Earlier this month, I wrote about Social Security’s huge fiscal problems, followed the next week by a column correcting some myths about the program that were disseminated by the Washington Post.

Today, let’s cross the Atlantic Ocean because the European Union just released a new Ageing Report and there are six visuals that are worth sharing because of the lessons we can learn for the United States.

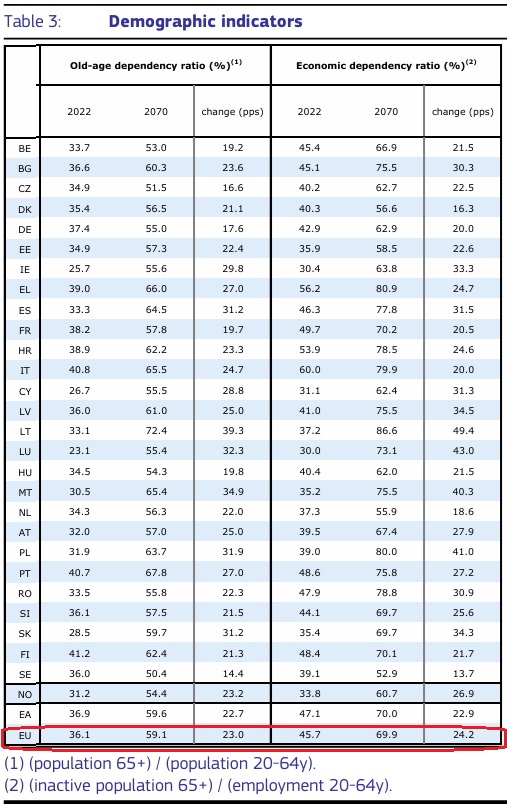

We’ll start with this table showing the old-age dependency ratio (number of old people relative to working-age people) and the even-more-important economic dependency ratio (number of retirees relative to the number of workers).

I’ve highlighted (near the bottom) the averages for EU nations. As you can see the ratios get much worse between 2022 and 2070.

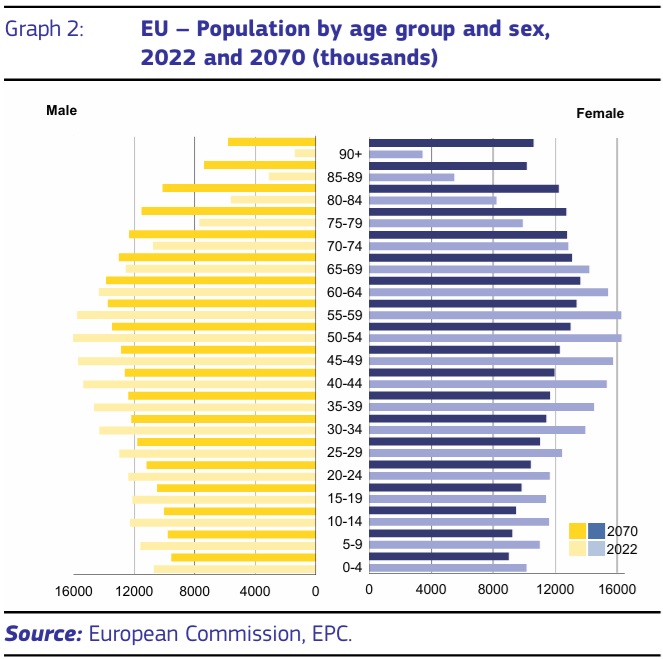

If you wonder why the above ratios are getting worse, this next graph shows the answer.

It’s all about demographic change. Simply stated, there will be more and more old people and comparatively fewer workers to finance benefits for those old people.

The same demographic problem exists in the United States. Not as big of a problem as exists in most European nations, but nonetheless big enough to cause major fiscal challenges.

