japanese economies are on the same trajectory; Japan is simply further along the big-government, low-growth path. …The United States is at risk of entering a Japanese death spiral.

Here’s another chart from the article showing the inverse relationship between government spending and economic growth.

Moreover, the U.S. numbers may be even worse because of coronavirus-related spending and whatever new handouts that might be created after the election.

The negative relationship of government spending with growth and investment holds with adjustments for cyclical influences such as using ten-year averages or the Congressional Budget Office’s estimates of cyclically adjusted U.S. government spending. CBO data highlight how close the U.S. is to a Japanese-style death spiral. …Of course, CBO’s recent forecast was prepared before the coronavirus shock and does not incorporate spending by a new Democratic government, so this dismal outlook is likely to worsen.

So what’s the solution? Can the United States avoid a Greek-style future?

The author explains how America can be saved.

Boosting growth means restraining government. Restraining government means reengineering entitlements… Economically, it shouldn’t be too difficult to do better. We have an insolvent, low-return government-retirement program along with an insolvent retiree-health program — part of a Rube Goldberg health-care system.

He’s right. To avoid stagnation and decline, we desperately need spending restraint and genuine entitlement reform in the United States.

Sadly, Trump is on the wrong side on that issue and Biden wants to add fuel to the fire by making the programs even bigger.

P.S. Here’s another depressing chart about Japan.

P.P.S. Unsurprisingly, the OECD and IMF have been cheerleading for Japan’s fiscal decline.

P.P.P.S. Japan’s government may win the prize for the strangest regulation and the prize for the most useless government giveaway.

[…] is caused by demographics. But there’s also been fiscal decline measured by both taxation and spending […]

[…] hard to be optimistic about Japan’s economic future, in large part because the burden of government is expanding thanks to an aging population and a tax-and-transfer entitlement […]

[…] I’ve also noted that Japan is in serious […]

[…] I’ve also noted that Japan is in serious […]

[…] I’ve also noted that Japan is in serious […]

[…] can determine that higher spending is bad […]

An excellent article. I often wonder if we are fighting a losing battle with the Left, and then I get depressed and rejoice in the fact I am old.

The wordcount of a country’s constitution also has an inverse effect on per capita GNP. The American constitution at some 8000 words appears to be a sort of upper bound on how much blarney it takes to protect individual rights against government assaults. Constitutions with ten times as many words are crammed with counterfeit entitlements, inflating out of existence the very notion of individual rights, leading a wake of famished paupers to further ruin.

Reblogged this on Boudica BPI Weblog.

I don’t think the United States, compared to Western Europe at any rate, is particularly known for its welfare state status. So when I read “reengineering entitlements”, I hear “rip the bottom out of social safety nets”.

While this may be inevitable as former Comptroller General David Walker warned in the post-911 “war on terror” period in the documentary film “IOUSA”, two things that stick with me about that film is the role of defense spending as compared to the outlays required to keep social security and medicare afloat for retiring baby boomers. (As an aside, the elephant in the room may very well be demographic, as it has been in Japan, where old people outnumber young, working-age adults.)

I have never seen anything that addresses what has done the greater deficit-creating damage — Democrats’ insistence on entitlement spending vs. Republicans’ promotion of defense spending. (President Reagan was the last of the Republicans who campaigned on reducing the deficit — although he managed to blow it up with his Star Wars program and his South American foreign policy entanglements. As such, the last presidential candidate to really push the deficit issue to the forefront was not a Republican but a third-party candidate — Ross Perot and his libertarian successor Ron Paul!)

I have been hearing that social security would go belly up before I retired — since I was a kid! (In all that time, what party has done anything to forestall the all-but inevitable?) Given the mutual neglect, the only reasonable thing to do is make both parties share responsibility for the 50+ years of financial recklessness that preceded them. Personally, I would attribute that pain somewhat more to Republicans for the simple fact that they have been largely successful fending off European style welfare state entitlements, whereas Democrats have been largely unsuccessful reigning in trillions of dollars over the decades in defense spending — to include the Iraq and Afghanistan wars and the even less defensible “black budget” — for which no one has a firm number! (Estimates, however, are $50B per year in black budget spending! How can this be even remotely acceptable?)

My feeling is that the partisan Right vs. Left fiscal narratives need to be challenged a bit by the reality that both parties have been pro-Big Government spenders. Until we have a country that is interested in fiscal responsibility and is willing to talk openly of sharing the blame, the unproductive finger-pointing will continue between Democrats who will argue — to popular support among an increasingly socialist-minded base! — that we are the wealthiest country in the world to provide so few protections vs. Republicans who constantly talk about cuts in a way that imply, intentionally or not, that those who need, want or rely on them — even in disability or old age! — are morally deficient. The conversation MUST change or this country will not survive the spiraling cost of our collective and cumulative denials!

We can’t afford generous entitlements and we can’t “have our cake and eat it too” where economic growth is concerned if we turn to socialism for an answer. Democrats promise voters “pie in the sky” at every turn, whereas Republicans are perceived to live in the pockets of Wall Street “job creators” (i.e. campaign donors) and the budgetary black hole that is the military-industrial complex.

Ordinary Americans who want their tax dollars to benefit them — our physical infrastructure if not in times of crisis — are not unreasonable. After all, to whatever extent wealthy people have created jobs on the one hand, the reality remains that GE, Amazon, Google, Microsoft and others have all but zeroed out their federal tax liability — despite whatever corporate tax rate may exist on paper — on the other hand! That means the poorest Americans pay no federal taxes and the richest corporations in America likewise are direct participants in our trillion-dollar deficits. If the entire burden of funding Big Government as we know it rests on people who live in the silent majority middle — the secretaries that Warren Buffet once remarked have a higher effective tax rate than the billionaires — it should be no wonder that our economic growth will slow, our quality of life will decline, our politics will be more polarized — and there is unrest in the streets, as we are seeing in 2020.

It’s not “populist” to want everyone to pay their fair share to operate the government we need/want. It’s simply not honest for partisans in the Democrat and Republican parties to blame each other when they have spent their way into the stratosphere, both excusing their particular brand of Big Government. When we’re serious about saving America’s future, we will be serious about sharing the responsibility.

kudos, dan, you are continuing to mine new veins in this generally uninformed popular debate.

Please call me.

RWR

Sent from my iPad

>