Over the past two years, most of the controversy over government-provided student loans has revolved around the moratorium on repayments (which started under Trump and has continued under Biden).

That is an important issue, especially for those of us who get upset about politicians redistributing money from the poor to the rich.

But the long-run problem with student loans is that colleges and universities have responded by increasing tuition and then using the extra loot to subsidize bureaucratic bloat.

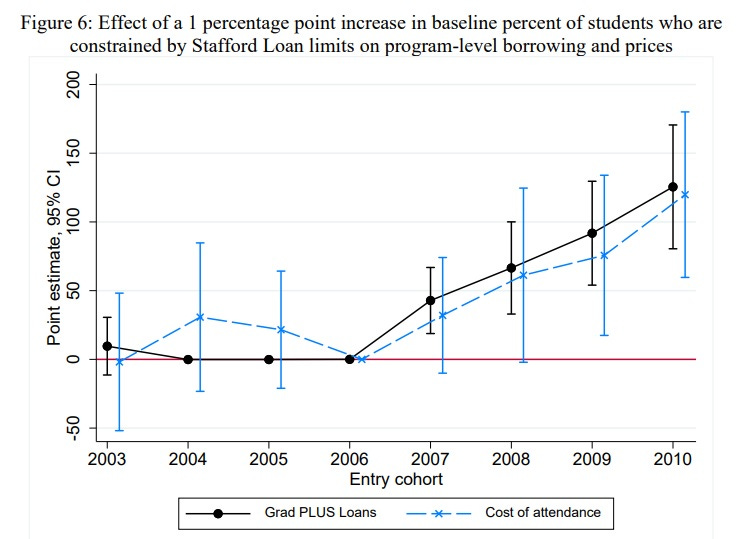

The relationship between student loans and higher tuition is very apparent in this chart.

The above chart comes from a study just published by the National Bureau of Economic Research. Authored by

Here’s some of the analysis about more loans resulting in higher tuition costs.

Universities, recognizing that students have more ability to pay when loan limits are increased, may try to capture some of the additional funding through higher prices. …In the years preceding Grad PLUS, program prices trended similarly for programs with low and high shares of students who were constrained by federal loan limits…

After Grad PLUS, however, programs with a higher percentage of students who were constrained at baseline show significantly larger increases in average cost of attendance. …these estimates suggest that prices increased by $0.75 per $1 increase in average per-student Grad PLUS loans and more than dollar for dollar with increases in total federal student loans. …Estimates suggest that $1 increase in federal loans resulted in a significant $1.10 increase in a program’s list price and a $0.64 increase in net price. …Grad PLUS-driven increases in federal student loans did significantly increase prices, confirming the Bennett Hypothesis. …Our results suggest that Grad PLUS loans primarily benefited institutions and programs that were able to charge higher prices.

None of this should come as a surprise for those who watched Professor Lin’s video more than 10 years ago.

Now let’s switch back to discussing the moratorium.

NBER also published a study on that controversy, authored by Michael Dinerstein, Constantine Yannelis & Ching-Tse Chen. Emma Camp wrote a useful summary of the findings for Reason.

The over three-year-long moratorium on federal student-loan repayment has long been hailed as a godsend for student loan borrowers. …However, a new working paper from the National Bureau of Economic Research indicates that borrowers whose loans were frozen by the moratorium actually ended up in a worse position than they started in—and have even accrued more student loan debt.

…According to the paper, those whose loans were frozen by the moratorium actually took on more debt—borrowing more on credit cards and mortgages and even accruing more student loan debt rather than working to pay off other debt they owe. …By the end of 2021, borrowers who saw their student loan payments paused increased their credit card, mortgage, and car-loan debt by $1,800 on average and even took on an additional $1,500 in student loan debt compared to those whose loan payments were not paused by the moratorium.

All things considered, another “success story” for big government.

P.S. Here’s some satire about the student loan moratorium.

P.P.S. And here’s an amusing video from Bill Maher about the higher-education racket.