At the start of 2021, shortly before Biden was inaugurated, I expressed hope that he would reverse Trump’s self-destructive protectionism.

Alas, I’ve been disappointed.

Alas, I’ve been disappointed.

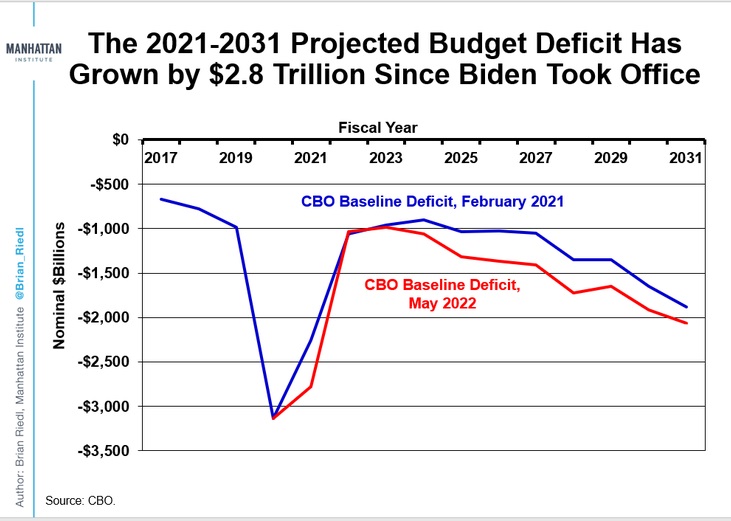

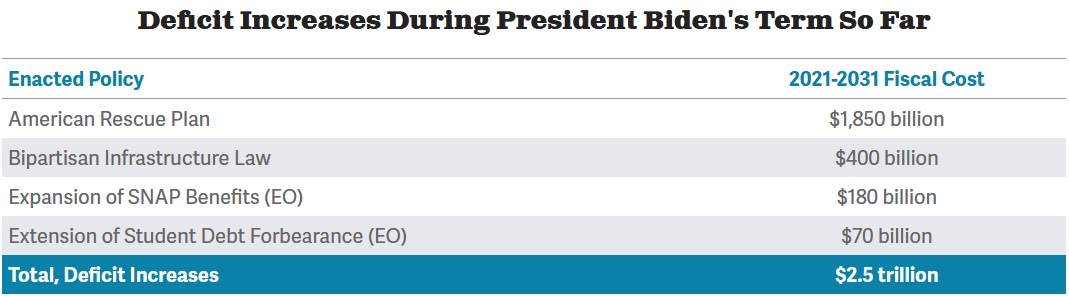

On trade issues, Biden has been just about as bad as his predecessor, (he’s also been as bad as Trump with regards to spending, but that’s a topic for another day).

The Wall Street Journal editorialized last month about this unfortunate similarity. Here are some of the highlights…or lowlights would be a better term since the net result of protectionism is to hurt taxpayers and consumer.

President Biden has rolled back some of Donald Trump’s destructive tariffs, but not enough, and they’re still doing economic harm. New analyses of Mr. Trump’s Section 232 steel and aluminum tariffs show how consumers and manufacturers are still paying for the border taxes that benefit only a few companies.

A study by Harbor Aluminum for the Beer Institute finds that the 10% tariff on imported aluminum cost U.S. beverage manufacturers $1.7 billion from March 2018 through August 2022. About 93% of the $1.7 billion has been pocketed by domestic aluminum producers and smelters in the U.S. and Canada. …By raising the cost of production, tariffs constrain manufacturers, who cut jobs and pass costs to consumers. …Repealing the Trump Section 232 tariffs could reduce prices at the margin. The longer they stay in place the more they deserve to be called the Biden-Trump tariffs.

Since the above column mentioned the Section 232 tariffs, this would be an opportune moment to cite the Tax Foundation’s research on the topic.

…economists have reached…negative conclusions regarding the impacts of the recent Section 232 tariffs on the economy. Lydia Cox and Kadee Russ, using an estimate derived from a Federal Reserve Board paper, calculated that the Section 232 tariffs reduced manufacturing employment by about 75,000 jobs.

