There was a lot of bad policy during the pandemic, with the health bureaucracies (the CDC and FDA) being especially incompetent.

But we also got lots of policy mistakes from elected officials, including trillions of dollars of fraud-riddled spending from both Trump and Biden.

Today, let’s focus on one part of that spending, the expanded unemployment benefits.

Today, let’s focus on one part of that spending, the expanded unemployment benefits.

Economists traditionally have worried that such policies extend and increase joblessness. Even left-leaning economists such as Paul Kruman and Larry Summers have written about this problem.

So what happened during the pandemic? Did extra-generous unemployment benefits discourage people from finding jobs?

According to new research from Michael R. Strain, R. Glenn Hubbard, and, Harry Holzer, the answer is yes. Here are are the issues they sought to address in their study, which was published by Economic Inquiry.

This paper studies whether special pandemic-era unemployment benefits reduced the flow of unemployed workers into employment. The American Rescue Plan, enacted in March 2021, built upon previous pandemic-era measures that expanded Unemployment Insurance (UI) benefits.

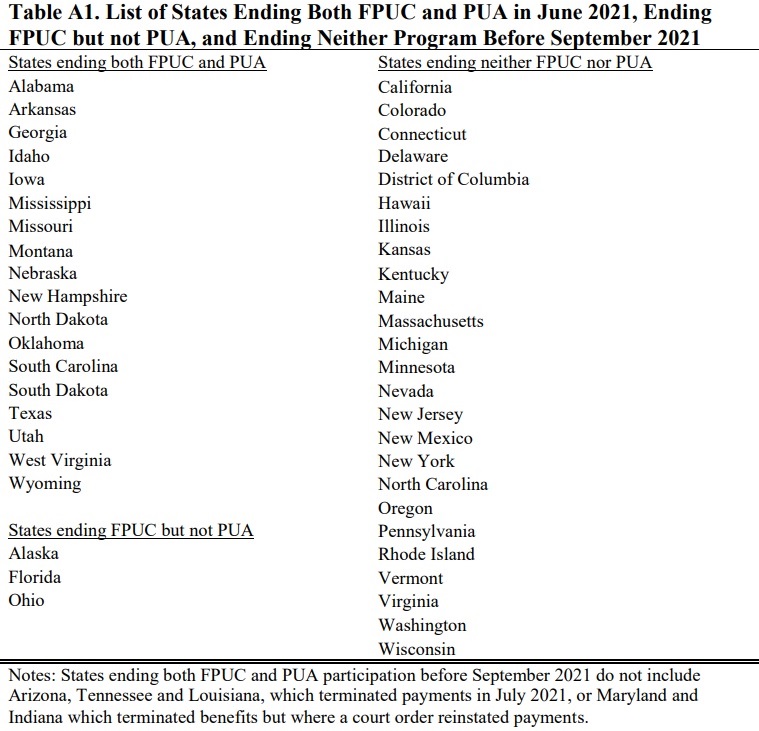

It extended the Federal Pandemic Unemployment Compensation (FPUC) program, which added a $300 weekly supplement to standard state UI benefits from the law’s passage in March 2021 until September 6, 2021. And it extended UI benefits to workers typically ineligible for state UI programs through the Pandemic Unemployment Assistance (PUA) program, such as the self-employed, “gig” and part-time workers. Concerns about the labor-market effects of PUA and FPUC led 26 states to opt out of at least one of these programs before it was set to expire in September 2021. Of those 26 states, 18 stopped participating in both programs in June 2021.

So we had a natural experiment. Some states, mostly “red states,” opted against extended and expanded benefits.

While other states, mostly “blue states,” did the opposite.

And here are some of the results.

It seems red states made the right choice, assuming the goal is getting people back to work.

