My Fifteenth Theorem of Government points out there is an “unavoidable choice” between entitlement reform and tax policy.

Simply stated, the folks who oppose fixing entitlements – including so-called national conservatives and politicians such as Donald Trump – are in favor of giant tax increases on lower-income and middle-class Americans.

Simply stated, the folks who oppose fixing entitlements – including so-called national conservatives and politicians such as Donald Trump – are in favor of giant tax increases on lower-income and middle-class Americans.

They don’t admit their support for huge tax hikes on regular people, of course, but that’s the inevitable outcome if fiscal policy is left on autopilot. Even Paul Krugman admits that’s what will happen.

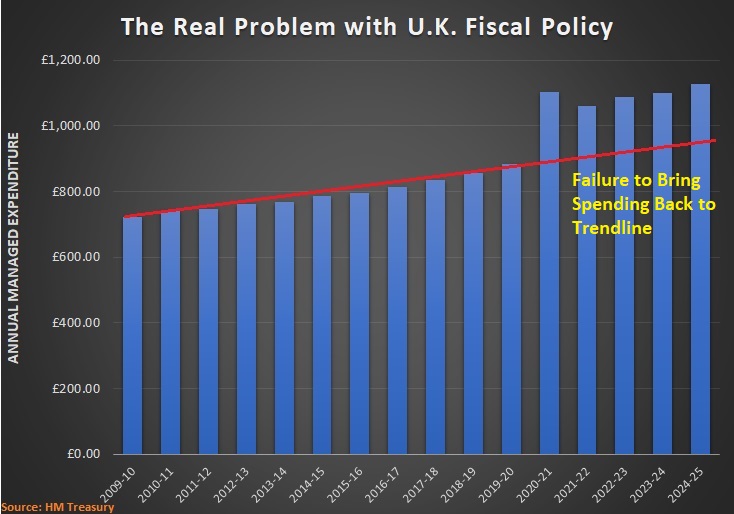

This process already is underway in the United Kingdom.

The Conservative Party became recklessly profligate under Boris Johnson, causing a big bump in the country’s (already excessive) spending trajectory.

The Conservative Party became recklessly profligate under Boris Johnson, causing a big bump in the country’s (already excessive) spending trajectory.

And bad spending policy is now leading to bad tax policy (the British pound no longer is the world’s reserve currency, so there’s not as much ability to finance ever-expanding spending by endlessly issuing new debt).

As explained in a Wall Street Journal editorial from last November, Prime Minister Rishi Sunak and his Chancellor of the Exchequer Jeremy Hunt have a tax agenda somewhat akin to Joe Biden’s.

The Chancellor and his boss, Prime Minister Rishi Sunak, are making a particular tax grab at highly mobile workers, especially in financial services, by reducing the threshold for the top 45% income-tax rate to £125,000 from £150,000. The Treasury pretends this will rake in an additional £3.8 billion in revenue over six years…

Mr. Hunt is increasing the top corporate tax rate to 25% from 19% and imposing a global minimum tax not even the European Union has managed to implement. …Mr. Sunak’s Conservative Party ditched Ms. Truss’s supply-side tax and regulatory reforms in favor of this plan to tax and spend Britain to prosperity. One of those strategies boasts a proven track record of success and the other has a history of failure. The Tories can explain their choice to voters at the next election.

In a column for CapX, Conor Holohan made similar points, while also pointing out the corporate tax hike won’t raise nearly as much money and Sunak and Hunt are hoping to collect.

Hunt is right to want to balance the books and avoid passing on huge levels of debt to future generations. But to raise corporation tax on such a scale risks turning away those businesses which will be central to the growth and investment we need to generate the receipts that will pay the nation’s bills….

But that static approach doesn’t..reflect the fact that businesses are being discouraged from investing in Britain because of the planned increase in corporation tax. …The TaxPayers’ Alliance (TPA) dynamic tax model..suggests the planned corporation tax rise could cost £30.2bn of lost GDP after a decade. This slower growth would see almost two thirds of the expected revenue from the rise to be lost through lower receipts. …By raising corporation tax on this scale, the Government will be eroding that tax base, and we will see more companies like AstraZeneca deciding that there are more competitive places to be investing.

Steve Entin of the Tax Foundation also did some economic analysis and is not impressed with the Sunak-Hunt tax-and-spend agenda.

…the Sunak-Hunt tax plan will raise labor costs and reduce hours worked. It will increase tax hurdles for new corporate investment, discouraging capital formation. With less labor and capital, real output and employment will fall, increasing the economic pain… The system phases out the untaxed personal allowance for incomes between £100,000 and £125,140, at a rate of £1 for every £2 of income over £100,000.

This results in a de facto 60 percent tax band in the middle of the 40 percent band. …The Sunak-Hunt plan…leaves the pending rise in the corporation tax in place. It raises the windfall profits tax on oil and gas producers and imposes a new tax on electricity generation, which will drive up the cost of energy, prompting the government to promise more spending on energy grants to consumers. …The Sunak-Hunt tax plan…estimates another 6 million workers will be pushed onto the tax roles due to the freezes. …History is clear. Lowering budget deficits via spending restraint frees resources for additional private output and jobs. …It is folly to think deficit reduction by means of a corporation tax increase would lower interest rates enough to spur investment despite the direct damage from the tax

Let’s close with a few passages from another Wall Street Journal editorial, this one published just yesterday.

U.K. Prime Minister Rishi Sunak promised economic expertise… British businesses think he needs a refresher. Witness the brewing revolt against the mammoth tax increases Mr. Sunak cooked up with Chancellor Jeremy Hunt. …they want to raise the top corporate tax rate to 25% from 19%; reduce the threshold for the top 45% personal income-tax rate to £125,140 from £150,000; and soak the middle class by freezing tax brackets…

The ruling Conservatives have convinced themselves that only a balanced budget can induce businesses to invest in Britain. But…James Dyson of vacuum cleaner fame wrote in the Telegraph in January that the Tory policy of tax hikes and overregulation is “short-sighted” and “stupid.” …Pharma giant AstraZeneca last month said it will build a £320 million factory in low-tax Ireland instead of the U.K. “because the [U.K.] tax rate was discouraging.” Shell is reevaluating $25 billion in oil and gas investments after Mr. Hunt cranked up a windfall-profits tax on top of the regular corporate rate. …The business revolt is a warning that the taxes will be fiscal duds. …That may leave the Tories defending a record of slow growth, high taxes and more deficits and debt at the next election. A party of the right that loses its low-tax, pro-growth economic credibility is headed for defeat.

Some readers may not care about fiscal policy in the United Kingdom.

But today’s column is a warning sign about what will happen in the United States if Republicans surrender on spending and entitlement programs are left on autopilot.

I won’t pretend that genuine entitlement reform will be politically easy. But my message to my Republicans friends is that a tax-increase agenda is not just economically destructive, but also politically suicidal.

A GOP that strays from Reagan-style classical liberalism is bad news.