Kyle Handley and other economists looked at the impacts of the import tariffs on export growth in the U.S. and found that companies exposed to the Section 232 tariffs experienced reduced export growth. This occurred because the cost of their inputs rose due to the tariffs, which hindered firms’ ability to increase their exports. For each 1 percent increase in the tariffs on steel and aluminum, export growth fell by 0.11 percent. …The aluminum tariffs in particular have disproportionately harmed certain industries. …Ford and General Motors estimated that the tariffs cost them about $1 billion each the first year they were in effect—roughly $700 per vehicle produced.

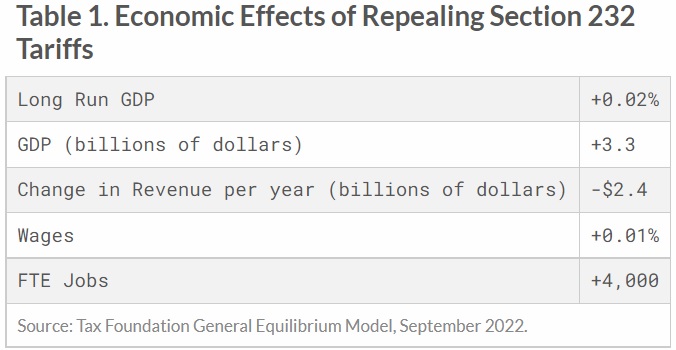

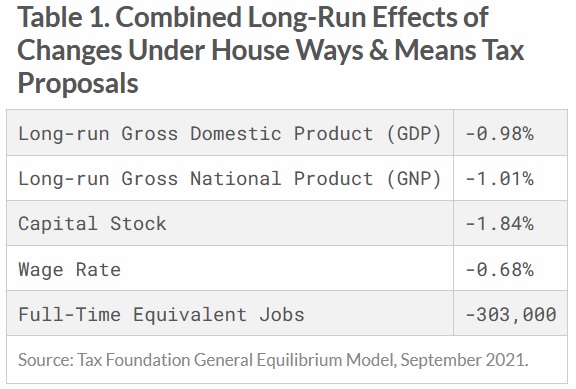

And here’s the Tax Foundation’s estimate of how the economy would benefit if these taxes on trade were repealed.

Since I’ve been criticizing Biden for being a protectionist, I’ll close by speculating whether Republicans have learned from Trump’s protectionist mistakes.

Here are some excerpts from a column in the Wall Street Journal by former Congressman Jeb Hensarling.

Numerous studies have shown that almost all the costs of tariffs initiated under the Trump administration were paid by American consumers and businesses. …According to the American Action Forum, Mr. Trump’s tariffs combined have increased consumer costs by approximately $51 billion a year.