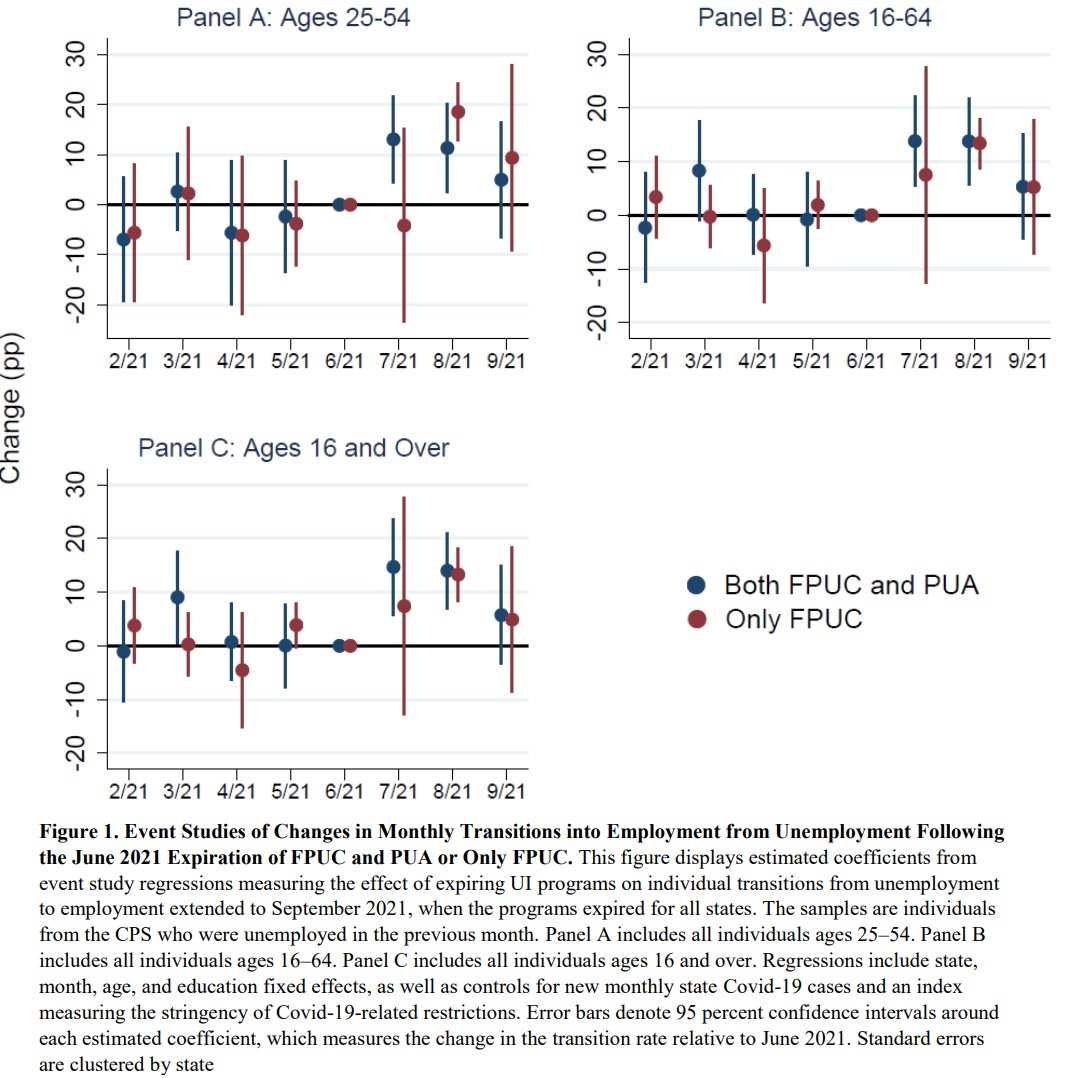

Using CPS data, we present difference-in-difference estimates that the flow of unemployed workers into employment increased by around 12-14 percentage points following early termination. Among prime-age workers, the effect is about two-thirds the size of the unemployed-to-employed flow among control states during the February–June 2021 period. …We show that state-level unemployment rates fell following early exit from FPUC and PUA.

Wonky readers may appreciate Figure 1 and its accompanying explanation.

These results are hardly surprising.

The left’s dependency agenda reduces the relative benefits of working compared to not working.

We should have learned that lesson during the Obama years.

P.S. Here’s an amusing way of looking at the issue. And another.