Two years ago, I wrote about how two former Prime Ministers in the United Kingdom, David Cameron and Theresa May, did a very good job of restraining spending.

On average, spending increased by only 1.8 percent per year last decade,  which helped to substantially reduce the fiscal burden of government relative to the private economy.

which helped to substantially reduce the fiscal burden of government relative to the private economy.

That was an impressive result, and it adds to the collection of success stories showing what happens when governments obey fiscal policy’s Golden Rule.

That was the good news.

The bad news is that spending restraint evaporated once the pandemic began.

The worse news is that the current Prime Minister, Boris Johnson, has no intention of restoring fiscal discipline now that the coronavirus is fading away.

The Wall Street Journal opined on the new budget that was just released by the supposedly conservative government.

London has spent some £407 billion ($568 billion) on pandemic relief since last year… This has blown a hole in public finances, with the fiscal deficit expected to be around 10% of GDP this year. …Britain’s political class, and especially the governing Conservative party, …faces pressure to “pay for” all this relief. …an increase to the corporate profits tax rate to 25% from 19%…freezing previously announced increases in the thresholds for personal income-tax brackets.

This tax hike on the sly is estimated to raise an additional £18 billion starting next year from beleaguered households who discover inflation pushing them into higher brackets. A holiday on the stamp duty on property purchases will expire in October, walloping households as the recovery is meant to begin. …The government’s Office for Budget Responsibility estimates that by 2026 tax revenue as a share of GDP will be 35%, the highest since 1969. The Institute for Fiscal Studies, a think tank, estimates that the additional £29 billion in annual revenue expected by 2026 amounts to the largest tax increase in any budget since 1993. …This Tory government came to power promising to unleash Britain’s entrepreneurial businesses for a post-Brexit growth spurt, and freeing those animal spirits is even more important after the pandemic. A super-taxing budget is a huge gamble.

The WSJ focused on all the tax increases.

Allister Heath’s column in the Daily Telegraph informs us that the bad news on taxes is a predictable and inevitable consequence of being weak on spending restraint.

For the past 50 years, the Tory party had believed that high tax rates, especially on income and profits, were bad for the economy and had strived to cut them. Today, this is no longer true… The Tory taboo on increasing direct rates of taxation…is over… Britain will continue

its shift to the Left on economics, sinking ever-deeper into a social-democratic, low growth, European-style model… Johnson, sadly, is planning to increase spending permanently by two percentage points of GDP and taxes by one. He is a big-government Conservative… the main problem facing the public finances longer-term isn’t the economic scarring from the pandemic, but the fact that the Tories are determined to keep increasing spending as if Covid never happened. …Reaganomics is over in Britain, dead and buried, as is much of the economic side of Thatcherism.

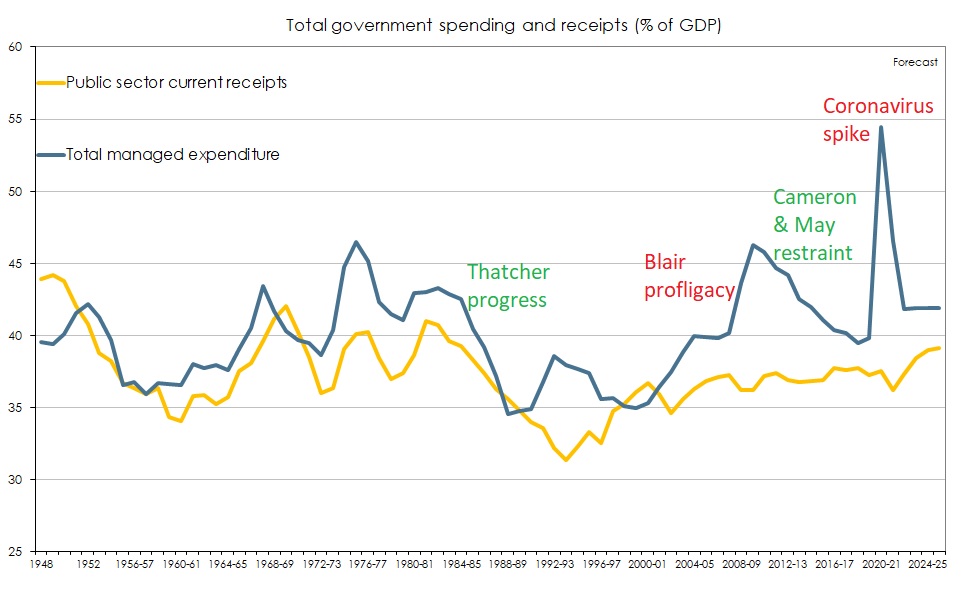

Here’s a chart from the U.K.’s Office of Budget Responsibility (OBR), which shows both taxes and spending as a share of gross domestic output (GDP).

I’ve added some text to show that there was fiscal progress under Thatcher, Cameron, and May, along with fiscal profligacy under Blair (and during the coronavirus, of course).

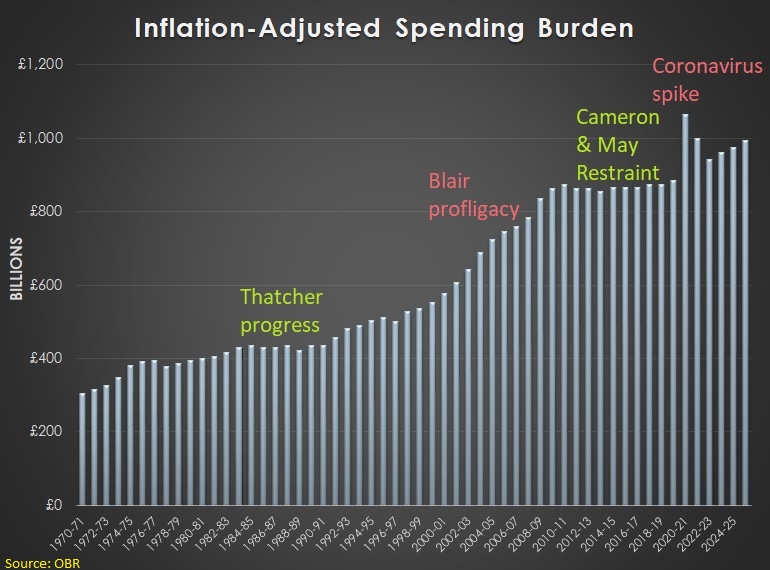

I also used OBR data to construct this chart, which shows inflation-adjusted spending over the past five decades, as well as projections until 2025.

The most worrisome part of the chart (and the biggest indictment of Boris Johnson) is the way spending climbs at a rapid rate in the final four years.

P.S. Because of my strong support for Brexit, I was very happy that Boris Johnson won a landslide victory in late 2019. And he then delivered an acceptable version of Brexit, so that worked out well. However, it definitely doesn’t look like he will fulfill my hopes of being a post-Brexit, 21st century version of Margaret Thatcher.