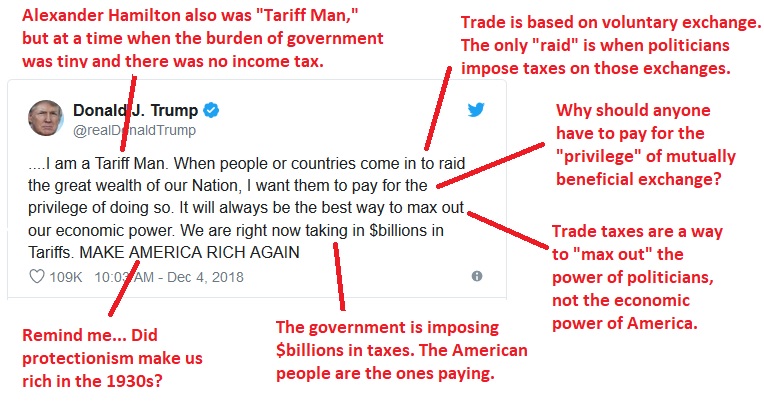

Donald Trump, who describes himself as “Tariff Man,” recently wrote a column in defense of his protectionist trade policy for the Wall Street Journal.

After reading the column, my first thought was that Trump was trying to show he is more economically illiterate than Joe Biden (a big challenge, as seen here and here).

And my second thought was that it seems as if America is governed by a random guy from the phone book or the quirky uncle who spouts off at Christmas dinner.

But let’s side aside my grousing and focus on what Trump actually wrote. Here are some excerpts.

When I imposed historic tariffs on nearly all foreign countries last April, the critics said my policies would cause a global economic meltdown. Instead, they have created an American economic miracle… Countless so-called experts…predicted confidently that the Trump tariffs would crash stock markets, crush economic growth, cause massive inflation, destroy American exports, and trigger a “worldwide recession.”

Nine months later, the results are in, every one of those predictions has proven completely and totally wrong. …Joe Biden handed me…the highest trade deficit in world history. But with the help of tariffs, we have…slashed our monthly trade deficit by an astonishing 77%… The data shows that the burden, or “incidence,” of the tariffs has fallen overwhelmingly on foreign producers and middlemen, including large corporations that are not from the U.S. According to a recent study by the Harvard Business School, these groups are paying at least 80% of tariff costs. …It was the tariff that made America strong and powerful in generations past, and it is tariffs that are making our country stronger, safer and richer than ever before.

Eric Boehm of Reason was not impressed.

He looked closely at three of Trump’s assertions. He started by debunking Trump’s claim of a smaller trade deficit.

Trump’s op-ed claims that he has “slashed our monthly trade deficit by an astonishing 77%.” That would be astonishing.

But in reality, the Census Bureau reported last week that the trade deficit increased—not decreased—by nearly 37 percent in November, the most recent month for which data are available. Through the first 11 months of 2025, the trade deficit was 4 percent higher than it had been in 2024. That is literally the opposite of what Trump is claiming.

This is absolutely correct. As I wrote about a month ago, the trade deficit has increased under Trump (though remember that this isn’t a bad thing).

He then points out that Trump misinterpreted the HBS study.

In fact, the paper he cited concludes that “tariffs led to both rapid and gradual retail price increases.” The study found that “prices began rising within days of the March announcements and continued to increase steadily over subsequent months,” and also that “imported goods rose roughly twice as much as domestic goods relative to pre-tariff trends.” There is no getting away from this fact: tariffs are pushing prices higher. The Harvard Business School, Trump’s favorite source on the matter, recently noted that prices for imported goods are up 9.7 percent from their pre-tariff trends, while domestic prices are up 4.4 percent.

Last but not least, Boehm points out that America avoided some of the economic damage because Trump hasn’t followed through on some of his worst ideas.