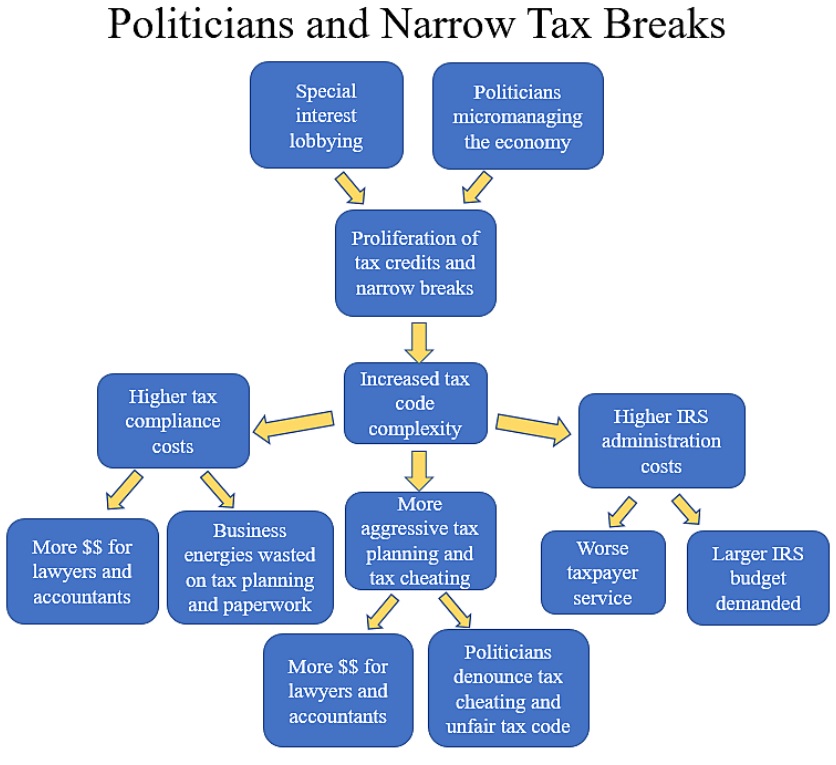

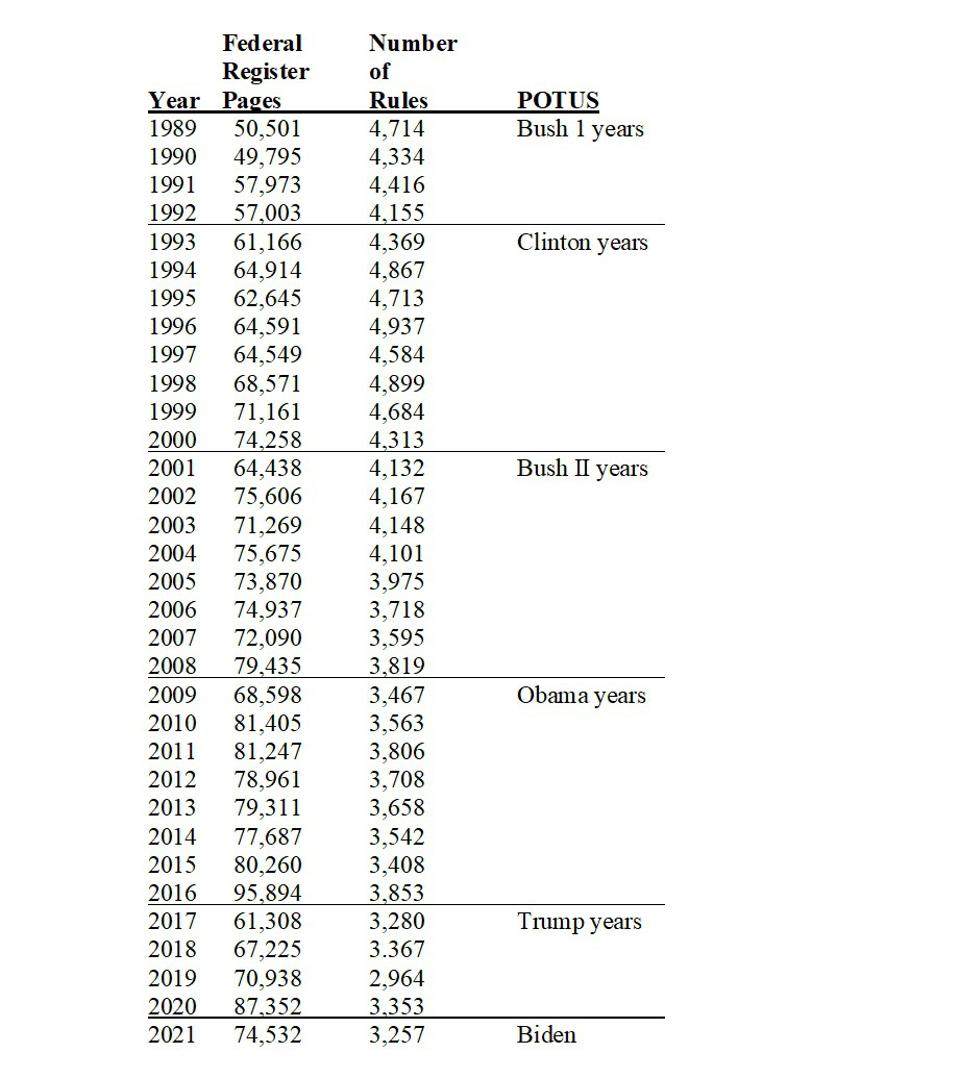

…Republicans love to talk about “draining the swamp” in Washington. But the tariffs imposed by the Trump administration empowered hundreds of bureaucrats at the Commerce Department and the Office of the U.S. Trade Representative to grant waivers under what can at best be described as an opaque process with discretionary standards. …A schedule of tariffs doesn’t drain the swamp. It fills it with well-connected lawyers and lobbyists who know how to work the system.

The bottom line is that protectionism does not work if Republicans do it, and protectionism does not work if Democrats do it.

Both parties should have learned from Hoover’s horrible mistake.

P.S. A big problem is that politicians genuinely don’t understand that a “trade deficit” is automatically and necessarily offset by a capital surplus. Helping them to understand this fact is key to renewing support for free trade.