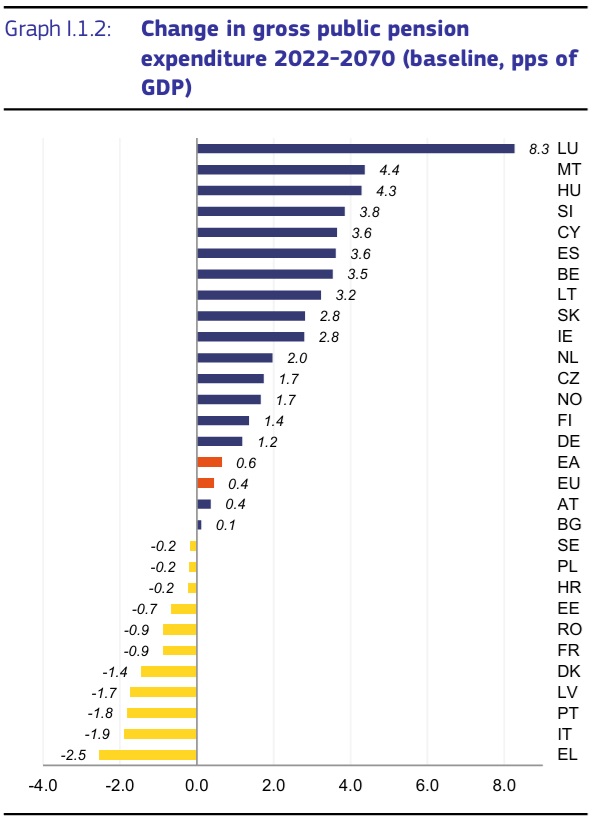

Shifting back to Europe, let’s see how these demographic changes will impact fiscal policy.

As you can see, there will be a significant increase in the burden of government spending in many nations (and government already is far too big in all of these countries).

So far, I’ve shared charts and tables with bad news.

But notice there there are some nations with yellow bars in the previous graph. These nations are projected to have smaller burdens of Social Security spending in 2070 (relative to economic output).

And the nations with the biggest declines, Greece (EL) and Italy (IT), are not exactly famous for good fiscal policy.

Which brings me to the second half of today’s column, which will focus on the fact that there are some positive lessons we can learn from European nations.

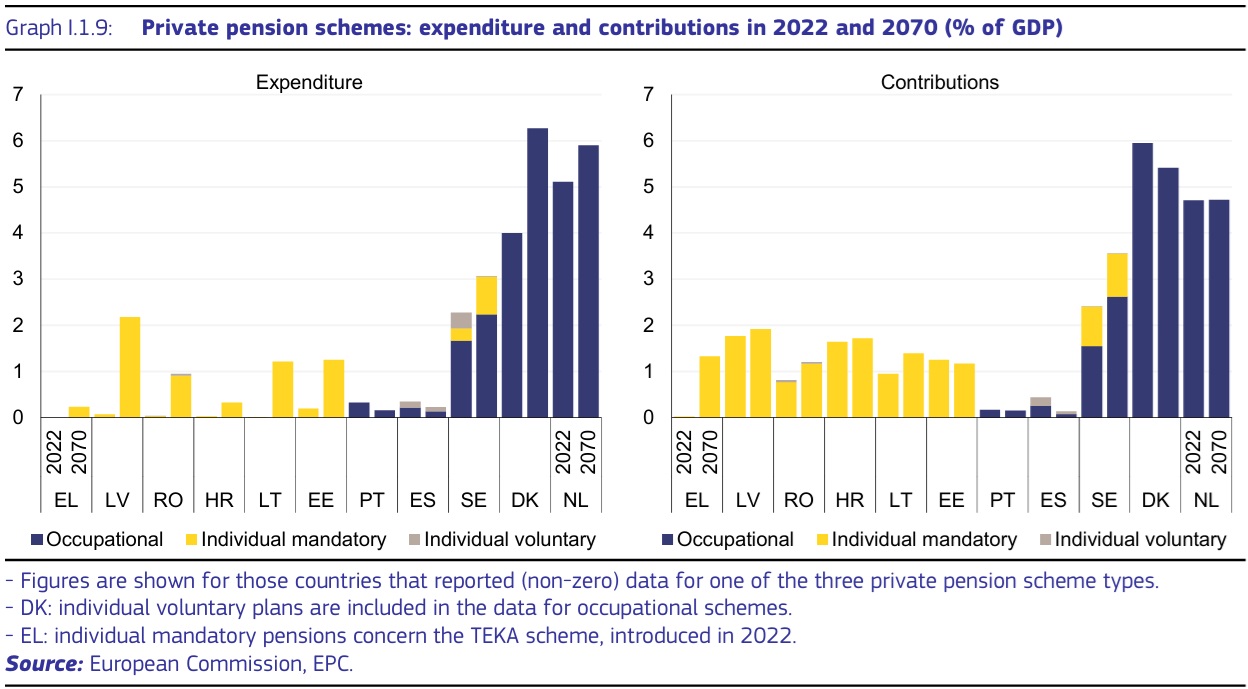

First, there are some countries that have fully or partially privatized their pension systems. I’ve already written about some of these nations – such as Sweden (SE), Denmark (DK), and the Netherlands (NL) – but the following graph shows that there also has been positive reform in nations such as Greece (EL), Latvia (LV), Romania (RO), Croatia (HR), Lithuania (LT), and Estonia (EE).

I’m particularly amazed that Greece recently adopted personal retirement accounts.

That’s the ideal policy, of course.