Trump repeatedly backed down and eased tariff threats in the face of negative shocks from both the stock market and the bond market. The “Liberation Day” tariffs announced on April 2 were postponed a week later after a huge stock market sell-off, and those that were later imposed were at lower rates. A threatened 130 percent tariff on Chinese goods never materialized. No wonder “TACO”—”Trump Always Chickens Out”—entered the political and financial lexicon last year. As the Yale Budget Lab’s data show, Trump raised the average U.S. tariff rate from less than 3 percent to more than 25 percent with his Liberation Day tariffs and other moves in the first half of 2025. But those rates declined in the second half of the year and settled around 17 percent. That’s still very high, but not as high as it could have been—so it makes sense that the consequences were less severe.

Here’s a chart from the Financial Times showing how Trump backed off after so-called Liberation Day.

For those keep score, that’s 3 wins for Eric Boehm and none for Trump.

My only complaint about the article is that he only corrected three of Trump’s errors.

So I’ll wrap up by looking at a few more of Trump’s claims and seeing whether they are justified. We’ll start with his assertion of a booming economy.

…my policies…have created an American economic miracle…we now have…extraordinarily high economic growth! …In the third quarter of 2025, gross domestic product growth was booming at 4.4%, and…the fourth quarter is projected by the Atlanta Fed to be well over 5%, a number like our country has not seen in many years.

But if the economy is booming, why are workers not enjoying an uptick in their compensation?

And why is there an “affordability crisis”?

Also (and this is a wonky point), GDI is a much better measure of economic performance than GDP. And the GDI number for the third quarter (2.4 percent) is much less impressive than the GDP number (4.4 percent).

Next, let’s look at Trump’s claim about inflation.

I inherited an economy ravaged by the…worst inflation in more than 40 years… Only 12 months into my second term in office, we now have the exact opposite—extremely low inflation. …while the average U.S. tariff rate on foreign products has increased by more than five times, inflation has fallen dramatically!

Yes, we had high inflation under Biden, especially in 2022 (because of bad monetary policy that began under Trump).

But Jessica Riedl points out that prices increases stabilized well before Trump took office again in early 2025.

By the way, protectionist policies are not inflationary. They distort relative prices, but don’t cause overall increases. If you want to know who to blame for rising prices, look at the Federal Reserve.

Next, we have Trump claiming that he’s reduced red ink.

Joe Biden handed me a catastrophically high budget deficit… But with the help of tariffs, we have cut that federal budget deficit by a staggering 27% in a single year

This is another easily debunked assertion.

The budget deficit was just as high in 2025 as it was in 2024, as shown by this data from the Committee for a Responsible Federal Budget.

By the way, the early data for the 2026 fiscal year don’t look any better.

Next, we have Trump claiming trade taxes are good for growth.

We have proven, decisively, that, properly applied, tariffs do not hurt growth—they promote growth and greatness

I’m tempted to simply point to Herbert Hoover and the Great Depression. Or to simply look at the wretched performance of the nations with the worst protectionism.

But I’ll be wonky and instead encourage people to read this Twitter thread from Erica York.

Next we have an absurd claim that Trump’s protectionism is going to produce $18 trillion of foreign investment into the U.S. economy.

I have successfully wielded the tariff tool to secure colossal Investments in America, like no other country has ever seen before. …In less than one year, we have secured commitments for more than $18 trillion, a number that is unfathomable to many.

Once again, Jessica Riedl has an appropriate reaction.

In fairness to Trump, I don’t think he’s ever claimed $18 trillion of investment would be a one-year phenomenon. Though the number is make-believe even when considering Trump’s full second term.

But let’s set that aside and focus on something else, which is that the necessary and automatic flip side of a trade deficit is a capital surplus. So if Trump really did attract $18 trillion of foreign capital, that would only be possible if foreigners first earned $18 trillion by selling goods and services to Americans.

In other words, big trade deficits. Which, of course, Trump is trying to stop.

Last but not least, Trump claims tariffs made America strong in the 1800s.

It was the tariff that made America strong and powerful in generations past.

I wrote a two-part series (here and here) about why this is nonsense, but this tweet from Dean Clancy gets the point across much quicker.

If Trump is willing to abolish the income tax and the welfare state, I’d be willing to trade those great policies for his awful policy of protectionism. I won’t hold my breath waiting for that trade.