Guided by the principles of good tax policy, I have mostly focused on two important provisions when writing about Trump’s 2017 Tax Cut and Jobs Act (TCJA).

- Reducing the federal corporate tax rate from 35 percent to 21 percent, thus improving incentives for growth and making the United States more competitive for business activity.

- Scaling back the itemized deduction for state and local tax payments, thus reducing an incentive for higher taxes and bigger government in states like California and New York.

Today, let’s look at a third feature of the Trump tax plan that deserves applause.

In both direct and indirect ways, the TCJA made tax filing simpler by making itemized deductions less attractive.

In part, this is because of the already-mentioned limit on deducting state and local taxes. But Trump’s tax package also included changes – such as much bigger standard deductions – that made it more attractive to file a basic tax return.*

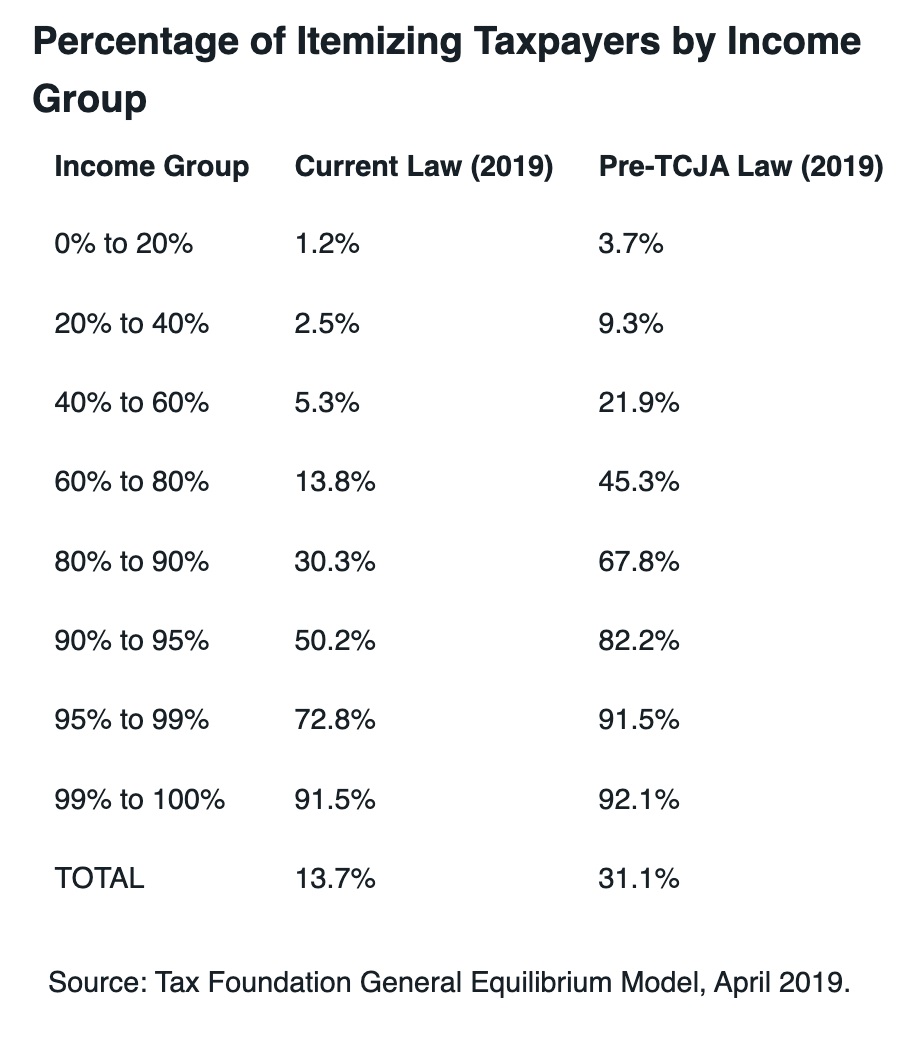

Those provisions caused a major change in taxpayer behavior. Here’s a chart from the Tax Foundation that was recently shared by the Committee to Unleash Prosperity. The data is a few years old, but you can see that a big shift occurred. Far fewer taxpayers use itemized deductions today.

I would have preferred a flat tax, which means getting rid of all itemized deductions, but I also don’t make the perfect the enemy of the good.

Trump’s TCJA moved the tax code in the right directions. Keep in mind the three principles of good tax policy.

The TCJA made progress on all three categories. I’m especially happy that we got the right combination – which is reduced use of loopholes and less money going to Washington.

Now we need to take the next step, which means going after big remaining loopholes (such as the fringe benefits exclusion and municipal bond interest exemption) as part of another tax reform that is either a net tax cut or revenue neutral.

* For readers unfamiliar with the U.S. tax system, the personal income tax does not apply to every dollar of income. Households can protect some of their income from tax by using either a standard deduction (In 2024, $14,600 for single taxpayers and $29,200 for married taxpayers) or by using itemized deductions (for things such as home mortgage interest, charitable contributions, and state and local taxes). Needless to say, all sane taxpayers (including leftists who say they want to pay more) pick the option that will minimize their tax burden.