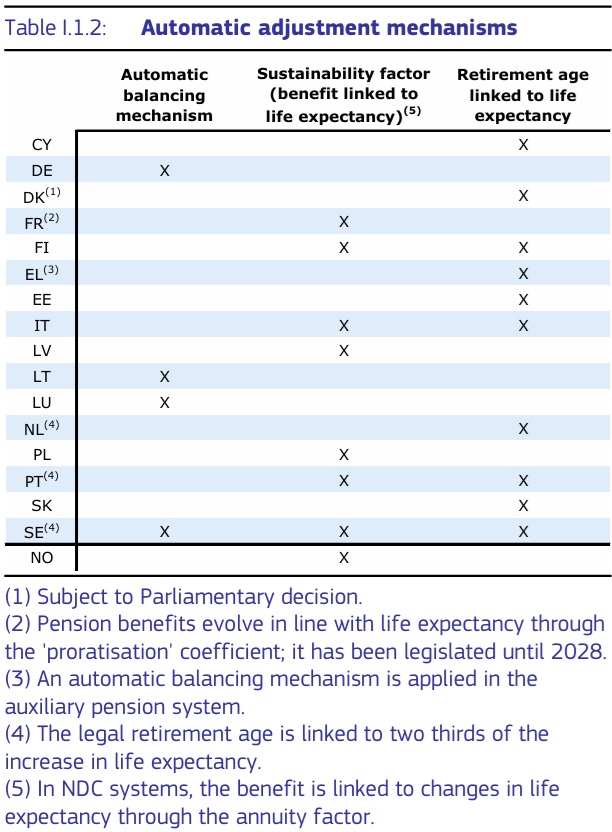

That being said, it’s worth noting that other European nations have enacted reforms that reduce the fiscal burden of government-run systems.

Here are the EU countries with “automatic adjustment mechanisms” to limit the growth of government.

By the way, “NDC” means notional defined contribution, which means that there is a formula that links retirement benefits to taxes paid.

While not nearly as good as a a real DC system (i.e., personal retirement accounts), an NDC system is much more responsible than an open-ended entitlement.

Indeed, the NDC approach is the main reason whey the spending burden in Italy will decline significantly between now and 2070.

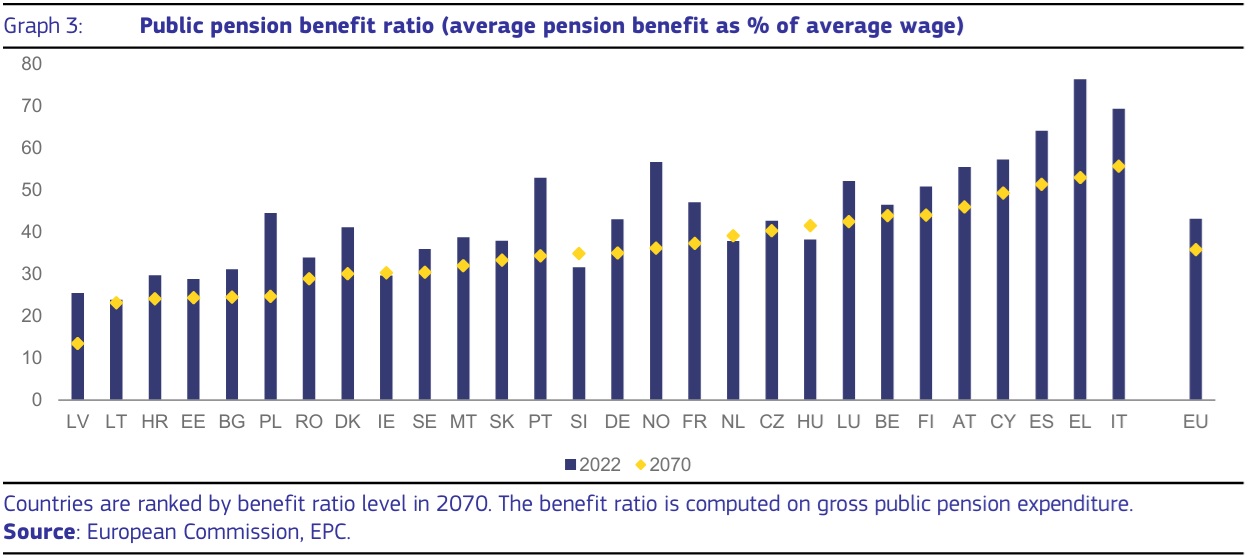

Last but not least, here’s a chart showing the generosity (relative to average wages) of government retirement benefits in 2022 (blue bar) and 2070 (yellow diamond).

As you can see, the vast majority of nations have moved in the right direction.

The lesson that Americans can and should learn is that reform is possible. Even in Europe, where bad fiscal policy often is the norm.

Sadly, both Trump and Biden are sticking their heads in the sand, which means it will be even harder to make necessary changes when (if?) a president who cares about America takes office.