Yesterday’s column pointed out why supporters of a global corporate tax cartel are misguided.

Today, I’m going to admit that I made a mistake. Not yesterday, but two years earlier.

Today, I’m going to admit that I made a mistake. Not yesterday, but two years earlier.

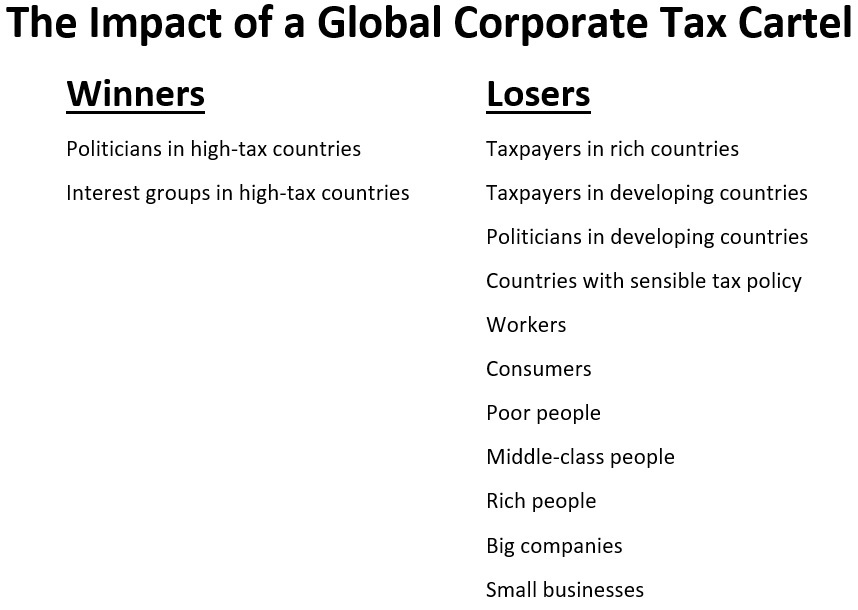

Back in 2021, I put together a list of winners and losers from the proposed tax cartel, which was organized by bureaucrats at the Paris-based Organization for Economic Cooperation and Development.

I think all the groups are correctly categorized, but my error was having an incomplete list of winners and losers.

Before identifying who they are, let’s start by looking at some excerpts from a Wall Street Journal column by Aharon Friedman last August. He aptly summarizes the scheme.

Imagine if California and other left-wing states conspired to require every state to impose high taxes. …Under the conspiracy, if, say, Florida, refused to comply, the other states would tax companies on their income earned in Florida to make up the difference.

…foreign governments and the Organization for Economic Cooperation and Development are working to enact exactly such a regime to increase taxes around the world to fund the left’s priorities. If Congress doesn’t comply, other countries would punish the U.S. by taxing American companies on income earned in the U.S. to make up the difference. …Americans generally dislike our Internal Revenue Code and Internal Revenue Service, but imagine a new global revenue code and global revenue service. There is no global supreme court to prevent foreign countries from taxing American companies in violation of our treaties.

Now that we have a description of the OECD’s plan, what were my sins of omission?

Who should be added to my list of winners and losers?

Well, this year Aharon explained in another WSJ column how the OECD’s tax cartel has rules that are bad for American competitiveness…and bad for American national security.

The U.S. Constitution specifies that Congress, not unelected bureaucrats or foreign adversaries, is in charge of crafting our nation’s tax laws. …Yet Treasury Secretary Janet Yellen is turning this bedrock principle on its head by writing a global tax code with the help of European bureaucrats that would redound to the benefit of Beijing.

…Ms. Yellen is encouraging such taxation as a way to coerce Congress… The complex rules…favor companies that emphasize social activism over profits, as well as state-owned enterprises, at the expense of capitalist competitors. This will benefit countries that take a broad view of government power, especially China… the framework mandates an expansive information-sharing regime among countries that have adopted the global tax code. Providing such detailed information on American defense and tech companies to the likes of China… The global tax code is also likely to push low-income countries toward state-owned foreign investment—such as China’s Belt and Road initiative.

My losers list does include “big companies,” but perhaps it would be best to also specifically mention “American firms.”

We can also add “U.S. national security” in the minus column.

And we should probably add “China” to the winners list.

But there may also be another winner. All businesses will be hurt by a global tax cartel, but European companies may get a competitive advantage if the plan disproportionately hurts U.S. businesses.

Which is what will happen. In an April columnin the WSJ, Phil Gramm and Mike Solon summarize how American companies are being targeted by the OECD’s tax cartel.

President Biden has now spearheaded the international agreement to let foreign nations tax American companies… The OECD minimum-tax agreement is estimated to collect some $236 billion in new taxes… The Oxford Center for Business Taxation has estimated the U.S. will pay 64% of the profits tax,

compared with 9.5% for China, 3.8% for the U.K., 1.6% for Germany and 0.7% for France. …the European Union, which dominates the OECD, is playing it with a willing American partner. It’s easy to understand why other countries are willing to agree to an international tax system in which Americans pay most of the taxes. But the White House’s championing of the tax reveals how committed the administration is to pushing big government everywhere and how desperate it is to raise U.S. corporate taxes.

The bottom line is that the OECD’s global corporate tax cartel is a terrible idea (see here, here, and here for more evidence).

Shame on Joe Biden and his administration for supporting something that is bad for America.

And shame on Donald Trump and his administration for supporting the development of the OECD’s awful plan.