Not everyone has appreciated my efforts to promote economic liberty over the past 40 years.

- The most common attack is “you don’t care about the poor” even though I’m pushing for the only economic system that has a track record of successfully lifting people out of poverty.

- On a related note, some people assert “you don’t care about workers” even though free enterprises is the only approach that has ever created widely shared prosperity.

- Another silly claim is “you’re a tool of big business” even though I am constantly fighting against cronyism and supporting the system (creative destruction) that puts pressure on big companies.

Today, we’re going to focus on a different attack. I’ve lost count of how many times someone has launched the accusation that “your policies are trickle-down economics.”

I confess that I’m never sure how to respond to this attack.

Do I say “thank you” because investment is a key precondition for long-run growth? And do I then augment my answer by noting that even socialists and communists agree (though they are wrong in thinking governments should control investment)?

Or do I politely say “you’re an idiot” because the person making the attack almost surely is thinking like a Keynesian and focusing on how rich people spend their money rather than how they earn it (sort of like the difference between GDP and GDI).

Given my wonkiness, I’m always tempted to launch into a detailed explanation about entrepreneurs and how they use capital to help drive innovation and creative destruction.

Leading to higher productivity and thus higher wages.

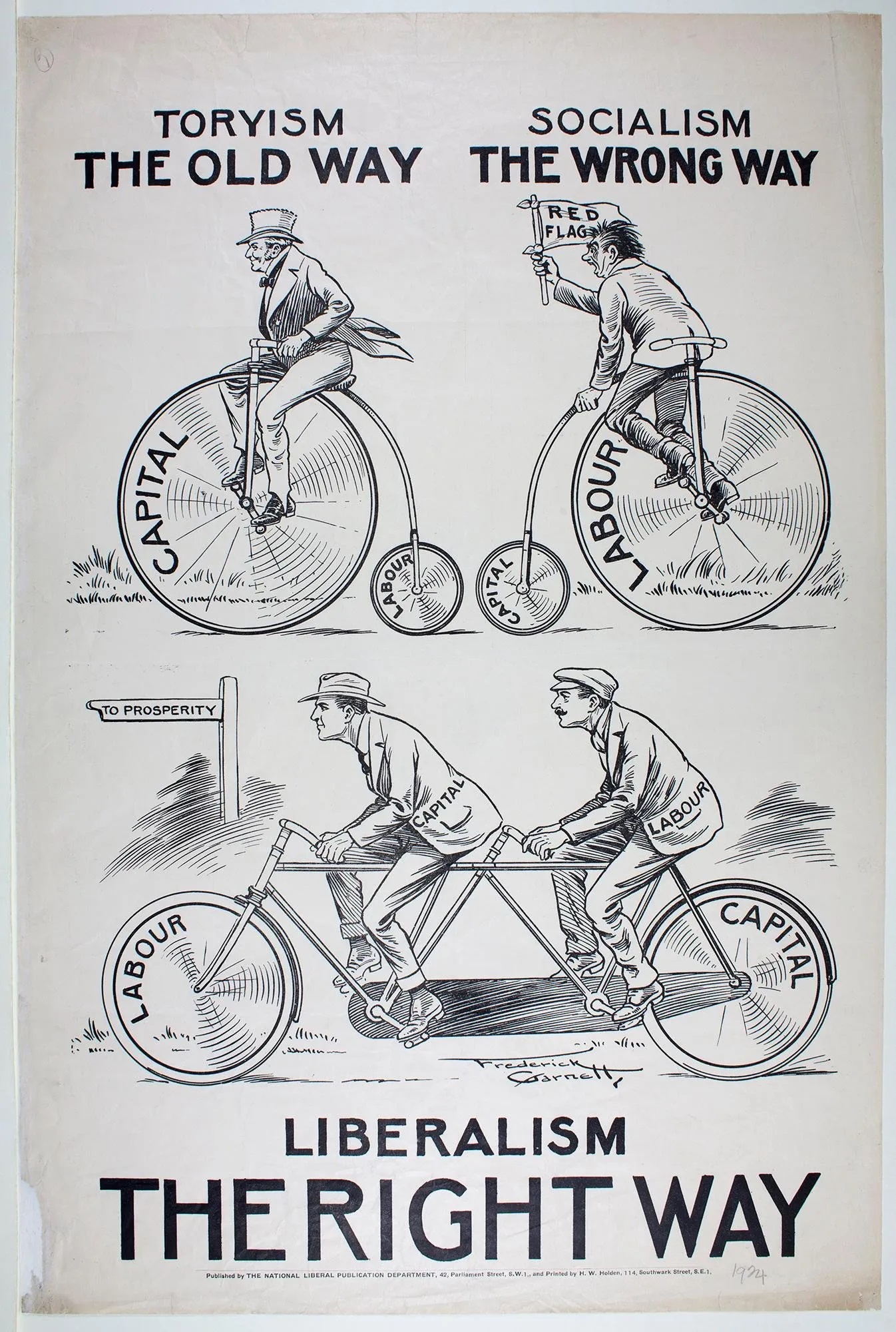

Which is why, as illustrated by this old campaign poster for the British Liberal Party (classical liberals, of course), labor and capital should be allies rather than opponents.

Heck, there’s an entire cartoon strip making the same point.

But let’s see what some others have to say about “trickle down.”

In a column for the Wall Street Journal, Professor Steven Rhoads embraces the term (similar to my “thank you” approach). Here’s some of what he wrote.

President Biden in his State of the Union address encouraged Americans to imagine a future in which “the days of trickle-down economics are over”… Politicians may scorn the trickle-down effect, but it is responsible for Americans’ economic well-being. Even some prominent 20th-century liberal economists, including Paul Samuelson and Alfred Kahn,

agreed that the innovation and investment that lead to capital formation are crucial to economic growth. …When employees use better equipment and have better managers, they become more productive. This makes them more valuable to their companies and stirs competition in the labor market, causing their real incomes to rise. …Politicians and the press mislead voters and readers when they claim that tax cuts for the rich don’t benefit other economic classes. We all gain from new, improved products made possible by innovative startups funded by the wealthy. Excessive taxation…could deplete the funds that entrepreneurs use to start and sustain useful ventures.

Peter Earle, by contrast, does not like the term.

He is closer to my “you’re an idiot” approach. Here are some excerpts from his column for the American Institute for Economic Research.

…the perennial favorite “trickle-down”…is back in vogue. …no political party, economist, or economic textbook has ever referred to “trickle-down” anything as a policy tool or outcome. …Most important of all, the phrase fails to accurately describe any economic phenomenon or outcome.

…It suggests, of course, that a particular political initiative results in huge benefits bestowed upon the wealthy, with ancillary benefits––if any––dripping down in tiny rivulets to the poor, the working class, minorities, women, and so on. …as a class warfare dog whistle, it deeply (and not coincidentally) confounds the way that the economy works, insofar as capital and labor are concerned. Setting aside corporatist cases, entrepreneurs and other innovators are overwhelmingly paid second, after workers. Their compensation comes on the back-end, so to speak, in the form of revenue, dividends, and/or rising market valuations.

If this doesn’t exhaust your interest in the topic, I also wrote about “trickle down” in 2011, 2016, and 2021.

P.S. Perhaps the dumbest attack is from hard-core leftists who shriek “you’re a fascist” even though libertarianism is at a completely different point of the ideological triangle. My lefty critics don’t realize that fascism is a nationalist version of socialism (based on controlling private companies rather than nationalizing them).